#economy #ai #markets #nvidia

China’s slowdown is accelerating and yet policymakers remain unconcerned bystanders, suggesting the weakening is less a story of endemic misfortune, but instead of political intent.

bobeunlimited.substack.com/p/chinas-dee...

China’s slowdown is accelerating and yet policymakers remain unconcerned bystanders, suggesting the weakening is less a story of endemic misfortune, but instead of political intent.

bobeunlimited.substack.com/p/chinas-dee...

..shares +26% YTD

..shares +26% YTD

(via Kev Gordon)

(via Kev Gordon)

Semianalysis expects azure revenue to accelerate to 50% YoY by end 2026

Semianalysis expects azure revenue to accelerate to 50% YoY by end 2026

Taiwanese exports of information & communication products (basically, semiconductors from TSMC) have risen from $10-11bn per month to $27bn in the space of a year. That's over $300bn annualised and roughly a fifth of total US equipment investment.

Taiwanese exports of information & communication products (basically, semiconductors from TSMC) have risen from $10-11bn per month to $27bn in the space of a year. That's over $300bn annualised and roughly a fifth of total US equipment investment.

⛔Year-to-date job cuts +65% y/y

⛔Year-to-date job cuts +65% y/y

Since the early 1980s, the moving 20-year avg of Burgundy grape harvest dates has dropped by 16 days. That is, harvest starts more than half a month earlier than 35 years ago. #climatechange #globalwarming

Since the early 1980s, the moving 20-year avg of Burgundy grape harvest dates has dropped by 16 days. That is, harvest starts more than half a month earlier than 35 years ago. #climatechange #globalwarming

September may look a little better, but I'm on a hold for any optimism within the next 3-5 months for freight.

September may look a little better, but I'm on a hold for any optimism within the next 3-5 months for freight.

The generational low in the cash index in March of 2009 was 666.

The generational low in the cash index in March of 2009 was 666.

1. Bad news: spreads near 20yr lows (orange diamonds)

2. But duration also near 20yr lows in many areas

3. Can absorb bigger rise in spread before spread wiped out/before underperf gov bonds (blue diamonds) = margin of safety

1. Bad news: spreads near 20yr lows (orange diamonds)

2. But duration also near 20yr lows in many areas

3. Can absorb bigger rise in spread before spread wiped out/before underperf gov bonds (blue diamonds) = margin of safety

#UMich

#UMich

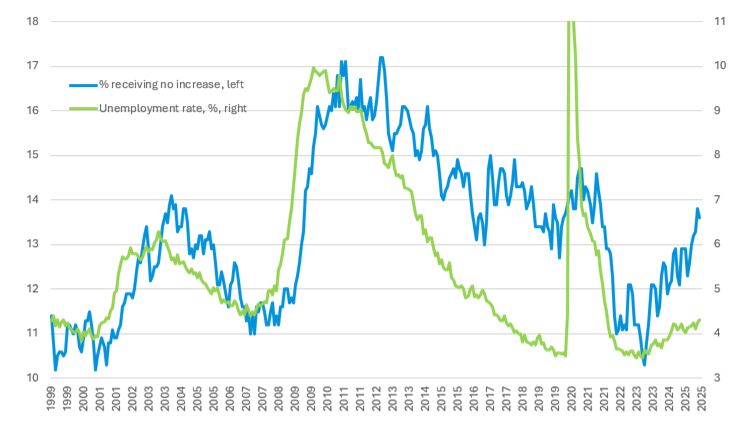

“.. almost 14% of workers are getting no raises.”

(via MetLife)

“.. almost 14% of workers are getting no raises.”

(via MetLife)