Key questions: Is the market's message of a coming economic pickup reliable? Has Big Tech been resting or stalling? Why no worry over elevated valuations?

New column.

Key questions: Is the market's message of a coming economic pickup reliable? Has Big Tech been resting or stalling? Why no worry over elevated valuations?

New column.

Here's some background on this source, whom I've quoted since 2009.

Here's some background on this source, whom I've quoted since 2009.

A few questions on possible swing factors:

Would a “broader” market truly be better?

Can huge onrushing demand for AI capital be met?

Is bitcoin now “normie” money with less speculative juice?

New column.

A few questions on possible swing factors:

Would a “broader” market truly be better?

Can huge onrushing demand for AI capital be met?

Is bitcoin now “normie” money with less speculative juice?

New column.

https://sherwood.news/tech/trump-ai-executive-order-is-a-major-win-for-open-ai-google-microsoft-and/

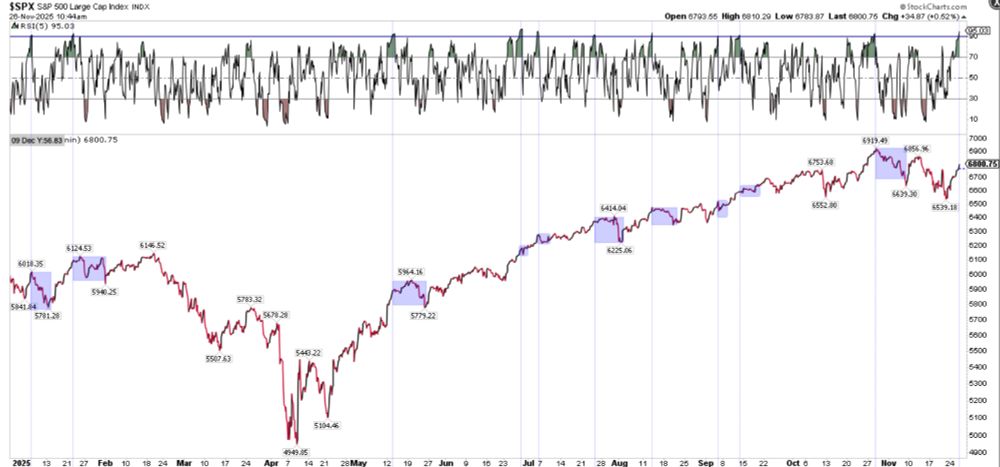

The market's been pressing its bets on a reacceleration into 2026, as “run-it-hot” policies kick in. (It tried this a year ago too).

Is the stampede into value looking a bit panicky yet?

The market's been pressing its bets on a reacceleration into 2026, as “run-it-hot” policies kick in. (It tried this a year ago too).

Is the stampede into value looking a bit panicky yet?

The tension release pushes market-implied volatiltiy down to levels likewise seen in late October.

This is how it goes when the market clenches up for a "hawkish cut" that turns out not so hawkish...

The tension release pushes market-implied volatiltiy down to levels likewise seen in late October.

This is how it goes when the market clenches up for a "hawkish cut" that turns out not so hawkish...

Heathy shift or head fake? Is the Street too bullish on ‘26?

Weekend column.

Heathy shift or head fake? Is the Street too bullish on ‘26?

Weekend column.

The S&P 500's rebound rally slowed, yet below the surface the market is emphatically executing an "early cycle" playbook to posiiton for a peppier economy and looser Fed.

Do investors have it right this time?

New column.

The S&P 500's rebound rally slowed, yet below the surface the market is emphatically executing an "early cycle" playbook to posiiton for a peppier economy and looser Fed.

Do investors have it right this time?

New column.

(CNBC Pro column free to read with email registration.)

It’s the season when business news slows, the Fed’s plan is priced in, and so the bulls’ story leans on “performance chase” logic. Works most years, didn’t in ‘24.

Did that 5% shakeout really recharge the market? New column.

(CNBC Pro column free to read with email registration.)

It’s the season when business news slows, the Fed’s plan is priced in, and so the bulls’ story leans on “performance chase” logic. Works most years, didn’t in ‘24.

Did that 5% shakeout really recharge the market? New column.

It’s the season when business news slows, the Fed’s plan is priced in, and so the bulls’ story leans on “performance chase” logic. Works most years, didn’t in ‘24.

Did that 5% shakeout really recharge the market? New column.

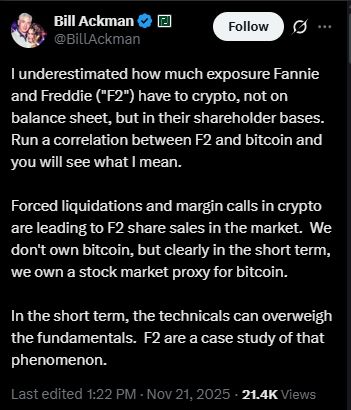

Varuious long-building imbalances now in the open: K-shaped/AI-centric growth, crypto as chaos agent.

New CNBC column, free with email registration.

Varuious long-building imbalances now in the open: K-shaped/AI-centric growth, crypto as chaos agent.

New CNBC column, free with email registration.

Still plenty to prove as the macro/Fed interplay shifts around, but worth watching...

Still plenty to prove as the macro/Fed interplay shifts around, but worth watching...

Maybe things will settle down after the Bitcoin close....

Maybe things will settle down after the Bitcoin close....

Watching for potential friction overhead: A purely mechanical oversold index bounce often stalls near the 20-day moving average...

Watching for potential friction overhead: A purely mechanical oversold index bounce often stalls near the 20-day moving average...

Stock-price correlation of "hyperscalers" MSFT, GOOGL, AMZN, META, ORCL collapsing as the market sorts winners vs. losers.

In particular, it seems investors are handing GOOGL the belt over MSFT (for now).

Stock-price correlation of "hyperscalers" MSFT, GOOGL, AMZN, META, ORCL collapsing as the market sorts winners vs. losers.

In particular, it seems investors are handing GOOGL the belt over MSFT (for now).

What would've been a smart way to set up for its last report in August? Typical beat-and-raise released Aug. 27 with the stock hovering just below a record high....

What would've been a smart way to set up for its last report in August? Typical beat-and-raise released Aug. 27 with the stock hovering just below a record high....

Today's flush is a stampede out of AI/Mag7, breadth not bad, defensive sectors trying to hold, equal-weight S&P 500 barely down.

Today's flush is a stampede out of AI/Mag7, breadth not bad, defensive sectors trying to hold, equal-weight S&P 500 barely down.

The original "jobless recovery" that got Clinton elected with "It's the economy, stupid."

The original "jobless recovery" that got Clinton elected with "It's the economy, stupid."