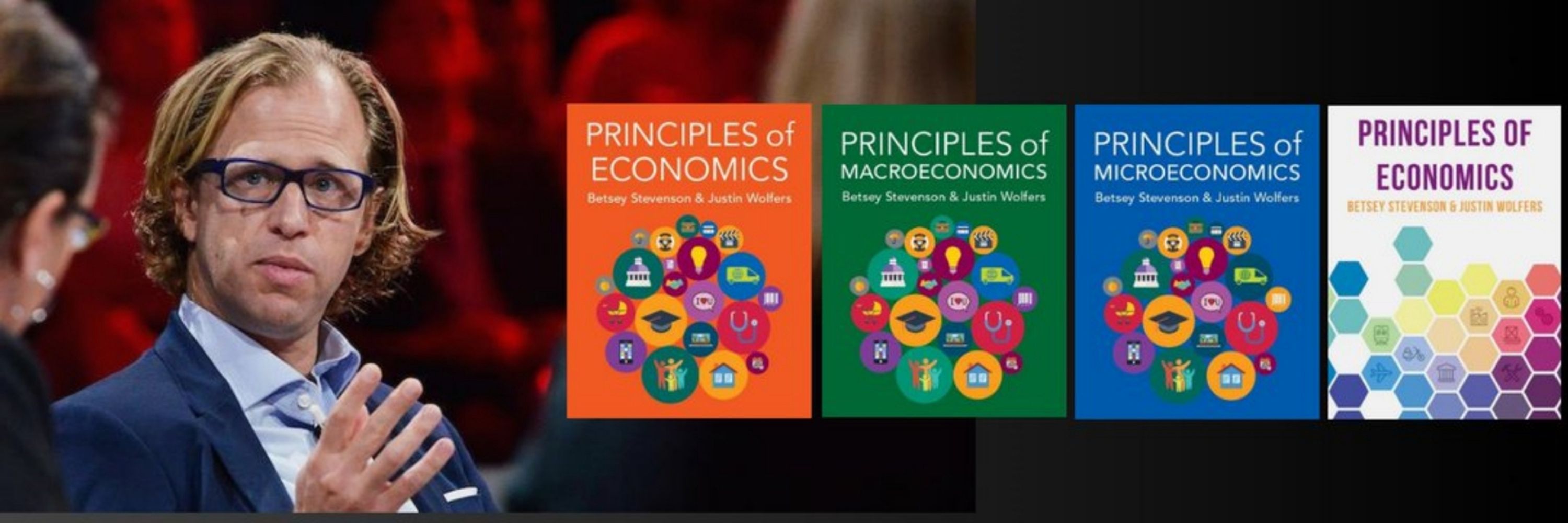

Econ professor at Michigan ● Senior fellow, Brookings ● Intro econ textbook author ● Think Like An Economist podcast ● An economist willing to admit that the glass really is half full.

Justin James Michael Wolfers is an Australian economist and public policy scholar. He is professor of economics and public policy at the Gerald R. Ford School of Public Policy at the University of Michigan, and a Senior Fellow at the Peterson Institute for International Economics. .. more

1. Swear less.

2. Try not to dismantle the institutions that are the foundation of prosperity.

Reposted by Justin Wolfers

—on cherry-picking one quarterly measure of GDP while ignoring jobs, wages & affordability. youtu.be/U_GVwBvHG54

Reposted by Stephen D. Williamson

Reposted by Joe R. Feagin, Patrick Dunleavy, Timothy D. McBride

Reposted by Karen Benjamin Guzzo