Govt can sell the deal as a win for Britain in three big ways

Much more needs to be done but this is a welcome step @bylinetimes.bsky.social

Govt can sell the deal as a win for Britain in three big ways

Much more needs to be done but this is a welcome step @bylinetimes.bsky.social

www.hussmanfunds.com/comment/mc25...

www.hussmanfunds.com/comment/mc25...

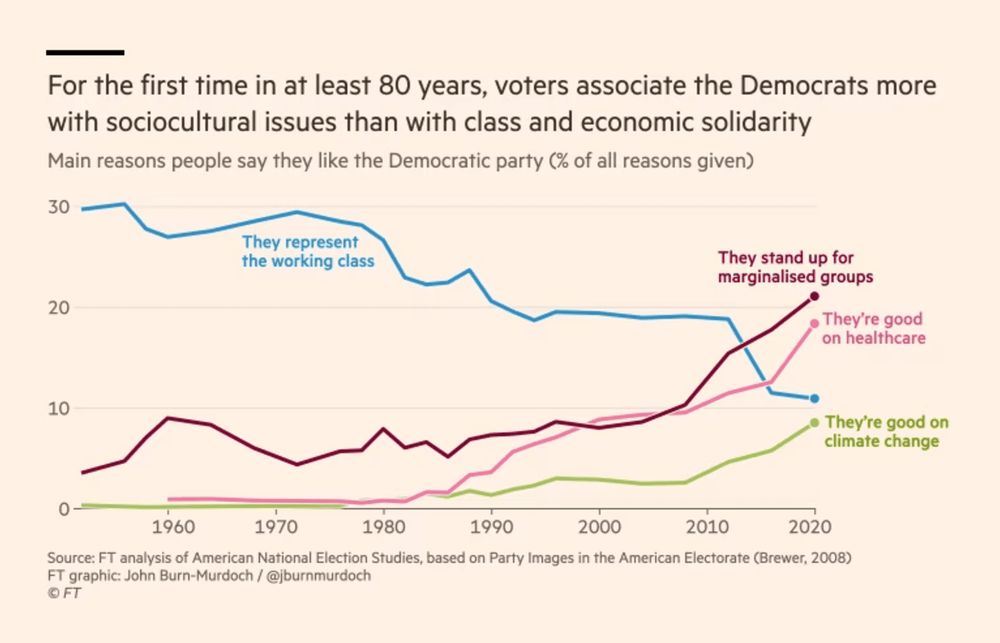

A 🧵 on a topic I find many students struggle with: "why do their 📊 look more professional than my 📊?"

It's *lots* of tiny decisions that aren't the defaults in many libraries, so let's break down 1 simple graph by @jburnmurdoch.bsky.social

🔗 www.ft.com/content/73a1...

creators.spotify.com/pod/show/ts-...

creators.spotify.com/pod/show/ts-...

It’s about giving himself another unilateral weapon to pursue a mercantilism laced with narcissism and caprice.

on.ft.com/4hFLQjk

It’s about giving himself another unilateral weapon to pursue a mercantilism laced with narcissism and caprice.

on.ft.com/4hFLQjk

But long-dated Treasuries are getting a recession and safe haven bid

But long-dated Treasuries are getting a recession and safe haven bid

www.resolutionfoundation.org/publications...

www.resolutionfoundation.org/publications...

He killed it, and as a result, pulitzer prize editorial cartoonist Ann Telnaes quit.

Make sure everyone sees this cartoon. - @aaronparnas.bsky.social

He killed it, and as a result, pulitzer prize editorial cartoonist Ann Telnaes quit.

Make sure everyone sees this cartoon. - @aaronparnas.bsky.social

Data here: www.ons.gov.uk/economy/econ...

This feels a decent indicator of consumer financial stress.

Data here: www.ons.gov.uk/economy/econ...

This feels a decent indicator of consumer financial stress.

Cracking piece by @sarahoconnorft.bsky.social

on.ft.com/49RKP4D

Cracking piece by @sarahoconnorft.bsky.social

on.ft.com/49RKP4D

www.hussmanfunds.com/comment/mc24...

www.hussmanfunds.com/comment/mc24...

- Chuck Prince, Citibank, July 2007

Citibank had already peaked in December 2006. It would lose -93% of its value by November 2008.

But sure, learn to stop worrying and love the rally.

- Chuck Prince, Citibank, July 2007

Citibank had already peaked in December 2006. It would lose -93% of its value by November 2008.

But sure, learn to stop worrying and love the rally.

I looked at what this means for companies hiring from a global talent pool: on.ft.com/49usgDl

I looked at what this means for companies hiring from a global talent pool: on.ft.com/49usgDl

cepr.org/voxeu/column...

onlinelibrary.wiley.com/doi/10.1111/...

onlinelibrary.wiley.com/doi/10.1111/...