📍 Boston

RenMac’s Dutta:

“GMAFB...USD weakness has been driven primarily by a shift in global risk appetite rather than a fundamental reassessment of US eco prospects.”

see: US stocks at ATHs, global stocks outperforming

RenMac’s Dutta:

“GMAFB...USD weakness has been driven primarily by a shift in global risk appetite rather than a fundamental reassessment of US eco prospects.”

see: US stocks at ATHs, global stocks outperforming

🚨@Conferenceboard consumer confidence index collapsed to lowest point since 2014 -- lower than during Covid!

🔻Confidence: -9.7pt

🔻Present situation: -9.9pt

🔻Expectations: -9.5pt

⚠️Depressed by weak job & income conditions & prospects

🚨@Conferenceboard consumer confidence index collapsed to lowest point since 2014 -- lower than during Covid!

🔻Confidence: -9.7pt

🔻Present situation: -9.9pt

🔻Expectations: -9.5pt

⚠️Depressed by weak job & income conditions & prospects

We know the old order is not coming back. We shouldn’t mourn it. Nostalgia is not a strategy, but we believe that from the fracture we can build something bigger, better, stronger, more just. "

globalnews.ca/news/1162087...

We know the old order is not coming back. We shouldn’t mourn it. Nostalgia is not a strategy, but we believe that from the fracture we can build something bigger, better, stronger, more just. "

globalnews.ca/news/1162087...

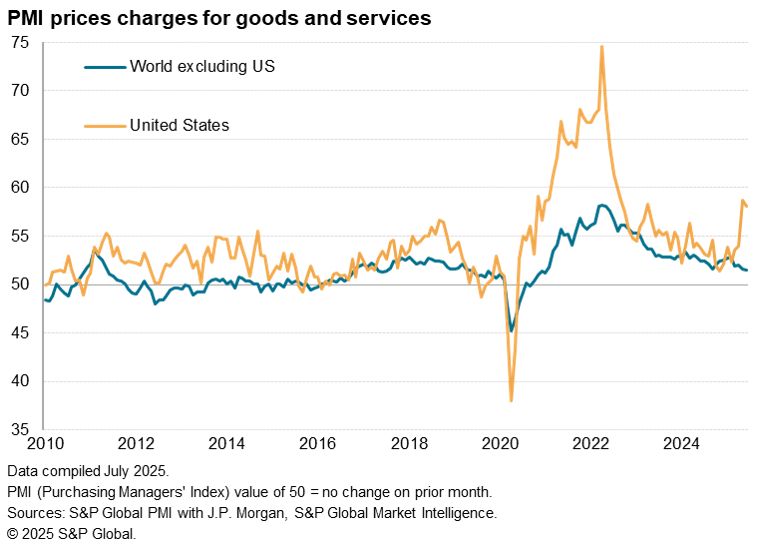

Tariffs don’t raise prices, but removing them lowers prices. 🤡

Tariffs don’t raise prices, but removing them lowers prices. 🤡

“.. a ~10% relative pullback .. similar .. to the DeepSeek pullback (Jan/Feb’24), but short of what we experienced in the Summer of 2024 .. and that of the Spring of 2025 (tariffs).”

“.. a ~10% relative pullback .. similar .. to the DeepSeek pullback (Jan/Feb’24), but short of what we experienced in the Summer of 2024 .. and that of the Spring of 2025 (tariffs).”

@bloomberg.com

www.bloomberg.com/news/article...

@bloomberg.com

www.bloomberg.com/news/article...

“AI is the procyclical scaffolding that holds up the k-shaped economy via the GDP boost from capex and the wealth effect”

“AI is the procyclical scaffolding that holds up the k-shaped economy via the GDP boost from capex and the wealth effect”

www.spglobal.com/marketintell...

www.spglobal.com/marketintell...

(via B of A)

(via B of A)

Speculative, junky stocks (alt-energy, crypto, mining, drone tech, quantum) are driving R2K way up vs. the "quality" S&P Small Cap 600, which requires members to have profits...

Speculative, junky stocks (alt-energy, crypto, mining, drone tech, quantum) are driving R2K way up vs. the "quality" S&P Small Cap 600, which requires members to have profits...

Gold ETF ($GLD) call options volume (5-day moving average) has spiked to a record 900,000 contracts.

Silver ETF ($SLV) call options volume hit ~1,000,000, the highest since 2021.

Precious metals have never been this HOT.

Gold ETF ($GLD) call options volume (5-day moving average) has spiked to a record 900,000 contracts.

Silver ETF ($SLV) call options volume hit ~1,000,000, the highest since 2021.

Precious metals have never been this HOT.