We need to pay elected leaders more money and stop pretending it's some sort of calling. They're managing hundreds of billions of dollars in investments and millions of people's lives.

my colleague Julius Probst and I wrote a guide for how policymakers and economists, as well as HR and recruiting leaders, can navigate this economy while "flying blind."

my colleague Julius Probst and I wrote a guide for how policymakers and economists, as well as HR and recruiting leaders, can navigate this economy while "flying blind."

So I dug into the how and why of revisions. A few big takeaways:

#EconSky

So I dug into the how and why of revisions. A few big takeaways:

#EconSky

That will weaken economic growth -- and will make economic statistics less accurate and more prone to revisions.

www.piie.com/publications...

That will weaken economic growth -- and will make economic statistics less accurate and more prone to revisions.

www.piie.com/publications...

It was priced around $17,500 to $20,000.

It was priced around $17,500 to $20,000.

www.washingtonpost.com/opinions/202...

www.washingtonpost.com/opinions/202...

• Broader scope for the 50% steel & aluminum tariffs to include some steel-derivative products.

• Relaxation of Chinese export restrictions on magnets & rate minerals.

• New distributional methodology.

1/9

• Broader scope for the 50% steel & aluminum tariffs to include some steel-derivative products.

• Relaxation of Chinese export restrictions on magnets & rate minerals.

• New distributional methodology.

1/9

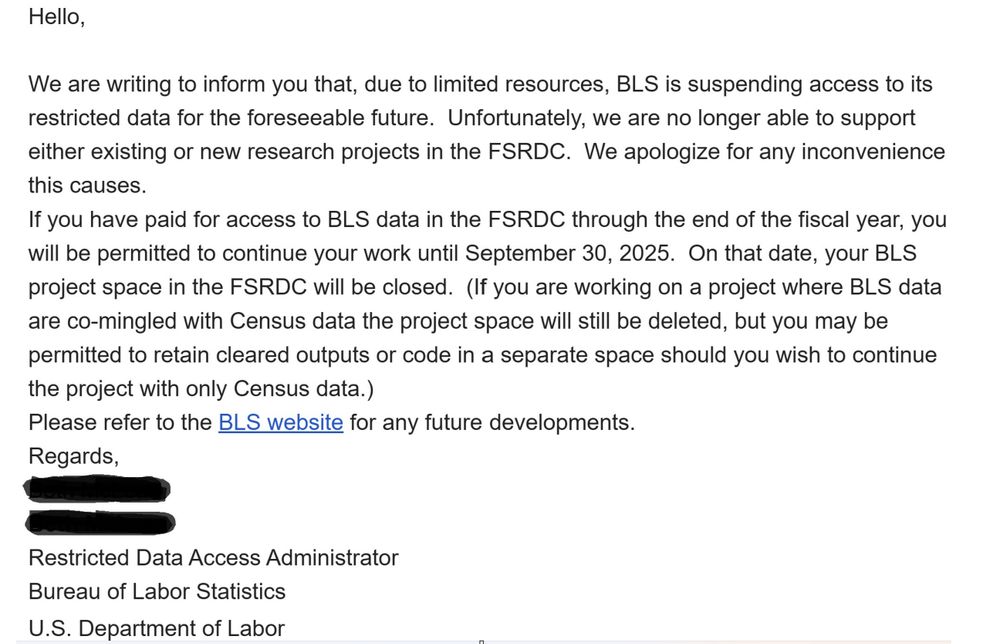

BLS is suspending access to its restricted data "for the forseeable future." Applies to projects through the Federal Statistical Research Data Centers & onsite projects with BLS.

#EconSky

BLS is suspending access to its restricted data "for the forseeable future." Applies to projects through the Federal Statistical Research Data Centers & onsite projects with BLS.

#EconSky

"You can almost think of the labor market as a rock in the ocean getting battered and getting weathered by all the other things going on in the economy"

www.nytimes.com/2025/04/03/b... @nytimes.com w/ @bencasselman.bsky.social

"You can almost think of the labor market as a rock in the ocean getting battered and getting weathered by all the other things going on in the economy"

www.nytimes.com/2025/04/03/b... @nytimes.com w/ @bencasselman.bsky.social

I've seen other press conferences/speeches where the market tanked, but it was always in the context of an ongoing crisis where the response looked insufficient.

I've seen other press conferences/speeches where the market tanked, but it was always in the context of an ongoing crisis where the response looked insufficient.

with @colbylsmith.bsky.social #EconSky

www.nytimes.com/2025/03/04/b...

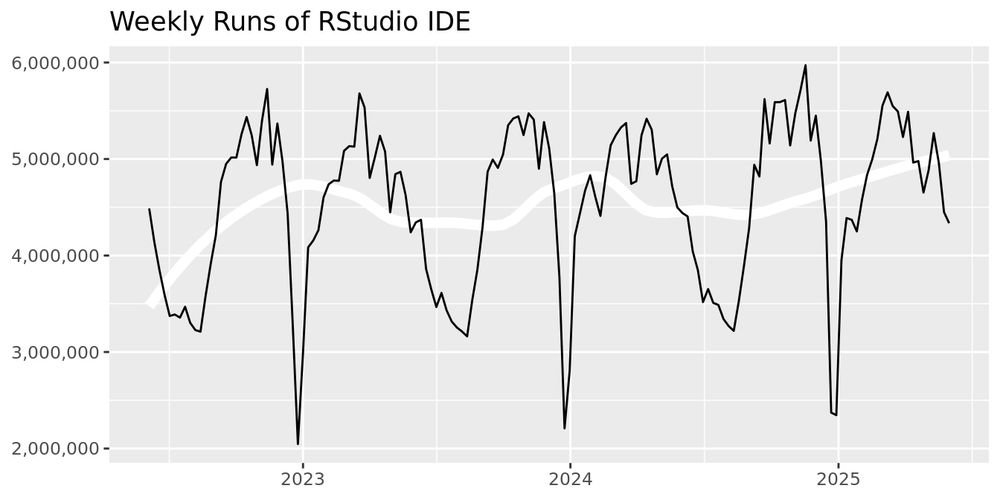

recruitonomics.com/the-past-pre...

recruitonomics.com/the-past-pre...