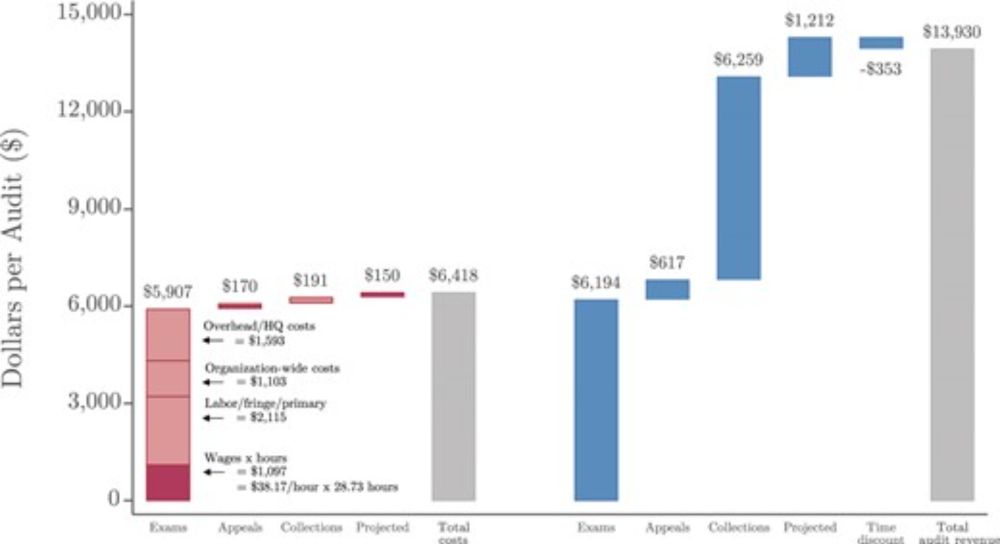

tax/law/econ/lake michigan

Reposted by Jacob Goldin

Unsure about the choice of title if i can be completely honest.

Reposted by Jacob Goldin

@allafarce.bsky.social via LinkedIn re: Propel’s internals.

This is illegal.

Reposted by Jacob Goldin

Join us for an hour-long virtual discussion with four panelists whose career paths include substantial work on environmental tax issues.

Register 👉 us02web.zoom.us/webinar/regi...

Reposted by Jacob Goldin

Reposted by Jacob Goldin

It's 25% off (with code PREORDER25) if you're a B&N Rewards OR Premium Member - & you can sign up to be a Rewards Member FOR FREE! @barnesandnoble.com

Here's the link: www.barnesandnoble.com/w/lawless-le...

Reposted by Jacob Goldin

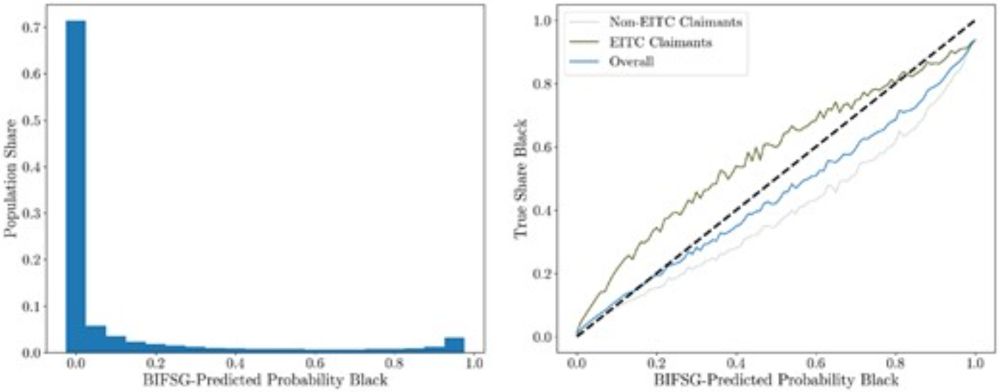

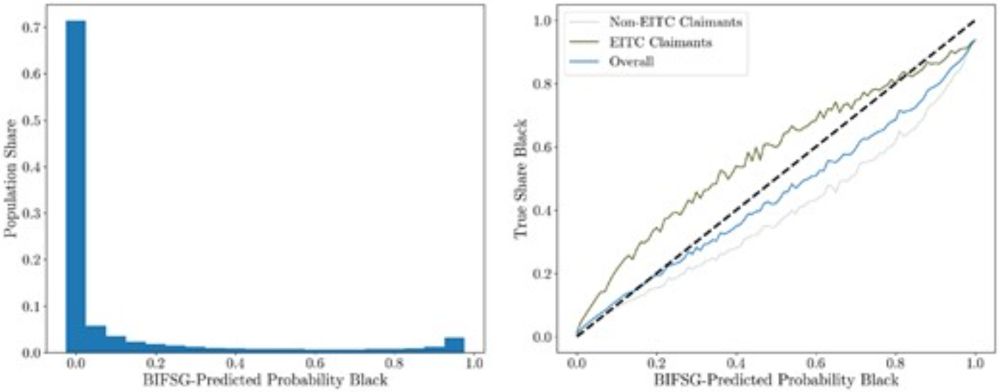

Monotone Ecological Inference (Elzayn, Goldin, Guage et al) We study monotone ecological inference, a partial identification approach to ecological inference. The approach exploits information about one or both of the following conditional associations: (1) outcome differences between gro

Reposted by Jacob Goldin

Reposted by Klaus W. Zimmermann, Timothy J. Bartik, Jacob Goldin

Reposted by Jacob Goldin

Reposted by Jacob Goldin

Reposted by Jacob Goldin

And it’d be lawless.

www.nytimes.com/2025/03/04/u...

Reposted by Jacob Goldin

Reposted by Jacob Goldin

Reposted by Jacob Goldin

All CES papers are down: www.census.gov/library/work...

All SEHSD, CED, ADEP, POP working papers published before 2024 appear to be down: www.census.gov/library/work...

Some 2024 and 2025 papers are still up.

Reposted by Jacob Goldin

www.nytimes.com/2025/02/01/...

codeforamerica.org/news/expandi...

Reposted by James P. Collins, Jacob Goldin, Narayan Sastry

Reposted by Jacob Goldin

Reposted by Lawrence F. Katz, Jacob Goldin, Feng Hu

Reposted by Lawrence F. Katz, Jacob Goldin, Ben Sprung-Keyser