Jacob Goldin

@jacobsgoldin.bsky.social

tax/law/econ/lake michigan

Reposted by Jacob Goldin

www.linkedin.com/posts/davegu...

@allafarce.bsky.social via LinkedIn re: Propel’s internals.

This is illegal.

@allafarce.bsky.social via LinkedIn re: Propel’s internals.

This is illegal.

In our real-time data we are seeing nearly 2 million SNAP households *not* receive their usual food benefits due to the shutdown. Yesterday's court ruling gives hope that money will come at some… ...

In our real-time data we are seeing nearly 2 million SNAP households *not* receive their usual food benefits due to the shutdown. Yesterday's court ruling gives hope that money will come at some point...

www.linkedin.com

November 1, 2025 at 10:18 PM

www.linkedin.com/posts/davegu...

@allafarce.bsky.social via LinkedIn re: Propel’s internals.

This is illegal.

@allafarce.bsky.social via LinkedIn re: Propel’s internals.

This is illegal.

Reposted by Jacob Goldin

What environmental taxation career opportunities are available?

Join us for an hour-long virtual discussion with four panelists whose career paths include substantial work on environmental tax issues.

Register 👉 us02web.zoom.us/webinar/regi...

Join us for an hour-long virtual discussion with four panelists whose career paths include substantial work on environmental tax issues.

Register 👉 us02web.zoom.us/webinar/regi...

June 12, 2025 at 4:06 PM

What environmental taxation career opportunities are available?

Join us for an hour-long virtual discussion with four panelists whose career paths include substantial work on environmental tax issues.

Register 👉 us02web.zoom.us/webinar/regi...

Join us for an hour-long virtual discussion with four panelists whose career paths include substantial work on environmental tax issues.

Register 👉 us02web.zoom.us/webinar/regi...

Reposted by Jacob Goldin

Congress is facing a choice on the Child Tax Credit, @bobgreensteindc.bsky.social writes: Will they adopt lower-cost CTC changes that benefit children in low-income working families, or higher-cost changes that largely exclude them?

Will the reconciliation bill’s Child Tax Credit changes leave out children in low-income working families? - The Hamilton Project

Lawmakers are considering a Child Tax Credit expansion that would primarily benefit higher-income families while continuing to exclude millions of children from the poorest working families.

www.hamiltonproject.org

May 12, 2025 at 4:11 PM

Congress is facing a choice on the Child Tax Credit, @bobgreensteindc.bsky.social writes: Will they adopt lower-cost CTC changes that benefit children in low-income working families, or higher-cost changes that largely exclude them?

Reposted by Jacob Goldin

link 📈🤖

Monotone Ecological Inference (Elzayn, Goldin, Guage et al) We study monotone ecological inference, a partial identification approach to ecological inference. The approach exploits information about one or both of the following conditional associations: (1) outcome differences between gro

Monotone Ecological Inference (Elzayn, Goldin, Guage et al) We study monotone ecological inference, a partial identification approach to ecological inference. The approach exploits information about one or both of the following conditional associations: (1) outcome differences between gro

April 22, 2025 at 4:39 PM

link 📈🤖

Monotone Ecological Inference (Elzayn, Goldin, Guage et al) We study monotone ecological inference, a partial identification approach to ecological inference. The approach exploits information about one or both of the following conditional associations: (1) outcome differences between gro

Monotone Ecological Inference (Elzayn, Goldin, Guage et al) We study monotone ecological inference, a partial identification approach to ecological inference. The approach exploits information about one or both of the following conditional associations: (1) outcome differences between gro

Reposted by Jacob Goldin

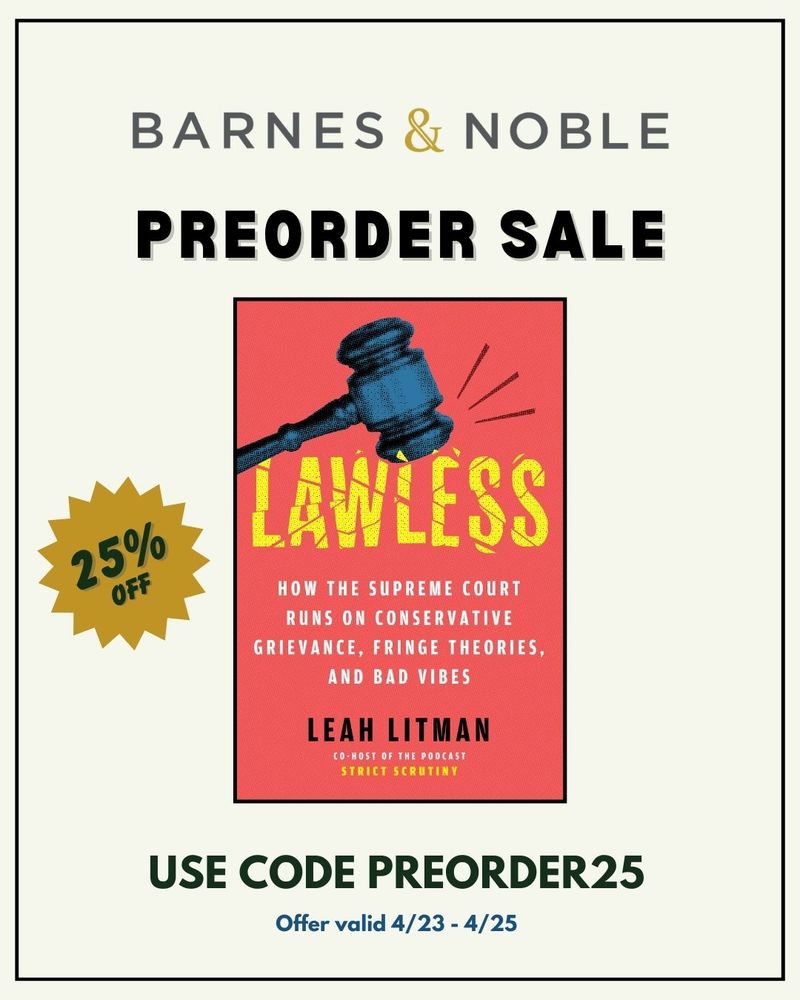

Barnes & Noble is running ANOTHER pre-order sale for LAWLESS (out May 13!!!!!!!)!

It's 25% off (with code PREORDER25) if you're a B&N Rewards OR Premium Member - & you can sign up to be a Rewards Member FOR FREE! @barnesandnoble.com

Here's the link: www.barnesandnoble.com/w/lawless-le...

It's 25% off (with code PREORDER25) if you're a B&N Rewards OR Premium Member - & you can sign up to be a Rewards Member FOR FREE! @barnesandnoble.com

Here's the link: www.barnesandnoble.com/w/lawless-le...

April 23, 2025 at 2:46 PM

Barnes & Noble is running ANOTHER pre-order sale for LAWLESS (out May 13!!!!!!!)!

It's 25% off (with code PREORDER25) if you're a B&N Rewards OR Premium Member - & you can sign up to be a Rewards Member FOR FREE! @barnesandnoble.com

Here's the link: www.barnesandnoble.com/w/lawless-le...

It's 25% off (with code PREORDER25) if you're a B&N Rewards OR Premium Member - & you can sign up to be a Rewards Member FOR FREE! @barnesandnoble.com

Here's the link: www.barnesandnoble.com/w/lawless-le...

Reposted by Jacob Goldin

In responses to attempted abuses in the Nixon admin, overwhelming bipartisan majorities enacted laws making it a crime for the President or any political appointee in the WH to directly or indirectly interfere in IRS audits or investigations of taxpayers. The President has done just this. 2/3

Understanding the Tax System’s Protections Against Political Interference in the Tax Code

By: The Tax Law Center

medium.com

April 16, 2025 at 11:53 PM

In responses to attempted abuses in the Nixon admin, overwhelming bipartisan majorities enacted laws making it a crime for the President or any political appointee in the WH to directly or indirectly interfere in IRS audits or investigations of taxpayers. The President has done just this. 2/3

Reposted by Jacob Goldin

We’re pleased to announce this year’s slate of Upjohn Institute Early Career Research Awards. Ten awardees receive $7,500 apiece to carry out policy-relevant research on labor market issues. #Econsky #ECRA

Upjohn Institute announces 2025 Early Career Research Awards

www.upjohn.org

April 8, 2025 at 4:31 PM

Reposted by Jacob Goldin

This is terrifying. Tax data is strictly protected by law—using it for anything beyond tax administration is a dangerous breach of trust. This is just the tip of the iceberg of how IRS info can be weaponized against people in this country. 🚨 #IRS #DOGE www.washingtonpost.com/us-policy/20...

IRS nears deal with ICE to share addresses of suspected undocumented immigrants

The move toward information-sharing comes as President Donald Trump pushes his administration to use every resource to conduct what he hopes will be the largest mass deportation of immigrants in U.S. ...

www.washingtonpost.com

March 22, 2025 at 10:32 PM

This is terrifying. Tax data is strictly protected by law—using it for anything beyond tax administration is a dangerous breach of trust. This is just the tip of the iceberg of how IRS info can be weaponized against people in this country. 🚨 #IRS #DOGE www.washingtonpost.com/us-policy/20...

Reposted by Jacob Goldin

A bright spot in recent tax policy has been the success of the IRS's in-house Direct File program, which allows many taxpayers to file taxes for free online through a simple interface, even on their phones. Let me tell you why I think so, and why Direct File’s future is at a crossroads. #EconSky

A government program made tax filing free and more efficient. Musk and DOGE may get rid of it anyway

The fate of the IRS Direct File program is unclear as Elon Musk and the Department of Government Efficiency cleave their way through the federal bureaucracy. Republicans and commercial tax preparation...

apnews.com

March 13, 2025 at 8:23 PM

A bright spot in recent tax policy has been the success of the IRS's in-house Direct File program, which allows many taxpayers to file taxes for free online through a simple interface, even on their phones. Let me tell you why I think so, and why Direct File’s future is at a crossroads. #EconSky

Reposted by Jacob Goldin

1/ Firing some half of the IRS staff to “reduce fraud” would be like trying to catch more fish by ripping your net in half.

And it’d be lawless.

www.nytimes.com/2025/03/04/u...

And it’d be lawless.

www.nytimes.com/2025/03/04/u...

Trump Administration Pushes to Slash I.R.S. Work Force in Half

Losing half of its employees would severely strap the I.R.S., meaning Americans may have to wait longer to receive tax refunds.

www.nytimes.com

March 4, 2025 at 10:21 PM

1/ Firing some half of the IRS staff to “reduce fraud” would be like trying to catch more fish by ripping your net in half.

And it’d be lawless.

www.nytimes.com/2025/03/04/u...

And it’d be lawless.

www.nytimes.com/2025/03/04/u...

Reposted by Jacob Goldin

1/ Treasury Secretary Bessent’s decision (home.treasury.gov/news/press-r...) to not enforce most of the Corporate Transparency Act on a permanent basis will encourage financial crimes using shell companies, including money laundering, terrorism, sanctions evasion, and tax evasion.

March 3, 2025 at 5:57 PM

1/ Treasury Secretary Bessent’s decision (home.treasury.gov/news/press-r...) to not enforce most of the Corporate Transparency Act on a permanent basis will encourage financial crimes using shell companies, including money laundering, terrorism, sanctions evasion, and tax evasion.

Reposted by Jacob Goldin

Former IRS Commissioners serving under every President going back to Reagan, including Trump: The mass, indiscriminate firings at the IRS will increase deficits, risk filing season disruptions, and shift tax burdens from tax cheats on to honest taxpayers. 1/4 www.nytimes.com/2025/02/24/o...

Opinion | Trump Just Fired 6,700 I.R.S. Workers in the Middle of Tax Season. That’s a Huge Mistake.

The Trump administration’s decision to fire over 6,000 I.R.S. workers will make the government less effective and less efficient, not more.

www.nytimes.com

February 24, 2025 at 2:51 PM

Former IRS Commissioners serving under every President going back to Reagan, including Trump: The mass, indiscriminate firings at the IRS will increase deficits, risk filing season disruptions, and shift tax burdens from tax cheats on to honest taxpayers. 1/4 www.nytimes.com/2025/02/24/o...

Reposted by Jacob Goldin

What Census research is now unavailable?

All CES papers are down: www.census.gov/library/work...

All SEHSD, CED, ADEP, POP working papers published before 2024 appear to be down: www.census.gov/library/work...

Some 2024 and 2025 papers are still up.

All CES papers are down: www.census.gov/library/work...

All SEHSD, CED, ADEP, POP working papers published before 2024 appear to be down: www.census.gov/library/work...

Some 2024 and 2025 papers are still up.

February 3, 2025 at 9:48 PM

What Census research is now unavailable?

All CES papers are down: www.census.gov/library/work...

All SEHSD, CED, ADEP, POP working papers published before 2024 appear to be down: www.census.gov/library/work...

Some 2024 and 2025 papers are still up.

All CES papers are down: www.census.gov/library/work...

All SEHSD, CED, ADEP, POP working papers published before 2024 appear to be down: www.census.gov/library/work...

Some 2024 and 2025 papers are still up.

Reposted by Jacob Goldin

Thousands of people, mostly kids, will die for no reason because of this

www.nytimes.com/2025/02/01/...

www.nytimes.com/2025/02/01/...

February 1, 2025 at 9:38 PM

Thousands of people, mostly kids, will die for no reason because of this

www.nytimes.com/2025/02/01/...

www.nytimes.com/2025/02/01/...

If you're looking for a free tax filing software but don't qualify to use IRS Direct File, I've had good experiences the last few years with cash.app/taxes

Free Tax Filing - Cash App Taxes

Easy, accurate and completely free tax filing with Cash App Taxes, formerly Credit Karma Tax. Includes Max Refund Guarantee, free Audit Defense & more.

cash.app

January 28, 2025 at 2:58 AM

If you're looking for a free tax filing software but don't qualify to use IRS Direct File, I've had good experiences the last few years with cash.app/taxes

Today is a big day for US tax policy - it’s the first time you can start your tax return using information the IRS already has about you: directfile.irs.gov This is government efficiency in action

January 27, 2025 at 10:18 PM

Today is a big day for US tax policy - it’s the first time you can start your tax return using information the IRS already has about you: directfile.irs.gov This is government efficiency in action

Reposted by Jacob Goldin

Just had our data access rescinded for a projected using federal microdata to study and reduce disparate impact in housing markets.

January 23, 2025 at 4:31 PM

Just had our data access rescinded for a projected using federal microdata to study and reduce disparate impact in housing markets.

Reposted by Jacob Goldin

Bob Dylan - Highway 61 Revisited- FULL ALBUM - If it was made in Motown!

YouTube video by Dylanfied

youtu.be

January 19, 2025 at 11:27 PM

Reposted by Jacob Goldin

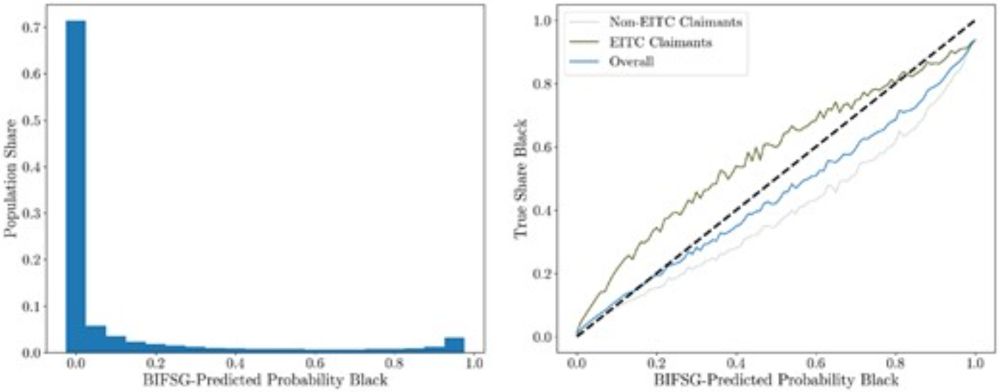

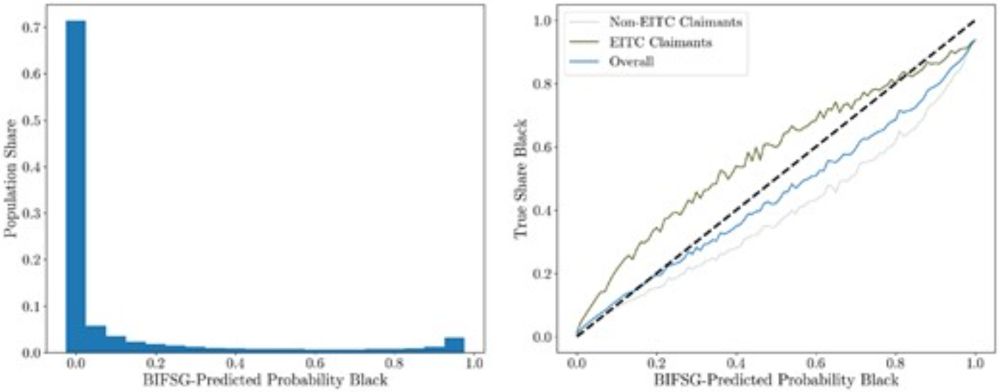

This paper is a great example of solid evidence of systemic discrimination:

"Black taxpayers are audited at 2.9 to 4.7 times the rate of non-Black taxpayers."

This reflects a series of choices built into the IRS audit algorithm: focus on the EITC, and overclaiming of credits.

"Black taxpayers are audited at 2.9 to 4.7 times the rate of non-Black taxpayers."

This reflects a series of choices built into the IRS audit algorithm: focus on the EITC, and overclaiming of credits.

#QJE Feb 2025, #3, “Measuring and Mitigating Racial Disparities in Tax Audits,” by Elzayn, Smith, Hertz, Guage, Ramesh, Fisher, Ho, and Goldin (@jacobsgoldin.bsky.social): doi.org/10.1093/qje/...

Measuring and Mitigating Racial Disparities in Tax Audits*

Abstract. Tax authorities around the world rely on audits to detect underreported tax liabilities and to verify that taxpayers qualify for the benefits the

doi.org

January 12, 2025 at 4:06 PM

This paper is a great example of solid evidence of systemic discrimination:

"Black taxpayers are audited at 2.9 to 4.7 times the rate of non-Black taxpayers."

This reflects a series of choices built into the IRS audit algorithm: focus on the EITC, and overclaiming of credits.

"Black taxpayers are audited at 2.9 to 4.7 times the rate of non-Black taxpayers."

This reflects a series of choices built into the IRS audit algorithm: focus on the EITC, and overclaiming of credits.

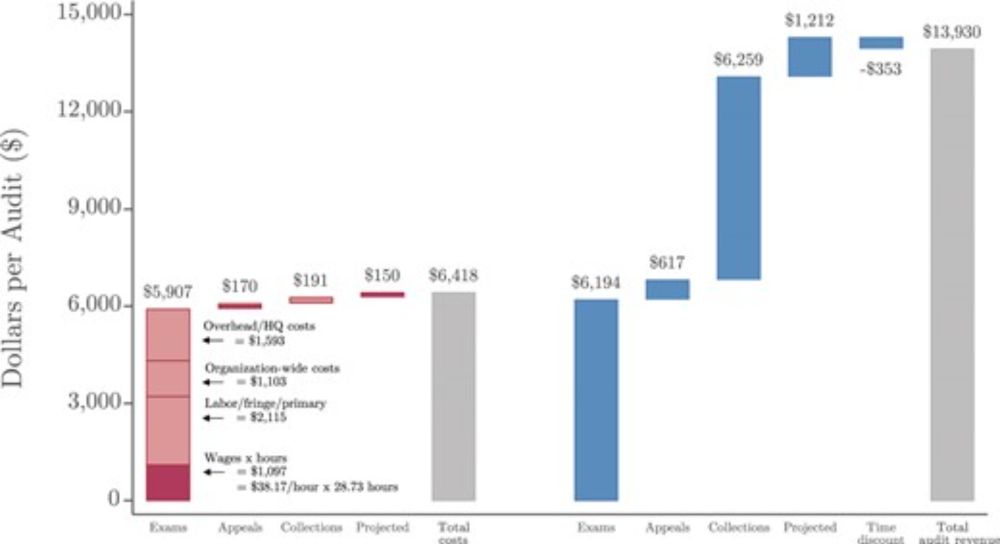

Whether you care about fairness or fiscal responsibility, cutting the IRS’s enforcement budget (as many Republicans have proposed) would be an absolute disaster. New evidence from back-to-back studies in the latest @qjeharvard.bsky.social ... (1/4)

January 12, 2025 at 3:38 PM

Whether you care about fairness or fiscal responsibility, cutting the IRS’s enforcement budget (as many Republicans have proposed) would be an absolute disaster. New evidence from back-to-back studies in the latest @qjeharvard.bsky.social ... (1/4)

Reposted by Jacob Goldin

#QJE Feb 2025, #2, “A Welfare Analysis of Tax Audits Across the Income Distribution,” by Boning, Hendren, Sprung-Keyser (@bsprungkeyser.bsky.social), and Stuart: doi.org/10.1093/qje/...

A Welfare Analysis of Tax Audits Across the Income Distribution*

Abstract. We estimate the returns to IRS audits of taxpayers across the income distribution. We find an additional $1 spent auditing taxpayers above the 90

doi.org

January 12, 2025 at 12:11 PM

#QJE Feb 2025, #2, “A Welfare Analysis of Tax Audits Across the Income Distribution,” by Boning, Hendren, Sprung-Keyser (@bsprungkeyser.bsky.social), and Stuart: doi.org/10.1093/qje/...

Reposted by Jacob Goldin

#QJE Feb 2025, #3, “Measuring and Mitigating Racial Disparities in Tax Audits,” by Elzayn, Smith, Hertz, Guage, Ramesh, Fisher, Ho, and Goldin (@jacobsgoldin.bsky.social): doi.org/10.1093/qje/...

Measuring and Mitigating Racial Disparities in Tax Audits*

Abstract. Tax authorities around the world rely on audits to detect underreported tax liabilities and to verify that taxpayers qualify for the benefits the

doi.org

January 12, 2025 at 12:11 PM

#QJE Feb 2025, #3, “Measuring and Mitigating Racial Disparities in Tax Audits,” by Elzayn, Smith, Hertz, Guage, Ramesh, Fisher, Ho, and Goldin (@jacobsgoldin.bsky.social): doi.org/10.1093/qje/...

Reposted by Jacob Goldin

Come work with me @Yale! I'm hiring a full-time RA to start in summer 2025, to work on understanding how to tax the super-rich and what drives sky-high US infrastructure construction costs.

tobin.yale.edu/programs/pre...

tobin.yale.edu/programs/pre...

October 22, 2024 at 12:53 PM

Come work with me @Yale! I'm hiring a full-time RA to start in summer 2025, to work on understanding how to tax the super-rich and what drives sky-high US infrastructure construction costs.

tobin.yale.edu/programs/pre...

tobin.yale.edu/programs/pre...

Reposted by Jacob Goldin

More news this morning that economic hardship increased from 2021 to 2022. This time measured as food insecurity from USDA

13.4 million kids without enough food in 2022, 3.7 million more than 2021

This is a policy choice we are making

13.4 million kids without enough food in 2022, 3.7 million more than 2021

This is a policy choice we are making

October 25, 2023 at 3:29 PM

More news this morning that economic hardship increased from 2021 to 2022. This time measured as food insecurity from USDA

13.4 million kids without enough food in 2022, 3.7 million more than 2021

This is a policy choice we are making

13.4 million kids without enough food in 2022, 3.7 million more than 2021

This is a policy choice we are making