GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

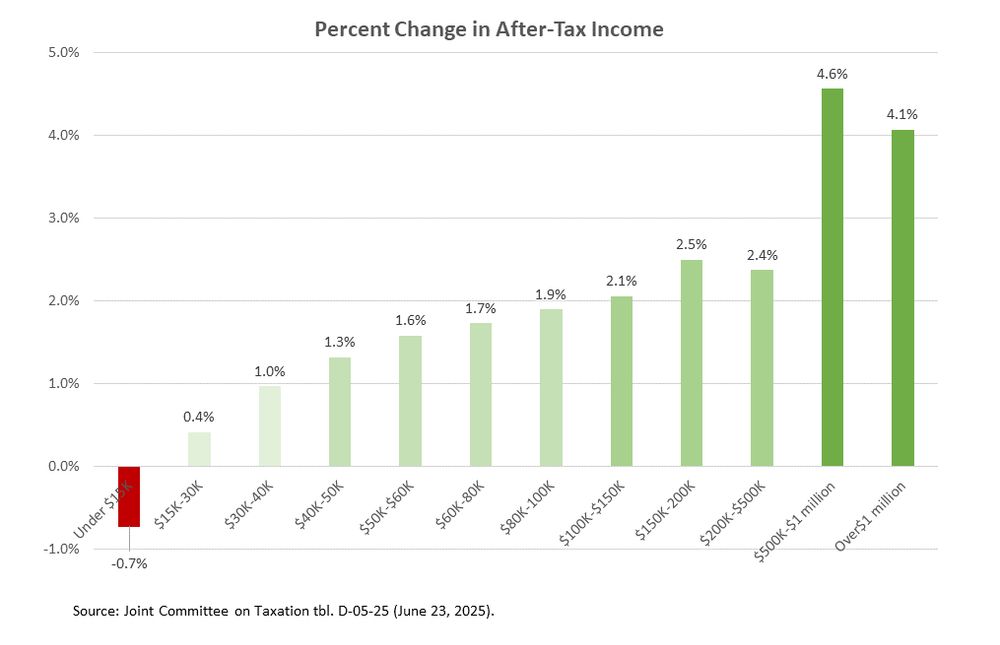

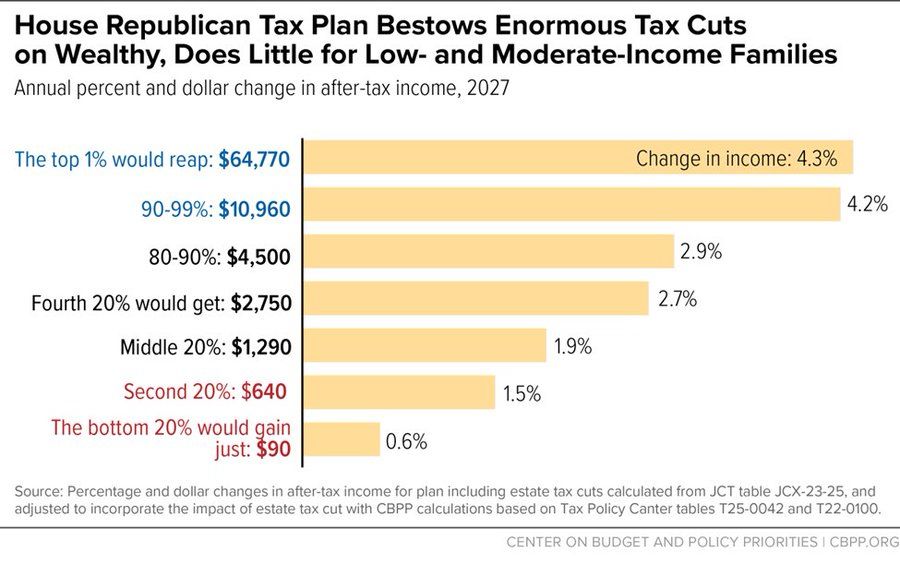

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

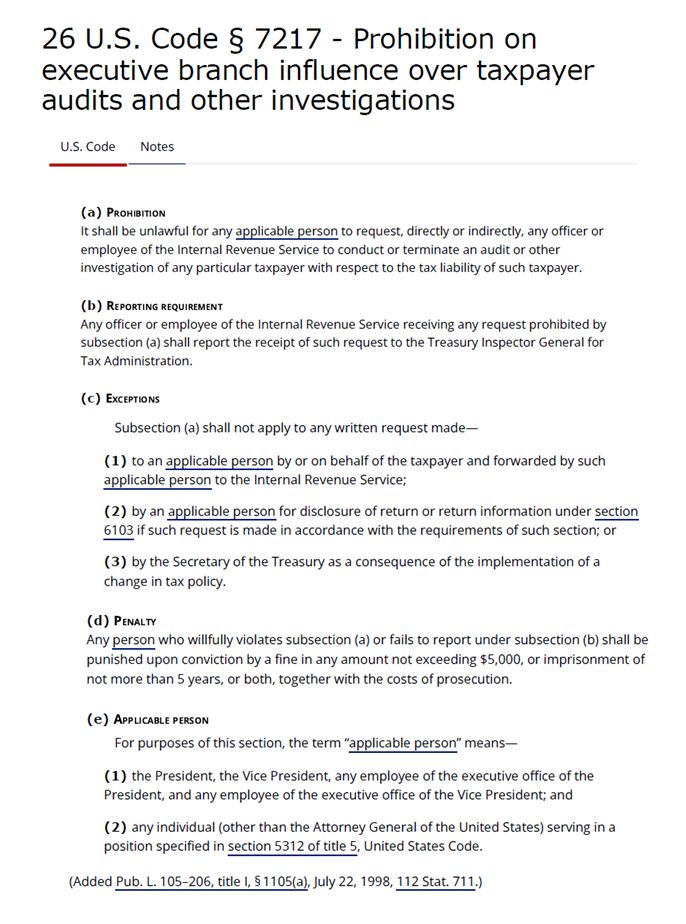

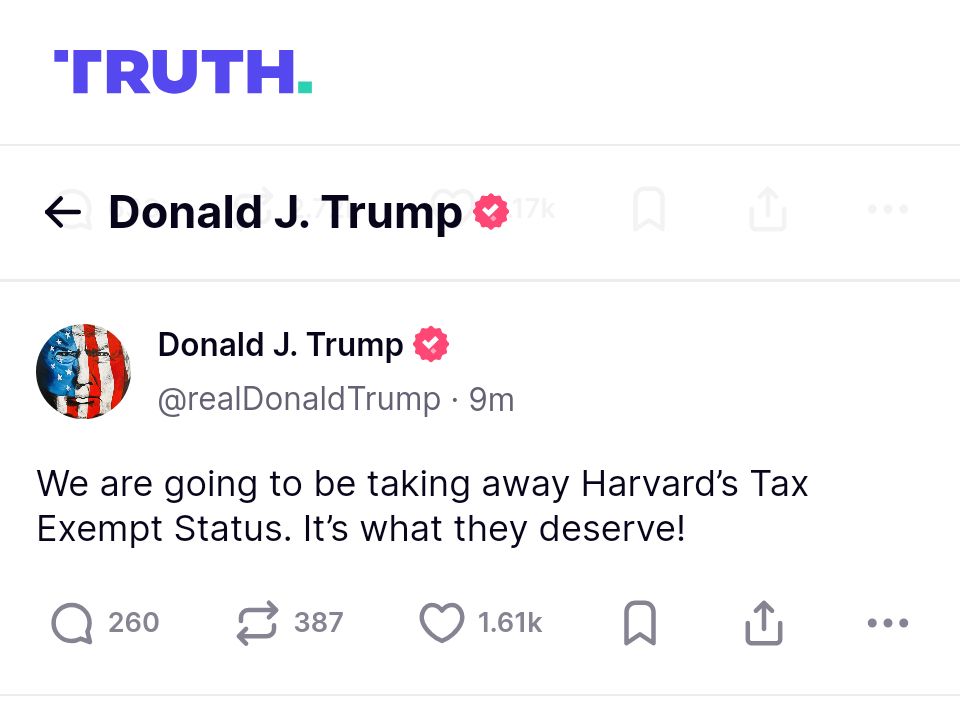

On Friday, before @jacobbogage.bsky.social broke this news about the escalation of the request @taxlawcenter.org explained one of many reasons why it could harm taxpayer rights: taxlawcenter.org/blog/irs-dhs...

On Friday, before @jacobbogage.bsky.social broke this news about the escalation of the request @taxlawcenter.org explained one of many reasons why it could harm taxpayer rights: taxlawcenter.org/blog/irs-dhs...

taxlawcenter.org/events/nyu-l...

taxlawcenter.org/events/nyu-l...

DHS has sought home addresses of undocumented immigrants who pay taxes

W/ @jacobbogage.bsky.social & co

Scoop via me + @jeffstein.bsky.social & WaPo team...