Tax, law, policy, budget, economy. US & NZ.

Former Senior Director for Economic Policy @centeronbudget.bsky.social.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

www.forbes.com/sites/kellyp...

Want info on call wait times? Leadership turnover? IRS-ICE data sharing? We’ve got you covered:

www.brookings.edu/projects/the...

www.reuters.com/world/tax-pr...

www.reuters.com/world/tax-pr...

www.reuters.com/world/tax-pr...

I'll add: this also puts the US further out of line with globally agreed minimum tax standards.

I'll add: this also puts the US further out of line with globally agreed minimum tax standards.

> IRS criminal investigations partnering with ICE

> what the 25% staffing cut means for tax refunds

> what has happened to IRS high-wealth audits

> Palantir's new contracts & your data privacy

> IRS criminal investigations partnering with ICE

> what the 25% staffing cut means for tax refunds

> what has happened to IRS high-wealth audits

> Palantir's new contracts & your data privacy

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

I look at why U.S. taxes are so complicated for @marketplace.org with @dashching.bsky.social & Larry Zelenak @dukelaw.bsky.social

www.marketplace.org/story/2025/1...

I look at why U.S. taxes are so complicated for @marketplace.org with @dashching.bsky.social & Larry Zelenak @dukelaw.bsky.social

www.marketplace.org/story/2025/1...

Unprecedented, dangerous turnover at IRS: Of 31 top positions, 15 have turned over since January, 2 have been placed on leave, 2 are vacant and 3 are slated for elimination.

www.brookings.edu/articles/the...

Unprecedented, dangerous turnover at IRS: Of 31 top positions, 15 have turned over since January, 2 have been placed on leave, 2 are vacant and 3 are slated for elimination.

www.brookings.edu/articles/the...

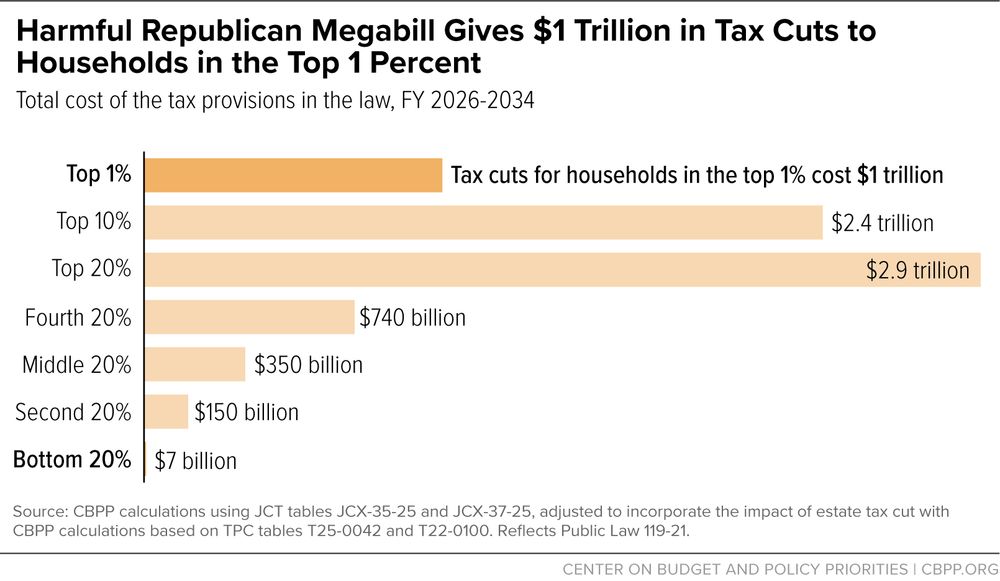

Tax cuts of around $500B for households in the bottom 60%--the very folks who also face the brunt of cuts to Medicaid and SNAP.

Tax cuts of around $500B for households in the bottom 60%--the very folks who also face the brunt of cuts to Medicaid and SNAP.

www.wired.com/story/doge-d...

www.wired.com/story/doge-d...

ProPublica has obtained the blueprint for the Trump administration’s unprecedented plan to turn over IRS records to Homeland Security in order to speed up the agency’s mass deportation efforts.

Trump Admin claimed "nearly 90% of Social Security beneficiaries will no longer pay fed income taxes on their bens"

50.9% of filers w/SS bens paid the tax before

47.3% now

Only 3.6% no longer pay

taxpolicycenter.org/taxvox/corre...

Trump Admin claimed "nearly 90% of Social Security beneficiaries will no longer pay fed income taxes on their bens"

50.9% of filers w/SS bens paid the tax before

47.3% now

Only 3.6% no longer pay

taxpolicycenter.org/taxvox/corre...

Just the tip of one of two big icebergs of tax cuts for special interests coming for the tax system. www.washingtonpost.com/business/202...

Just the tip of one of two big icebergs of tax cuts for special interests coming for the tax system. www.washingtonpost.com/business/202...

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.