Chye-Ching Huang

@dashching.bsky.social

Executive Director @taxlawcenter.org

Tax, law, policy, budget, economy. US & NZ.

Former Senior Director for Economic Policy @centeronbudget.bsky.social.

Tax, law, policy, budget, economy. US & NZ.

Former Senior Director for Economic Policy @centeronbudget.bsky.social.

Pinned

The Senate-passed bill weakens the tax system and makes it more regressive, complex, and gameable.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

Reposted by Chye-Ching Huang

Tuning in for SCOTUS oral argument on tariffs today? @justsecurity.org @taxlawcenter.org's Kelsey Merrick with a primer on how using tariffs to raise revenue is a choice for Congress, not the President.

On Wednesday, SCOTUS will weigh whether the President can use IEEPA to unilaterally impose tariffs.

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

The Use of Tariffs to Raise Revenue is a Choice for Congress

Congress did not write IEEPA to allow a President to replace the income tax system with a patchwork of tariffs that they can impose, adjust, or suspend at will.

www.justsecurity.org

November 5, 2025 at 1:26 PM

Tuning in for SCOTUS oral argument on tariffs today? @justsecurity.org @taxlawcenter.org's Kelsey Merrick with a primer on how using tariffs to raise revenue is a choice for Congress, not the President.

Tuning in for SCOTUS oral argument on tariffs today? @justsecurity.org @taxlawcenter.org's Kelsey Merrick with a primer on how using tariffs to raise revenue is a choice for Congress, not the President.

On Wednesday, SCOTUS will weigh whether the President can use IEEPA to unilaterally impose tariffs.

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

The Use of Tariffs to Raise Revenue is a Choice for Congress

Congress did not write IEEPA to allow a President to replace the income tax system with a patchwork of tariffs that they can impose, adjust, or suspend at will.

www.justsecurity.org

November 5, 2025 at 1:26 PM

Tuning in for SCOTUS oral argument on tariffs today? @justsecurity.org @taxlawcenter.org's Kelsey Merrick with a primer on how using tariffs to raise revenue is a choice for Congress, not the President.

Reposted by Chye-Ching Huang

On Wednesday, SCOTUS will weigh whether the President can use IEEPA to unilaterally impose tariffs.

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

The Use of Tariffs to Raise Revenue is a Choice for Congress

Congress did not write IEEPA to allow a President to replace the income tax system with a patchwork of tariffs that they can impose, adjust, or suspend at will.

www.justsecurity.org

November 3, 2025 at 2:03 PM

On Wednesday, SCOTUS will weigh whether the President can use IEEPA to unilaterally impose tariffs.

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Kelsey Merrick argues Congress intentionally ended tariffs as a major revenue source decades ago and never delegated that choice to the President.

www.justsecurity.org/123833/tarif...

Reposted by Chye-Ching Huang

On 10/28, join us for a panel discussion highlighting how OBBBA missed substantial opportunities to improve the tax system and falls far short of the "tax reform" that many across the political spectrum have long called for. nyu.zoom.us/webinar/regi...

October 22, 2025 at 2:30 PM

On 10/28, join us for a panel discussion highlighting how OBBBA missed substantial opportunities to improve the tax system and falls far short of the "tax reform" that many across the political spectrum have long called for. nyu.zoom.us/webinar/regi...

Reposted by Chye-Ching Huang

Fun fact: You can write clarinet lessons off on your taxes! (with a note from your dentist) It’s one of thousands of exemptions

I look at why U.S. taxes are so complicated for @marketplace.org with @dashching.bsky.social & Larry Zelenak @dukelaw.bsky.social

www.marketplace.org/story/2025/1...

I look at why U.S. taxes are so complicated for @marketplace.org with @dashching.bsky.social & Larry Zelenak @dukelaw.bsky.social

www.marketplace.org/story/2025/1...

taxes.you

October 10, 2025 at 1:51 PM

Fun fact: You can write clarinet lessons off on your taxes! (with a note from your dentist) It’s one of thousands of exemptions

I look at why U.S. taxes are so complicated for @marketplace.org with @dashching.bsky.social & Larry Zelenak @dukelaw.bsky.social

www.marketplace.org/story/2025/1...

I look at why U.S. taxes are so complicated for @marketplace.org with @dashching.bsky.social & Larry Zelenak @dukelaw.bsky.social

www.marketplace.org/story/2025/1...

Could be a big deal for many filers, including those who are elderly, disabled, rural, and unbanked:

Treasury and IRS have not yet announced how they plan to implement the Administration’s executive order ending the use of paper checks for tax refunds. We outline potential issues and recommendations for a sound implementation plan: taxlawcenter.org/blog/rushed-...

Rushed Implementation of Executive Order to Restrict Use of Paper Checks Risks Harming Taxpayers

The Trump Administration issued an Executive Order in March directing the Secretary of the Treasury to stop issuing and receiving paper checks for all federal payments, including tax refunds, by Septe...

taxlawcenter.org

August 28, 2025 at 4:35 PM

Could be a big deal for many filers, including those who are elderly, disabled, rural, and unbanked:

Reposted by Chye-Ching Huang

New from me at @brookings.edu:

Unprecedented, dangerous turnover at IRS: Of 31 top positions, 15 have turned over since January, 2 have been placed on leave, 2 are vacant and 3 are slated for elimination.

www.brookings.edu/articles/the...

Unprecedented, dangerous turnover at IRS: Of 31 top positions, 15 have turned over since January, 2 have been placed on leave, 2 are vacant and 3 are slated for elimination.

www.brookings.edu/articles/the...

August 12, 2025 at 9:44 PM

New from me at @brookings.edu:

Unprecedented, dangerous turnover at IRS: Of 31 top positions, 15 have turned over since January, 2 have been placed on leave, 2 are vacant and 3 are slated for elimination.

www.brookings.edu/articles/the...

Unprecedented, dangerous turnover at IRS: Of 31 top positions, 15 have turned over since January, 2 have been placed on leave, 2 are vacant and 3 are slated for elimination.

www.brookings.edu/articles/the...

Reposted by Chye-Ching Huang

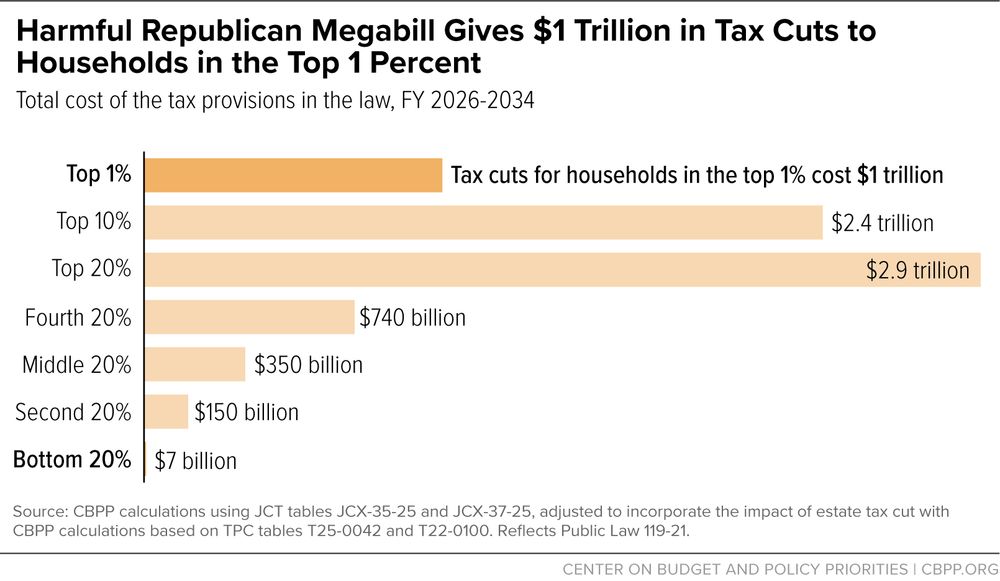

Our analysis of the full Joint Committee on Taxation tables of the flawed GOP megabill: a $1T tax cut for the top 1% and a staggering $2.4T tax cut for the top 10%.

Tax cuts of around $500B for households in the bottom 60%--the very folks who also face the brunt of cuts to Medicaid and SNAP.

Tax cuts of around $500B for households in the bottom 60%--the very folks who also face the brunt of cuts to Medicaid and SNAP.

July 31, 2025 at 1:02 PM

Our analysis of the full Joint Committee on Taxation tables of the flawed GOP megabill: a $1T tax cut for the top 1% and a staggering $2.4T tax cut for the top 10%.

Tax cuts of around $500B for households in the bottom 60%--the very folks who also face the brunt of cuts to Medicaid and SNAP.

Tax cuts of around $500B for households in the bottom 60%--the very folks who also face the brunt of cuts to Medicaid and SNAP.

Reposted by Chye-Ching Huang

Eliminating multi-language services would make it harder for taxpayers to comply with their tax obligations, set honest taxpayers up to fail and needlessly put tax revenue at risk. The IRS should not move forward with this harmful idea that has no sound tax administration purpose.

Exclusive: Trump administration officials are considering eliminating multi-language services at the IRS, according to records obtained by The Post, a move that would make it dramatically more difficult for non-English-speakers to file their taxes.

IRS considers eliminating non-English language tax services

The Trump administration is considering eliminating non-English-language tax services, which could affect millions of taxpayers who rely on multilingual support.

wapo.st

July 25, 2025 at 3:24 PM

Eliminating multi-language services would make it harder for taxpayers to comply with their tax obligations, set honest taxpayers up to fail and needlessly put tax revenue at risk. The IRS should not move forward with this harmful idea that has no sound tax administration purpose.

Reposted by Chye-Ching Huang

We are excited to launch a project to remake federal tax administration. Effective tax administration is critical to the federal government, but has recently faced drastic challenges over the last six months.

July 17, 2025 at 6:17 PM

We are excited to launch a project to remake federal tax administration. Effective tax administration is critical to the federal government, but has recently faced drastic challenges over the last six months.

Reposted by Chye-Ching Huang

SCOOP: DOGE moved to kill Direct File, the IRS's popular free tax filing tool, days after meeting with private tax filing software lobbyists.

www.wired.com/story/doge-d...

www.wired.com/story/doge-d...

DOGE Put Free Tax Filing Tool on Chopping Block After One Meeting With Lobbyists

A key operative from DOGE initiated plans to potentially kill Direct File, the free tax filing tool developed by the IRS, after offering assurances it would be spared from cuts.

www.wired.com

July 17, 2025 at 12:48 PM

SCOOP: DOGE moved to kill Direct File, the IRS's popular free tax filing tool, days after meeting with private tax filing software lobbyists.

www.wired.com/story/doge-d...

www.wired.com/story/doge-d...

Reposted by Chye-Ching Huang

This piece confirms grave risk to all taxpayers from DHS efforts to get its hands on legally protected IRS data, risking targeting of US citizens, mistaken arrests, and rampant violations of privacy rights and civil liberties

NEW: The IRS Is Building a Vast System to Share Millions of Taxpayers’ Data With ICE

ProPublica has obtained the blueprint for the Trump administration’s unprecedented plan to turn over IRS records to Homeland Security in order to speed up the agency’s mass deportation efforts.

ProPublica has obtained the blueprint for the Trump administration’s unprecedented plan to turn over IRS records to Homeland Security in order to speed up the agency’s mass deportation efforts.

The IRS Is Building a Vast System to Share Millions of Taxpayers’ Data With ICE

ProPublica has obtained the blueprint for the Trump administration’s unprecedented plan to turn over IRS records to Homeland Security in order to speed up the agency’s mass deportation efforts.

www.propublica.org

July 15, 2025 at 8:58 PM

This piece confirms grave risk to all taxpayers from DHS efforts to get its hands on legally protected IRS data, risking targeting of US citizens, mistaken arrests, and rampant violations of privacy rights and civil liberties

Reposted by Chye-Ching Huang

TPC corrects the record on taxes on Social Security benefits.

Trump Admin claimed "nearly 90% of Social Security beneficiaries will no longer pay fed income taxes on their bens"

50.9% of filers w/SS bens paid the tax before

47.3% now

Only 3.6% no longer pay

taxpolicycenter.org/taxvox/corre...

Trump Admin claimed "nearly 90% of Social Security beneficiaries will no longer pay fed income taxes on their bens"

50.9% of filers w/SS bens paid the tax before

47.3% now

Only 3.6% no longer pay

taxpolicycenter.org/taxvox/corre...

Correcting the Social Security Administration About The Big Budget Bill

The misleading communication from SSA may add to the confusion many older adults already feel about the complex retirement insurance program.

taxpolicycenter.org

July 10, 2025 at 2:19 PM

TPC corrects the record on taxes on Social Security benefits.

Trump Admin claimed "nearly 90% of Social Security beneficiaries will no longer pay fed income taxes on their bens"

50.9% of filers w/SS bens paid the tax before

47.3% now

Only 3.6% no longer pay

taxpolicycenter.org/taxvox/corre...

Trump Admin claimed "nearly 90% of Social Security beneficiaries will no longer pay fed income taxes on their bens"

50.9% of filers w/SS bens paid the tax before

47.3% now

Only 3.6% no longer pay

taxpolicycenter.org/taxvox/corre...

Via @jeffstein.bsky.social @washingtonpost.com anti-tax interests want the Trump IRS to give an unlawful tax cut to wealthy people by executive fiat.

Just the tip of one of two big icebergs of tax cuts for special interests coming for the tax system. www.washingtonpost.com/business/202...

Just the tip of one of two big icebergs of tax cuts for special interests coming for the tax system. www.washingtonpost.com/business/202...

Conservatives are asking Trump for another big tax cut

Fresh off passage of the “One Big Beautiful Bill,” some anti-tax advocates hope to push the administration to change how taxable capital gains are calculated.

www.washingtonpost.com

July 10, 2025 at 1:16 PM

Via @jeffstein.bsky.social @washingtonpost.com anti-tax interests want the Trump IRS to give an unlawful tax cut to wealthy people by executive fiat.

Just the tip of one of two big icebergs of tax cuts for special interests coming for the tax system. www.washingtonpost.com/business/202...

Just the tip of one of two big icebergs of tax cuts for special interests coming for the tax system. www.washingtonpost.com/business/202...

House-passed, etc.:

The Senate-passed bill weakens the tax system and makes it more regressive, complex, and gameable.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

July 3, 2025 at 6:43 PM

House-passed, etc.:

Reposted by Chye-Ching Huang

The 2017 tax bill was bad for Republican politicians. The 2025 law could easily be worse.

www.taxnotes.com/featured-ana...

www.taxnotes.com/featured-ana...

Grim Polls for the GOP Budget Bill | Tax Notes

Joseph J. Thorndike examines the results of several polls that report voter support of and opposition to the One Big Beautiful Bill Act.

www.taxnotes.com

July 3, 2025 at 1:55 PM

The 2017 tax bill was bad for Republican politicians. The 2025 law could easily be worse.

www.taxnotes.com/featured-ana...

www.taxnotes.com/featured-ana...

The Senate-passed bill weakens the tax system and makes it more regressive, complex, and gameable.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

July 1, 2025 at 4:55 PM

The Senate-passed bill weakens the tax system and makes it more regressive, complex, and gameable.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

Many of its tax cuts are complicated and wasteful tax breaks that dole out favors to specific industries and activities with little or no good policy reason.

Thread:

Lawmakers are realizing “surprises,” “airdrops” &“mysteries” are buried in the bill.

Time to take a beat: seems more important to know what's in a ~$5T bill than meet a fake deadline! Things worth $10s/100s of billions & people’s livelihoods & health aren’t “minutiae.”

Lawmakers are realizing “surprises,” “airdrops” &“mysteries” are buried in the bill.

Time to take a beat: seems more important to know what's in a ~$5T bill than meet a fake deadline! Things worth $10s/100s of billions & people’s livelihoods & health aren’t “minutiae.”

July 1, 2025 at 1:40 PM

Thread:

Lawmakers are realizing “surprises,” “airdrops” &“mysteries” are buried in the bill.

Time to take a beat: seems more important to know what's in a ~$5T bill than meet a fake deadline! Things worth $10s/100s of billions & people’s livelihoods & health aren’t “minutiae.”

Lawmakers are realizing “surprises,” “airdrops” &“mysteries” are buried in the bill.

Time to take a beat: seems more important to know what's in a ~$5T bill than meet a fake deadline! Things worth $10s/100s of billions & people’s livelihoods & health aren’t “minutiae.”

Thread:

Article highlighting a tax break for the wealthy shoved into the tax bill the Senate is considering: turbo-charging a loophole-ridden tax break for venture capitalists and other well-off investors.

www.bloomberg.com/news/article... (Paywall via @bloomberglaw.com @bloombergtax.com)

Article highlighting a tax break for the wealthy shoved into the tax bill the Senate is considering: turbo-charging a loophole-ridden tax break for venture capitalists and other well-off investors.

www.bloomberg.com/news/article... (Paywall via @bloomberglaw.com @bloombergtax.com)

Silicon Valley's Favorite Tax Break Gets Stronger Under GOP's Proposed Spending Bill

Silicon Valley’s favorite tax break may be getting an upgrade.

www.bloomberg.com

June 30, 2025 at 6:25 PM

Thread:

Article highlighting a tax break for the wealthy shoved into the tax bill the Senate is considering: turbo-charging a loophole-ridden tax break for venture capitalists and other well-off investors.

www.bloomberg.com/news/article... (Paywall via @bloomberglaw.com @bloombergtax.com)

Article highlighting a tax break for the wealthy shoved into the tax bill the Senate is considering: turbo-charging a loophole-ridden tax break for venture capitalists and other well-off investors.

www.bloomberg.com/news/article... (Paywall via @bloomberglaw.com @bloombergtax.com)

While tax subsidies for space ports were added to the text in the middle of the night.

The Senate is racing to pass “a stand alone in history—a reconciliation bill that drives up poverty and the number of people uninsured, while increasing deficits and debt.”

@centeronbudget.bsky.social

How many GOP Senators who will vote for it think this is a good idea?

www.cbpp.org/press/statem...

@centeronbudget.bsky.social

How many GOP Senators who will vote for it think this is a good idea?

www.cbpp.org/press/statem...

Senate Republicans Can Still Abandon Disastrous, Rushed Reconciliation Bill | Center on Budget and Policy Priorities

The Senate is barreling toward a vote on a still-not-finished bill that would take away health coverage and food assistance from millions of people who need it, raise families’ costs, and make a large...

www.cbpp.org

June 28, 2025 at 8:44 PM

While tax subsidies for space ports were added to the text in the middle of the night.

Some of the surprise costly new tax breaks popped up overnight in the new Senate text:

1) tax benefits for spaceports (who asked for this?)

2) tax credits for coal (including exports)

1) tax benefits for spaceports (who asked for this?)

2) tax credits for coal (including exports)

June 28, 2025 at 8:36 PM

Some of the surprise costly new tax breaks popped up overnight in the new Senate text:

1) tax benefits for spaceports (who asked for this?)

2) tax credits for coal (including exports)

1) tax benefits for spaceports (who asked for this?)

2) tax credits for coal (including exports)

THREAD:

The SALT “deal” in the latest Senate bill is a nonsensical approach to tax policy. It preserves (and lessens) a limit on deductions for wealthy taxpayers while ignoring a loophole that allows the wealthiest of those taxpayers to avoid the limit entirely.

The SALT “deal” in the latest Senate bill is a nonsensical approach to tax policy. It preserves (and lessens) a limit on deductions for wealthy taxpayers while ignoring a loophole that allows the wealthiest of those taxpayers to avoid the limit entirely.

FULL TEXT: Senate Republicans just released their 940-page reconciliation bill. www.budget.senate.gov/imo/media/do...

www.budget.senate.gov

June 28, 2025 at 3:02 PM

THREAD:

The SALT “deal” in the latest Senate bill is a nonsensical approach to tax policy. It preserves (and lessens) a limit on deductions for wealthy taxpayers while ignoring a loophole that allows the wealthiest of those taxpayers to avoid the limit entirely.

The SALT “deal” in the latest Senate bill is a nonsensical approach to tax policy. It preserves (and lessens) a limit on deductions for wealthy taxpayers while ignoring a loophole that allows the wealthiest of those taxpayers to avoid the limit entirely.

And the US tax system is *subsidizing* executives' personal use of company jets by not fully including that perk in their taxable income: taxlawcenter.org/tealbook/pol....

A new study found that the United States was responsible for 55 percent of the pollution emitted by private jets globally.

Private jets polluted more than all flights from Heathrow, study finds

A new study found that the United States was responsible for 55 percent of the pollution emitted by private jets globally.

www.washingtonpost.com

June 27, 2025 at 12:34 PM

And the US tax system is *subsidizing* executives' personal use of company jets by not fully including that perk in their taxable income: taxlawcenter.org/tealbook/pol....

Another day, more SALT discussion news, but as yet none of it about this potentially major $$$ sleeper issue:

THREAD:

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

June 25, 2025 at 12:22 PM

Another day, more SALT discussion news, but as yet none of it about this potentially major $$$ sleeper issue:

THREAD:

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

June 24, 2025 at 9:28 PM

THREAD:

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?