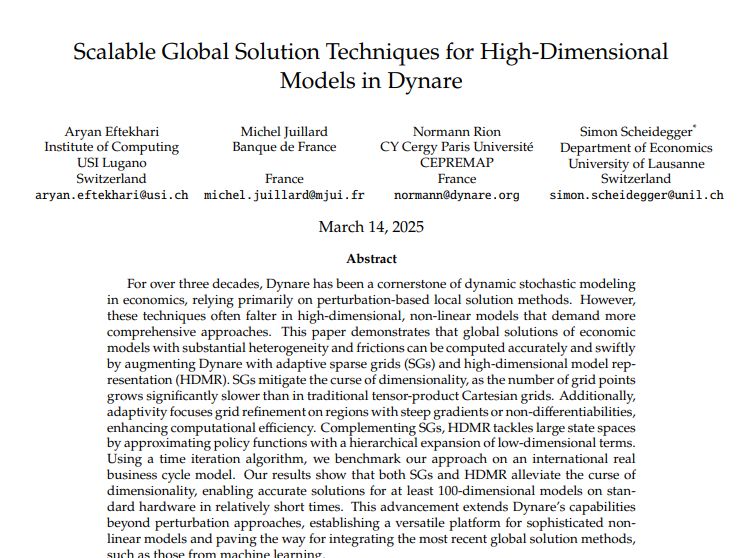

www.dynare.org/wp-repo/dyna...

github.com/NormannR/HDM...

www.youtube.com/watch?v=UrbH...

www.youtube.com/watch?v=UrbH...

My new research paper finds that under certain conditions, the answer is a surprising YES.

A thread on a monetary policy puzzle (1/10) #Economics #MonetaryPolicy #CentralBank

My new research paper finds that under certain conditions, the answer is a surprising YES.

A thread on a monetary policy puzzle (1/10) #Economics #MonetaryPolicy #CentralBank

I've read Karthik Sastry's excellent forthcoming AEJ many times but recently it dawned on me that one of his results seemed to contradict a well-established idea in this literature

whymacro.substack.com/p/fed-info-r...

I've read Karthik Sastry's excellent forthcoming AEJ many times but recently it dawned on me that one of his results seemed to contradict a well-established idea in this literature

whymacro.substack.com/p/fed-info-r...

Would you like to join? Sign up here 👇:

forms.office.com/e/hYhCPCZ2Lp

@tcdeconomics.bsky.social #EconBlueSky #EconSky

Would you like to join? Sign up here 👇:

forms.office.com/e/hYhCPCZ2Lp

@tcdeconomics.bsky.social #EconBlueSky #EconSky

My first substack uses these claims to assess the broader debate

whymacro.substack.com/p/the-fed-in...

My first substack uses these claims to assess the broader debate

whymacro.substack.com/p/the-fed-in...

www.federalreserve.gov/econres/feds... 1/3

www.federalreserve.gov/econres/feds... 1/3

Sign up: cepr-org.zoom.us/webinar/regi...

Monthly sessions explore central bank frameworks, policy design, and international dimensions.

More: cepr.org/events/event...

#EconSky

Sign up: cepr-org.zoom.us/webinar/regi...

What does monetary policy do?

Our best evidence comes from quality empirical monetary policy shocks (EMPS) using high-frequency and narrative methods.

… but what *are* these shocks?

What does monetary policy do?

Our best evidence comes from quality empirical monetary policy shocks (EMPS) using high-frequency and narrative methods.

… but what *are* these shocks?

Data: doi.org/10.7910/DVN/MQ…

Paper: cm1518.github.io/files/BMW.pdf

Data: doi.org/10.7910/DVN/MQ…

Paper: cm1518.github.io/files/BMW.pdf

Was the recent inflation surge due to a lack of coordination? Can lack of coordination lead to too much inflation?

Yes, we show. Especially in response to global supply shocks.

link to paper: economics.mit.edu/sites/defaul...

1/n🧵

Was the recent inflation surge due to a lack of coordination? Can lack of coordination lead to too much inflation?

Yes, we show. Especially in response to global supply shocks.

link to paper: economics.mit.edu/sites/defaul...

1/n🧵

📄 papers.ssrn.com/sol3/papers....

We propose a broadly applicable computationally efficient method for full-information estimation of nonlinear DSGE models. It avoids two key bottlenecks: global solutions and nonlinear filters.

📄 papers.ssrn.com/sol3/papers....

We propose a broadly applicable computationally efficient method for full-information estimation of nonlinear DSGE models. It avoids two key bottlenecks: global solutions and nonlinear filters.

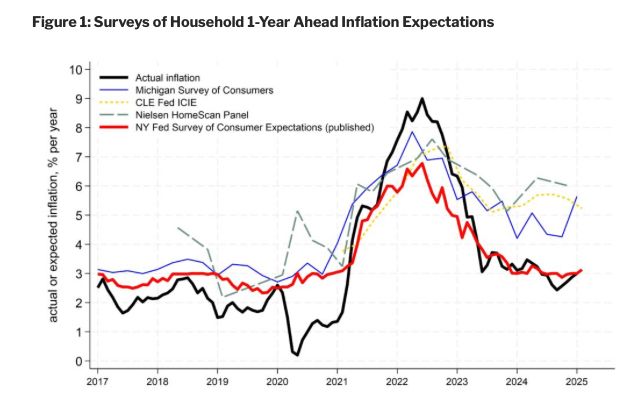

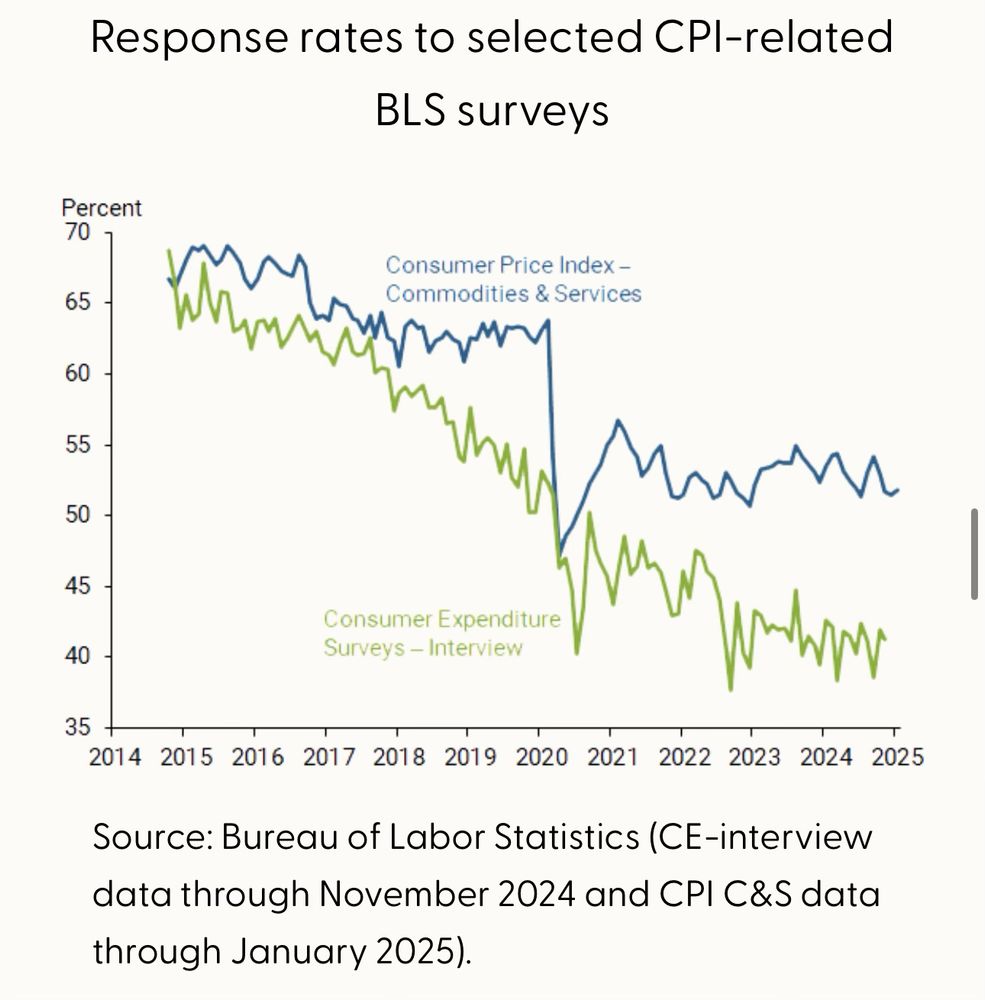

Two often used household surveys disagree:

- the Michigan MSC says inflation expectations are up

- the NY Fed SCE says they're not...

Which one is it?

New blog by Oli Coibion and @ygorodnichenko.bsky.social says: MSC is right!

Find out why ⬇️

Two often used household surveys disagree:

- the Michigan MSC says inflation expectations are up

- the NY Fed SCE says they're not...

Which one is it?

New blog by Oli Coibion and @ygorodnichenko.bsky.social says: MSC is right!

Find out why ⬇️

I'm specifically interested in the concept that firms may only re-optimize (e.g. pricing) infrequently, once they get hit by a shock. Whether because of inertia or adjustment costs.

I'm specifically interested in the concept that firms may only re-optimize (e.g. pricing) infrequently, once they get hit by a shock. Whether because of inertia or adjustment costs.

The excessive focus on linearized solutions to HA models is a bit like the old joke about the drunk who is looking for a key under a lamppost because that's where the light is.

More discussion of why we need non-linear models and ways forward here benjaminmoll.com/challenge/

The excessive focus on linearized solutions to HA models is a bit like the old joke about the drunk who is looking for a key under a lamppost because that's where the light is.

More discussion of why we need non-linear models and ways forward here benjaminmoll.com/challenge/