https://sites.utexas.edu/macro/

@ygorodnichenko.bsky.social and I are starting a new conference on Expectations and Behavior, with a special focus on giving junior researchers the opportunity to interact with more senior researchers in the field.

@ygorodnichenko.bsky.social and I are starting a new conference on Expectations and Behavior, with a special focus on giving junior researchers the opportunity to interact with more senior researchers in the field.

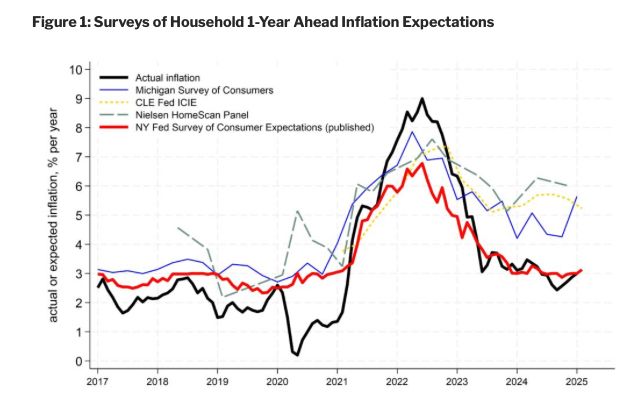

A difficult situation for the Fed. Cut interest rates now → risk of rising inflation ⬆️

More here: "Inflation, Expectations and Monetary Policy: What Have We Learned and to What End?" with Oli Coibion @empctmacrotx.bsky.social, shorturl.at/2fmOD

#EconSky

A difficult situation for the Fed. Cut interest rates now → risk of rising inflation ⬆️

More here: "Inflation, Expectations and Monetary Policy: What Have We Learned and to What End?" with Oli Coibion @empctmacrotx.bsky.social, shorturl.at/2fmOD

#EconSky

That is what Olivier Coibion and Yuriy Gorodnichenko explore in our most recent blog post "When Foreign Wars Abroad Hit Wallets at Home".

That is what Olivier Coibion and Yuriy Gorodnichenko explore in our most recent blog post "When Foreign Wars Abroad Hit Wallets at Home".

The Dynamics of Technology Transfer: Multinational Investment in China and Rising Global Competition

by @jaedochoi.bsky.social, George Cui, Younghun Shim & Yongseok Shin.

Link to the paper as well as other working papers of our center: sites.utexas.edu/macro/resear...

The Dynamics of Technology Transfer: Multinational Investment in China and Rising Global Competition

by @jaedochoi.bsky.social, George Cui, Younghun Shim & Yongseok Shin.

Link to the paper as well as other working papers of our center: sites.utexas.edu/macro/resear...

The Inflation Attention Threshold and Inflation Surges by

@pfaeutiecon.bsky.social

.

Link to the paper as well as other working papers of our center:

sites.utexas.edu/macro/resear...

The Inflation Attention Threshold and Inflation Surges by

@pfaeutiecon.bsky.social

.

Link to the paper as well as other working papers of our center:

sites.utexas.edu/macro/resear...

New blog post by Chris Boehm and @kronerniklas.bsky.social (UT graduate @utaustinecon.bsky.social 🤟) based on paper recently published in @reveconstudies.bsky.social.

Short summary below ⬇️

New blog post by Chris Boehm and @kronerniklas.bsky.social (UT graduate @utaustinecon.bsky.social 🤟) based on paper recently published in @reveconstudies.bsky.social.

Short summary below ⬇️

New blog post by Oli Coibion, @erwan-gautier.bsky.social and Frédérique Savignac.

Short summary follows ⬇️

New blog post by Oli Coibion, @erwan-gautier.bsky.social and Frédérique Savignac.

Short summary follows ⬇️

New paper by Oli Coibion and @ygorodnichenko.bsky.social sheds new light on the recent inflation period and looks ahead.

New paper by Oli Coibion and @ygorodnichenko.bsky.social sheds new light on the recent inflation period and looks ahead.

Check out the new EMPCT working paper by @erwan-gautier.bsky.social, Savignac & Coibion: sites.utexas.edu/macro/resear...

Check out the new EMPCT working paper by @erwan-gautier.bsky.social, Savignac & Coibion: sites.utexas.edu/macro/resear...

econbrowser.com/archives/202...

The pandemic "inflation surge experience has further unanchored [household & firm] expectations"

sites.utexas.edu/macro/2025/0...

The pandemic "inflation surge experience has further unanchored [household & firm] expectations"

sites.utexas.edu/macro/2025/0...

Good to know, that the two Oli's at @utaustinecon.bsky.social agree 😅

Good to know, that the two Oli's at @utaustinecon.bsky.social agree 😅

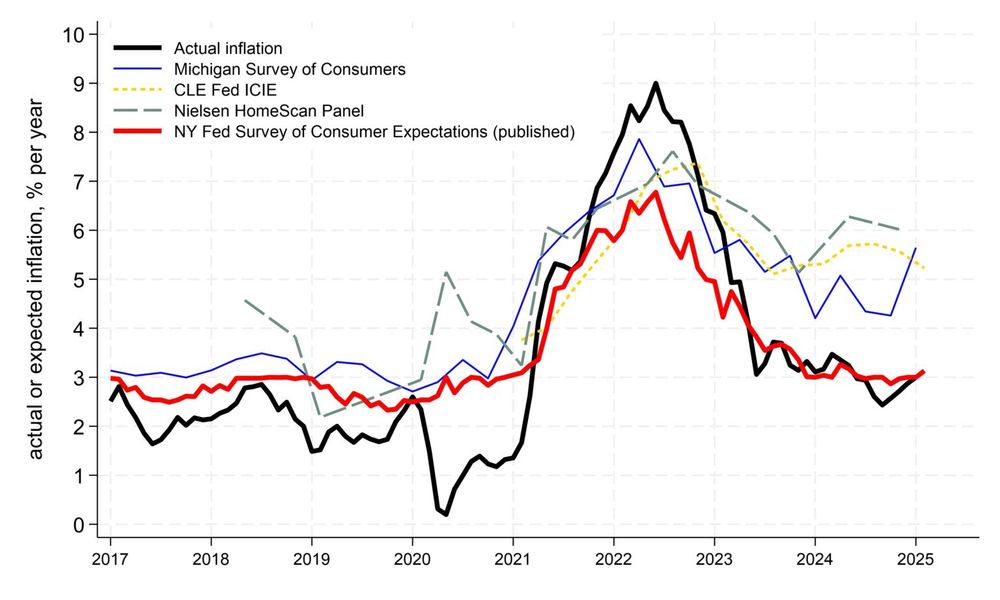

Two often used household surveys disagree:

- the Michigan MSC says inflation expectations are up

- the NY Fed SCE says they're not...

Which one is it?

New blog by Oli Coibion and @ygorodnichenko.bsky.social says: MSC is right!

Find out why ⬇️

Two often used household surveys disagree:

- the Michigan MSC says inflation expectations are up

- the NY Fed SCE says they're not...

Which one is it?

New blog by Oli Coibion and @ygorodnichenko.bsky.social says: MSC is right!

Find out why ⬇️

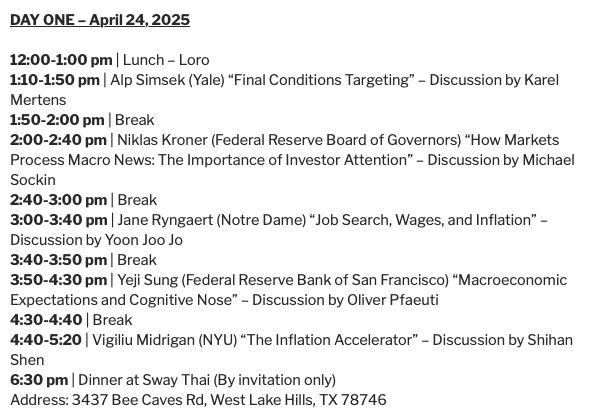

We have a great line-up of speakers & discussants (program below)

including @alpsimsek.bsky.social, @kronerniklas.bsky.social, @pfaeutiecon.bsky.social, @mathpedemonte.bsky.social, @hugolhuillier.com, @elpuntoderocio.bsky.social

(+ some not on here)

We have a great line-up of speakers & discussants (program below)

including @alpsimsek.bsky.social, @kronerniklas.bsky.social, @pfaeutiecon.bsky.social, @mathpedemonte.bsky.social, @hugolhuillier.com, @elpuntoderocio.bsky.social

(+ some not on here)

We have a great line-up of speakers & discussants (program below)

including @alpsimsek.bsky.social, @kronerniklas.bsky.social, @pfaeutiecon.bsky.social, @mathpedemonte.bsky.social, @hugolhuillier.com, @elpuntoderocio.bsky.social

(+ some not on here)

We have a great line-up of speakers & discussants (program below)

including @alpsimsek.bsky.social, @kronerniklas.bsky.social, @pfaeutiecon.bsky.social, @mathpedemonte.bsky.social, @hugolhuillier.com, @elpuntoderocio.bsky.social

(+ some not on here)

We have a great line-up of speakers & discussants (program below)

including @alpsimsek.bsky.social, @kronerniklas.bsky.social, @pfaeutiecon.bsky.social, @mathpedemonte.bsky.social, @hugolhuillier.com, @elpuntoderocio.bsky.social

(+ some not on here)

How have recent developments like the US-China trade war, Brexit, or the breakdown of economic ties between the West & Russia affected trade?

New blog post by @nityanayar.bsky.social & co-authors looks into these questions ⬇️

How have recent developments like the US-China trade war, Brexit, or the breakdown of economic ties between the West & Russia affected trade?

New blog post by @nityanayar.bsky.social & co-authors looks into these questions ⬇️

www.restud.com/the-us-econo...

𝐀𝐭𝐭𝐞𝐧𝐭𝐢𝐨𝐧 𝐭𝐨 𝐭𝐡𝐞 𝐌𝐚𝐜𝐫𝐨𝐞𝐜𝐨𝐧𝐨𝐦𝐲

with Sebastian Link, @apeichl.bsky.social, Chris Roth and @johanneswohlfart.bsky.social

Short thread below ⬇️

@empctmacrotx.bsky.social @utaustinecon.bsky.social