If gamblers underestimate minority trainers (or just don’t 𝘭𝘪𝘬𝘦 them), their horses may generate higher risk-adjusted returns!

Download WP lukeste.in/horsebetting

1/7

That’s unheard of. With tax day around the corner, fair to be worried about this filing season – and what’s to come with respect to our ability to collect taxes and raise revenue

That’s unheard of. With tax day around the corner, fair to be worried about this filing season – and what’s to come with respect to our ability to collect taxes and raise revenue

The IRS is entering into an agmt to share data about undocumented immigrants with ICE. Historically, the agency promised data would not be used in this way.

We estimate the govt will lose ~$300B in the next decade as a result.

The IRS is entering into an agmt to share data about undocumented immigrants with ICE. Historically, the agency promised data would not be used in this way.

We estimate the govt will lose ~$300B in the next decade as a result.

www.reddit.com/r/dataisbeau...

www.reddit.com/r/dataisbeau...

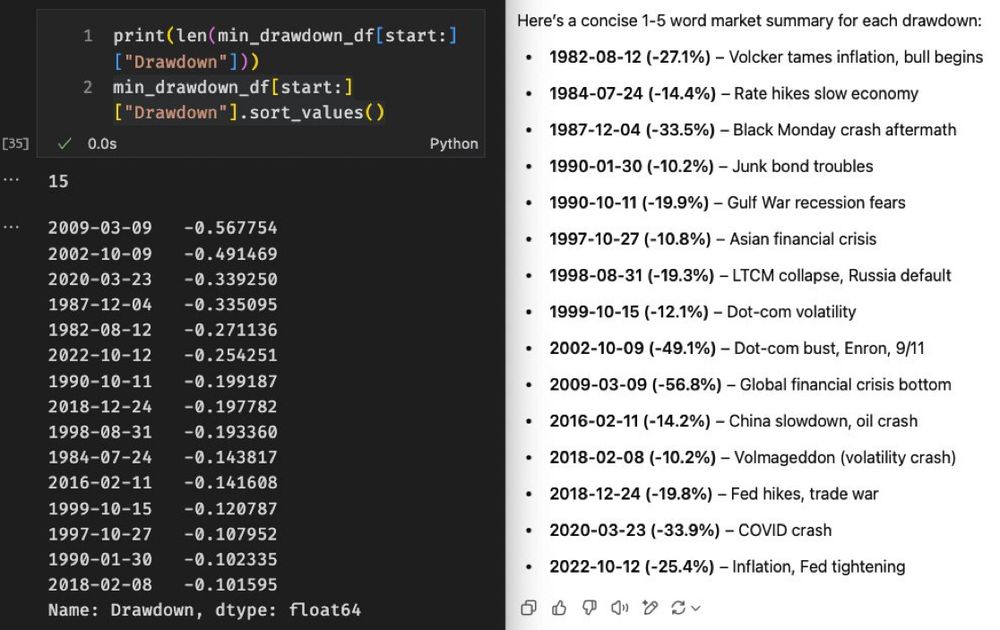

- 6 hit a new high before dropping 15%

- Another 6 fell >25%

- Only 3 turned around at 15–25% (all close to 20%)

- 6 hit a new high before dropping 15%

- Another 6 fell >25%

- Only 3 turned around at 15–25% (all close to 20%)

Everyone at our company is a stupid dumbass moron and think people don't wanna order hotcakes and sausages at 1 P.M when it's been shown with extensive market research and customer reviews they DO want that.

We used to offer it but removed it. Sorry, I hate our hashbrowns too.

Everyone at our company is a stupid dumbass moron and think people don't wanna order hotcakes and sausages at 1 P.M when it's been shown with extensive market research and customer reviews they DO want that.

We used to offer it but removed it. Sorry, I hate our hashbrowns too.

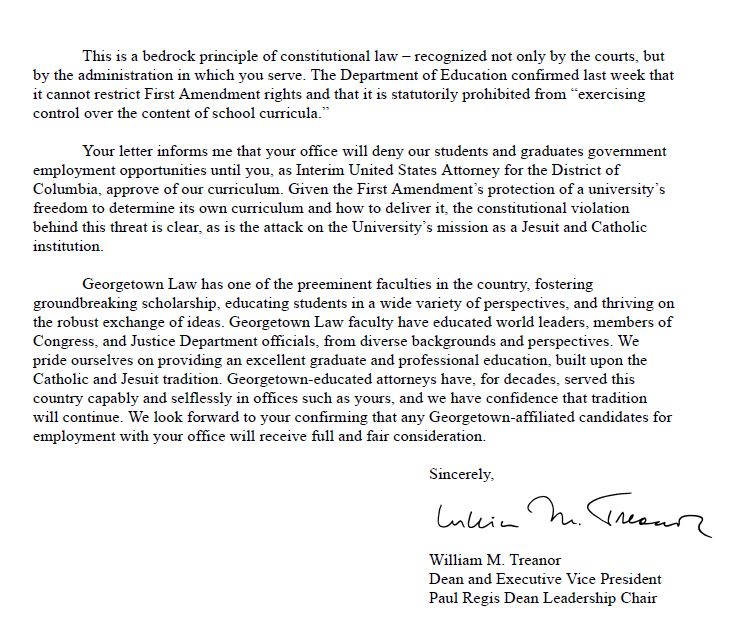

You are beta=1 with decent alpha that puts you reliably in the top 40% of performers at your firm.

You also have a reliable prediction: "70% chance market goes down next 3 months."

There is also more career risk in losing money when markets are going up than losing money when markets go down, which creates additional long bias above just what you expect from E[returns] > 0.

You are beta=1 with decent alpha that puts you reliably in the top 40% of performers at your firm.

You also have a reliable prediction: "70% chance market goes down next 3 months."