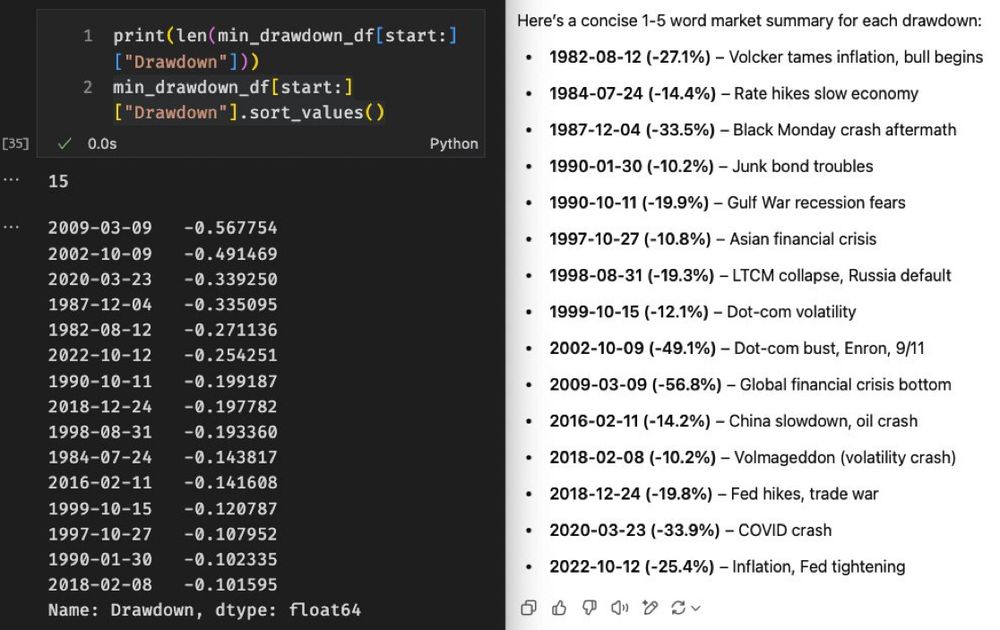

- 20% turn around the next day

- 40% turn around two weeks – two months

- 27% five months – one year

- 13% more than a year

- 20% turn around the next day

- 40% turn around two weeks – two months

- 27% five months – one year

- 13% more than a year

- 6 hit a new high before dropping 15%

- Another 6 fell >25%

- Only 3 turned around at 15–25% (all close to 20%)

- 6 hit a new high before dropping 15%

- Another 6 fell >25%

- Only 3 turned around at 15–25% (all close to 20%)

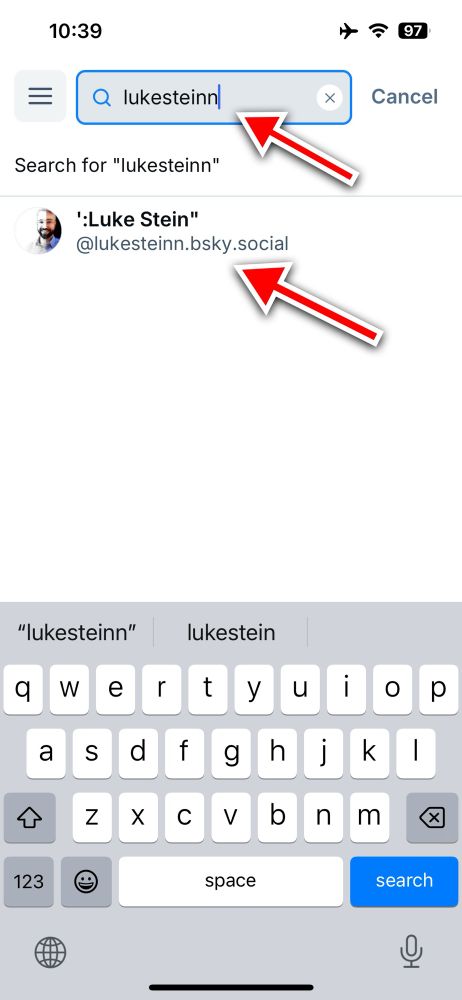

On mobile, it’s

- Search for account

- Click the “three dots” menu and “report account”

- Check “misleading account” and finish the report

On mobile, it’s

- Search for account

- Click the “three dots” menu and “report account”

- Check “misleading account” and finish the report

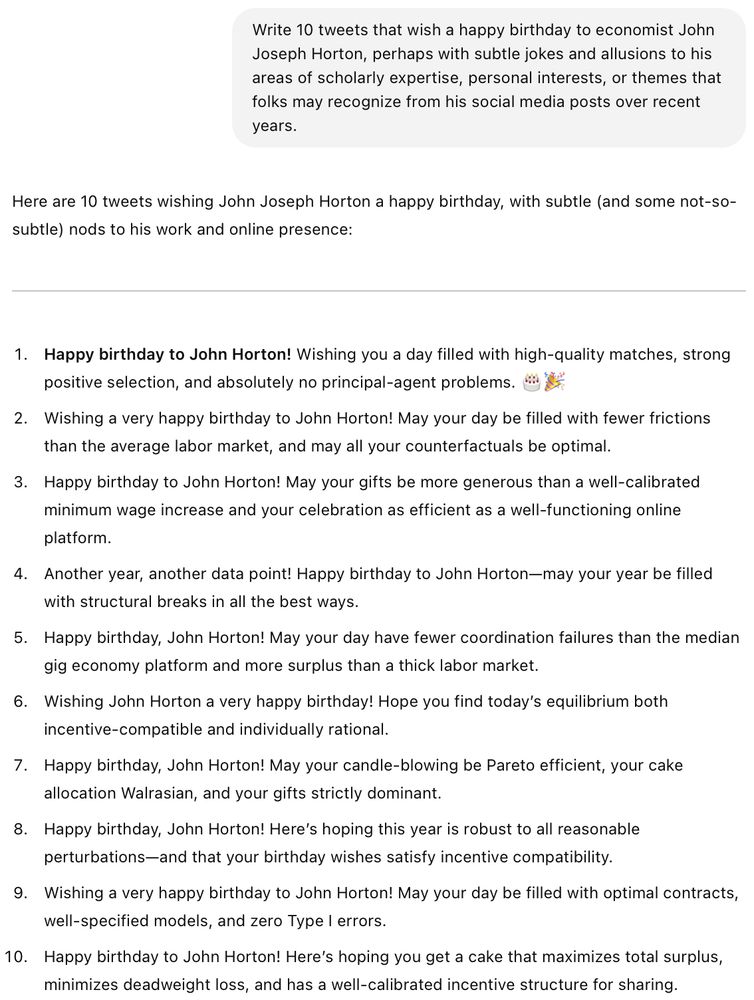

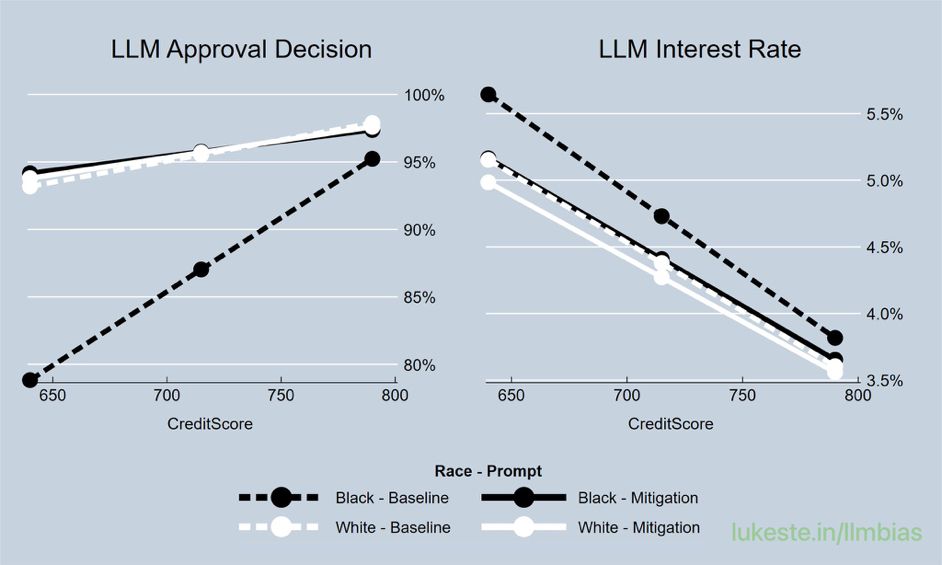

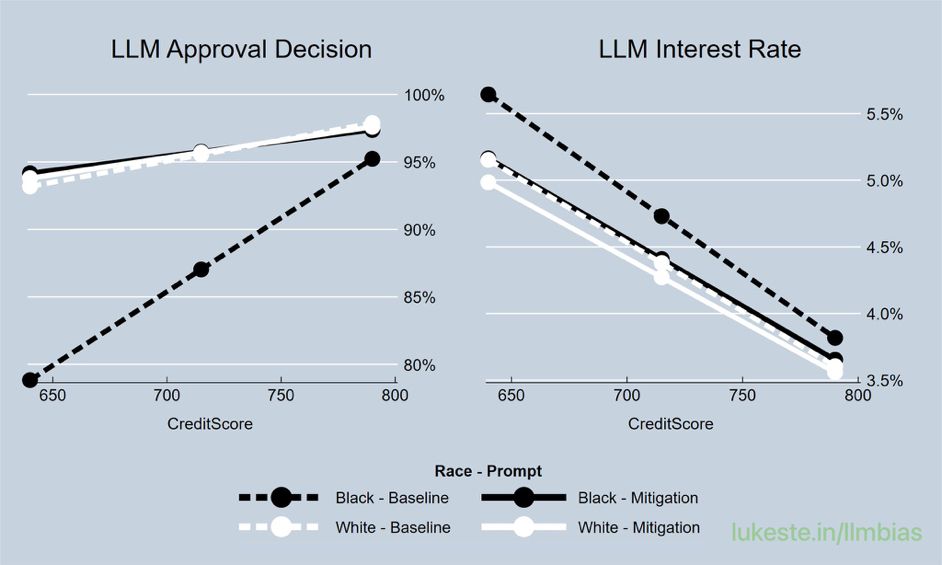

• Eliminates approval recommendation gap (on average and across different credit scores)

• Reduces average racial interest rate gap by about 60% (from 35bp to 14), with even larger effects for lower-credit-score Black applicants

8/

• Eliminates approval recommendation gap (on average and across different credit scores)

• Reduces average racial interest rate gap by about 60% (from 35bp to 14), with even larger effects for lower-credit-score Black applicants

8/

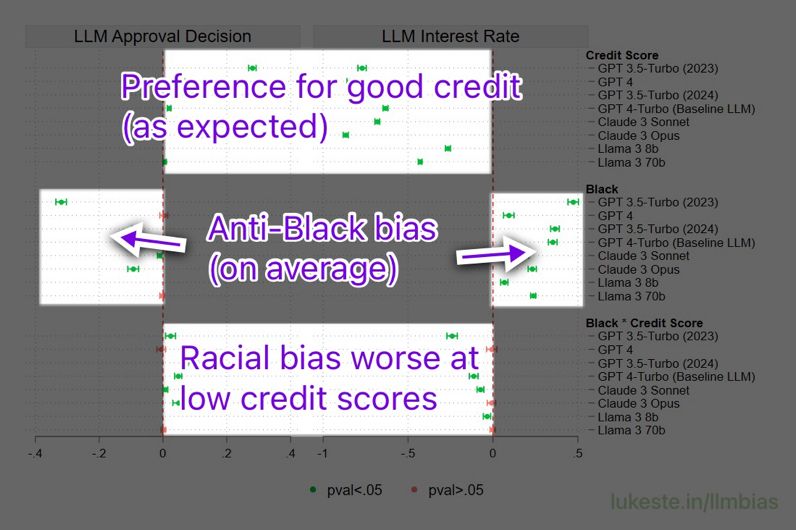

Black borrowers with low credit scores suffer the most

6/

Black borrowers with low credit scores suffer the most

6/

They would, on average, need credit scores ~120 points higher than white applicants to receive the same approval rate; ~30 higher to get same interest rate

4/

They would, on average, need credit scores ~120 points higher than white applicants to receive the same approval rate; ~30 higher to get same interest rate

4/

• Claims it’s unbiased…

• …but it 𝗶𝘀 biased against Black applicants. Particularly at low credit scores. (We also have this for other risk measures.)

• We can partly close the racial gap just by asking for unbiased responses.

3/

• Claims it’s unbiased…

• …but it 𝗶𝘀 biased against Black applicants. Particularly at low credit scores. (We also have this for other risk measures.)

• We can partly close the racial gap just by asking for unbiased responses.

3/

Especially at low credit scores/riskier loans

Simple prompt engineering can help mitigate gaps

Especially at low credit scores/riskier loans

Simple prompt engineering can help mitigate gaps