Luca Fornaro

@lucafornaro.bsky.social

Pinned

Luca Fornaro

@lucafornaro.bsky.social

· Apr 21

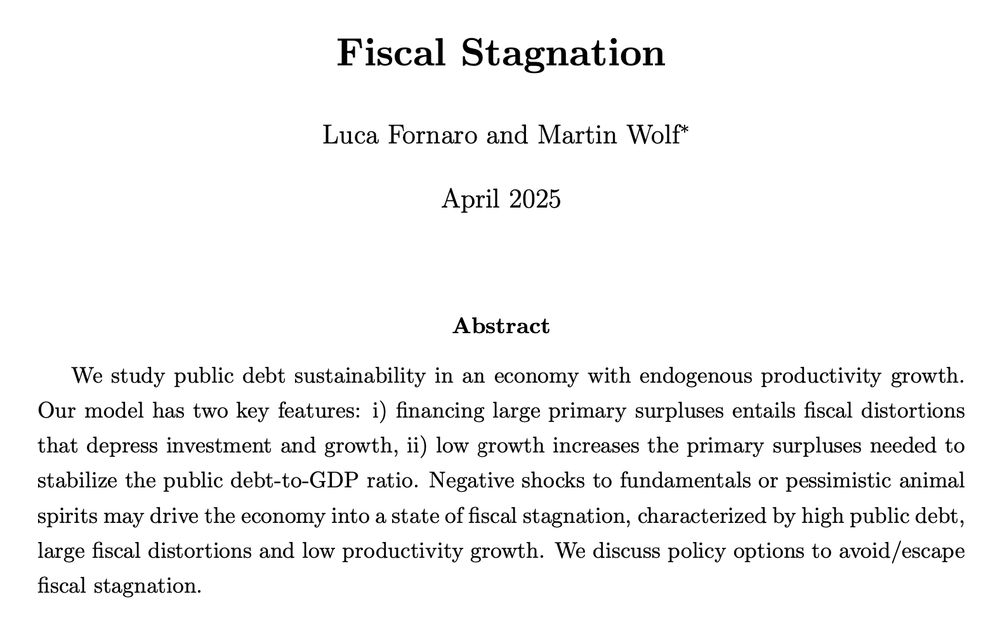

New paper with Martin Wolf on Fiscal Stagnation.

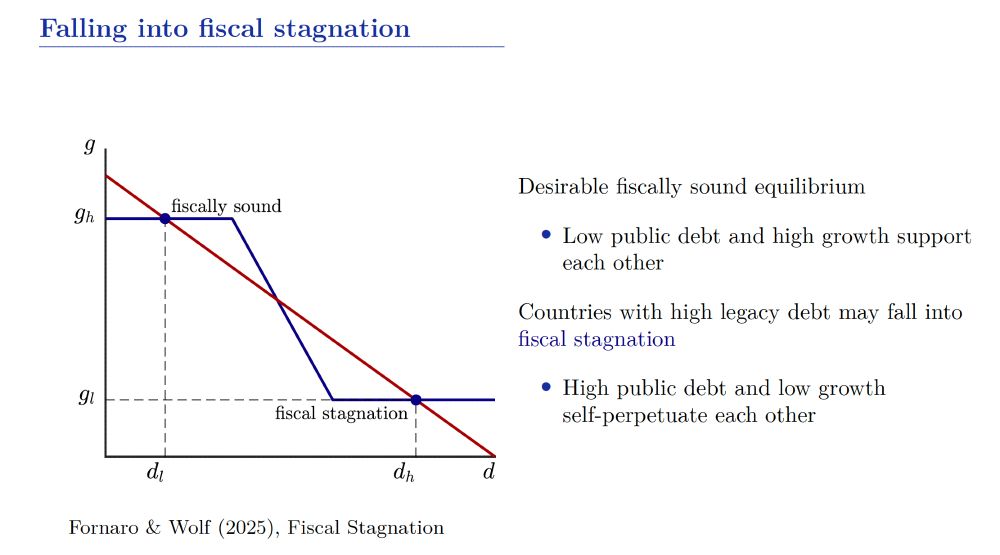

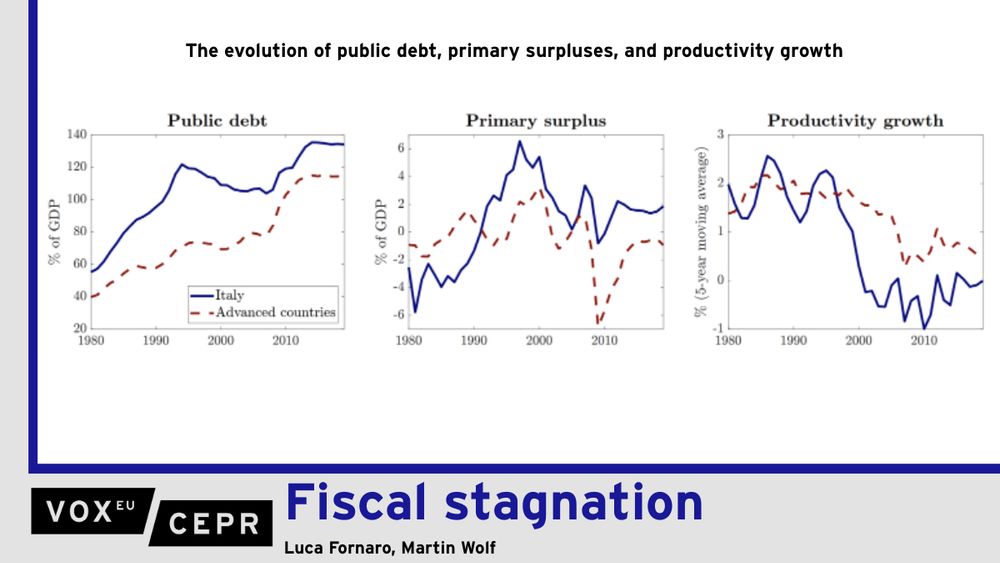

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

Are public debts in the European Union sustainable? This recent article is a great introduction to this topic, I learned a lot by reading it.

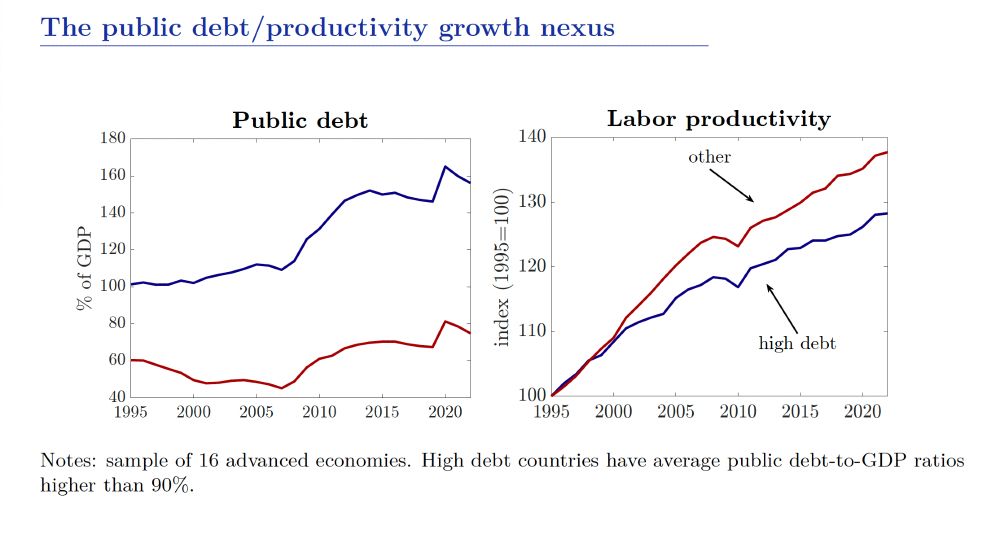

One thing that struck me is that debt sustainability analyses typically abstract from the impact of fiscal policy on productivity growth.

One thing that struck me is that debt sustainability analyses typically abstract from the impact of fiscal policy on productivity growth.

November 11, 2025 at 2:38 PM

Are public debts in the European Union sustainable? This recent article is a great introduction to this topic, I learned a lot by reading it.

One thing that struck me is that debt sustainability analyses typically abstract from the impact of fiscal policy on productivity growth.

One thing that struck me is that debt sustainability analyses typically abstract from the impact of fiscal policy on productivity growth.

How will tariffs affect innovation in the US and abroad? Shall the EU use tariffs to protect its high-tech industries? Should the rise in Chinese exports of high-tech goods worry the rest of the world?

We tackle these issues in a new paper on Tariffs and Technological Hegemony.

We tackle these issues in a new paper on Tariffs and Technological Hegemony.

October 30, 2025 at 10:40 AM

How will tariffs affect innovation in the US and abroad? Shall the EU use tariffs to protect its high-tech industries? Should the rise in Chinese exports of high-tech goods worry the rest of the world?

We tackle these issues in a new paper on Tariffs and Technological Hegemony.

We tackle these issues in a new paper on Tariffs and Technological Hegemony.

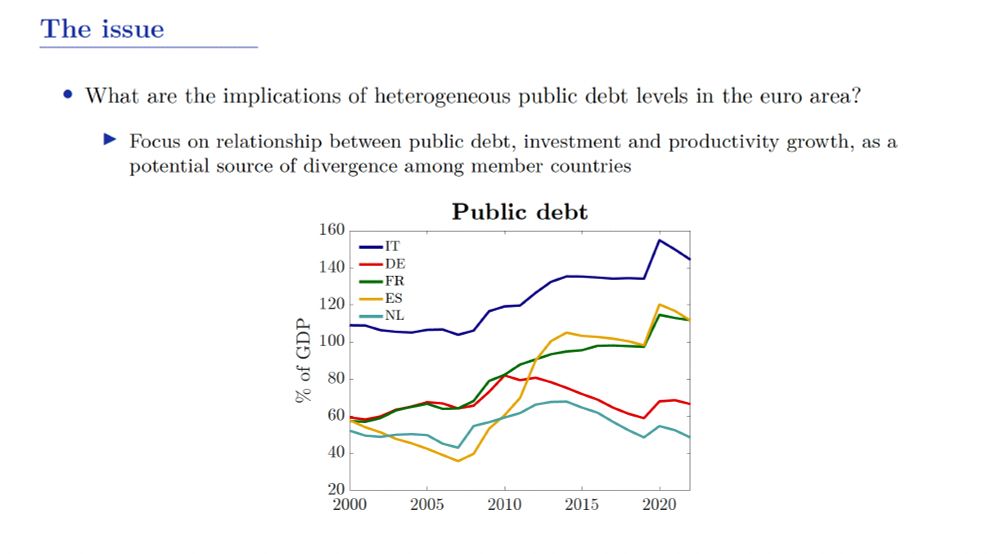

Some thoughts on the interactions between public debt, public investments and productivity growth in the euro area. Key risk is that the union ends up being split between a fiscally sound/high growth block and a fiscally stagnant one.

www.ecb.europa.eu/pub/pdf/sint...

www.ecb.europa.eu/pub/pdf/sint...

September 23, 2025 at 8:45 AM

Some thoughts on the interactions between public debt, public investments and productivity growth in the euro area. Key risk is that the union ends up being split between a fiscally sound/high growth block and a fiscally stagnant one.

www.ecb.europa.eu/pub/pdf/sint...

www.ecb.europa.eu/pub/pdf/sint...

Is the EU heading towards a financial resource curse? Cheap imports (and capital flows) from China could crowd out economic activity in tradable industries in the EU, causing a productivity growth slowdown. crei.cat/wp-content/u...

July 31, 2025 at 4:35 AM

Is the EU heading towards a financial resource curse? Cheap imports (and capital flows) from China could crowd out economic activity in tradable industries in the EU, causing a productivity growth slowdown. crei.cat/wp-content/u...

Deeply honored to have participated in a panel at the

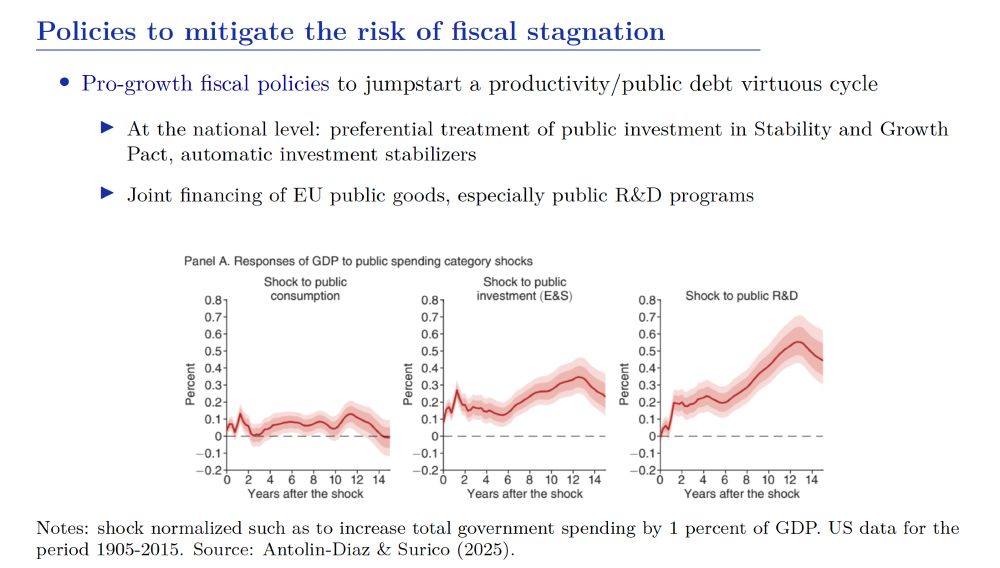

@ecb.europa.eu Forum in Sintra. My remarks focused on the risk that high legacy debt may push part of the euro area into fiscal stagnation, and how a pro-growth approach to fiscal policy can mitigate this risk.

@ecb.europa.eu Forum in Sintra. My remarks focused on the risk that high legacy debt may push part of the euro area into fiscal stagnation, and how a pro-growth approach to fiscal policy can mitigate this risk.

July 3, 2025 at 10:52 AM

Deeply honored to have participated in a panel at the

@ecb.europa.eu Forum in Sintra. My remarks focused on the risk that high legacy debt may push part of the euro area into fiscal stagnation, and how a pro-growth approach to fiscal policy can mitigate this risk.

@ecb.europa.eu Forum in Sintra. My remarks focused on the risk that high legacy debt may push part of the euro area into fiscal stagnation, and how a pro-growth approach to fiscal policy can mitigate this risk.

Reposted by Luca Fornaro

This Macro-Musings episode 🔈

podcasts.apple.com/it/podcast/m...

featuring @lucafornaro.bsky.social provides extremely insightful and clear views on macroeconomic policies to counter hysteresis and stagnation 📈

podcasts.apple.com/it/podcast/m...

featuring @lucafornaro.bsky.social provides extremely insightful and clear views on macroeconomic policies to counter hysteresis and stagnation 📈

Luca Fornaro on Hysteresis, Endogenous Growth, and Aggregate Demand Policies

Puntata podcast · Macro Musings with David Beckworth · 19/05/2025 · 1 h

podcasts.apple.com

July 2, 2025 at 6:59 AM

This Macro-Musings episode 🔈

podcasts.apple.com/it/podcast/m...

featuring @lucafornaro.bsky.social provides extremely insightful and clear views on macroeconomic policies to counter hysteresis and stagnation 📈

podcasts.apple.com/it/podcast/m...

featuring @lucafornaro.bsky.social provides extremely insightful and clear views on macroeconomic policies to counter hysteresis and stagnation 📈

Reposted by Luca Fornaro

Enjoyed very much this podcast with MacroMusings and @lucafornaro.bsky.social about endogenous growth and aggregate demand policies.

youtu.be/B7aRTPgepok?...

youtu.be/B7aRTPgepok?...

Luca Fornaro on Hysteresis, Endogenous Growth, and Aggregate Demand Policies

YouTube video by Mercatus Center

youtu.be

June 26, 2025 at 10:25 PM

Enjoyed very much this podcast with MacroMusings and @lucafornaro.bsky.social about endogenous growth and aggregate demand policies.

youtu.be/B7aRTPgepok?...

youtu.be/B7aRTPgepok?...

Reposted by Luca Fornaro

What do powerlifting and economic hysteresis have in common? My latest newsletter explores this connection, building on @petercontibrown.bsky.social Conti-Brown's powerlifting journey and @lucafornaro.bsky.social's hysteresis research. macroeconomicpolicynexus.substack.com/p/let-it-fai...

Powerlifting through Hysteresis

On strength lost, strength regained, and the scars that shape an economy.

macroeconomicpolicynexus.substack.com

June 10, 2025 at 7:08 PM

What do powerlifting and economic hysteresis have in common? My latest newsletter explores this connection, building on @petercontibrown.bsky.social Conti-Brown's powerlifting journey and @lucafornaro.bsky.social's hysteresis research. macroeconomicpolicynexus.substack.com/p/let-it-fai...

Reposted by Luca Fornaro

New column by @lucafornaro.bsky.social and Martin Wolf cepr.org/voxeu/column...

Fiscal stagnation

Public debt-to-GDP ratios have climbed to historic highs in most advanced economies. This column studies the connection between productivity growth, fiscal policy, and public debt. Using a theoretical model, it argues that a feedback loop is possible between fiscal policy and growth. Large primary surpluses are associated with fiscal distortions which depress investment and productivity growth, and lead to further pressure on public debt-to-GDP ratios. A fall into fiscal stagnation can result from hysteresis effects or pessimistic animal spirits. Meanwhile, exiting fiscal stagnation requires large policy interventions that reduce the public debt-to-GDP ratio, such as credible pro-growth strategies.

cepr.org

June 2, 2025 at 7:22 AM

New column by @lucafornaro.bsky.social and Martin Wolf cepr.org/voxeu/column...

Reposted by Luca Fornaro

@lucafornaro.bsky.social & Martin Wolf argue that a feedback loop is possible between fiscal policy and #growth. Exiting fiscal stagnation requires large policy interventions that reduce public debt-to-GDP ratio, such as credible pro-growth strategies.

cepr.org/voxeu/column...

#EconSky

cepr.org/voxeu/column...

#EconSky

June 2, 2025 at 8:33 AM

@lucafornaro.bsky.social & Martin Wolf argue that a feedback loop is possible between fiscal policy and #growth. Exiting fiscal stagnation requires large policy interventions that reduce public debt-to-GDP ratio, such as credible pro-growth strategies.

cepr.org/voxeu/column...

#EconSky

cepr.org/voxeu/column...

#EconSky

New paper with Martin Wolf on Fiscal Stagnation.

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

April 21, 2025 at 4:48 AM

New paper with Martin Wolf on Fiscal Stagnation.

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

Key insights: 1) High public debt may push the economy into fiscal stagnation, a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

Reposted by Luca Fornaro

I like that Brunnermeier and Merkel at least nod (without citation for some reason) at @gianlucabenigno.bsky.social and @lucafornaro.bsky.social ‘s work on the Financial Resource Curse (e.g crei.cat/wp-content/u...) 3/n

crei.cat

April 19, 2025 at 10:43 AM

I like that Brunnermeier and Merkel at least nod (without citation for some reason) at @gianlucabenigno.bsky.social and @lucafornaro.bsky.social ‘s work on the Financial Resource Curse (e.g crei.cat/wp-content/u...) 3/n

Reposted by Luca Fornaro

In an AER paper w Martin Wolf (of U.St.Gallen) @gianlucabenigno.bsky.social and @lucafornaro.bsky.social show that the Financial Resource Curse has even larger negative implications when flows go to the world technological leader, I.e. the US (ungated here: www.newyorkfed.org/research/sta...) 3/n

The Global Financial Resource Curse - FEDERAL RESERVE BANK of NEW YORK

www.newyorkfed.org

April 19, 2025 at 10:49 AM

In an AER paper w Martin Wolf (of U.St.Gallen) @gianlucabenigno.bsky.social and @lucafornaro.bsky.social show that the Financial Resource Curse has even larger negative implications when flows go to the world technological leader, I.e. the US (ungated here: www.newyorkfed.org/research/sta...) 3/n

Reposted by Luca Fornaro

Too many recent takes on this issue ignore the downsides of Treasuries’ global safe haven status. 2/n

April 19, 2025 at 10:38 AM

Too many recent takes on this issue ignore the downsides of Treasuries’ global safe haven status. 2/n

Reposted by Luca Fornaro

Finally, in my own paper with @gianlucabenigno.bsky.social and @lucafornaro.bsky.social, we show that the Financial Resource Curse is not merely a theoretical possibility by presenting careful empirical evidence that it is a general phenomenon www.sciencedirect.com/science/arti... 4/n

Large capital inflows, sectoral allocation, and economic performance

This paper describes the stylized facts characterizing periods of exceptionally large capital inflows in a sample of 70 middle- and high-income countr…

www.sciencedirect.com

April 19, 2025 at 1:53 PM

Finally, in my own paper with @gianlucabenigno.bsky.social and @lucafornaro.bsky.social, we show that the Financial Resource Curse is not merely a theoretical possibility by presenting careful empirical evidence that it is a general phenomenon www.sciencedirect.com/science/arti... 4/n

Reposted by Luca Fornaro

Very clear and comprehensive piece by Brunnermeier and Merkel on the pros and cons (for the US) of US Treasuries being a global safe asset. 1/n

Preserving the global safe asset status of US Treasuries and the US dollar is in everyone's interest @piie.com

www.piie.com/blogs/realti...

www.piie.com/blogs/realti...

Preserving the global safe asset status of US Treasuries and the US dollar is in everyone's interest

Some observers blame the strength of the dollar, due to its role as global reserve currency, for the decline of manufacturing jobs in the US. In this blog post, we outline the arguments for and agains...

www.piie.com

April 19, 2025 at 10:35 AM

Very clear and comprehensive piece by Brunnermeier and Merkel on the pros and cons (for the US) of US Treasuries being a global safe asset. 1/n

Reposted by Luca Fornaro

This is very cool

Olivier Blanchard argues that we should understand better the macroeconomics of the medium run, and I could not agree more. Since I have been working on this for a while, let me show you why this is a promising field for young researchers!

April 6, 2025 at 6:42 PM

This is very cool

Olivier Blanchard argues that we should understand better the macroeconomics of the medium run, and I could not agree more. Since I have been working on this for a while, let me show you why this is a promising field for young researchers!

April 6, 2025 at 4:57 PM

Olivier Blanchard argues that we should understand better the macroeconomics of the medium run, and I could not agree more. Since I have been working on this for a while, let me show you why this is a promising field for young researchers!

Reposted by Luca Fornaro

@lucafornaro.bsky.social argues that political constraint is a reflection of financial constraint, @michaelpettis.bsky.social that political constraint is a function of choices made by other political actors. It is not that international capital flows always restrict the domestic policy space...

Very interesting thoughts, as usual, from @michaelpettis.bsky.social. But is it true that openness to international capital flows always restrict the domestic policy space? Capital inflows typically reduce the government's borrowing cost, which should increase the policy space.

1/20

The views of Maurice Obstfeld (and other American economists) on the relationship between the internal and external accounts of the US are finally starting to evolve.

www.brookings.edu/wp-content/u...

The views of Maurice Obstfeld (and other American economists) on the relationship between the internal and external accounts of the US are finally starting to evolve.

www.brookings.edu/wp-content/u...

March 31, 2025 at 9:36 PM

@lucafornaro.bsky.social argues that political constraint is a reflection of financial constraint, @michaelpettis.bsky.social that political constraint is a function of choices made by other political actors. It is not that international capital flows always restrict the domestic policy space...

Very interesting thoughts, as usual, from @michaelpettis.bsky.social. But is it true that openness to international capital flows always restrict the domestic policy space? Capital inflows typically reduce the government's borrowing cost, which should increase the policy space.

1/20

The views of Maurice Obstfeld (and other American economists) on the relationship between the internal and external accounts of the US are finally starting to evolve.

www.brookings.edu/wp-content/u...

The views of Maurice Obstfeld (and other American economists) on the relationship between the internal and external accounts of the US are finally starting to evolve.

www.brookings.edu/wp-content/u...

www.brookings.edu

March 28, 2025 at 7:07 AM

Very interesting thoughts, as usual, from @michaelpettis.bsky.social. But is it true that openness to international capital flows always restrict the domestic policy space? Capital inflows typically reduce the government's borrowing cost, which should increase the policy space.

Reposted by Luca Fornaro

All of this points to downside growth risks. It's not necessarily a recession I'm worried about (although I am). Lower growth expectations reduces the incentive to invest in productivity-improving technology (see Benigno and Fornaro's work on Keynesian growth models)

bsky.app/profile/pear...

bsky.app/profile/pear...

Agree with this. There’s a lot of downside to the 2023-2024 growth pace. Mechanically via lower immigration is a big part of it. But expectations can only carry that downside so far, so it’s talking about slow growth rather than a recession barring accelerating macro shocks from here.

“Multiple compression in large cap US/tech stocks, stagnant real incomes due to the impact of tariffs, a gradual rise in unemployment, and a worsening 2026 capex outlook” feels like the bad-but-not-black-swan 2025 economic/market scenario.

March 17, 2025 at 6:19 PM

All of this points to downside growth risks. It's not necessarily a recession I'm worried about (although I am). Lower growth expectations reduces the incentive to invest in productivity-improving technology (see Benigno and Fornaro's work on Keynesian growth models)

bsky.app/profile/pear...

bsky.app/profile/pear...

Reposted by Luca Fornaro

This line of thought, in addition to having zero merit on the substance, objectively advances Putin's agenda of turning European people against the European Union.

March 5, 2025 at 8:43 PM

This line of thought, in addition to having zero merit on the substance, objectively advances Putin's agenda of turning European people against the European Union.

Interesting thoughts, make me think of this great book by Thomas Philippon www.hup.harvard.edu/books/978067...

February 24, 2025 at 4:18 PM

Interesting thoughts, make me think of this great book by Thomas Philippon www.hup.harvard.edu/books/978067...

There's a very interesting debate on the macroeconomic consequences of international capital flows going on between @pkrugman.bsky.social and Klein/ @michaelpettis.bsky.social

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...

Contra Krugman on Current Account Controversies

The surpluses of Edwardian Britain were not benign and should not be used to justify similar surpluses in Japan, Germany, and elsewhere.

open.substack.com

February 12, 2025 at 5:48 AM

There's a very interesting debate on the macroeconomic consequences of international capital flows going on between @pkrugman.bsky.social and Klein/ @michaelpettis.bsky.social

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...

open.substack.com/pub/matthewc...