Luca Fornaro

@lucafornaro.bsky.social

Whether and how this virtuous cycle can be triggered in the EU is a first order issue. IMO, this is one of the most interesting research and policy questions of our times.

November 11, 2025 at 2:38 PM

Whether and how this virtuous cycle can be triggered in the EU is a first order issue. IMO, this is one of the most interesting research and policy questions of our times.

This amplification effect could also go in reverse. A 'pro-growth' fiscal reform could raise productivity growth, making public debt easier to sustain, in turn freeing fiscal space for even more pro-growth policies.

November 11, 2025 at 2:38 PM

This amplification effect could also go in reverse. A 'pro-growth' fiscal reform could raise productivity growth, making public debt easier to sustain, in turn freeing fiscal space for even more pro-growth policies.

Martin Wolf and I have studied this amplification effect in a recent paper, and show that it may lead to a state of fiscal stagnation, characterized by a self-sustained vicious cycle of high debt, high fiscal distortions and low productivity growth. Italy may be an example of it.

November 11, 2025 at 2:38 PM

Martin Wolf and I have studied this amplification effect in a recent paper, and show that it may lead to a state of fiscal stagnation, characterized by a self-sustained vicious cycle of high debt, high fiscal distortions and low productivity growth. Italy may be an example of it.

If the drop in public investment has a strong negative impact on productivity growth, the future public debt to GDP ratio may end up raising. This will call for another round of fiscal adjustment through cuts in public investments, and so on.

November 11, 2025 at 2:38 PM

If the drop in public investment has a strong negative impact on productivity growth, the future public debt to GDP ratio may end up raising. This will call for another round of fiscal adjustment through cuts in public investments, and so on.

Moreover, there may be an amplification effect at play. Imagine that a government cuts public investments to increase its surplus and stabilize its debt (pretty much what happened during the euro area sovereign debt crisis).

November 11, 2025 at 2:38 PM

Moreover, there may be an amplification effect at play. Imagine that a government cuts public investments to increase its surplus and stabilize its debt (pretty much what happened during the euro area sovereign debt crisis).

There is also evidence suggesting that taxes on investment in intangibles tend to slow down innovation and productivity growth.

While this evidence is preliminary, it thus does look like fiscal policy affects productivity growth.

While this evidence is preliminary, it thus does look like fiscal policy affects productivity growth.

November 11, 2025 at 2:38 PM

There is also evidence suggesting that taxes on investment in intangibles tend to slow down innovation and productivity growth.

While this evidence is preliminary, it thus does look like fiscal policy affects productivity growth.

While this evidence is preliminary, it thus does look like fiscal policy affects productivity growth.

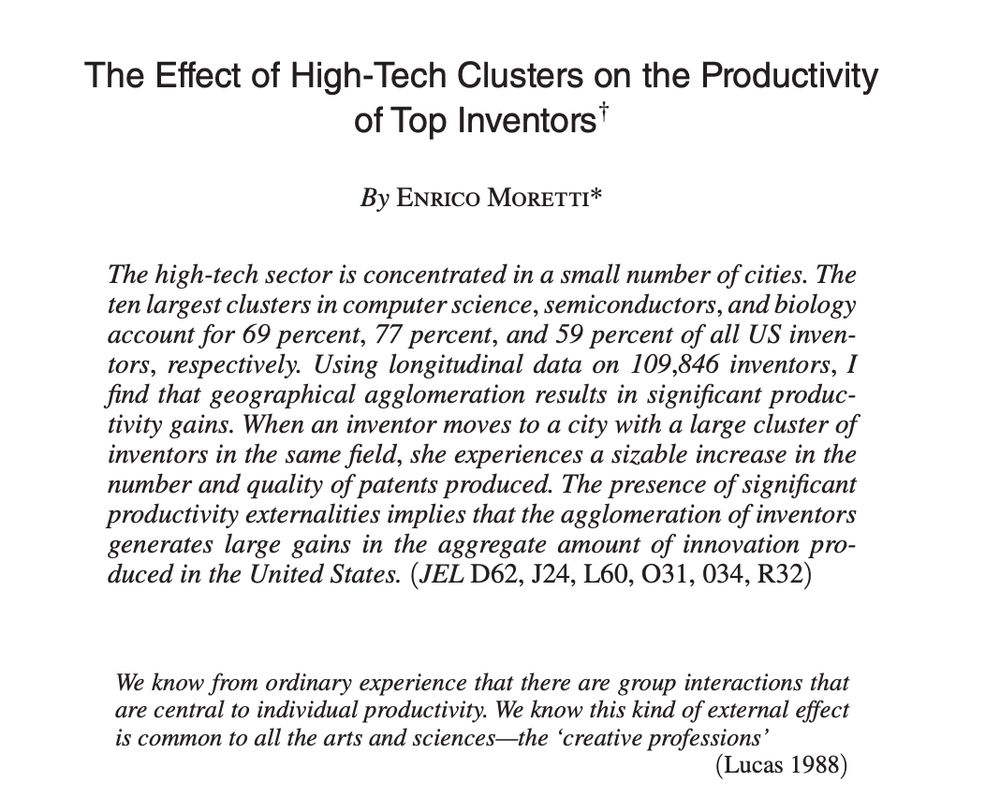

On the empirical side, recent research suggests that public investments matter for productivity. In particular, these two brilliant papers show that higher spending in public R&D crowd in private investment and lead to higher productivity growth in the medium run.

November 11, 2025 at 2:38 PM

On the empirical side, recent research suggests that public investments matter for productivity. In particular, these two brilliant papers show that higher spending in public R&D crowd in private investment and lead to higher productivity growth in the medium run.

My feeling is that this may be a big miss, and that integrating endogenous productivity dynamics in debt sustainability analyses could be an important area for future research.

Let me explain by citing a few recent works.

Let me explain by citing a few recent works.

November 11, 2025 at 2:38 PM

My feeling is that this may be a big miss, and that integrating endogenous productivity dynamics in debt sustainability analyses could be an important area for future research.

Let me explain by citing a few recent works.

Let me explain by citing a few recent works.

Also, I will be presenting this paper at the next IMF Jacques Polak conference imf.org/en/News/Semi.... The program looks great, and I look forward to it.

26th Jacques Polak Annual Research Conference: The Evolving Landscape of Global Trade and Financial Integration

The 2025 IMF Annual Research Conference will bring together academics and policy makers, promote innovative research, and provide a platform for a fruitful exchange of views.

imf.org

October 30, 2025 at 10:40 AM

Also, I will be presenting this paper at the next IMF Jacques Polak conference imf.org/en/News/Semi.... The program looks great, and I look forward to it.

If you're interested, you can find the full paper here crei.cat/wp-content/u....

@mw_econ

and I are pretty new to the international trade literature, so comments are welcome.

@mw_econ

and I are pretty new to the international trade literature, so comments are welcome.

crei.cat

October 30, 2025 at 10:40 AM

If you're interested, you can find the full paper here crei.cat/wp-content/u....

@mw_econ

and I are pretty new to the international trade literature, so comments are welcome.

@mw_econ

and I are pretty new to the international trade literature, so comments are welcome.

Finally, what if a country puts a tariff on innovation inputs, perhaps by taxing researchers moving from abroad? This policy may fail spectacularly, by triggering an outflows of innovation goods, which over time will erode the country's technological rents.

October 30, 2025 at 10:40 AM

Finally, what if a country puts a tariff on innovation inputs, perhaps by taxing researchers moving from abroad? This policy may fail spectacularly, by triggering an outflows of innovation goods, which over time will erode the country's technological rents.

Moreover, if the rest of the world chooses to retaliate, the result will be a full-blown trade war. In this scenario, tariffs have no impact on the distribution of technological rents across countries, but they cause big efficiency and output losses.

October 30, 2025 at 10:40 AM

Moreover, if the rest of the world chooses to retaliate, the result will be a full-blown trade war. In this scenario, tariffs have no impact on the distribution of technological rents across countries, but they cause big efficiency and output losses.

But this strategy has several drawbacks. First, reducing imports of foreign high-tech goods generates productivity and output losses. Second, even if import tariffs may increase national welfare, this comes at the expense of even larger welfare losses in the rest of the world.

October 30, 2025 at 10:40 AM

But this strategy has several drawbacks. First, reducing imports of foreign high-tech goods generates productivity and output losses. Second, even if import tariffs may increase national welfare, this comes at the expense of even larger welfare losses in the rest of the world.

Tariffs on imports of high-tech goods may be used to steal technological rents from the rest of the world. Intuitively, tariffs reduce the profitability of foreign high-tech firms, causing a flow of innovation inputs and technological rents to the country imposing the tariffs.

October 30, 2025 at 10:40 AM

Tariffs on imports of high-tech goods may be used to steal technological rents from the rest of the world. Intuitively, tariffs reduce the profitability of foreign high-tech firms, causing a flow of innovation inputs and technological rents to the country imposing the tariffs.

From a national perspective, importing innovation inputs yields technological rents, because of the positive knowledge spillovers that they create. So countries have an incentive to compete for technological hegemony, i.e. to become net importers of innovation inputs.

October 30, 2025 at 10:40 AM

From a national perspective, importing innovation inputs yields technological rents, because of the positive knowledge spillovers that they create. So countries have an incentive to compete for technological hegemony, i.e. to become net importers of innovation inputs.

To innovate, high-tech firms need specialized 'innovation inputs', such as researchers and venture capital. Building a strong high-tech cluster requires importing innovation inputs from abroad. Think of foreign researchers working for Big Tech firms in the Silicon Valley.

October 30, 2025 at 10:40 AM

To innovate, high-tech firms need specialized 'innovation inputs', such as researchers and venture capital. Building a strong high-tech cluster requires importing innovation inputs from abroad. Think of foreign researchers working for Big Tech firms in the Silicon Valley.

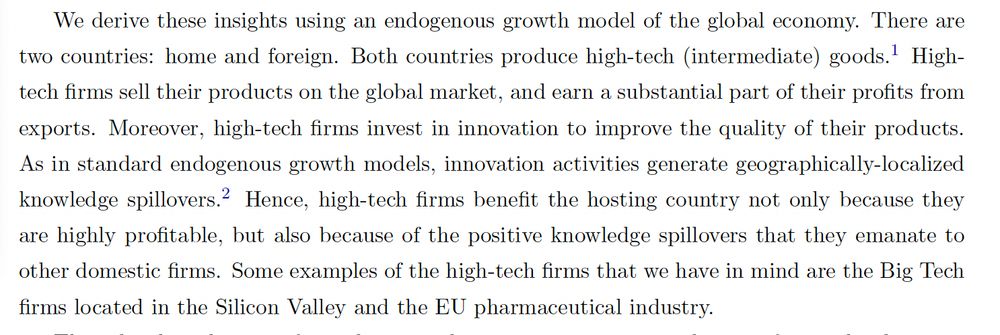

We start from the observation that high-tech clusters generate technological rents for the countries hosting them. Not only high-tech firms are highly profitable, but their innovation activities trigger positive knowledge spillovers to other domestic firms.

October 30, 2025 at 10:40 AM

We start from the observation that high-tech clusters generate technological rents for the countries hosting them. Not only high-tech firms are highly profitable, but their innovation activities trigger positive knowledge spillovers to other domestic firms.

We provide a framework connecting trade policies to innovation and technological hegemony. Our model focuses on high-tech firms that invest heavily in R&D and other intangibles. Nowadays, these firms play a key role in international trade.

October 30, 2025 at 10:40 AM

We provide a framework connecting trade policies to innovation and technological hegemony. Our model focuses on high-tech firms that invest heavily in R&D and other intangibles. Nowadays, these firms play a key role in international trade.

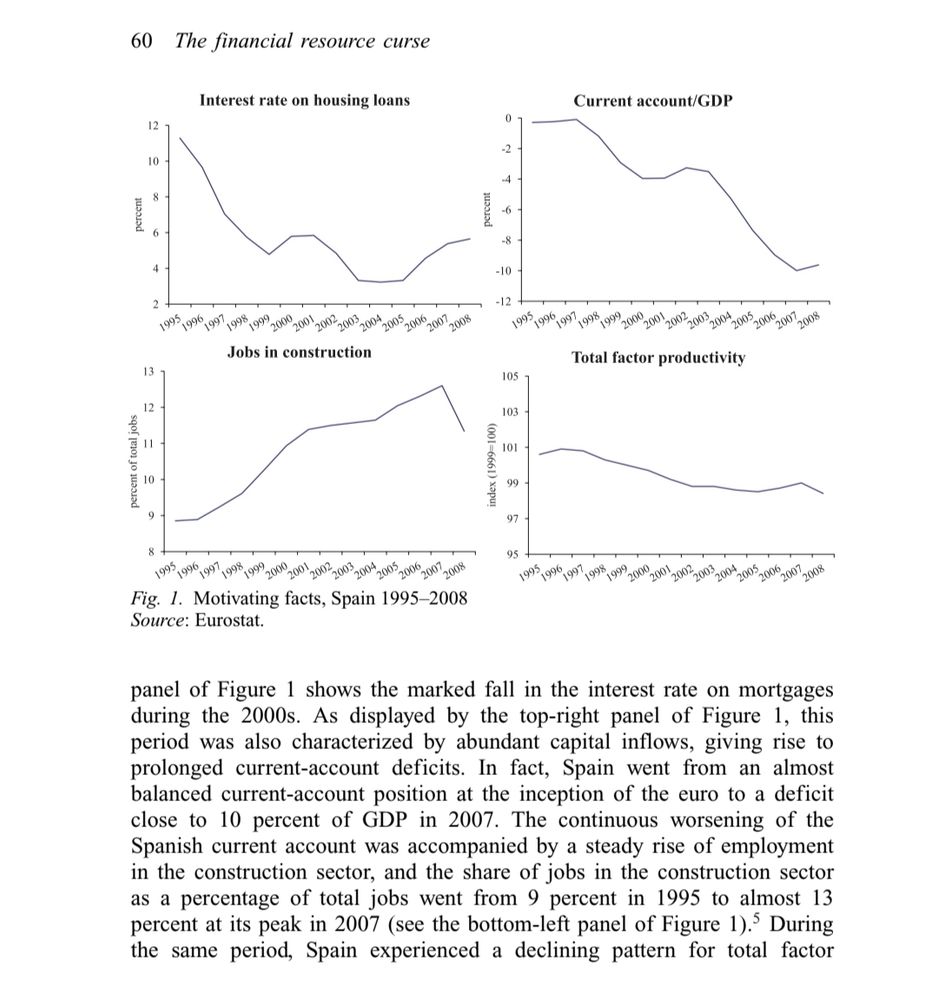

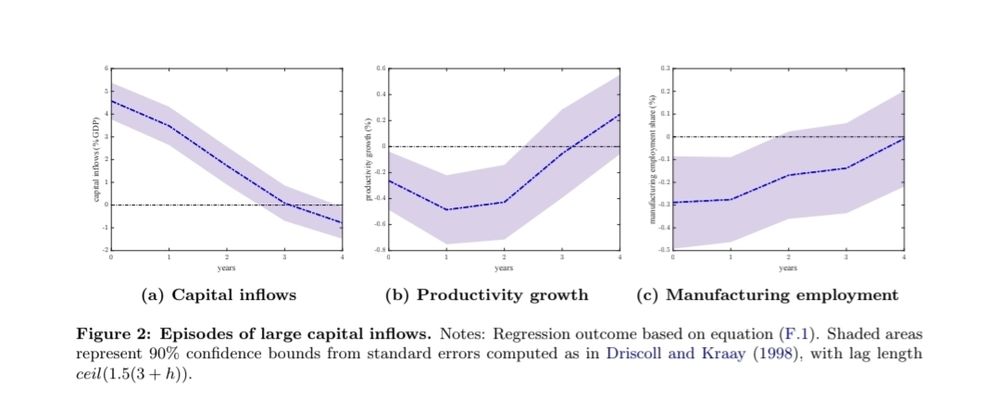

Spain during the 2000s is a good example of these dynamics, but productivity growth slowdowns during large surges in trade deficits are quite common.

July 31, 2025 at 4:35 AM

Spain during the 2000s is a good example of these dynamics, but productivity growth slowdowns during large surges in trade deficits are quite common.

Here you can find the full slides ecb.europa.eu/pub/pdf/sint..., while here is the recording of the panel ecb.europa.eu/press/confer..., which features great contributions by

@isabelschnabel.bsky.social, @agnesbq.bsky.social, @pietphc.bsky.social and @refetgurkaynak.bsky.social.

@isabelschnabel.bsky.social, @agnesbq.bsky.social, @pietphc.bsky.social and @refetgurkaynak.bsky.social.

ecb.europa.eu

July 3, 2025 at 10:52 AM

Here you can find the full slides ecb.europa.eu/pub/pdf/sint..., while here is the recording of the panel ecb.europa.eu/press/confer..., which features great contributions by

@isabelschnabel.bsky.social, @agnesbq.bsky.social, @pietphc.bsky.social and @refetgurkaynak.bsky.social.

@isabelschnabel.bsky.social, @agnesbq.bsky.social, @pietphc.bsky.social and @refetgurkaynak.bsky.social.