take the change in job openings by industry. Plot it against the change in employment by industry. The sectors with the biggest REDUCTIONS in job openings also saw the largest INCREASES in employment.

US, France, UK all the same story

ChatGPT my ass

take the change in job openings by industry. Plot it against the change in employment by industry. The sectors with the biggest REDUCTIONS in job openings also saw the largest INCREASES in employment.

US, France, UK all the same story

ChatGPT my ass

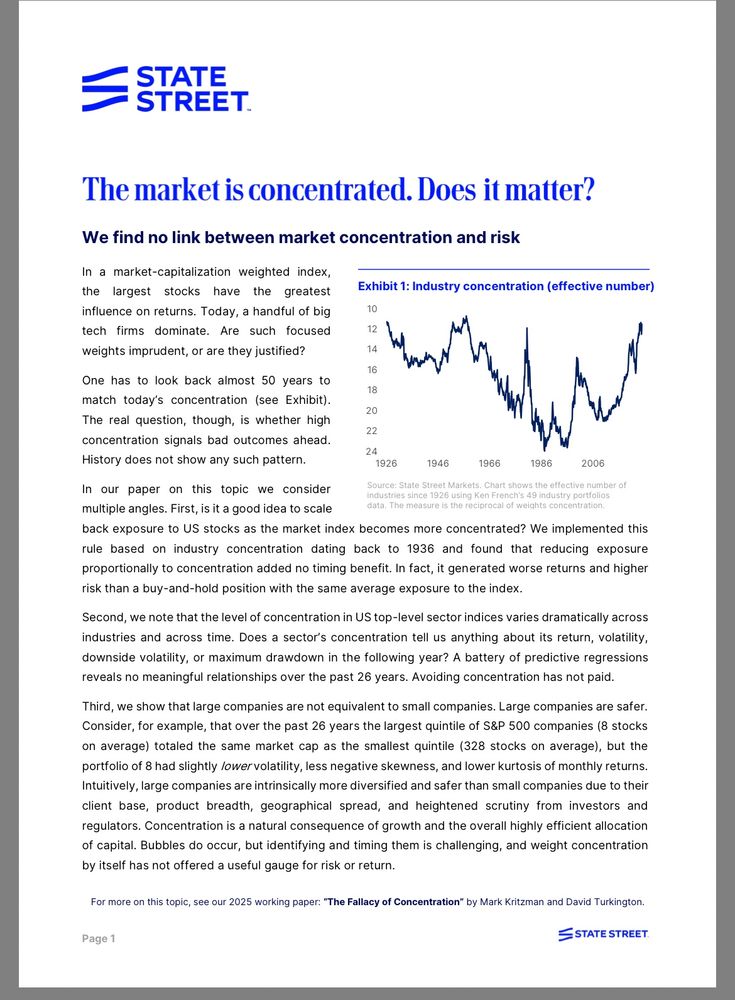

globalmarkets.statestreet.com/research/por...

globalmarkets.statestreet.com/research/por...

Politics in Japan and France over the weekend: not so fast

Politics in Japan and France over the weekend: not so fast

Back in 2019 I led a research effort to digitize old climate model projections and assess how well they did. Turns out they got future warming pretty spot on!

Back in 2019 I led a research effort to digitize old climate model projections and assess how well they did. Turns out they got future warming pretty spot on!

This is now a common phenomenon in advanced economies, which, for countries like Britain and France...

1 of 2

This is now a common phenomenon in advanced economies, which, for countries like Britain and France...

1 of 2

www.nber.org/system/files...

I 🧡 HTSI

I 🧡 HTSI