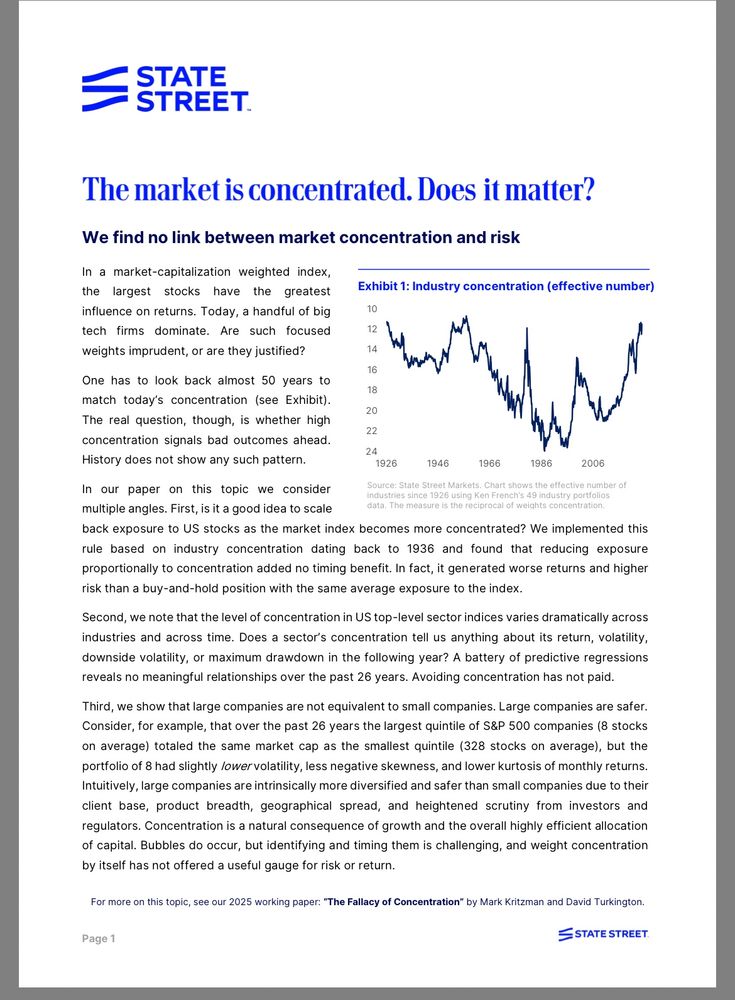

globalmarkets.statestreet.com/research/por...

globalmarkets.statestreet.com/research/por...

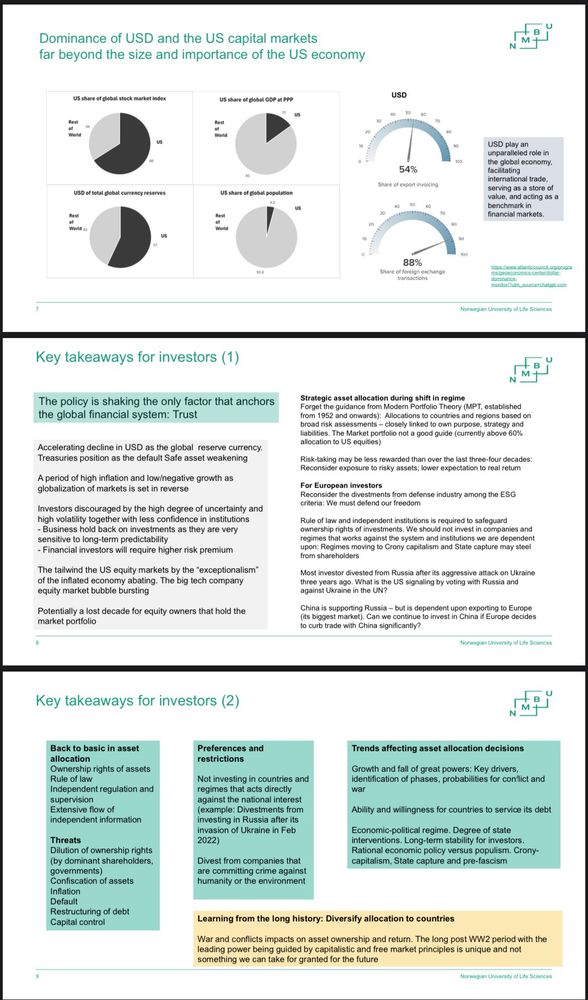

#LiberationDay

#LiberationDay

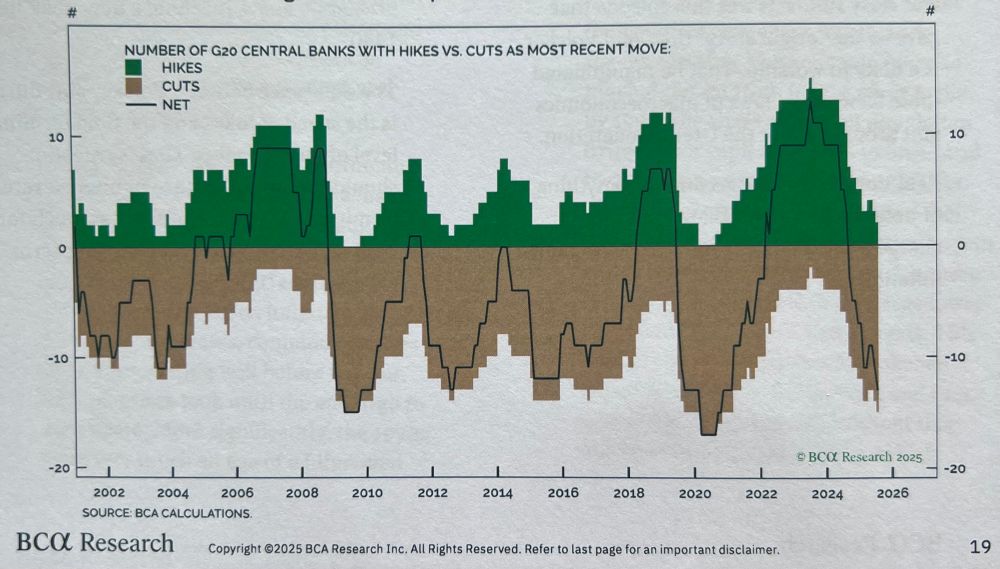

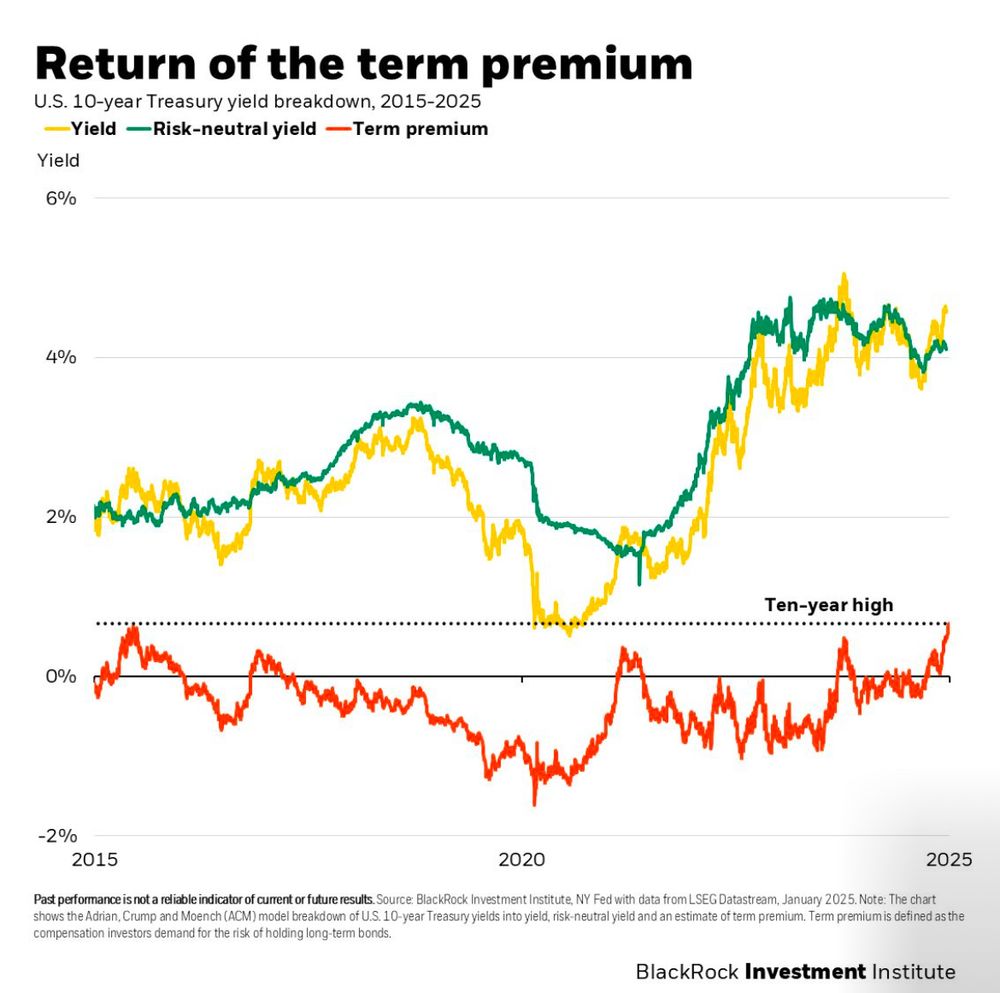

Looks like they locked in lower rates for longer.

Looks like they locked in lower rates for longer.

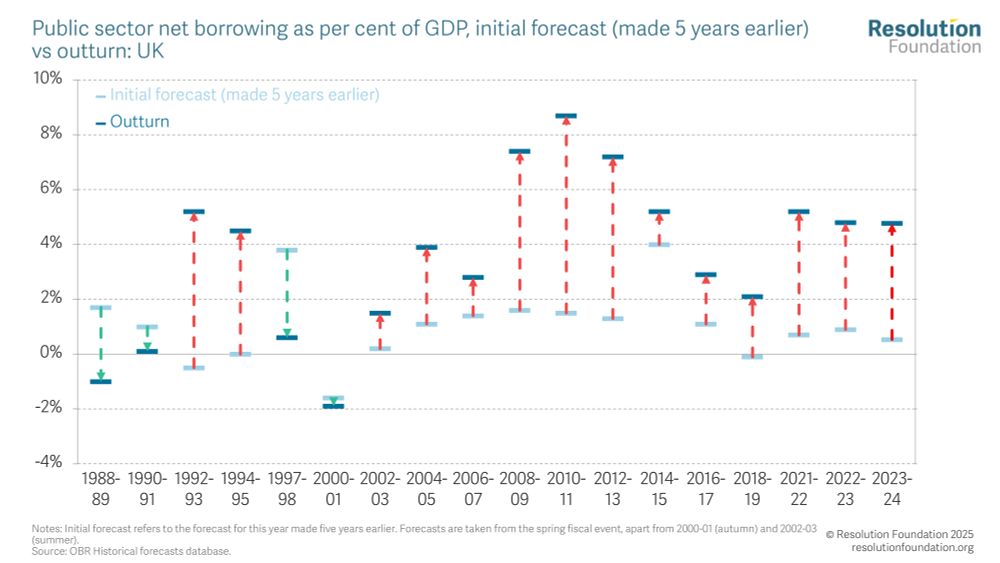

The true enemy of rail isn’t lack of investment, but the leaves 🍂.

The true enemy of rail isn’t lack of investment, but the leaves 🍂.