Leading indicators declined for three years with no recession - here is what actually happened.

epbresearch.substack.com/p/why-leadin...

Leading indicators declined for three years with no recession - here is what actually happened.

epbresearch.substack.com/p/why-leadin...

The Hidden Link Between Government Size, Vanishing Net Investment, and Stagnant Real Incomes

open.substack.com/pub/epbresea...

The Hidden Link Between Government Size, Vanishing Net Investment, and Stagnant Real Incomes

open.substack.com/pub/epbresea...

Double the 10% level that was seen in the 80s, 90s, and early 00s.

What is going on?

Double the 10% level that was seen in the 80s, 90s, and early 00s.

What is going on?

TL;DR: Look out for

- Durable Goods Consumption (Consumers)

- Residential Investment (Consumers)

- Business Equipment Investment (Companies)

The rest is noise.

TL;DR: Look out for

- Durable Goods Consumption (Consumers)

- Residential Investment (Consumers)

- Business Equipment Investment (Companies)

The rest is noise.

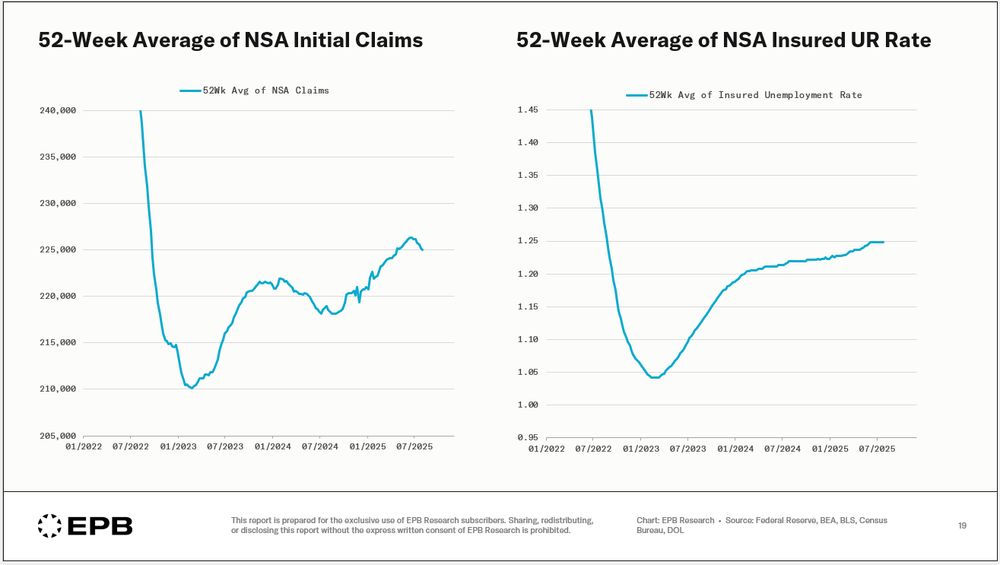

No fire (stable initial claims)

No hire (higher unemployment rate)

No fire (stable initial claims)

No hire (higher unemployment rate)

A global banking crisis? Not so much.

Here are three charts that signaled the recession 18 months early.

blog.epbresearch.com/p/you-could-...

A global banking crisis? Not so much.

Here are three charts that signaled the recession 18 months early.

blog.epbresearch.com/p/you-could-...

Hiring rate and quits are remain extremely weak while the layoff rate ticked up slightly.

It remains an extremely tough labor market for new entrants and those looking for a job.

Layoffs are still generally low.

Hiring rate and quits are remain extremely weak while the layoff rate ticked up slightly.

It remains an extremely tough labor market for new entrants and those looking for a job.

Layoffs are still generally low.

Production of business vehicles is exploding 📈

What's the best explanation for this?

Production of business vehicles is exploding 📈

What's the best explanation for this?

Why conventional analysis fails — and the three sectors you should actually be watching.

epbresearch.substack.com/p/the-20-of-...

Why conventional analysis fails — and the three sectors you should actually be watching.

epbresearch.substack.com/p/the-20-of-...

But roughly 60% of those transfer payments are directed at the older demographic (Social Security and Medicare).

But roughly 60% of those transfer payments are directed at the older demographic (Social Security and Medicare).

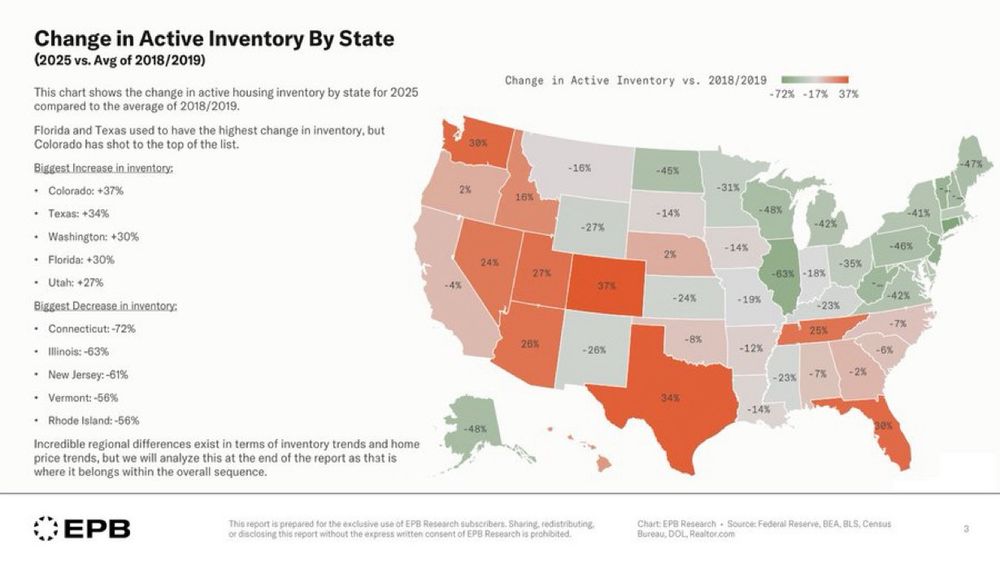

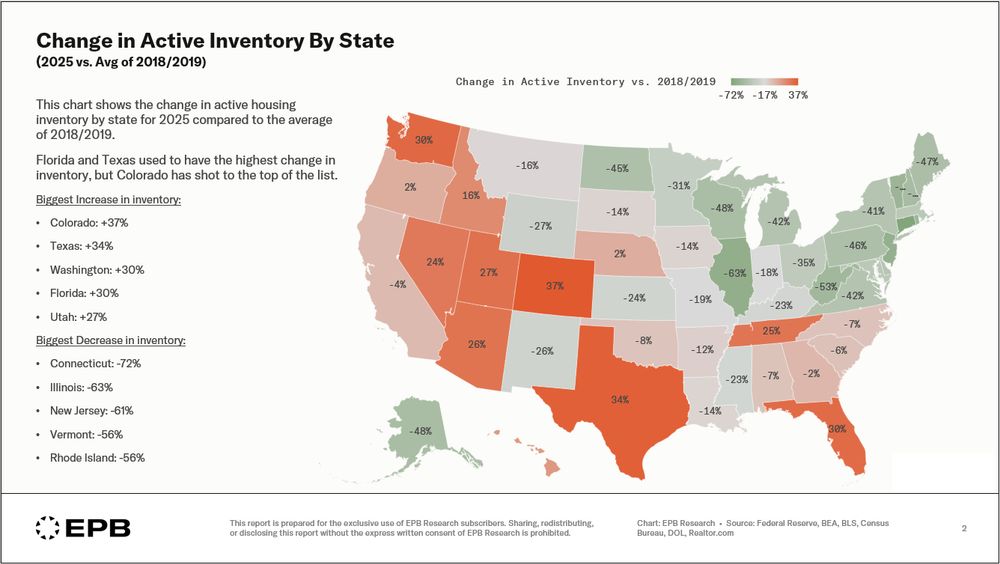

Among the worst in the country.

Among the worst in the country.

However, the inventory profile is very different across the state.

This chart breaks down the metro-level inventory data across California.

You can see which areas are better/worse than average.

However, the inventory profile is very different across the state.

This chart breaks down the metro-level inventory data across California.

You can see which areas are better/worse than average.

It covers the full housing cycle & highlights major regional disparities in inventory & price trends.

If you're interested in reports like this, you can find more info here: epbresearch.com/services/

It covers the full housing cycle & highlights major regional disparities in inventory & price trends.

If you're interested in reports like this, you can find more info here: epbresearch.com/services/

Less so for the insured UR rate.

Less so for the insured UR rate.

Construction and manufacturing employment just turned negative YoY, a classic recession signal.

Credit to @epbresearch.bsky.social for this, the kind of signal Alethia is built to highlight.

writings.alethia.news/cyclical-job...

Construction and manufacturing employment just turned negative YoY, a classic recession signal.

Credit to @epbresearch.bsky.social for this, the kind of signal Alethia is built to highlight.

writings.alethia.news/cyclical-job...

This chart shows active housing inventory in 2025 compared to 2018/2019 levels.

This is the one of the largest variations in inventory and home prices by geography or region in history.

This chart shows active housing inventory in 2025 compared to 2018/2019 levels.

This is the one of the largest variations in inventory and home prices by geography or region in history.

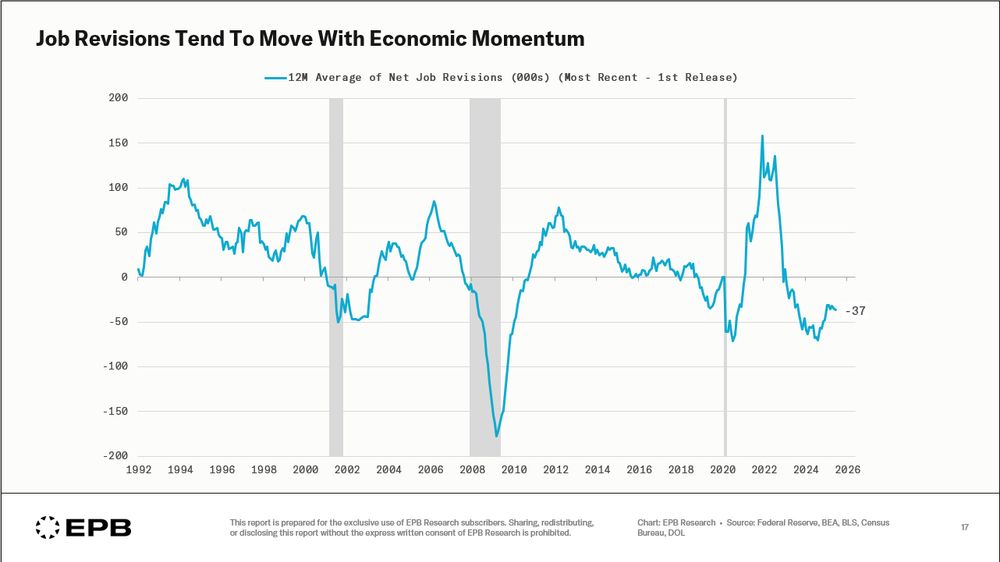

1] Establishment survey nonfarm payroll revisions tend to move with economic momentum (so much that rolling revisions look like an economic indicator)

2] The unemployment rate is much less revised.

1] Establishment survey nonfarm payroll revisions tend to move with economic momentum (so much that rolling revisions look like an economic indicator)

2] The unemployment rate is much less revised.