Among the worst in the country.

Among the worst in the country.

However, the inventory profile is very different across the state.

This chart breaks down the metro-level inventory data across California.

You can see which areas are better/worse than average.

However, the inventory profile is very different across the state.

This chart breaks down the metro-level inventory data across California.

You can see which areas are better/worse than average.

It covers the full housing cycle & highlights major regional disparities in inventory & price trends.

If you're interested in reports like this, you can find more info here: epbresearch.com/services/

It covers the full housing cycle & highlights major regional disparities in inventory & price trends.

If you're interested in reports like this, you can find more info here: epbresearch.com/services/

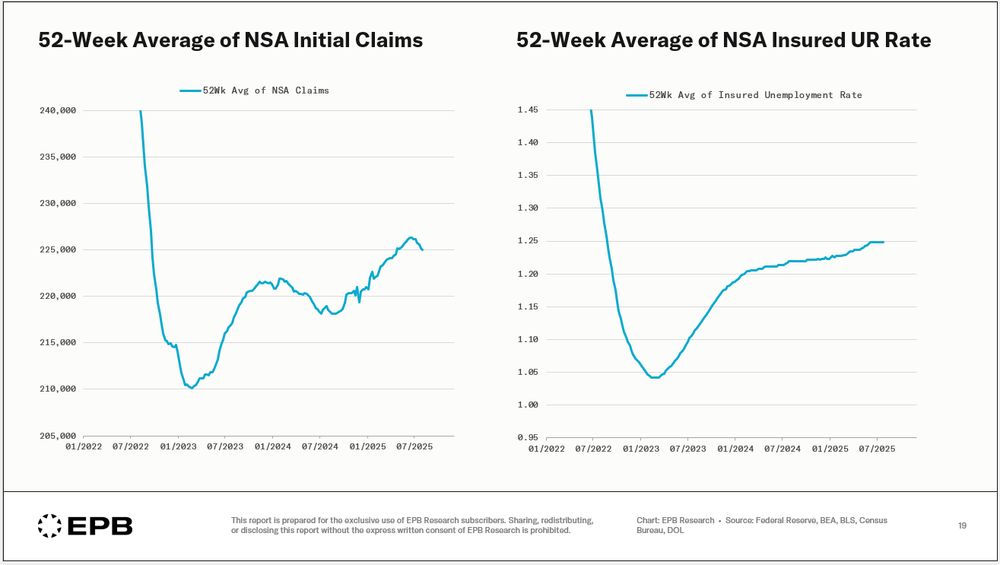

Less so for the insured UR rate.

Less so for the insured UR rate.

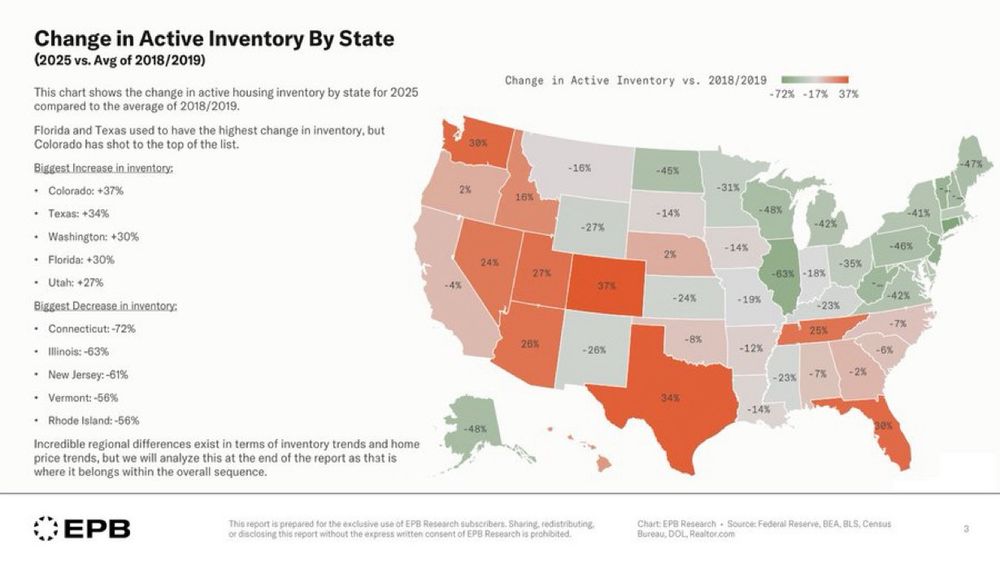

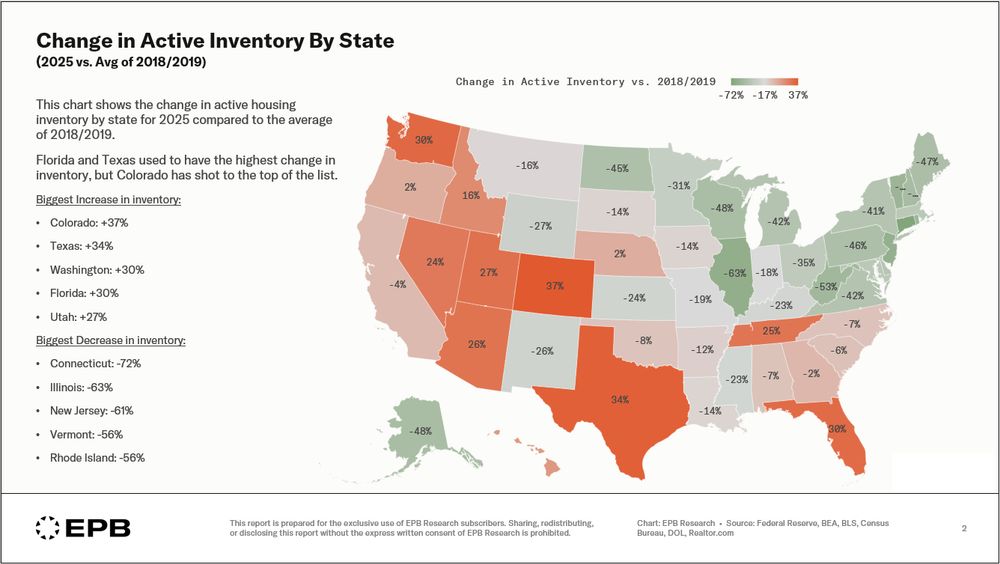

This chart shows active housing inventory in 2025 compared to 2018/2019 levels.

This is the one of the largest variations in inventory and home prices by geography or region in history.

This chart shows active housing inventory in 2025 compared to 2018/2019 levels.

This is the one of the largest variations in inventory and home prices by geography or region in history.

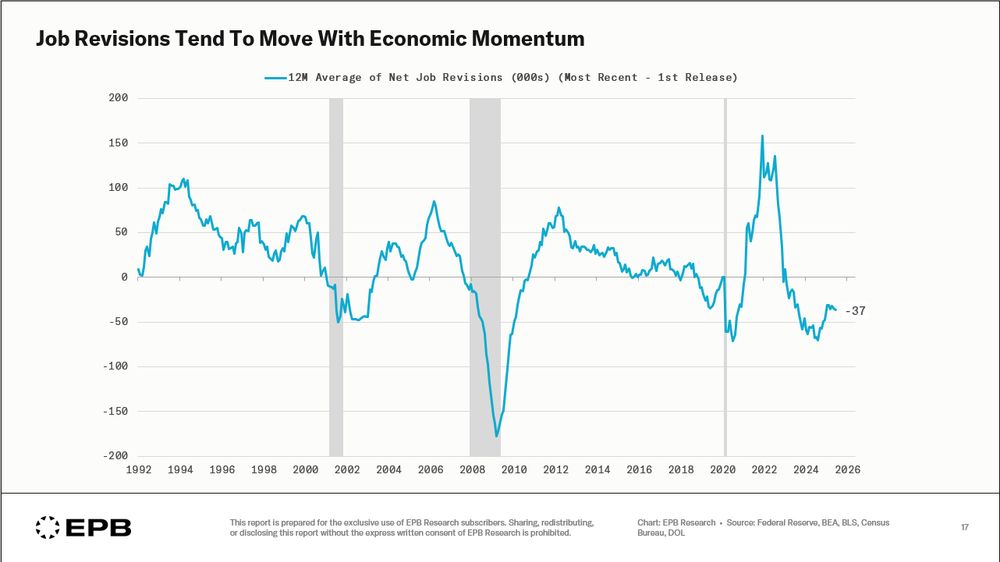

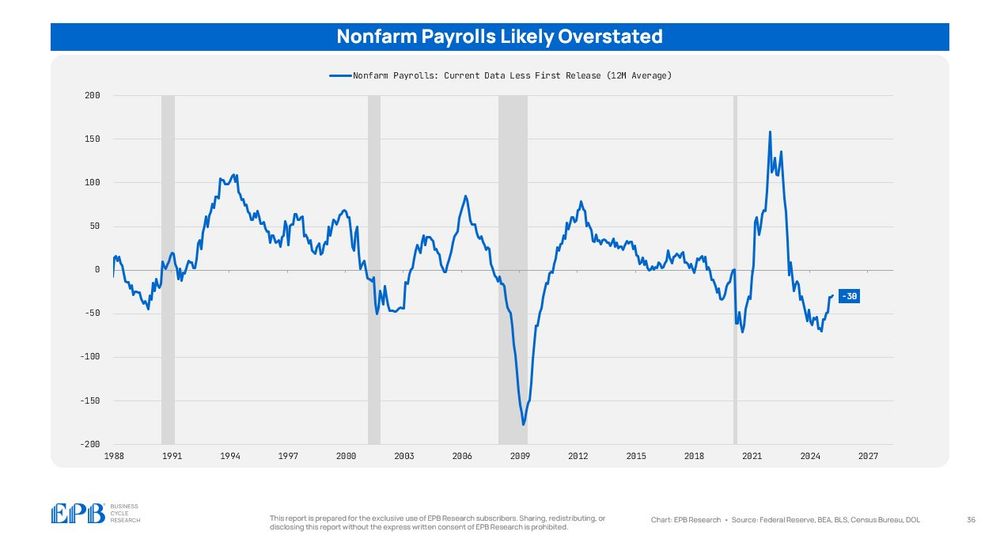

1] Establishment survey nonfarm payroll revisions tend to move with economic momentum (so much that rolling revisions look like an economic indicator)

2] The unemployment rate is much less revised.

1] Establishment survey nonfarm payroll revisions tend to move with economic momentum (so much that rolling revisions look like an economic indicator)

2] The unemployment rate is much less revised.

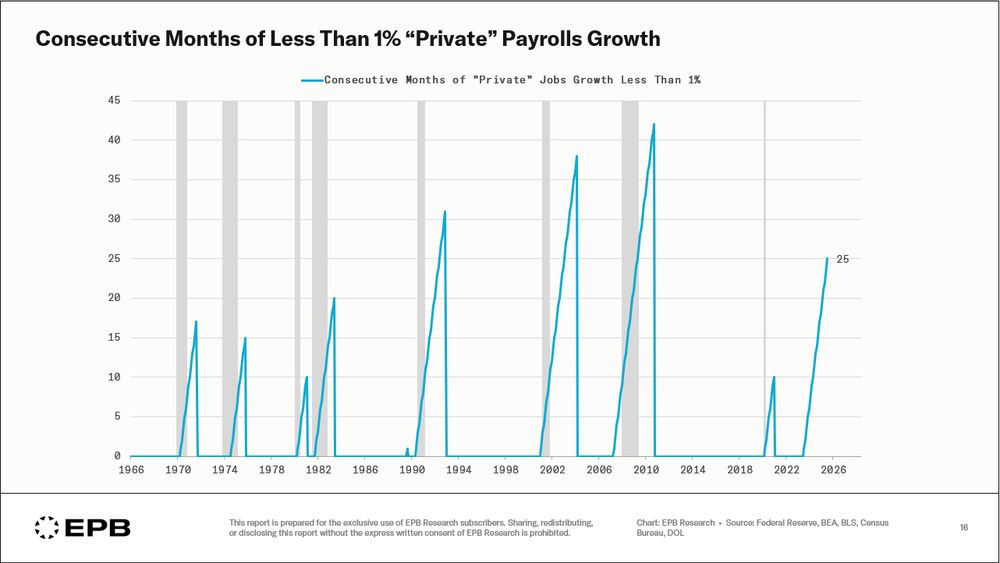

Unusual outside of recessionary periods.

Unusual outside of recessionary periods.

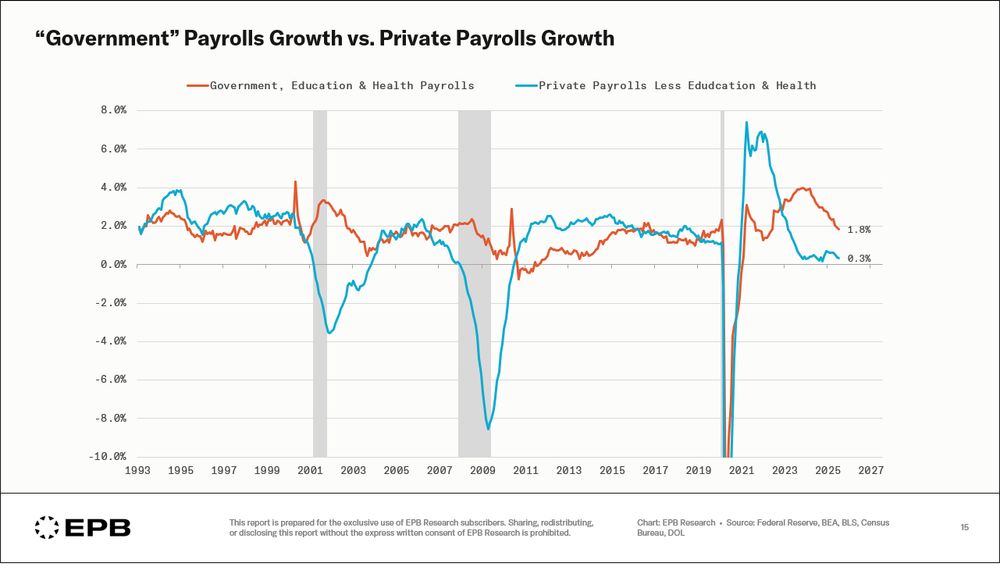

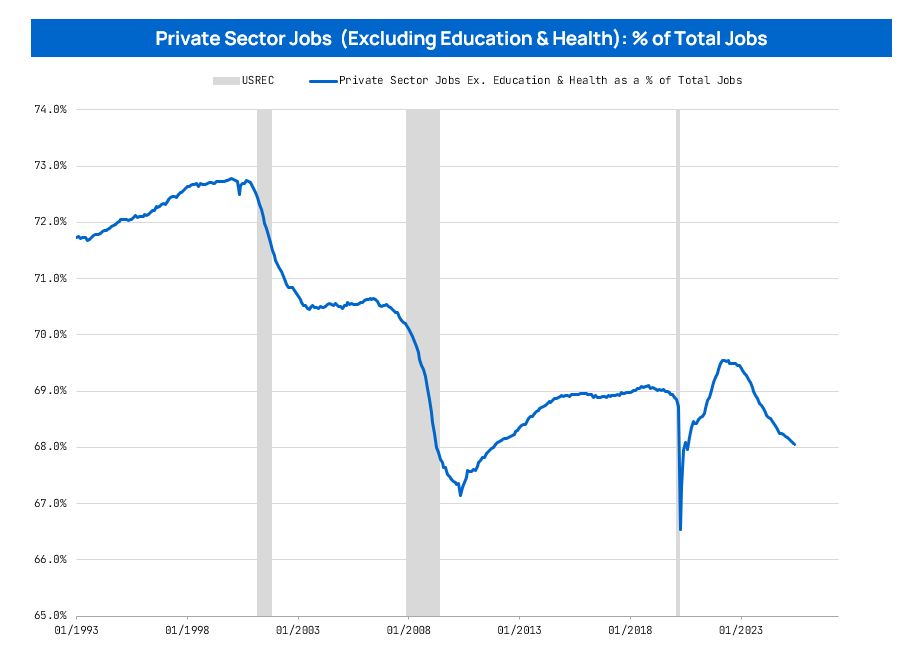

"Private" sector jobs (68% of total) are growing at 0.3%.

This split is textbook late-cycle labor dynamics.

"Private" sector jobs (68% of total) are growing at 0.3%.

This split is textbook late-cycle labor dynamics.

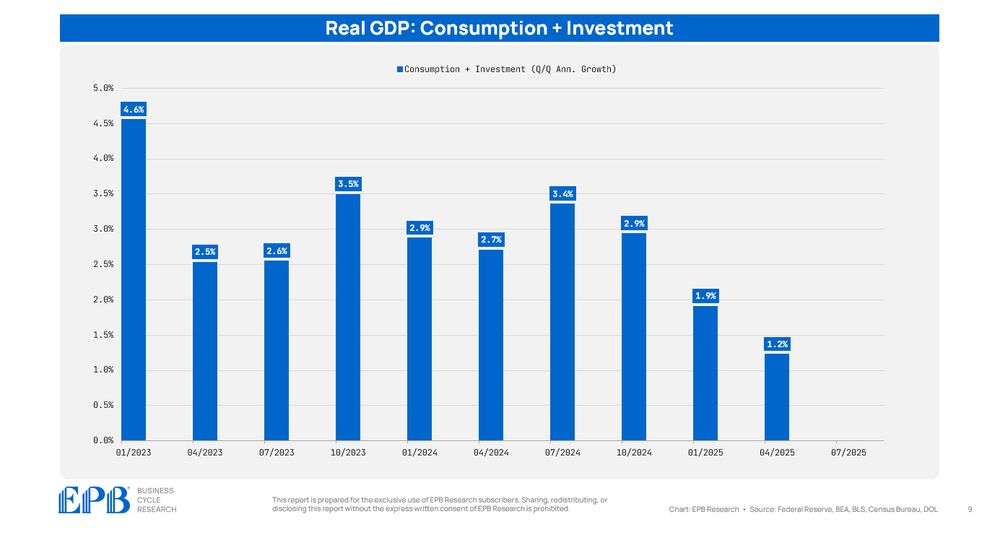

Q324: 3.4%

Q424: 2.9%

Q125: 1.9%

Q225: 1.2%

Q324: 3.4%

Q424: 2.9%

Q125: 1.9%

Q225: 1.2%

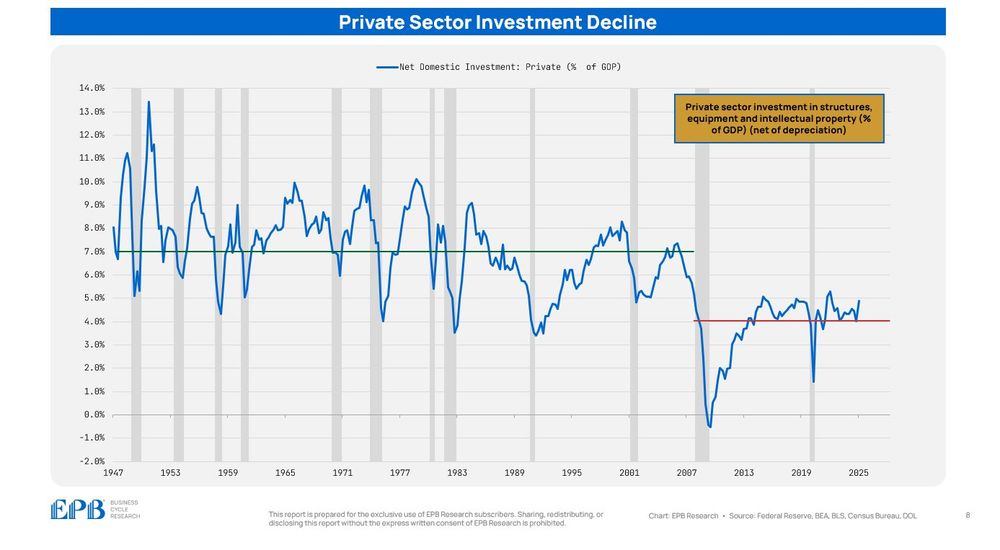

From 1947-07, the private sector invested ~7% of GDP in new structures, equipment & IP.

From 07-today, it's been ~4%.

This is around $1T of missing investment per year!

From 1947-07, the private sector invested ~7% of GDP in new structures, equipment & IP.

From 07-today, it's been ~4%.

This is around $1T of missing investment per year!

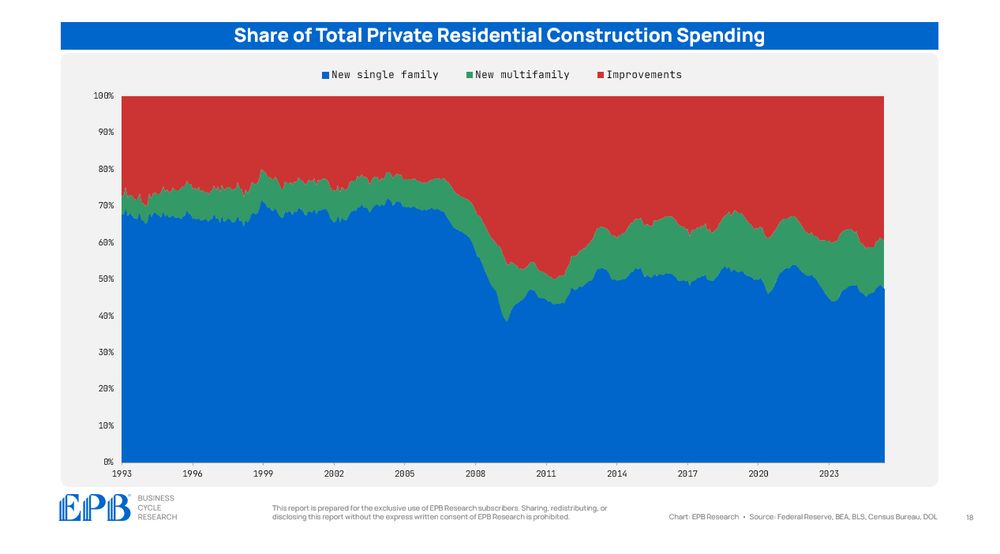

In the early 90s, 70% of residential construction spending was on new single-family buildings.

Today, it's 47%.

Remodeling and new multi-family buildings have increased their share from a combined 30% to over 50%.

In the early 90s, 70% of residential construction spending was on new single-family buildings.

Today, it's 47%.

Remodeling and new multi-family buildings have increased their share from a combined 30% to over 50%.

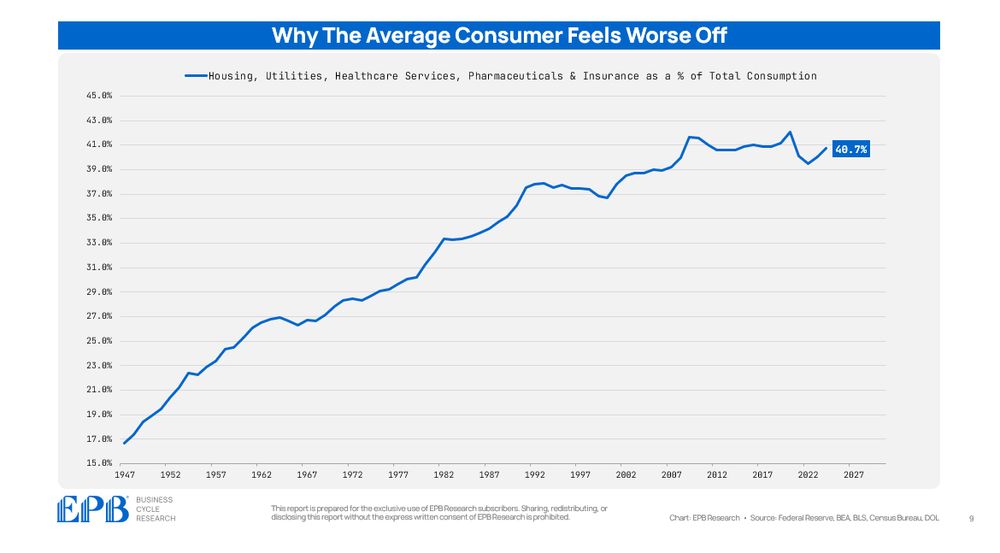

Because 41% of consumer spending goes to: housing, utilities, healthcare, medications, and insurance.

This was 16% in 1947, 30% in 1980, and 35% in 1990.

Fewer consumer dollars are left for true discretionary spending.

Because 41% of consumer spending goes to: housing, utilities, healthcare, medications, and insurance.

This was 16% in 1947, 30% in 1980, and 35% in 1990.

Fewer consumer dollars are left for true discretionary spending.

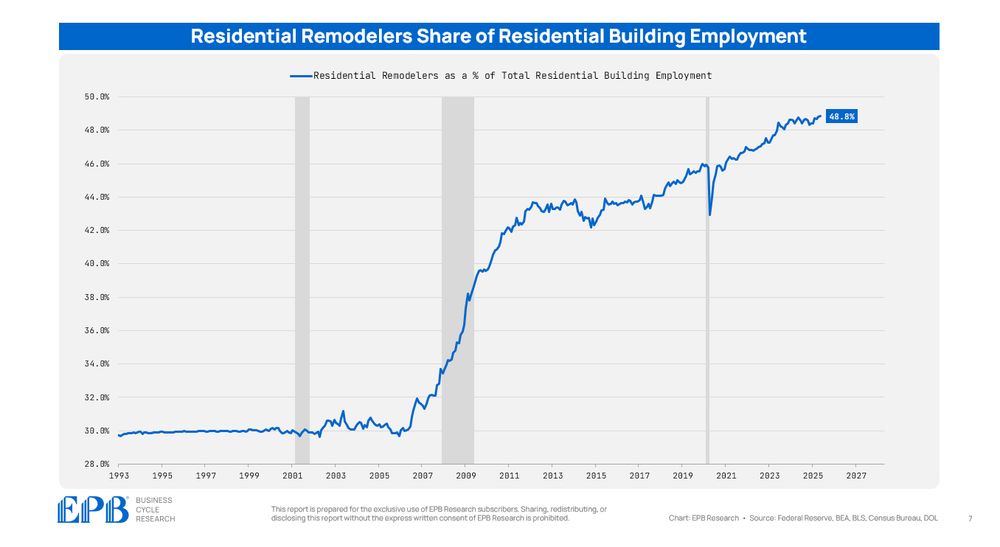

Residential building includes single & multi-family building as well as remodelers.

Remodeling has increased from 30% to nearly 50% of total residential building employment.

Residential building includes single & multi-family building as well as remodelers.

Remodeling has increased from 30% to nearly 50% of total residential building employment.

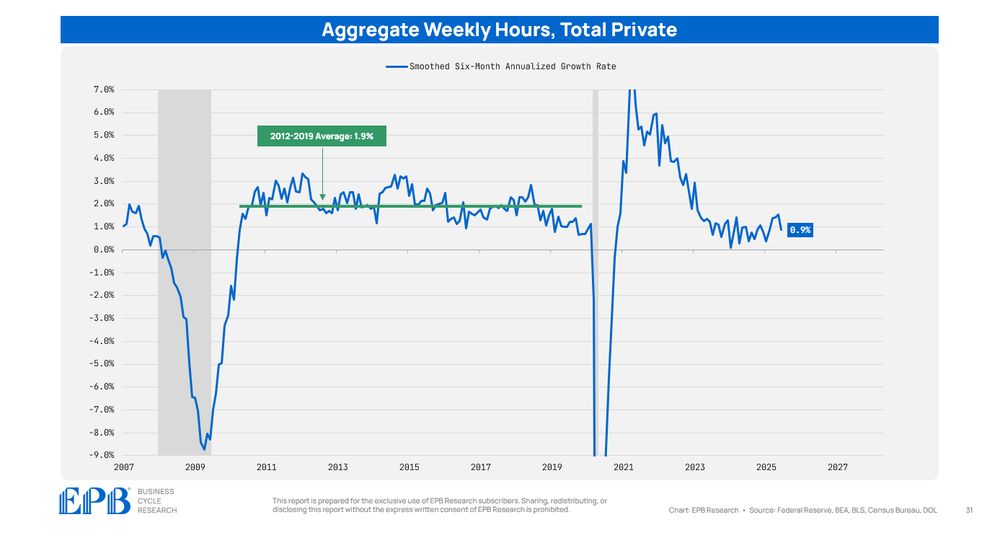

This compares to an average rate of 1.9% in the pre-pandemic expansion.

The private sector labor market is weak for a non-recessionary period.

This compares to an average rate of 1.9% in the pre-pandemic expansion.

The private sector labor market is weak for a non-recessionary period.

Normally, the private sector share of jobs falls in recessions, not expansions.

The labor market gains continue to be dominated by government, and quasi-government jobs.

Normally, the private sector share of jobs falls in recessions, not expansions.

The labor market gains continue to be dominated by government, and quasi-government jobs.

Over the last 12 months, nonfarm payrolls were revised lower by an average of 30,000 per month.

Current data suggests we are adding ~1.6 million jobs per year. The pace is likely closer to 1.25 million, a 20% difference.

Over the last 12 months, nonfarm payrolls were revised lower by an average of 30,000 per month.

Current data suggests we are adding ~1.6 million jobs per year. The pace is likely closer to 1.25 million, a 20% difference.

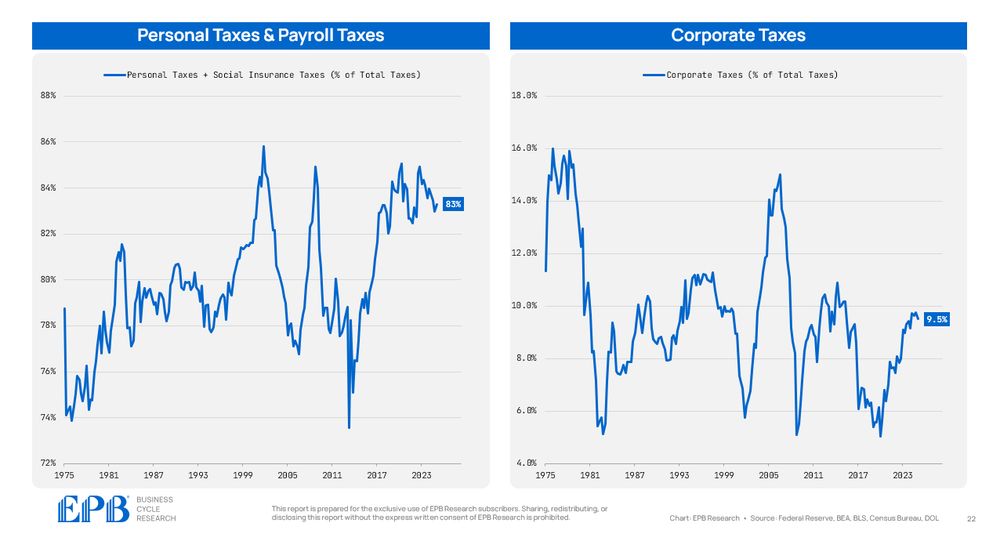

Over the last 50 years, more taxes have shifted to personal & payroll and a bit less on corporations.

Over the last 50 years, more taxes have shifted to personal & payroll and a bit less on corporations.

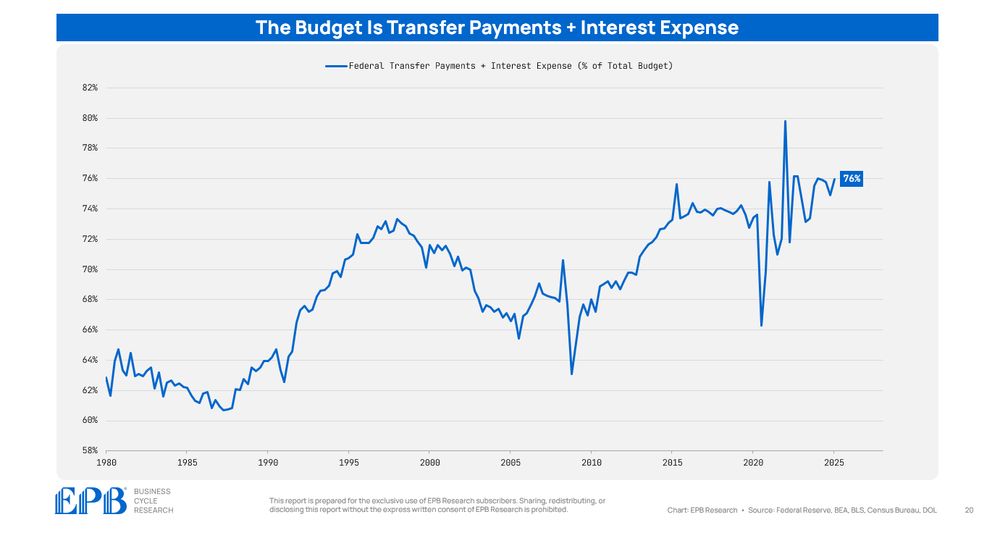

Any budget conversation that doesn't address transfer payments is not a serious one.

Any budget conversation that doesn't address transfer payments is not a serious one.