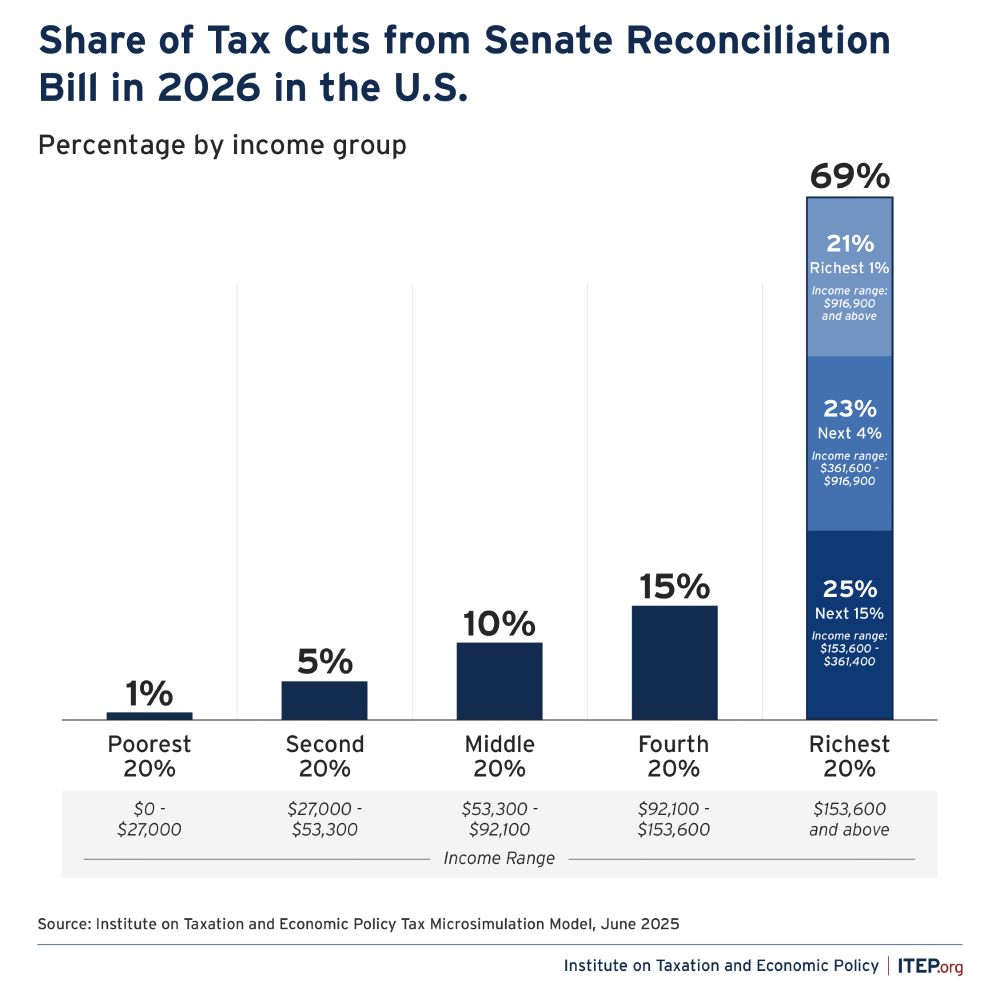

The most ludicrous of these “affordability” tax cuts is ELIMINATING the estate tax—a tax only affecting heirs to fortunes worth over $30 MILLION DOLLARS per couple.

The most ludicrous of these “affordability” tax cuts is ELIMINATING the estate tax—a tax only affecting heirs to fortunes worth over $30 MILLION DOLLARS per couple.

This group within IRS was poised to generate astronomical returns on investment for the country.

equitablegrowth.org/research-pap...

This group within IRS was poised to generate astronomical returns on investment for the country.

equitablegrowth.org/research-pap...

I am not a fan (of QSBS)! The podcast I like very much.

taxchats.buzzsprout.com/1878989/epis...

cc: @taxnotes.com coauthor @kylepomerleau.bsky.social

I am not a fan (of QSBS)! The podcast I like very much.

taxchats.buzzsprout.com/1878989/epis...

cc: @taxnotes.com coauthor @kylepomerleau.bsky.social

But Dan Acland @goldmanschool.bsky.social proves otherwise—showing how weighting can overcome bias against low income & bridge divide b/w equity & efficiency equitablegrowth.org/research-pap... @equitablegrowth.bsky.social

But Dan Acland @goldmanschool.bsky.social proves otherwise—showing how weighting can overcome bias against low income & bridge divide b/w equity & efficiency equitablegrowth.org/research-pap... @equitablegrowth.bsky.social

And possible model for federal reform: Give a break to the 90% of (actually small!) businesses (including independent contractors who file as businesses) that make less than $2 million in gross receipts each year, while raising rates on the larger firms.

And possible model for federal reform: Give a break to the 90% of (actually small!) businesses (including independent contractors who file as businesses) that make less than $2 million in gross receipts each year, while raising rates on the larger firms.

When enhanced marketplace tax credits expire, businesspeople making <$150k, face a larger tax hike than eliminating the passthru deduction

They find AI exposure is higher among people with higher levels of education who work in high-paying jobs, regardless of gender or race.

🔗:

They find AI exposure is higher among people with higher levels of education who work in high-paying jobs, regardless of gender or race.

🔗:

@kylepomerleau.bsky.social & me on why QSBS-which Republicans just expanded-is inefficient, unfair & should be scrapped, or at least reformed to fix glaring defects.

www.taxnotes.com/tax-notes-to... @taxnotes.com

@kylepomerleau.bsky.social & me on why QSBS-which Republicans just expanded-is inefficient, unfair & should be scrapped, or at least reformed to fix glaring defects.

www.taxnotes.com/tax-notes-to... @taxnotes.com

www.cbo.gov/publication/...

www.cbo.gov/publication/...

@itep.org.

States should follow California's lead and decouple from the federal Qualified Small Business Stock exclusion. It sure doesn't seem like early-stage tech investment in CA has suffered without it...

itep.org/qsbs-trump-t...

@itep.org.

States should follow California's lead and decouple from the federal Qualified Small Business Stock exclusion. It sure doesn't seem like early-stage tech investment in CA has suffered without it...

itep.org/qsbs-trump-t...

Very good take from @howardgleckman.bsky.social @taxpolicycenter.bsky.social:

Very good take from @howardgleckman.bsky.social @taxpolicycenter.bsky.social:

My attempt at translation: weeklyhumorist.com/the-jaded-we...

"I got really lucky and am marrying someone completely out of my league"

=

“I will be spending the next 20 years paranoid about you cheating on me”

My attempt at translation: weeklyhumorist.com/the-jaded-we...

"I got really lucky and am marrying someone completely out of my league"

=

“I will be spending the next 20 years paranoid about you cheating on me”

New study out today by Balkir, Saez, Yagan, and Zucman finds 400 richest Americans pay just 23.8% in total (federal, state, foreign) taxes, less than the 30% paid by the average American. www.nber.org/papers/w34170 🧵

New study out today by Balkir, Saez, Yagan, and Zucman finds 400 richest Americans pay just 23.8% in total (federal, state, foreign) taxes, less than the 30% paid by the average American. www.nber.org/papers/w34170 🧵

As Republican states send National Guard troops to Washington, D.C., organizer Keya Chatterjee of @freedcproject.bsky.social joins calls to end Trump's federal takeover of the nation's capital.

As Republican states send National Guard troops to Washington, D.C., organizer Keya Chatterjee of @freedcproject.bsky.social joins calls to end Trump's federal takeover of the nation's capital.

And for reminding/educating fellow Americans across the country, who will be reading news stories about yesterday's events, about the 700,000+ disenfranchised Americans living in DC without representation in Congress.

And for reminding/educating fellow Americans across the country, who will be reading news stories about yesterday's events, about the 700,000+ disenfranchised Americans living in DC without representation in Congress.

The 10 worst policies in the budget bill Trump signed earlier this month. 🧵

How will they impact Americans and economic growth over the next 10 years and beyond?

equitablegrowth.org/the-10-worst...

The 10 worst policies in the budget bill Trump signed earlier this month. 🧵

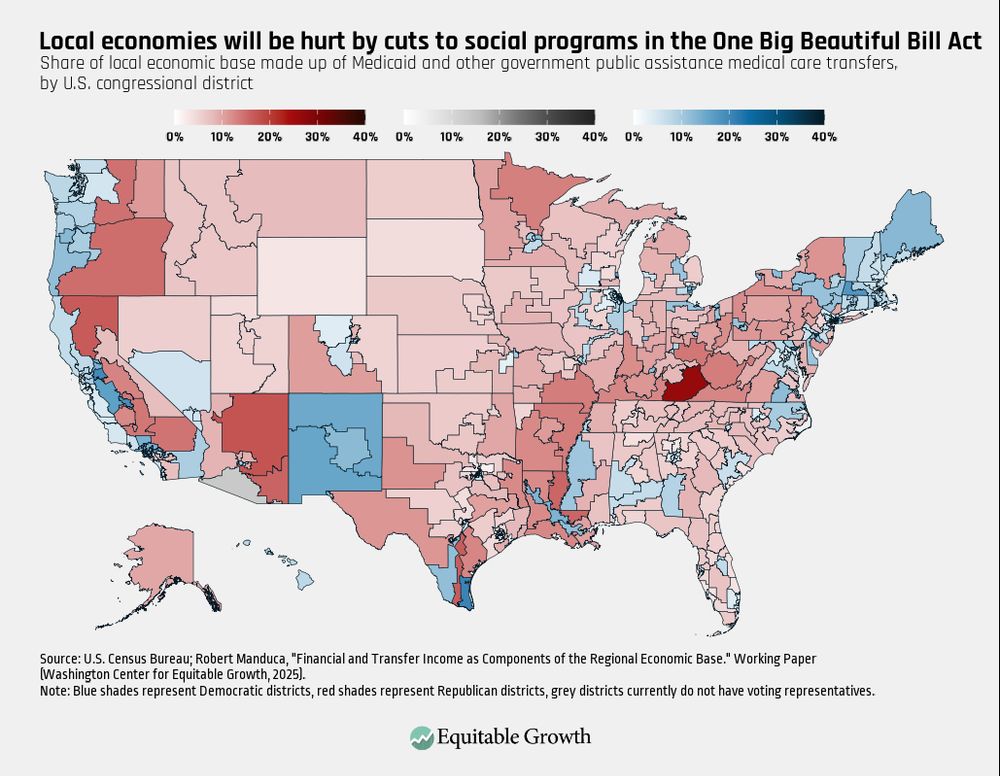

97% of food manufacturing in New Jersey's 7th district (Kean)

85% of farming in NE-2 (Bacon)

69% of hospitality (largest private industry in district!) in CO-3 (Hurd)

...

97% of food manufacturing in New Jersey's 7th district (Kean)

85% of farming in NE-2 (Bacon)

69% of hospitality (largest private industry in district!) in CO-3 (Hurd)

...

Future generations will pay for the multitrillion-dollar debt increase.

And what for? Massive, expensive tax cuts to the wealthiest few.

Future generations will pay for the multitrillion-dollar debt increase.

And what for? Massive, expensive tax cuts to the wealthiest few.

equitablegrowth.org/medicaid-and...

equitablegrowth.org/medicaid-and...

Including the particularly egregious but little publicized expansion of qualified small business stock exclusion

Both QSBS & bill overall are:

- Not pro-growth!

- Regressive!

- Expensive!

www.concordcoalition.org/facing-the-f...

Including the particularly egregious but little publicized expansion of qualified small business stock exclusion

Both QSBS & bill overall are:

- Not pro-growth!

- Regressive!

- Expensive!

www.concordcoalition.org/facing-the-f...

Pro (equitable!) growth tax policies abound, including taxing ultra-rich, but #OBBBA moves in wrong direction @equitablegrowth.bsky.social @msnbc.com www.msnbc.com/opinion/msnb...

Pro (equitable!) growth tax policies abound, including taxing ultra-rich, but #OBBBA moves in wrong direction @equitablegrowth.bsky.social @msnbc.com www.msnbc.com/opinion/msnb...