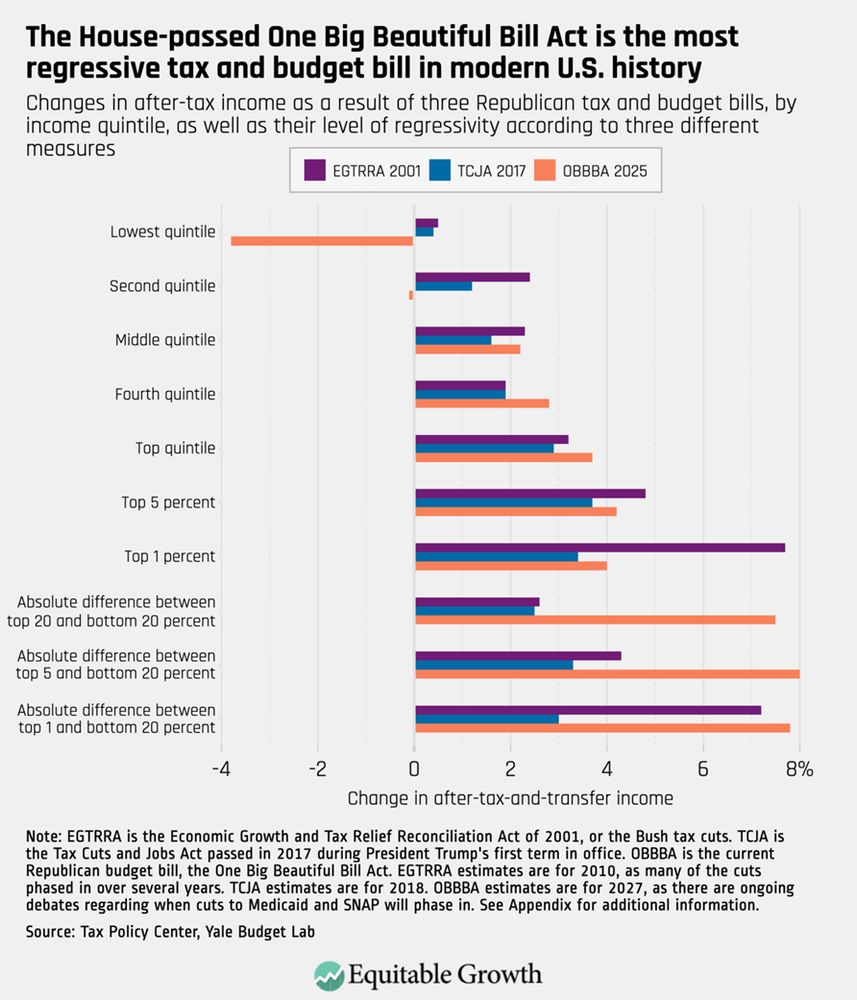

The Tax Cuts & Jobs Act of 2017 already led to a big cut for the top. But this year's One Big Beautiful Bill Act not only extended TCJA but further lowered estate tax & provided additional breaks to high-income businesses & investors.

END/

The Tax Cuts & Jobs Act of 2017 already led to a big cut for the top. But this year's One Big Beautiful Bill Act not only extended TCJA but further lowered estate tax & provided additional breaks to high-income businesses & investors.

END/

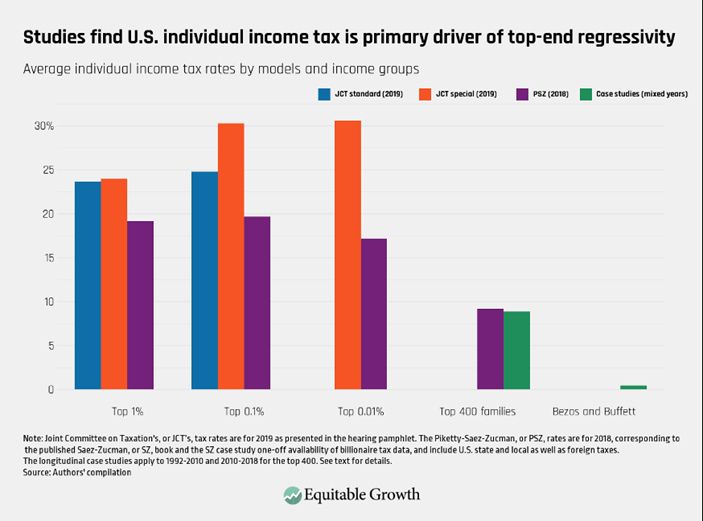

Either way, the researchers find the corporate tax is critical for fairly taxing the richest Americans. Their total tax rate would be ≈15% without it.

Either way, the researchers find the corporate tax is critical for fairly taxing the richest Americans. Their total tax rate would be ≈15% without it.

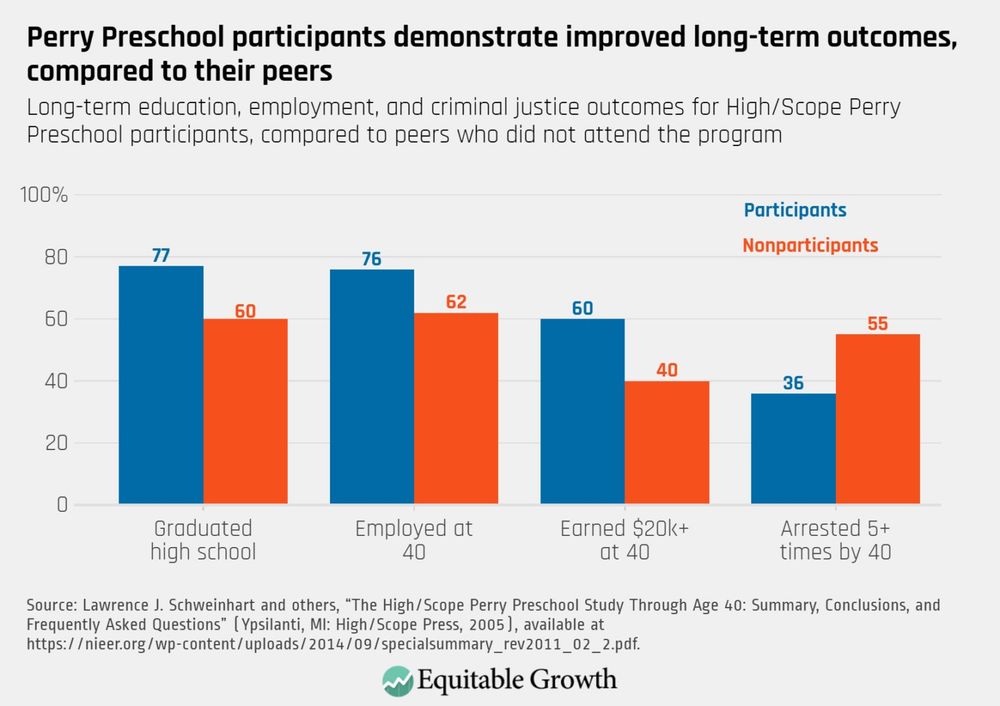

Instead of making the investments we know we need in paid leave, child care, and pre-K, the law tweaks a few employer tax credits and modestly and selectively increases the child tax credit, a woefully inadequate response to the care crisis.

Instead of making the investments we know we need in paid leave, child care, and pre-K, the law tweaks a few employer tax credits and modestly and selectively increases the child tax credit, a woefully inadequate response to the care crisis.

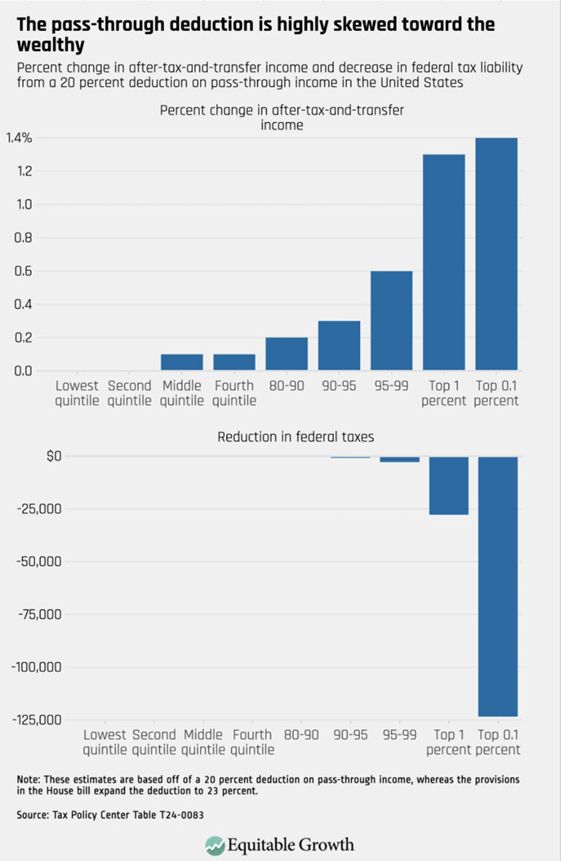

The law doesnt just extend TCJA & doesnt just affect marginal rates. It gifts bunch of other handouts to the rich, including

Increase in estate tax exemption

Enhanced qualified small business stock exclusion

Extension of pass-through deduction

The law doesnt just extend TCJA & doesnt just affect marginal rates. It gifts bunch of other handouts to the rich, including

Increase in estate tax exemption

Enhanced qualified small business stock exclusion

Extension of pass-through deduction

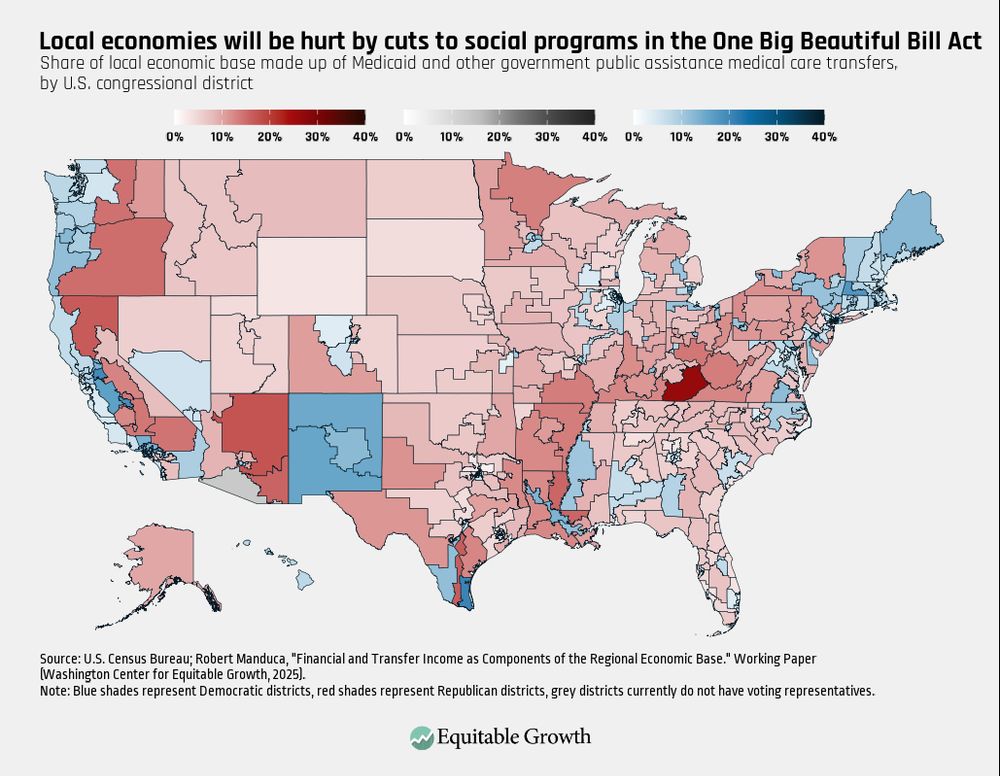

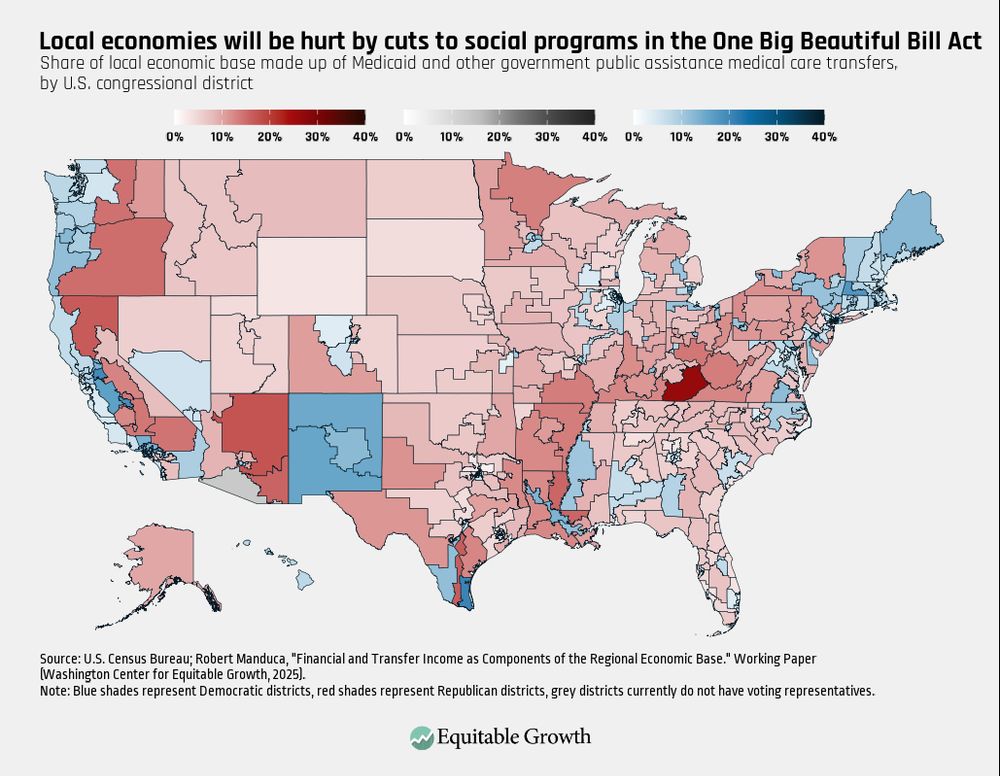

The law uses these savings from Medicaid & SNAP for large tax cuts for the rich, making it the most regressive tax & budget bill in modern history.

The average household in top 0.1%, which makes >$2 million/year, gets a $300K+ cut in 2027.

The law uses these savings from Medicaid & SNAP for large tax cuts for the rich, making it the most regressive tax & budget bill in modern history.

The average household in top 0.1%, which makes >$2 million/year, gets a $300K+ cut in 2027.

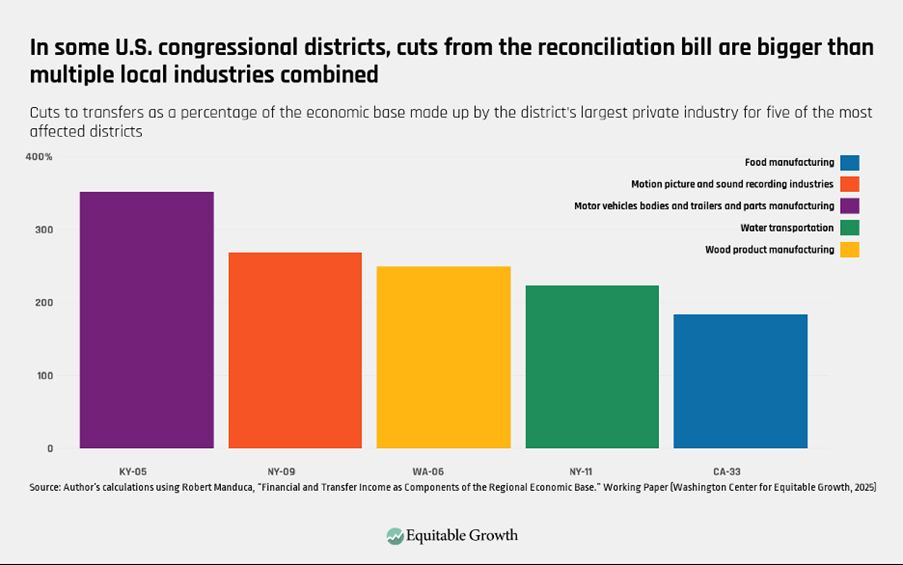

22 million families will lose some or all of their SNAP benefits as a result of the cuts, which will also have negative downstream consequences on local economies across the US.

22 million families will lose some or all of their SNAP benefits as a result of the cuts, which will also have negative downstream consequences on local economies across the US.

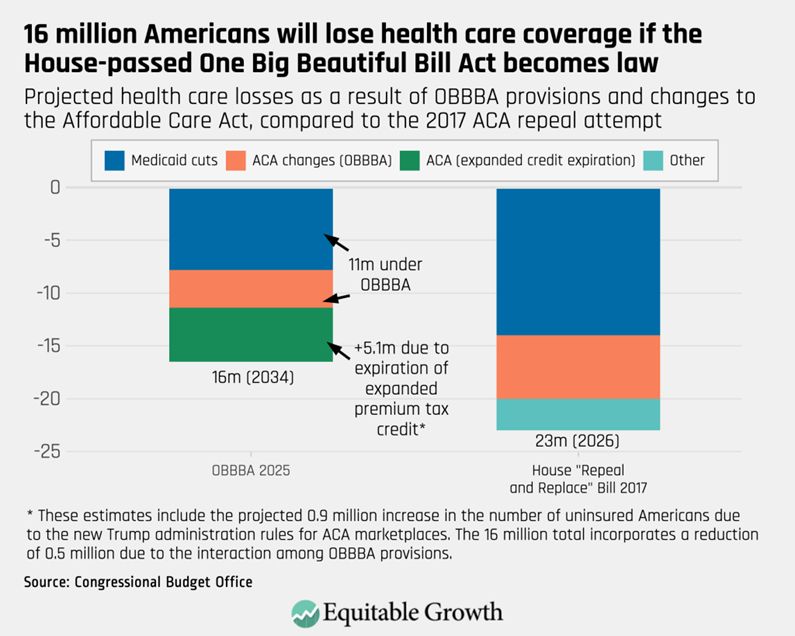

It's not just Medicaid that gets hit, but also enhanced premium tax credits that millions of Americans use to gain access to affordable insurance through the state marketplaces.

It's not just Medicaid that gets hit, but also enhanced premium tax credits that millions of Americans use to gain access to affordable insurance through the state marketplaces.

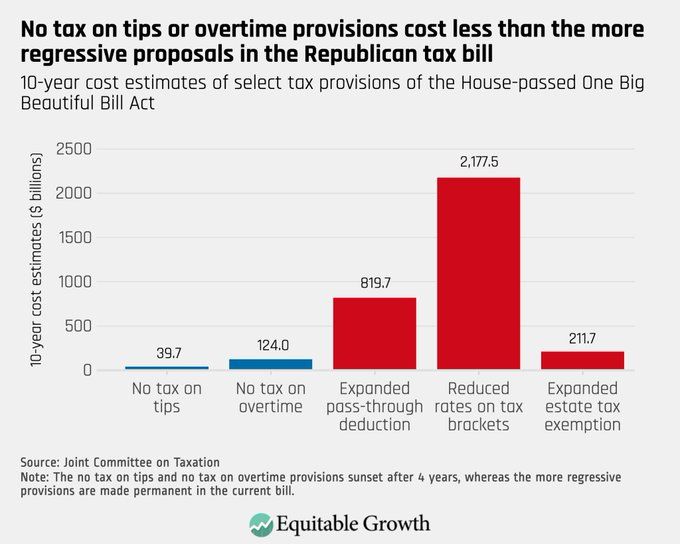

Though "no tax on tips/overtime" got a lot of attention, they are tiny compared to the rest of the law.

Plus, they're overly complicated, hard to enforce, will benefit few U.S. workers, and will expire after 2028...

Though "no tax on tips/overtime" got a lot of attention, they are tiny compared to the rest of the law.

Plus, they're overly complicated, hard to enforce, will benefit few U.S. workers, and will expire after 2028...

97% of food manufacturing in New Jersey's 7th district (Kean)

85% of farming in NE-2 (Bacon)

69% of hospitality (largest private industry in district!) in CO-3 (Hurd)

...

97% of food manufacturing in New Jersey's 7th district (Kean)

85% of farming in NE-2 (Bacon)

69% of hospitality (largest private industry in district!) in CO-3 (Hurd)

...

All machinery manufacturing in Pennsylvania

If 80% of military bases in Missouri closed

In total: Loss of $120 billion in local income & 1.6 million local jobs

Check out the full list @equitablegrowth.bsky.social: equitablegrowth.org/medicaid-and...

All machinery manufacturing in Pennsylvania

If 80% of military bases in Missouri closed

In total: Loss of $120 billion in local income & 1.6 million local jobs

Check out the full list @equitablegrowth.bsky.social: equitablegrowth.org/medicaid-and...

Once Americans learn about the unprecedented regressivity in the reconciliation bill, they oppose 78-11.

Even Republicans oppose 61-23 (after initially supporting before learning the distributional effect of the tax & spending cuts).

Once Americans learn about the unprecedented regressivity in the reconciliation bill, they oppose 78-11.

Even Republicans oppose 61-23 (after initially supporting before learning the distributional effect of the tax & spending cuts).

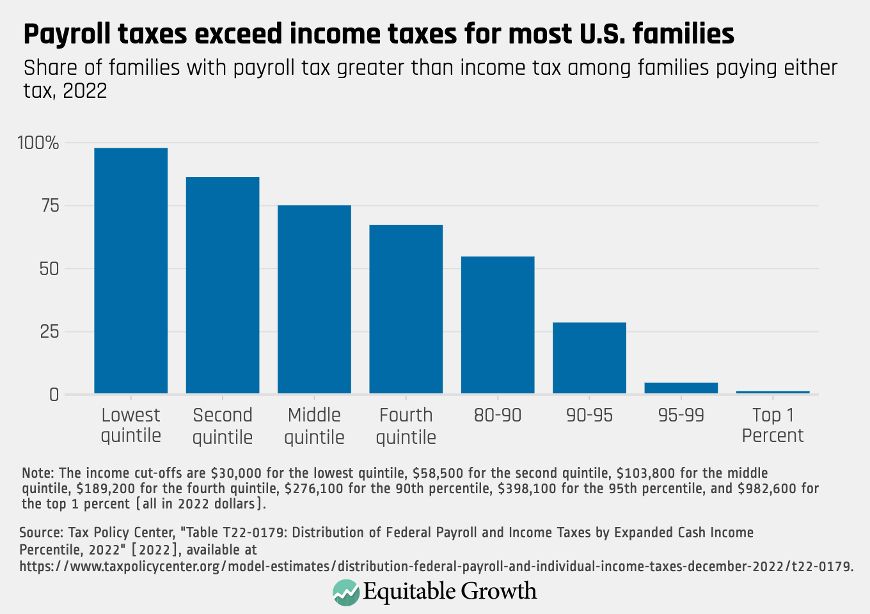

All of these rates are considerably lower than what many non-rich, wage-earning Americans pay, especially given regressive federal payroll taxes. 5/

All of these rates are considerably lower than what many non-rich, wage-earning Americans pay, especially given regressive federal payroll taxes. 5/

Especially when you (correctly!) count unrealized capital gains (appreciated assets that are big part of fortunes at the top) as income. 4/

Especially when you (correctly!) count unrealized capital gains (appreciated assets that are big part of fortunes at the top) as income. 4/

This includes ALL tax: state, federal, & foreign…as well as their share of their companies’ corporate tax.

(h/t Emmanuel Saez & @gabrielzucman.bsky.social) 3/

This includes ALL tax: state, federal, & foreign…as well as their share of their companies’ corporate tax.

(h/t Emmanuel Saez & @gabrielzucman.bsky.social) 3/

So this one wasteful provision will send ≈$400 billion/10yrs to millionaires & billionaires.

While at the same time the bill cuts SNAP by 27% to "save" $300b, kicking millions off food stamps so that Mike Bloomberg & friends get a bigger tax cut.

So this one wasteful provision will send ≈$400 billion/10yrs to millionaires & billionaires.

While at the same time the bill cuts SNAP by 27% to "save" $300b, kicking millions off food stamps so that Mike Bloomberg & friends get a bigger tax cut.

By sunsetting various provisions (among other budget gimmicks), this bill sets up ANOTHER fiscal cliff in 4 years. 8/ www.crfb.org/blogs/reconc...

By sunsetting various provisions (among other budget gimmicks), this bill sets up ANOTHER fiscal cliff in 4 years. 8/ www.crfb.org/blogs/reconc...

Dynamic distributional analysis shows that low- & middle-income, especially kids & seniors, are hurt the most (red = bill makes you worse off) 4/ budgetmodel.wharton.upenn.edu/issues/2025/...

Dynamic distributional analysis shows that low- & middle-income, especially kids & seniors, are hurt the most (red = bill makes you worse off) 4/ budgetmodel.wharton.upenn.edu/issues/2025/...

82% of bill's net benefits go to top 20% (income >$128K)

Top 0.1% (income >$3.4 million) will get $285K! 3/

budgetlab.yale.edu/research/dis...

82% of bill's net benefits go to top 20% (income >$128K)

Top 0.1% (income >$3.4 million) will get $285K! 3/

budgetlab.yale.edu/research/dis...

Michael Bloomberg, the Uihleins, Diane Hendricks, and their ilk are surely popping bottles in celebration...

Michael Bloomberg, the Uihleins, Diane Hendricks, and their ilk are surely popping bottles in celebration...

-Renewing failed opportunity zone program, giving wealthy another chance to shelter capital gains in already-gentrifying areas

-Leaving intact carried interest, qualified small business stock exclusion, & other loopholes

-Renewing failed opportunity zone program, giving wealthy another chance to shelter capital gains in already-gentrifying areas

-Leaving intact carried interest, qualified small business stock exclusion, & other loopholes

I guess because wealthy inequality and oligarchy are not already big enough problems in the U.S. And hard-working heirs of the rich and famous deserve tax-free trust funds.

equitablegrowth.org/research-pap...

I guess because wealthy inequality and oligarchy are not already big enough problems in the U.S. And hard-working heirs of the rich and famous deserve tax-free trust funds.

equitablegrowth.org/research-pap...

1) Permanently increasing 199A for passthrough business owners, a $800 billion gift to the likes of Michael Bloomberg equitablegrowth.org/2017-tax-cut...

1) Permanently increasing 199A for passthrough business owners, a $800 billion gift to the likes of Michael Bloomberg equitablegrowth.org/2017-tax-cut...

No, another tax cut that gives much bigger benefits to the rich than to everyone else doubles down on the trickle down economics that got us here and exacerbates inequality. 5/

No, another tax cut that gives much bigger benefits to the rich than to everyone else doubles down on the trickle down economics that got us here and exacerbates inequality. 5/