David S. Mitchell

@dsmitch28.bsky.social

tax & regulatory policy @equitablegrowth. proud alum of @AspenFSP @SenSherrodBrown @GeorgetownLaw @PrincetonSPIA @TuftsUniversity. Opinions my own.

America First!

September 24, 2025 at 6:22 PM

America First!

Reason #3: These rich folks just got another tax cut!

The Tax Cuts & Jobs Act of 2017 already led to a big cut for the top. But this year's One Big Beautiful Bill Act not only extended TCJA but further lowered estate tax & provided additional breaks to high-income businesses & investors.

END/

The Tax Cuts & Jobs Act of 2017 already led to a big cut for the top. But this year's One Big Beautiful Bill Act not only extended TCJA but further lowered estate tax & provided additional breaks to high-income businesses & investors.

END/

August 25, 2025 at 3:37 PM

Reason #3: These rich folks just got another tax cut!

The Tax Cuts & Jobs Act of 2017 already led to a big cut for the top. But this year's One Big Beautiful Bill Act not only extended TCJA but further lowered estate tax & provided additional breaks to high-income businesses & investors.

END/

The Tax Cuts & Jobs Act of 2017 already led to a big cut for the top. But this year's One Big Beautiful Bill Act not only extended TCJA but further lowered estate tax & provided additional breaks to high-income businesses & investors.

END/

Reason #2: The researchers attribute the ENTIRE corporate tax to shareholders. Most analysts assume some of the tax gets paid by workers.

Either way, the researchers find the corporate tax is critical for fairly taxing the richest Americans. Their total tax rate would be ≈15% without it.

Either way, the researchers find the corporate tax is critical for fairly taxing the richest Americans. Their total tax rate would be ≈15% without it.

August 25, 2025 at 3:37 PM

Reason #2: The researchers attribute the ENTIRE corporate tax to shareholders. Most analysts assume some of the tax gets paid by workers.

Either way, the researchers find the corporate tax is critical for fairly taxing the richest Americans. Their total tax rate would be ≈15% without it.

Either way, the researchers find the corporate tax is critical for fairly taxing the richest Americans. Their total tax rate would be ≈15% without it.

This is actually a conservative estimate, for a few reasons:

Reason #1: That’s 23.8% of what the researchers call “economic income," a fairly comprehensive measure but still not capturing all unrealized capital gains. When those are included in denominator, the tax rate for the top drops to 21.2%.

Reason #1: That’s 23.8% of what the researchers call “economic income," a fairly comprehensive measure but still not capturing all unrealized capital gains. When those are included in denominator, the tax rate for the top drops to 21.2%.

August 25, 2025 at 3:37 PM

This is actually a conservative estimate, for a few reasons:

Reason #1: That’s 23.8% of what the researchers call “economic income," a fairly comprehensive measure but still not capturing all unrealized capital gains. When those are included in denominator, the tax rate for the top drops to 21.2%.

Reason #1: That’s 23.8% of what the researchers call “economic income," a fairly comprehensive measure but still not capturing all unrealized capital gains. When those are included in denominator, the tax rate for the top drops to 21.2%.

Congress had opportunity to write simpler & more equitable tax code that raised additional revenue while encouraging economic competition & innovation that boosts productivity & growth. equitablegrowth.org/research-pap...

But this law moves in the opposite direction on every front. END

But this law moves in the opposite direction on every front. END

The promise of equitable and pro-growth tax reform

The next president and the incoming 119th Congress will have a rare opportunity in 2025 to enact true pro-growth tax reform.

equitablegrowth.org

July 15, 2025 at 5:06 PM

Congress had opportunity to write simpler & more equitable tax code that raised additional revenue while encouraging economic competition & innovation that boosts productivity & growth. equitablegrowth.org/research-pap...

But this law moves in the opposite direction on every front. END

But this law moves in the opposite direction on every front. END

10) Politically Targeted Pay-Fors

What do research universities, legal immigrants, blue-state homeowners & clean energy producers/investors/consumers have in common?

They're all seen as political enemies by those in power. So they get an economically destructive tax INCREASE.

What do research universities, legal immigrants, blue-state homeowners & clean energy producers/investors/consumers have in common?

They're all seen as political enemies by those in power. So they get an economically destructive tax INCREASE.

July 15, 2025 at 5:06 PM

10) Politically Targeted Pay-Fors

What do research universities, legal immigrants, blue-state homeowners & clean energy producers/investors/consumers have in common?

They're all seen as political enemies by those in power. So they get an economically destructive tax INCREASE.

What do research universities, legal immigrants, blue-state homeowners & clean energy producers/investors/consumers have in common?

They're all seen as political enemies by those in power. So they get an economically destructive tax INCREASE.

9) Encourages Outsourcing

Despite all of Trump’s rhetoric on tariffs and trade, his signature legislative initiative undermines domestic production by loosening tax penalties for profit shifting by multinational corporations. www.nytimes.com/2025/06/20/o...

Despite all of Trump’s rhetoric on tariffs and trade, his signature legislative initiative undermines domestic production by loosening tax penalties for profit shifting by multinational corporations. www.nytimes.com/2025/06/20/o...

Opinion | This Loophole Buried in Trump’s Bill Is Anything but Beautiful

www.nytimes.com

July 15, 2025 at 5:06 PM

9) Encourages Outsourcing

Despite all of Trump’s rhetoric on tariffs and trade, his signature legislative initiative undermines domestic production by loosening tax penalties for profit shifting by multinational corporations. www.nytimes.com/2025/06/20/o...

Despite all of Trump’s rhetoric on tariffs and trade, his signature legislative initiative undermines domestic production by loosening tax penalties for profit shifting by multinational corporations. www.nytimes.com/2025/06/20/o...

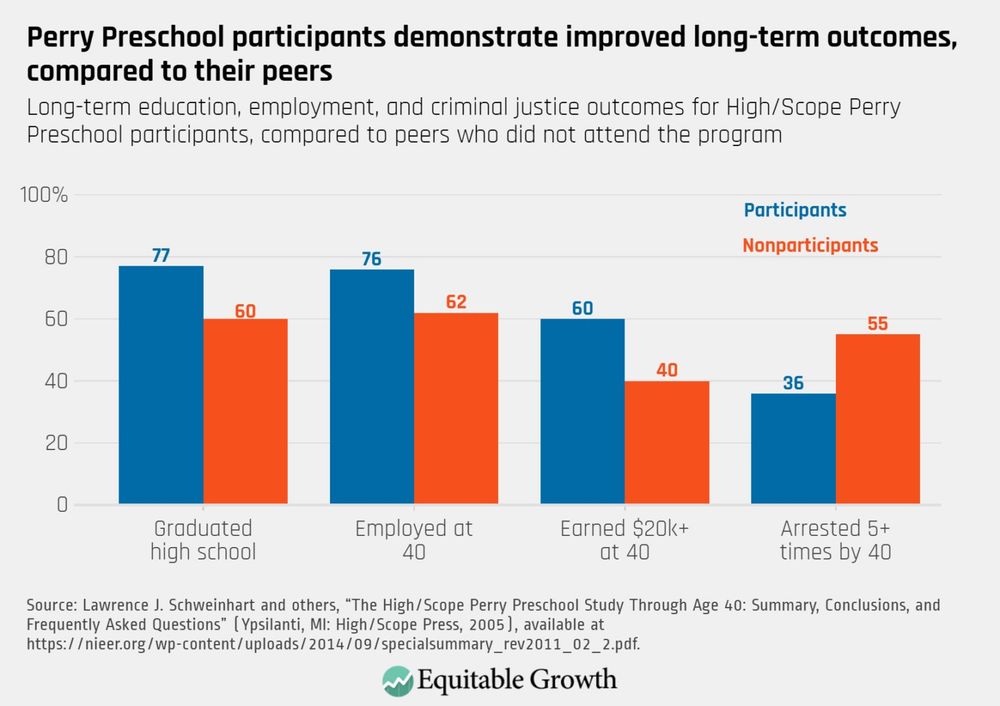

8) Missed Opportunity on Care

Instead of making the investments we know we need in paid leave, child care, and pre-K, the law tweaks a few employer tax credits and modestly and selectively increases the child tax credit, a woefully inadequate response to the care crisis.

Instead of making the investments we know we need in paid leave, child care, and pre-K, the law tweaks a few employer tax credits and modestly and selectively increases the child tax credit, a woefully inadequate response to the care crisis.

July 15, 2025 at 5:06 PM

8) Missed Opportunity on Care

Instead of making the investments we know we need in paid leave, child care, and pre-K, the law tweaks a few employer tax credits and modestly and selectively increases the child tax credit, a woefully inadequate response to the care crisis.

Instead of making the investments we know we need in paid leave, child care, and pre-K, the law tweaks a few employer tax credits and modestly and selectively increases the child tax credit, a woefully inadequate response to the care crisis.

7) Other Macroeconomic Consequences

The law increases interest rates, not just b/c of fiscal risk premium, but also b/c of price pressure from deficit-spending. Even if Trump (illegally) fires Powell, consumers pay higher prices 1 way (inflation) or another (expensive credit).

The law increases interest rates, not just b/c of fiscal risk premium, but also b/c of price pressure from deficit-spending. Even if Trump (illegally) fires Powell, consumers pay higher prices 1 way (inflation) or another (expensive credit).

July 15, 2025 at 5:06 PM

7) Other Macroeconomic Consequences

The law increases interest rates, not just b/c of fiscal risk premium, but also b/c of price pressure from deficit-spending. Even if Trump (illegally) fires Powell, consumers pay higher prices 1 way (inflation) or another (expensive credit).

The law increases interest rates, not just b/c of fiscal risk premium, but also b/c of price pressure from deficit-spending. Even if Trump (illegally) fires Powell, consumers pay higher prices 1 way (inflation) or another (expensive credit).

6) Budget Gimmicks

The most egregious is the use of the “current policy baseline” to fraudulently conceal $3.8 trillion in tax cut extensions. This unprecedented abuse of the budget reconciliation process erodes trust in US global leadership & heightens fiscal risk.

The most egregious is the use of the “current policy baseline” to fraudulently conceal $3.8 trillion in tax cut extensions. This unprecedented abuse of the budget reconciliation process erodes trust in US global leadership & heightens fiscal risk.

July 15, 2025 at 5:06 PM

6) Budget Gimmicks

The most egregious is the use of the “current policy baseline” to fraudulently conceal $3.8 trillion in tax cut extensions. This unprecedented abuse of the budget reconciliation process erodes trust in US global leadership & heightens fiscal risk.

The most egregious is the use of the “current policy baseline” to fraudulently conceal $3.8 trillion in tax cut extensions. This unprecedented abuse of the budget reconciliation process erodes trust in US global leadership & heightens fiscal risk.

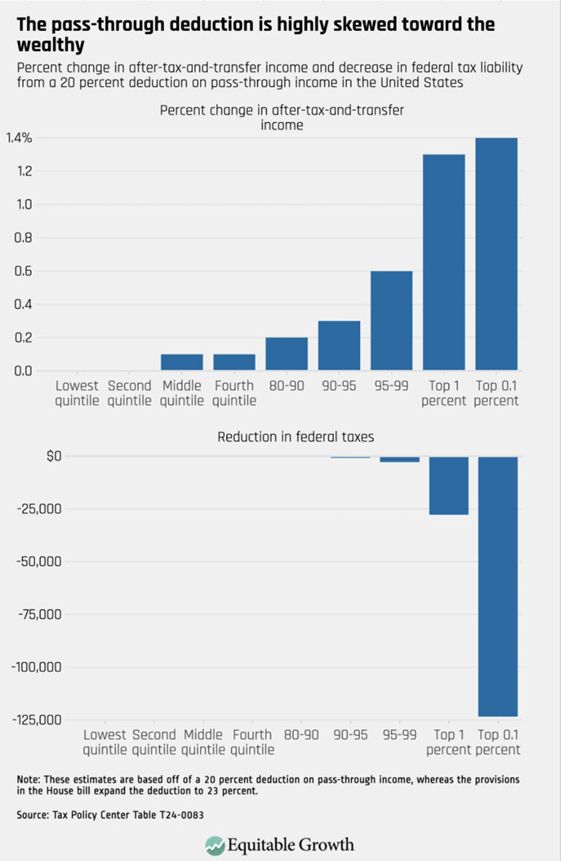

5) More Indefensible Tax Giveaways

The law doesnt just extend TCJA & doesnt just affect marginal rates. It gifts bunch of other handouts to the rich, including

Increase in estate tax exemption

Enhanced qualified small business stock exclusion

Extension of pass-through deduction

The law doesnt just extend TCJA & doesnt just affect marginal rates. It gifts bunch of other handouts to the rich, including

Increase in estate tax exemption

Enhanced qualified small business stock exclusion

Extension of pass-through deduction

July 15, 2025 at 5:06 PM

5) More Indefensible Tax Giveaways

The law doesnt just extend TCJA & doesnt just affect marginal rates. It gifts bunch of other handouts to the rich, including

Increase in estate tax exemption

Enhanced qualified small business stock exclusion

Extension of pass-through deduction

The law doesnt just extend TCJA & doesnt just affect marginal rates. It gifts bunch of other handouts to the rich, including

Increase in estate tax exemption

Enhanced qualified small business stock exclusion

Extension of pass-through deduction

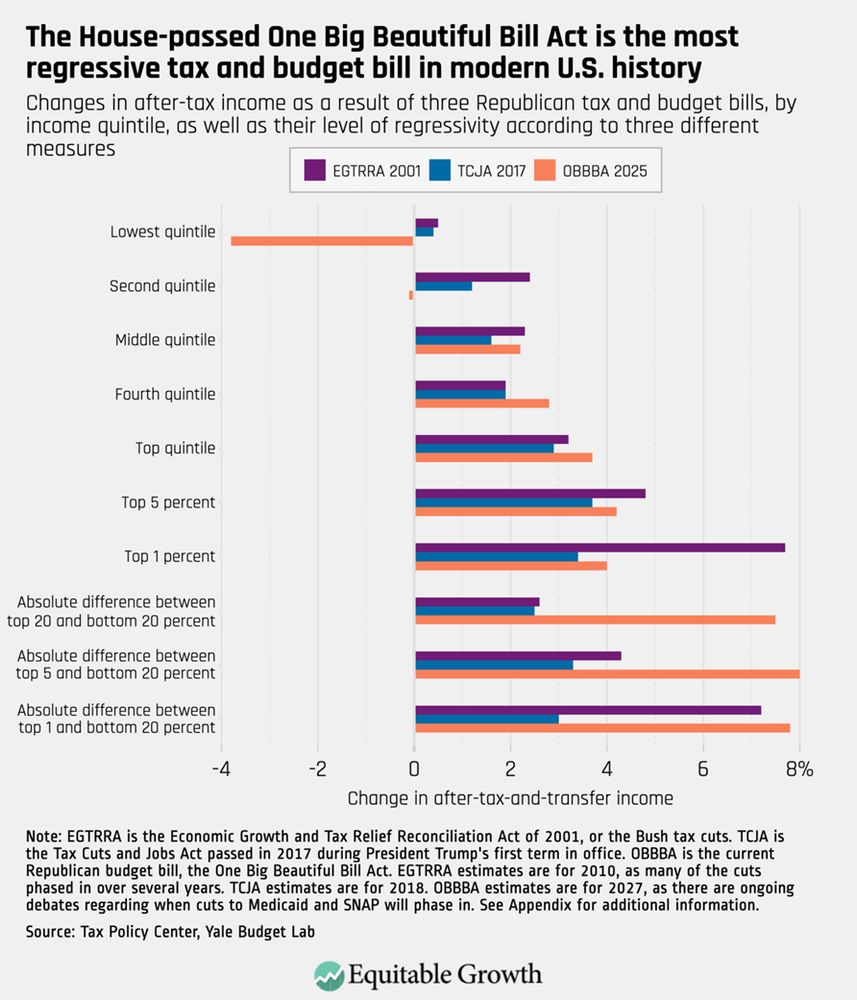

4) Large Tax Cuts for the Wealthy

The law uses these savings from Medicaid & SNAP for large tax cuts for the rich, making it the most regressive tax & budget bill in modern history.

The average household in top 0.1%, which makes >$2 million/year, gets a $300K+ cut in 2027.

The law uses these savings from Medicaid & SNAP for large tax cuts for the rich, making it the most regressive tax & budget bill in modern history.

The average household in top 0.1%, which makes >$2 million/year, gets a $300K+ cut in 2027.

July 15, 2025 at 5:06 PM

4) Large Tax Cuts for the Wealthy

The law uses these savings from Medicaid & SNAP for large tax cuts for the rich, making it the most regressive tax & budget bill in modern history.

The average household in top 0.1%, which makes >$2 million/year, gets a $300K+ cut in 2027.

The law uses these savings from Medicaid & SNAP for large tax cuts for the rich, making it the most regressive tax & budget bill in modern history.

The average household in top 0.1%, which makes >$2 million/year, gets a $300K+ cut in 2027.