Economist. Macro, inequality, public finance, international finance, asset pricing, labor.

https://www.jonathanheathcote.com

Reposted by Jonathan Heathcote

Reposted by Jonathan Heathcote

www.aeaweb.org/research/net...

Reposted by Jonathan Heathcote

We have 3️⃣ tenure-track positions:

•2 Open-Field

•1 linked to our Masters in Financial Economics (open to various fields)

Come work with us in 🇨🇦! Share with your students!

📄 Open-Field uwo.ca/facultyrelat...

📄 MFE Position uwo.ca/facultyrelat...

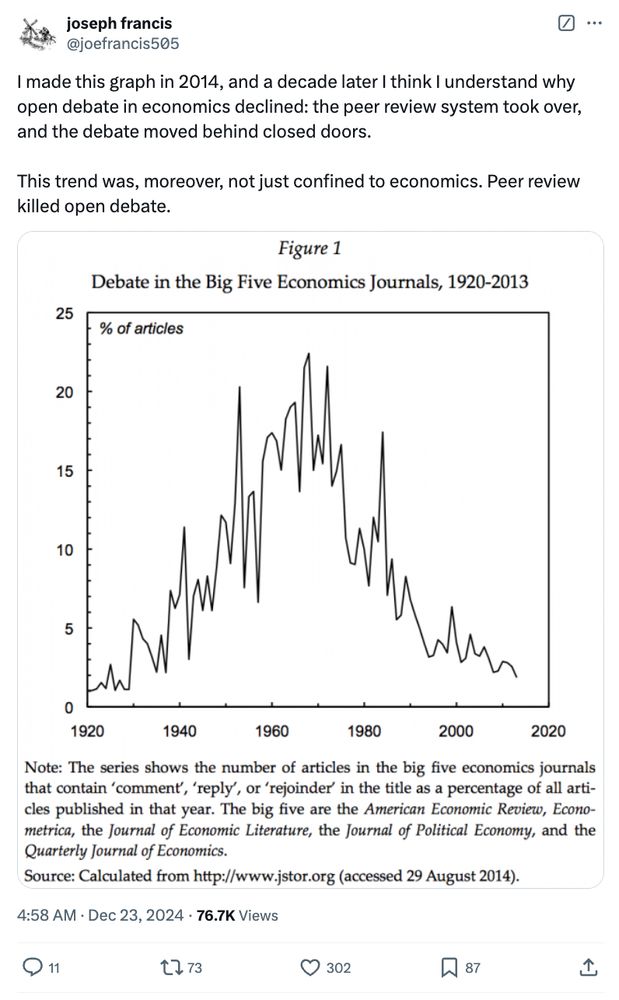

Reposted by Jonathan Heathcote, Tore Ellingsen

As a result, valuable debate happens in secret, and the resulting paper is an opaque compromise with anonymous co-authors called referees.

1/

Reposted by Jonathan Heathcote

Deadline is Dec 22.

irs.princeton.edu/news/2024/nl...

Reposted by Jonathan Heathcote, Randi Hjalmarsson

Reposted by Micaël Castanheira, Jonathan Heathcote, Pierre Boyer

cepr.org/events/cepr-...

Reposted by Mariacristina De Nardi

Reposted by Jonathan Heathcote

Reposted by Jonathan Heathcote

📍 Monash Prato Centre, Prato, Italy🇮🇹

📅 June 25-26, 2025

Submit your research thred.devecon.org/conferences/...

#EconSky #DevelopmentEconomics