Professor UC Irvine Economics; Editor-in-Chief ITAX; Research on tax, fiscal competition, local policy, RST/VAT, inequality & mobility

https://sites.socsci.uci.edu/~dagrawa4/

Reposted by David R. Agrawal

David Agrawal (UC Irvine) presents “Policy Competition in a Spatial Economy” (osus.info)

Hosted by @urbaneconomics.bsky.social

Paper: papers.ssrn.com/sol3/papers....

Get the zoom link for the talk here: us06web.zoom.us/webinar/regi...

Reposted by David R. Agrawal

"Policy Responses to Tax Competition" (w/ Poterba &

@omzidar.bsky.social)

I know everyone is looking forward to order it here:

amazon.com/-/es/Respons...

Thanks, @davidragrawal.bsky.social, Jim Poterba and @omzidar.bsky.social, for leading this project so successfully.

It was an honor and a pleasure to contribute a chapter on corporate tax competition among the Swiss cantons.

and all the authors who contributed @jeffreypclemens.bsky.social @stanveuger.bsky.social @s-stantcheva.bsky.social @mariusbrulhart.bsky.social @kurtschmidheiny.bsky.social & many others not on here!

Reposted by Marius Brülhart

"Policy Responses to Tax Competition" (w/ Poterba &

@omzidar.bsky.social)

I know everyone is looking forward to order it here:

amazon.com/-/es/Respons...

Reposted by David R. Agrawal

Reposted by Christian Traxler

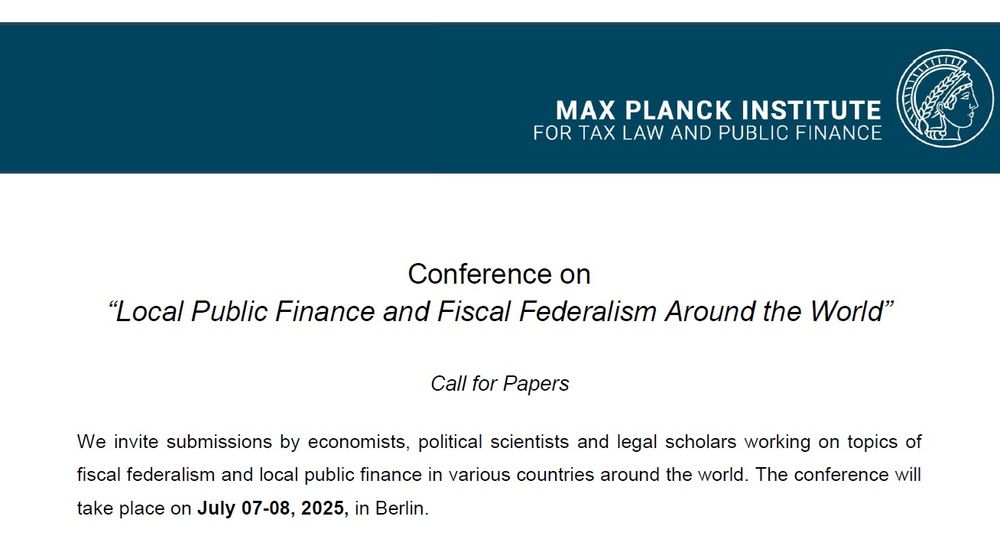

Working on local public finance or fiscal federalism?

Present your research in Berlin 🇩🇪

📅 July 7–8, 2025

📍 Harnack-Haus

🎙️ Keynote: @davidragrawal.bsky.social (UC Irvine)

✈️ Travel & stay covered

📩 Apply by April 15 → events.tax.mpg.de/event/10/

Please share this! ♻️

Reposted by David R. Agrawal, Christian Traxler

Working on local public finance or fiscal federalism?

Present your research in Berlin 🇩🇪

📅 July 7–8, 2025

📍 Harnack-Haus

🎙️ Keynote: @davidragrawal.bsky.social (UC Irvine)

✈️ Travel & stay covered

📩 Apply by April 15 → events.tax.mpg.de/event/10/

Please share this! ♻️

I'm excited to return to Berlin to give the keynote at this conference on local public finance issues around the world.

Travel funding available!

Submit your local PF papers here:

events.tax.mpg.de/event/10/

@ronbdavies.bsky.social) and Nadine Riedel stepped down as ITAX Editors-in-Chief. We want to thank them for all they did to solidify ITAX's position as one of the leading journals in the field of public economics!

And follow @itaxjournal.bsky.social which is new here!

Reposted by David R. Agrawal

Reposted by David R. Agrawal

@ronbdavies.bsky.social) and Nadine Riedel stepped down as ITAX Editors-in-Chief. We want to thank them for all they did to solidify ITAX's position as one of the leading journals in the field of public economics!

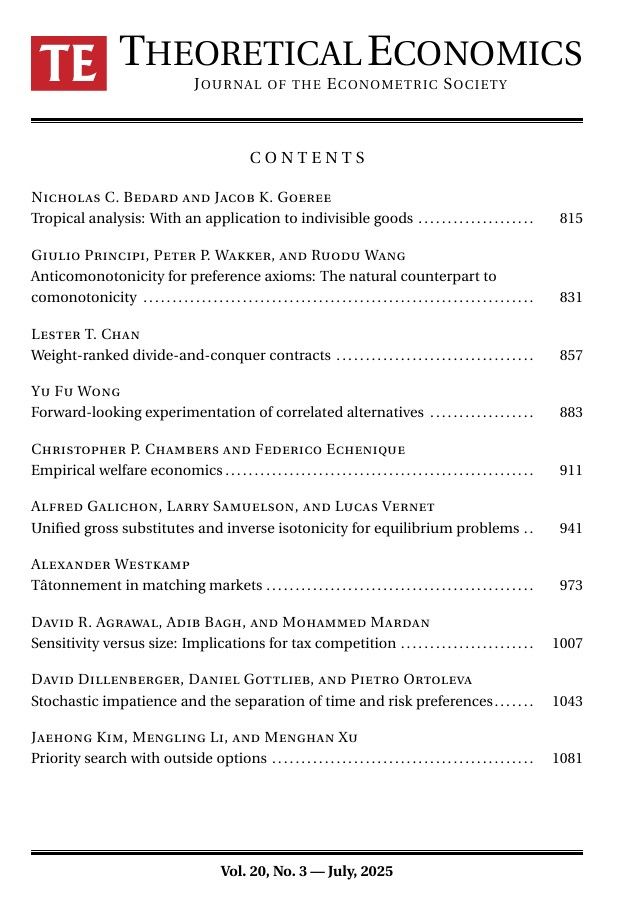

See my paper "Sensitivity versus size: Implications for tax competition" w/ Bagh and Mardan in

@econtheory.bsky.social

Thread:

econtheory.org/ojs/index.ph...

Highly recommend the process at

@econtheory.bsky.social

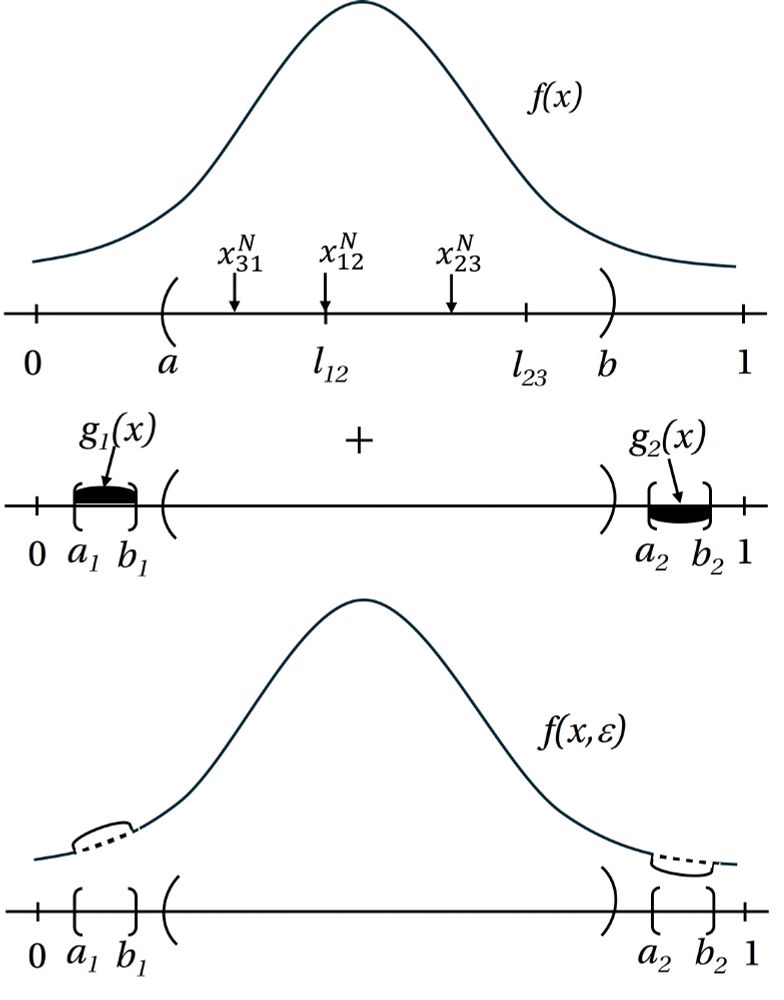

Finally, we discussion how our results might be applicable to spatial price competition with multiple firms, to spatial voting models, or to border effects in trade.

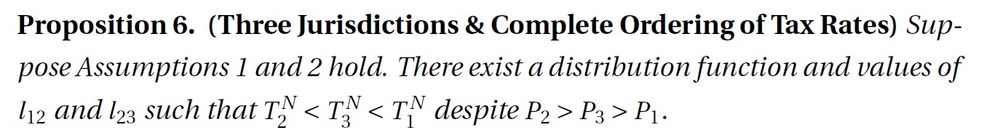

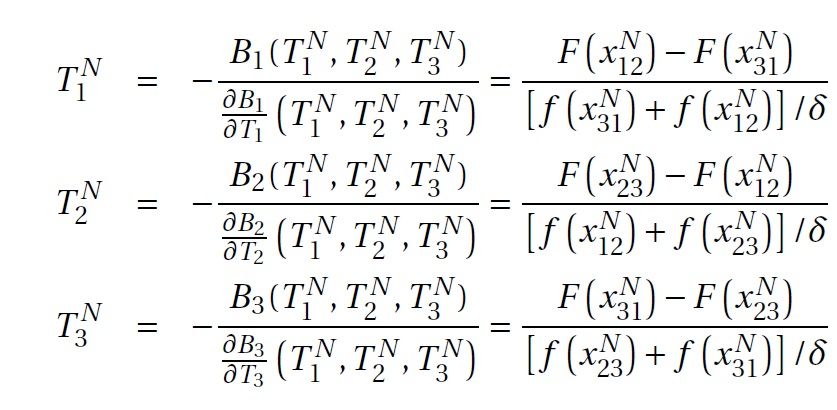

With three jurisdictions, the distribution of moving costs for firms plays the same role as population density.

Again bigger jurisdiction can set lower rates!

We generalize to three jurisdictions with a more general convex cost function for profit shifting.

The higher derivatives of the cost function play the same role as population density.

Wilson).

Thus, tax base sensitivities are no longer equal

Elasticities in Ramsey rule depend on size and on the average base change at 2 borders!

That is, a smaller jurisdiction can set a higher

tax rate than the next largest jurisdiction.

Thus, reduce this border a small amount such that

T1 < T2 > T3

But under the perturbed population distribution we have P1 > P2 > P3.

QED (many complex details in paper)

Although the initial equilibrium satisfied the assumptions for existence, the perturbed density may not.

But we prove the equilibrium of the original unperturbed game is also an equilibrium to a perturbed game! T1 = T2 > T3

Proof strategy:

Start from a Nash eq where population P1 = P2 > P3 and taxes are T1 = T2 > T3

Make a specific population perturbation that changes populations but leaves tax bases unchanged