David R. Agrawal

@davidragrawal.bsky.social

Professor UC Irvine Economics; Editor-in-Chief ITAX; Research on tax, fiscal competition, local policy, RST/VAT, inequality & mobility

https://sites.socsci.uci.edu/~dagrawa4/

https://sites.socsci.uci.edu/~dagrawa4/

Thanks to our editor at @uchicagopress.bsky.social

and all the authors who contributed @jeffreypclemens.bsky.social @stanveuger.bsky.social @s-stantcheva.bsky.social @mariusbrulhart.bsky.social @kurtschmidheiny.bsky.social & many others not on here!

and all the authors who contributed @jeffreypclemens.bsky.social @stanveuger.bsky.social @s-stantcheva.bsky.social @mariusbrulhart.bsky.social @kurtschmidheiny.bsky.social & many others not on here!

October 10, 2025 at 11:41 PM

Thanks to our editor at @uchicagopress.bsky.social

and all the authors who contributed @jeffreypclemens.bsky.social @stanveuger.bsky.social @s-stantcheva.bsky.social @mariusbrulhart.bsky.social @kurtschmidheiny.bsky.social & many others not on here!

and all the authors who contributed @jeffreypclemens.bsky.social @stanveuger.bsky.social @s-stantcheva.bsky.social @mariusbrulhart.bsky.social @kurtschmidheiny.bsky.social & many others not on here!

Elasticities are endogenous and government choices. Eg they can be influenced by sale or things like zoning. We wanted to add this to the model but will save for future work

January 31, 2025 at 6:59 AM

Elasticities are endogenous and government choices. Eg they can be influenced by sale or things like zoning. We wanted to add this to the model but will save for future work

An interesting question is where the optimal borders are in light of this heterogeneity

January 31, 2025 at 6:58 AM

An interesting question is where the optimal borders are in light of this heterogeneity

Thanks! Can you say more about the model application with SALT?

January 30, 2025 at 7:10 AM

Thanks! Can you say more about the model application with SALT?

Check out the paper here:

econtheory.org/ojs/index.ph...

econtheory.org/ojs/index.ph...

econtheory.org

January 28, 2025 at 11:31 PM

Check out the paper here:

econtheory.org/ojs/index.ph...

econtheory.org/ojs/index.ph...

We are grateful to @florianscheuer.bsky.social for his extensive comments as editor and for the three excellent referees he selected, especially Referee B whose reports were some of the most insightful I have ever seen.

Highly recommend the process at

@econtheory.bsky.social

Highly recommend the process at

@econtheory.bsky.social

January 28, 2025 at 11:31 PM

We are grateful to @florianscheuer.bsky.social for his extensive comments as editor and for the three excellent referees he selected, especially Referee B whose reports were some of the most insightful I have ever seen.

Highly recommend the process at

@econtheory.bsky.social

Highly recommend the process at

@econtheory.bsky.social

In ongoing work, we verify our theoretical commodity tax result empirically. That paper is coming soon!

Finally, we discussion how our results might be applicable to spatial price competition with multiple firms, to spatial voting models, or to border effects in trade.

Finally, we discussion how our results might be applicable to spatial price competition with multiple firms, to spatial voting models, or to border effects in trade.

January 28, 2025 at 11:31 PM

In ongoing work, we verify our theoretical commodity tax result empirically. That paper is coming soon!

Finally, we discussion how our results might be applicable to spatial price competition with multiple firms, to spatial voting models, or to border effects in trade.

Finally, we discussion how our results might be applicable to spatial price competition with multiple firms, to spatial voting models, or to border effects in trade.

Capital competition models with two jurisdictions place assumptions on moving costs.

With three jurisdictions, the distribution of moving costs for firms plays the same role as population density.

Again bigger jurisdiction can set lower rates!

With three jurisdictions, the distribution of moving costs for firms plays the same role as population density.

Again bigger jurisdiction can set lower rates!

January 28, 2025 at 11:31 PM

Capital competition models with two jurisdictions place assumptions on moving costs.

With three jurisdictions, the distribution of moving costs for firms plays the same role as population density.

Again bigger jurisdiction can set lower rates!

With three jurisdictions, the distribution of moving costs for firms plays the same role as population density.

Again bigger jurisdiction can set lower rates!

Profit shifting models often have 2 jurisdictions and quadratic costs.

We generalize to three jurisdictions with a more general convex cost function for profit shifting.

The higher derivatives of the cost function play the same role as population density.

We generalize to three jurisdictions with a more general convex cost function for profit shifting.

The higher derivatives of the cost function play the same role as population density.

January 28, 2025 at 11:31 PM

Profit shifting models often have 2 jurisdictions and quadratic costs.

We generalize to three jurisdictions with a more general convex cost function for profit shifting.

The higher derivatives of the cost function play the same role as population density.

We generalize to three jurisdictions with a more general convex cost function for profit shifting.

The higher derivatives of the cost function play the same role as population density.

Finally, we show the result generalizes beyond spatial commodity tax competition to models of profit taxation (Keen and Konrad ) or capital taxation (Mongrain and

Wilson).

Wilson).

January 28, 2025 at 11:31 PM

Finally, we show the result generalizes beyond spatial commodity tax competition to models of profit taxation (Keen and Konrad ) or capital taxation (Mongrain and

Wilson).

Wilson).

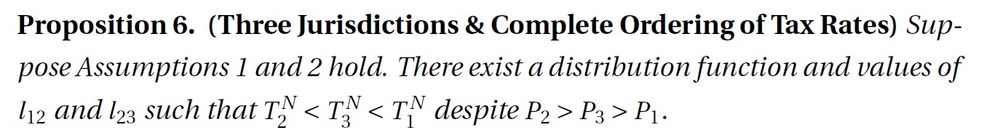

And we go even further to show there exist a distribution function and jurisdiction boundaries such that the complete ordering of tax rates reverses from the rankings of populations.

January 28, 2025 at 11:31 PM

And we go even further to show there exist a distribution function and jurisdiction boundaries such that the complete ordering of tax rates reverses from the rankings of populations.

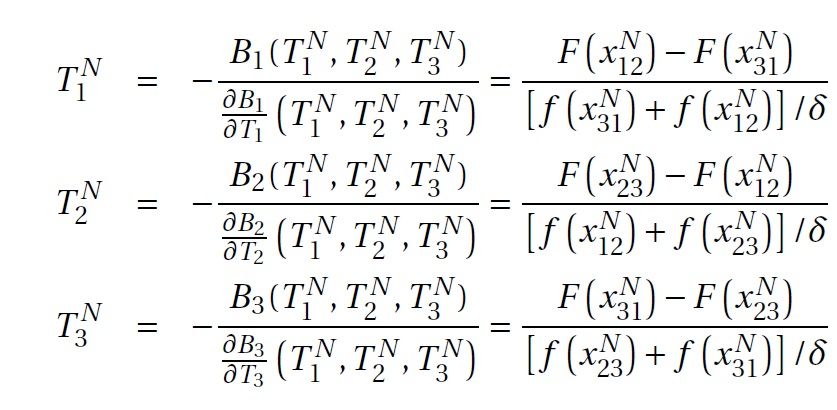

In other words, the denominators of the optimal tax rates are now different!

January 28, 2025 at 11:31 PM

In other words, the denominators of the optimal tax rates are now different!

Classic result can be overturned b/c with 3 jurisdictions, a jurisdiction can attract cross-border shoppers from 2—instead of 1 jurisdiction

Thus, tax base sensitivities are no longer equal

Elasticities in Ramsey rule depend on size and on the average base change at 2 borders!

Thus, tax base sensitivities are no longer equal

Elasticities in Ramsey rule depend on size and on the average base change at 2 borders!

January 28, 2025 at 11:31 PM

Classic result can be overturned b/c with 3 jurisdictions, a jurisdiction can attract cross-border shoppers from 2—instead of 1 jurisdiction

Thus, tax base sensitivities are no longer equal

Elasticities in Ramsey rule depend on size and on the average base change at 2 borders!

Thus, tax base sensitivities are no longer equal

Elasticities in Ramsey rule depend on size and on the average base change at 2 borders!

We conclude that we can find a population jurisdiction with three jurisdictions such that P1 > P2 and T1 < T2.

That is, a smaller jurisdiction can set a higher

tax rate than the next largest jurisdiction.

That is, a smaller jurisdiction can set a higher

tax rate than the next largest jurisdiction.

January 28, 2025 at 11:31 PM

We conclude that we can find a population jurisdiction with three jurisdictions such that P1 > P2 and T1 < T2.

That is, a smaller jurisdiction can set a higher

tax rate than the next largest jurisdiction.

That is, a smaller jurisdiction can set a higher

tax rate than the next largest jurisdiction.