David R. Agrawal

@davidragrawal.bsky.social

Professor UC Irvine Economics; Editor-in-Chief ITAX; Research on tax, fiscal competition, local policy, RST/VAT, inequality & mobility

https://sites.socsci.uci.edu/~dagrawa4/

https://sites.socsci.uci.edu/~dagrawa4/

Excited to receive our new 536 page book on tax competition and coordination in the mail today:

"Policy Responses to Tax Competition" (w/ Poterba &

@omzidar.bsky.social)

I know everyone is looking forward to order it here:

amazon.com/-/es/Respons...

"Policy Responses to Tax Competition" (w/ Poterba &

@omzidar.bsky.social)

I know everyone is looking forward to order it here:

amazon.com/-/es/Respons...

October 10, 2025 at 11:41 PM

Excited to receive our new 536 page book on tax competition and coordination in the mail today:

"Policy Responses to Tax Competition" (w/ Poterba &

@omzidar.bsky.social)

I know everyone is looking forward to order it here:

amazon.com/-/es/Respons...

"Policy Responses to Tax Competition" (w/ Poterba &

@omzidar.bsky.social)

I know everyone is looking forward to order it here:

amazon.com/-/es/Respons...

Local public economics and federalism are important!

I'm excited to return to Berlin to give the keynote at this conference on local public finance issues around the world.

Travel funding available!

Submit your local PF papers here:

events.tax.mpg.de/event/10/

I'm excited to return to Berlin to give the keynote at this conference on local public finance issues around the world.

Travel funding available!

Submit your local PF papers here:

events.tax.mpg.de/event/10/

March 25, 2025 at 5:58 PM

Local public economics and federalism are important!

I'm excited to return to Berlin to give the keynote at this conference on local public finance issues around the world.

Travel funding available!

Submit your local PF papers here:

events.tax.mpg.de/event/10/

I'm excited to return to Berlin to give the keynote at this conference on local public finance issues around the world.

Travel funding available!

Submit your local PF papers here:

events.tax.mpg.de/event/10/

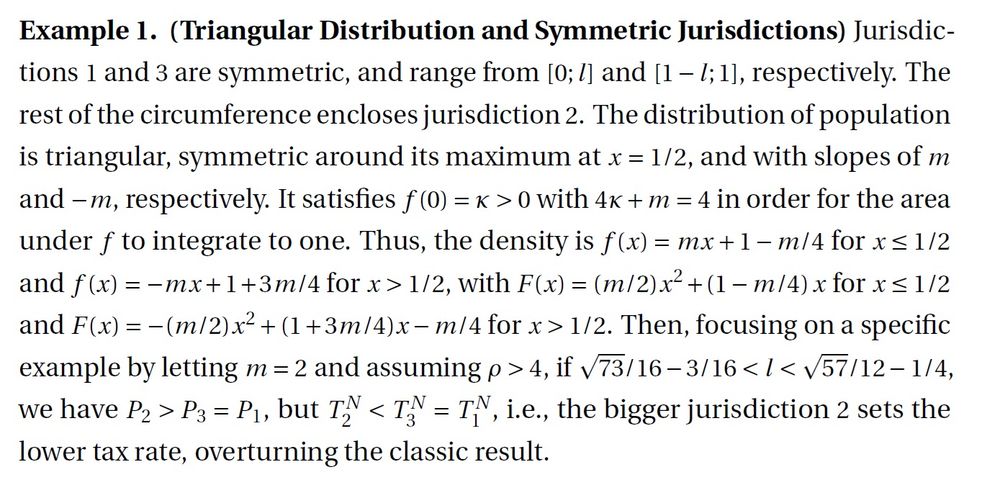

And we go even further to show there exist a distribution function and jurisdiction boundaries such that the complete ordering of tax rates reverses from the rankings of populations.

January 28, 2025 at 11:31 PM

And we go even further to show there exist a distribution function and jurisdiction boundaries such that the complete ordering of tax rates reverses from the rankings of populations.

In other words, the denominators of the optimal tax rates are now different!

January 28, 2025 at 11:31 PM

In other words, the denominators of the optimal tax rates are now different!

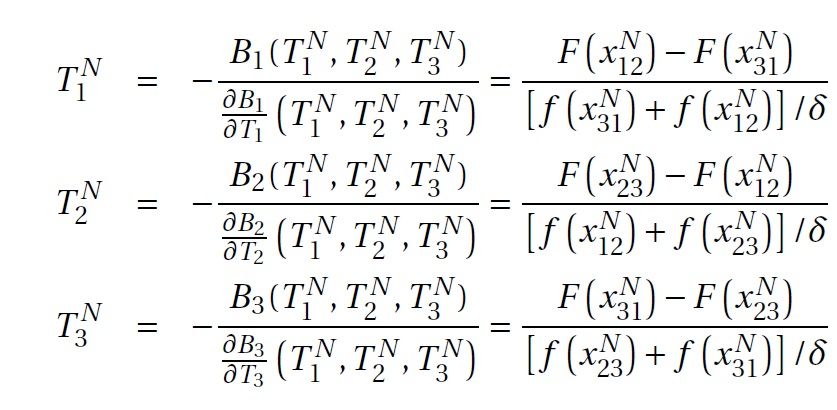

Finally, we generalize this result for an arbitrary f(x) and asymmetric jurisdictions.

Proof strategy:

Start from a Nash eq where population P1 = P2 > P3 and taxes are T1 = T2 > T3

Make a specific population perturbation that changes populations but leaves tax bases unchanged

Proof strategy:

Start from a Nash eq where population P1 = P2 > P3 and taxes are T1 = T2 > T3

Make a specific population perturbation that changes populations but leaves tax bases unchanged

January 28, 2025 at 11:31 PM

Finally, we generalize this result for an arbitrary f(x) and asymmetric jurisdictions.

Proof strategy:

Start from a Nash eq where population P1 = P2 > P3 and taxes are T1 = T2 > T3

Make a specific population perturbation that changes populations but leaves tax bases unchanged

Proof strategy:

Start from a Nash eq where population P1 = P2 > P3 and taxes are T1 = T2 > T3

Make a specific population perturbation that changes populations but leaves tax bases unchanged

We first prove smaller places set higher rates using a simple example:

Population distribution is triangular.

2 jurisdictions are symmetric and have a common border at the lowest density point.

Then for a certain range of their lengths, we get

little t > big T despite p < P

Population distribution is triangular.

2 jurisdictions are symmetric and have a common border at the lowest density point.

Then for a certain range of their lengths, we get

little t > big T despite p < P

January 28, 2025 at 11:31 PM

We first prove smaller places set higher rates using a simple example:

Population distribution is triangular.

2 jurisdictions are symmetric and have a common border at the lowest density point.

Then for a certain range of their lengths, we get

little t > big T despite p < P

Population distribution is triangular.

2 jurisdictions are symmetric and have a common border at the lowest density point.

Then for a certain range of their lengths, we get

little t > big T despite p < P

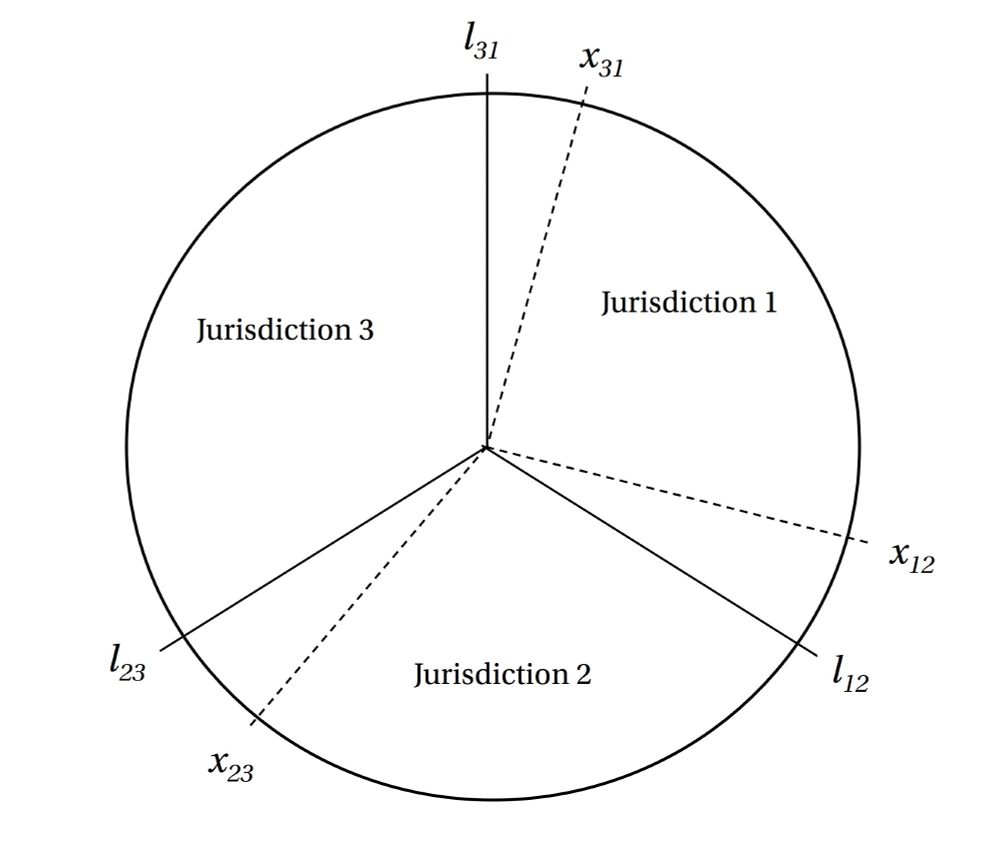

To do this, simply add a third jurisdiction with a general f(x).

January 28, 2025 at 11:31 PM

To do this, simply add a third jurisdiction with a general f(x).

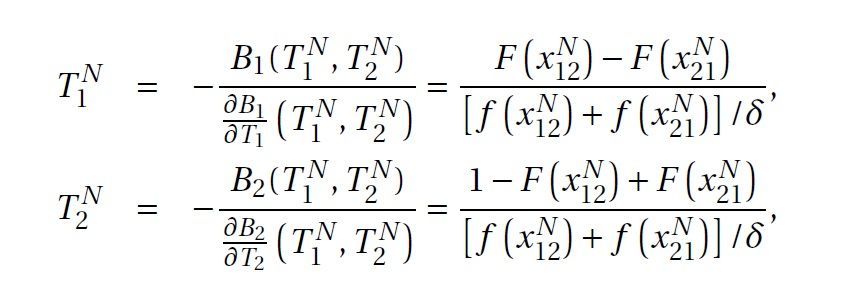

In other words, Nash taxes depend on

-tax bases: numerators in these equations that differ

-tax base sensitivities: denominators in these equations, which are the same for both jurisdictions.

On the margin, they compete for the same people!

-tax bases: numerators in these equations that differ

-tax base sensitivities: denominators in these equations, which are the same for both jurisdictions.

On the margin, they compete for the same people!

January 28, 2025 at 11:31 PM

In other words, Nash taxes depend on

-tax bases: numerators in these equations that differ

-tax base sensitivities: denominators in these equations, which are the same for both jurisdictions.

On the margin, they compete for the same people!

-tax bases: numerators in these equations that differ

-tax base sensitivities: denominators in these equations, which are the same for both jurisdictions.

On the margin, they compete for the same people!

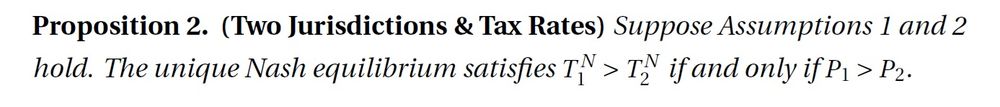

We keep everything the same

except population is not uniform, but distributed according to f(x) that is continuous and differentiable

Then, we can show the big jurisdiction's tax rate is always greater than the little's regardless of f(x).

except population is not uniform, but distributed according to f(x) that is continuous and differentiable

Then, we can show the big jurisdiction's tax rate is always greater than the little's regardless of f(x).

January 28, 2025 at 11:31 PM

We keep everything the same

except population is not uniform, but distributed according to f(x) that is continuous and differentiable

Then, we can show the big jurisdiction's tax rate is always greater than the little's regardless of f(x).

except population is not uniform, but distributed according to f(x) that is continuous and differentiable

Then, we can show the big jurisdiction's tax rate is always greater than the little's regardless of f(x).

Primer on the K-K model:

2 countries

one big / one small

uniform population within countries

set commodity taxes

in Nash game

to maximize revenue

in the presence of consumers who cross-border shop

where consumers tradeoff distance costs with lower taxes

Big T > little t

2 countries

one big / one small

uniform population within countries

set commodity taxes

in Nash game

to maximize revenue

in the presence of consumers who cross-border shop

where consumers tradeoff distance costs with lower taxes

Big T > little t

January 28, 2025 at 11:31 PM

Primer on the K-K model:

2 countries

one big / one small

uniform population within countries

set commodity taxes

in Nash game

to maximize revenue

in the presence of consumers who cross-border shop

where consumers tradeoff distance costs with lower taxes

Big T > little t

2 countries

one big / one small

uniform population within countries

set commodity taxes

in Nash game

to maximize revenue

in the presence of consumers who cross-border shop

where consumers tradeoff distance costs with lower taxes

Big T > little t

Now back to the paper.

In tax competition papers like Kanbur and Keen, the equilibrium tax rates follow a simple Ramsey rule that forms the basis for much of our intuition on tax competition.

In tax competition papers like Kanbur and Keen, the equilibrium tax rates follow a simple Ramsey rule that forms the basis for much of our intuition on tax competition.

January 28, 2025 at 11:31 PM

Now back to the paper.

In tax competition papers like Kanbur and Keen, the equilibrium tax rates follow a simple Ramsey rule that forms the basis for much of our intuition on tax competition.

In tax competition papers like Kanbur and Keen, the equilibrium tax rates follow a simple Ramsey rule that forms the basis for much of our intuition on tax competition.

Then we though, maybe its a result of linearity in the distribution function.

Lets try a general f(x).

We couldn't find a general f(x) that overturned the

Kanbur and Keen result with two jurisdictions.

Lets try a general f(x).

We couldn't find a general f(x) that overturned the

Kanbur and Keen result with two jurisdictions.

January 28, 2025 at 11:31 PM

Then we though, maybe its a result of linearity in the distribution function.

Lets try a general f(x).

We couldn't find a general f(x) that overturned the

Kanbur and Keen result with two jurisdictions.

Lets try a general f(x).

We couldn't find a general f(x) that overturned the

Kanbur and Keen result with two jurisdictions.

So we sat down and solved the model for about 10 different population distributions.

Lots of people near the border, few near the border, different gradients, all types of asymmetries...

Nothing could overturn the result that bigger jurisdictions set higher rates.

Lots of people near the border, few near the border, different gradients, all types of asymmetries...

Nothing could overturn the result that bigger jurisdictions set higher rates.

January 28, 2025 at 11:31 PM

So we sat down and solved the model for about 10 different population distributions.

Lots of people near the border, few near the border, different gradients, all types of asymmetries...

Nothing could overturn the result that bigger jurisdictions set higher rates.

Lots of people near the border, few near the border, different gradients, all types of asymmetries...

Nothing could overturn the result that bigger jurisdictions set higher rates.

Before giving details, let me tell you how this paper started.

I love the Kanbur and Keen model of tax competition. It intuitively shows jurisdiction size matters.

I wondered, shouldn't it matter whether the country has more people near the border or far from it?

I love the Kanbur and Keen model of tax competition. It intuitively shows jurisdiction size matters.

I wondered, shouldn't it matter whether the country has more people near the border or far from it?

January 28, 2025 at 11:31 PM

Before giving details, let me tell you how this paper started.

I love the Kanbur and Keen model of tax competition. It intuitively shows jurisdiction size matters.

I wondered, shouldn't it matter whether the country has more people near the border or far from it?

I love the Kanbur and Keen model of tax competition. It intuitively shows jurisdiction size matters.

I wondered, shouldn't it matter whether the country has more people near the border or far from it?

I return to the issue of corporate havens by considering the role that state and local governments play with respect to regulatory policies governing corporations.

Governments compete corporate charters in a market for incorporations. Incentives created by formula apportionment

Governments compete corporate charters in a market for incorporations. Incentives created by formula apportionment

December 20, 2024 at 6:55 PM

I return to the issue of corporate havens by considering the role that state and local governments play with respect to regulatory policies governing corporations.

Governments compete corporate charters in a market for incorporations. Incentives created by formula apportionment

Governments compete corporate charters in a market for incorporations. Incentives created by formula apportionment

Under this scenario, a jurisdiction has chosen its tax mix, electing not to utilize a particular taxing instrument, hoping that tax base mobility helps generate revenue or real economic activity from other sources.

December 20, 2024 at 6:55 PM

Under this scenario, a jurisdiction has chosen its tax mix, electing not to utilize a particular taxing instrument, hoping that tax base mobility helps generate revenue or real economic activity from other sources.

I argue that whether a subnational jurisdiction is dubbed a tax haven matters substantially for political debate, but the distinction is not necessarily central for mobility/behavioral responses unless the political debate amplifies the salience of low-tax jurisdictions.

December 20, 2024 at 6:55 PM

I argue that whether a subnational jurisdiction is dubbed a tax haven matters substantially for political debate, but the distinction is not necessarily central for mobility/behavioral responses unless the political debate amplifies the salience of low-tax jurisdictions.

Many state or local governments levying zero tax rates on personal income, consumption, wealth, or excises.

States set regulatory policies concerning incorporation law, trust law, secrecy rules, influencing the ability of to engage in tax avoidance/evasion opportunities.

States set regulatory policies concerning incorporation law, trust law, secrecy rules, influencing the ability of to engage in tax avoidance/evasion opportunities.

December 20, 2024 at 6:55 PM

Many state or local governments levying zero tax rates on personal income, consumption, wealth, or excises.

States set regulatory policies concerning incorporation law, trust law, secrecy rules, influencing the ability of to engage in tax avoidance/evasion opportunities.

States set regulatory policies concerning incorporation law, trust law, secrecy rules, influencing the ability of to engage in tax avoidance/evasion opportunities.

A “tax haven” stirs up imagery of tropical island paradises that set very low tax rates. Are state/local governments that levy zero tax rates hidden "tax havens"?

Check out my chapter "Hidden Havens: State and Local Governments as Tax Havens?" in this @elgarpublishing.bsky.social book

Thread:

Check out my chapter "Hidden Havens: State and Local Governments as Tax Havens?" in this @elgarpublishing.bsky.social book

Thread:

December 20, 2024 at 6:55 PM

A “tax haven” stirs up imagery of tropical island paradises that set very low tax rates. Are state/local governments that levy zero tax rates hidden "tax havens"?

Check out my chapter "Hidden Havens: State and Local Governments as Tax Havens?" in this @elgarpublishing.bsky.social book

Thread:

Check out my chapter "Hidden Havens: State and Local Governments as Tax Havens?" in this @elgarpublishing.bsky.social book

Thread:

Further, under WFH with source taxation, if labor demand is inelastic then population rises in the high-tax state at the expense of the low-tax state. With residence taxation, however, the effects on population depend upon whether public services are under or over provided.

December 19, 2024 at 11:28 PM

Further, under WFH with source taxation, if labor demand is inelastic then population rises in the high-tax state at the expense of the low-tax state. With residence taxation, however, the effects on population depend upon whether public services are under or over provided.

While many states tax these interstate workers where they live, several states levy taxes at the firm's location. Some double tax! And there is great policy debate over this issue, which led to NH challenging the ability of MA to tax individuals teleworking from their NH homes.

December 19, 2024 at 11:28 PM

While many states tax these interstate workers where they live, several states levy taxes at the firm's location. Some double tax! And there is great policy debate over this issue, which led to NH challenging the ability of MA to tax individuals teleworking from their NH homes.

With telework decoupling the state of work & residence, how do local income taxes affect wages, house prices, population and employment?

Check out my article “Taxes and telework: The impacts of state income taxes in a work-from-home economy” w/ Brueckner in J. @urbaneconomics.bsky.social

Thread:

Check out my article “Taxes and telework: The impacts of state income taxes in a work-from-home economy” w/ Brueckner in J. @urbaneconomics.bsky.social

Thread:

December 19, 2024 at 11:28 PM

With telework decoupling the state of work & residence, how do local income taxes affect wages, house prices, population and employment?

Check out my article “Taxes and telework: The impacts of state income taxes in a work-from-home economy” w/ Brueckner in J. @urbaneconomics.bsky.social

Thread:

Check out my article “Taxes and telework: The impacts of state income taxes in a work-from-home economy” w/ Brueckner in J. @urbaneconomics.bsky.social

Thread:

Small counties generally saw two to three times larger effects than big counties.

This is consistent with residents of smaller counties being more likely to buy online, perhaps because driving to specialized stores would entail substantial cost.

November 25, 2024 at 5:53 PM

Small counties generally saw two to three times larger effects than big counties.

This is consistent with residents of smaller counties being more likely to buy online, perhaps because driving to specialized stores would entail substantial cost.

We find that requiring firms rather than individuals to remit increased sales tax revenues by 5.4 percent

and then marketplace laws that required platforms to remit further increased revenues by 5.1 percent.

and then marketplace laws that required platforms to remit further increased revenues by 5.1 percent.

November 25, 2024 at 5:53 PM

We find that requiring firms rather than individuals to remit increased sales tax revenues by 5.4 percent

and then marketplace laws that required platforms to remit further increased revenues by 5.1 percent.

and then marketplace laws that required platforms to remit further increased revenues by 5.1 percent.

We use comprehensive high-frequency county-level and municipal-level data on tax revenue and taxable sales.

We exploit the staggered adoption of firm-based remittance and marketplace facilitator laws that shifted remittance to platforms from vendors.

We exploit the staggered adoption of firm-based remittance and marketplace facilitator laws that shifted remittance to platforms from vendors.

November 25, 2024 at 5:53 PM

We use comprehensive high-frequency county-level and municipal-level data on tax revenue and taxable sales.

We exploit the staggered adoption of firm-based remittance and marketplace facilitator laws that shifted remittance to platforms from vendors.

We exploit the staggered adoption of firm-based remittance and marketplace facilitator laws that shifted remittance to platforms from vendors.