founder of https://CommodityContext.com

former bank economist

markets, code, barbecue

Ukrainian attack on major Russian oil port shocks oil market back to life just as WTI was on the edge of prompt contango.

Full report: www.commoditycontext.com/p/ocw46w25

Summary:

Ukrainian attack on major Russian oil port shocks oil market back to life just as WTI was on the edge of prompt contango.

Full report: www.commoditycontext.com/p/ocw46w25

Summary:

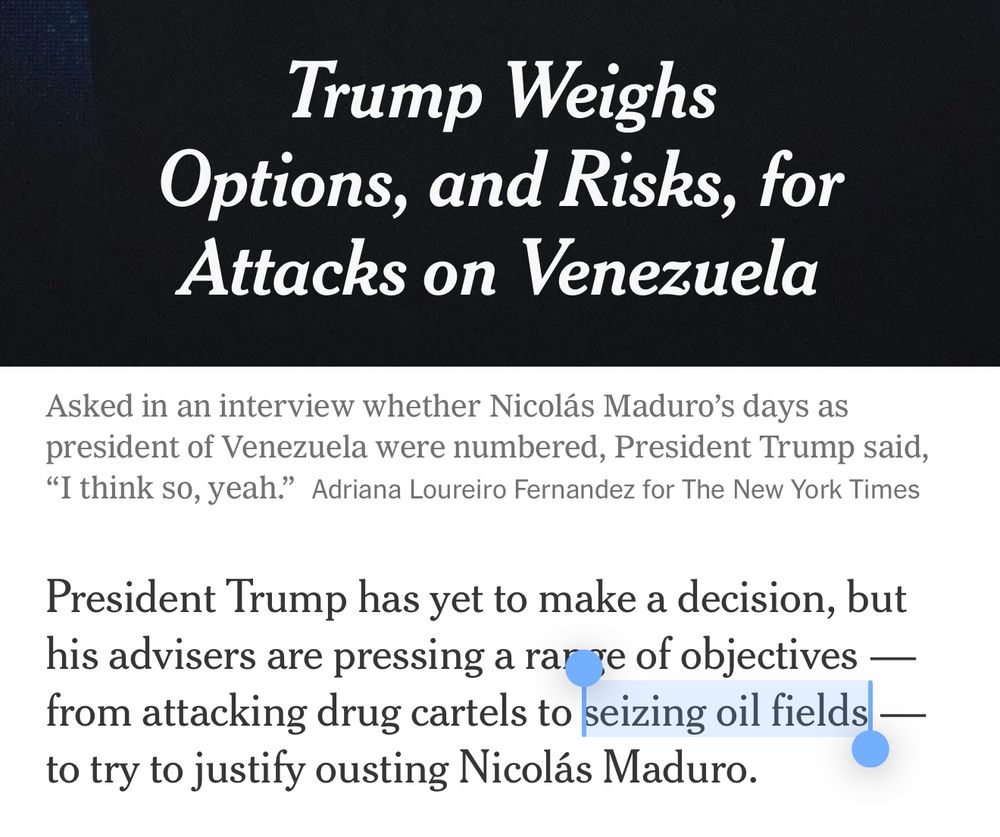

The US has built up a *massive* military force off Venezuela’s coast and feels poised to strike

In the latest episode of the Oil Ground Up podcast, I spoke with

@fmonaldi.bsky.social to help me understand what’s happening and what’s at stake for VZ’s oil industry.

The US has built up a *massive* military force off Venezuela’s coast and feels poised to strike

In the latest episode of the Oil Ground Up podcast, I spoke with

@fmonaldi.bsky.social to help me understand what’s happening and what’s at stake for VZ’s oil industry.

“U.S. private equity giant Carlyle is exploring options to buy foreign assets from Russian oil major Lukoil, three sources familiar with the situation said.”

“U.S. private equity giant Carlyle is exploring options to buy foreign assets from Russian oil major Lukoil, three sources familiar with the situation said.”

🇨🇦🛢️ On the latest episode of the Oil Ground Up podcast, I was joined by Kevin Birn of S&P Global to discuss the current position and both pipeline- and policy-dependent future of Canada’s oil sands industry.

Listen below or on your fav platform:

clearcommodity.net/podcasts/oil...

🇨🇦🛢️ On the latest episode of the Oil Ground Up podcast, I was joined by Kevin Birn of S&P Global to discuss the current position and both pipeline- and policy-dependent future of Canada’s oil sands industry.

Listen below or on your fav platform:

clearcommodity.net/podcasts/oil...

Crude prices fell, weighed down by both fundamental pressure and a broader equity market pullback; futures curves have resumed their descent toward prompt contango while refined product markets spiked.

Full report: www.commoditycontext.com/p/ocw45w25

Summary:

Crude prices fell, weighed down by both fundamental pressure and a broader equity market pullback; futures curves have resumed their descent toward prompt contango while refined product markets spiked.

Full report: www.commoditycontext.com/p/ocw45w25

Summary:

Bloomberg: “Gunvor Group withdrew its offer for the international assets of sanctioned Russian oil producer Lukoil PJSC after the US Treasury Department said the oil and gas trader would never get a license and called it “the Kremlin’s puppet.””

Bloomberg: “Gunvor Group withdrew its offer for the international assets of sanctioned Russian oil producer Lukoil PJSC after the US Treasury Department said the oil and gas trader would never get a license and called it “the Kremlin’s puppet.””

Crude curves weakening again, Brent prompt timespreads got as low as 20c earlier today (rebounded a bit since) while WTI still sitting at only 13c.

Crude curves weakening again, Brent prompt timespreads got as low as 20c earlier today (rebounded a bit since) while WTI still sitting at only 13c.

Three ways to go.

Three ways to go.

Because they are now.

Because they are now.

New York Times:

www.nytimes.com/2025/11/04/u...

New York Times:

www.nytimes.com/2025/11/04/u...

And a pretty darn narrow spread for oil prices between upside and downside scenarios.

And a pretty darn narrow spread for oil prices between upside and downside scenarios.

I... have no idea what this means.

I... have no idea what this means.

can't wait until they discover price signals

can't wait until they discover price signals

Imho value of Churchill would be more about northern/artic Canadian presence projection than energy security (no need to supply up there and demand better diversified headed west)

Imho value of Churchill would be more about northern/artic Canadian presence projection than energy security (no need to supply up there and demand better diversified headed west)