www.jchs.harvard.edu/blog/interac...

www.jchs.harvard.edu/blog/interac...

Join us Apr 17 for a conversation with former Freddie Mac CEO (and former JCHS Fellow) Don Layton.

www.jchs.harvard.edu/calendar/mor...

Join us Apr 17 for a conversation with former Freddie Mac CEO (and former JCHS Fellow) Don Layton.

www.jchs.harvard.edu/calendar/mor...

bipartisanpolicy.org/event/instit...

bipartisanpolicy.org/event/instit...

finance.yahoo.com/news/fhfa-ch...

finance.yahoo.com/news/fhfa-ch...

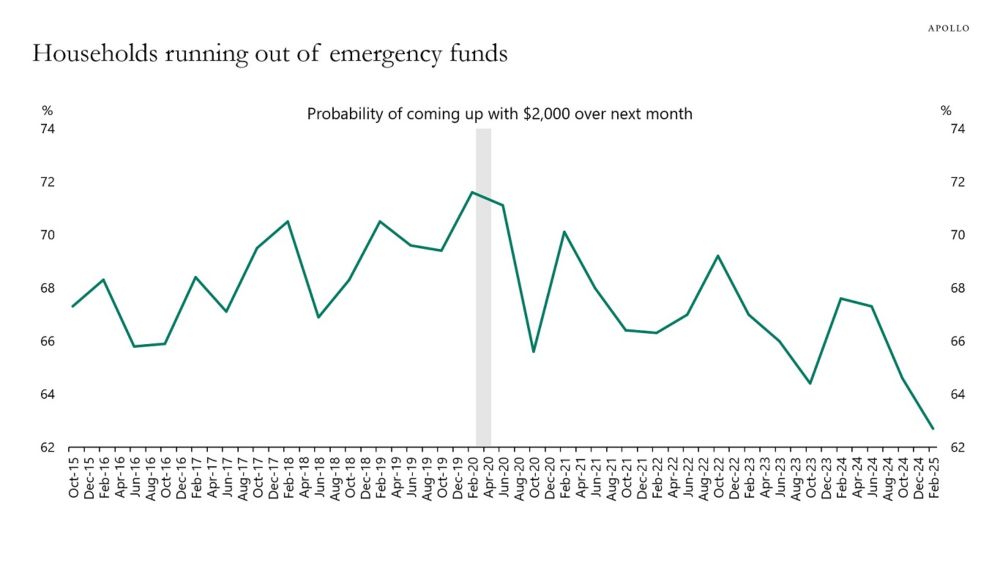

www.apolloacademy.com/households-r...

www.apolloacademy.com/households-r...

Join us for the release of our new report about the US remodeling industry tomorrow, Thursday, March 20, at 2pm ET. Registration required.

www.jchs.harvard.edu/calendar/imp...

Join us for the release of our new report about the US remodeling industry tomorrow, Thursday, March 20, at 2pm ET. Registration required.

www.jchs.harvard.edu/calendar/imp...

In person only, registration required.

www.jchs.harvard.edu/calendar/stu...

In person only, registration required.

www.jchs.harvard.edu/calendar/stu...

@DataArbor

@DataArbor

www.startribune.com/cuts-to-hud-...

www.startribune.com/cuts-to-hud-...

How this is possible, and why it is getting harder to sustain ⤵️

How this is possible, and why it is getting harder to sustain ⤵️

Even as a landlord, I can’t believe how heartless this is. A mere three-day eviction notice? That’s beyond unreasonable—it’s downright inhumane. Are they serious?

www.nytimes.com/2025/02/13/r...

Even as a landlord, I can’t believe how heartless this is. A mere three-day eviction notice? That’s beyond unreasonable—it’s downright inhumane. Are they serious?

realestate.usnews.com/real-estate/...

realestate.usnews.com/real-estate/...

Imagine if this was today , how many people would be saying “Why are we studying Gila Monsters and their impact on diabetes ? That’s wasted money !”

globalnews.ca/news/9793403...

Imagine if this was today , how many people would be saying “Why are we studying Gila Monsters and their impact on diabetes ? That’s wasted money !”

globalnews.ca/news/9793403...

The attempt to force Costco to audit their #DEI work was by an anti-inclusion lobby group:

"The proponent's broader agenda is not reducing risk for the Company but abolition of diversity initiatives." - Costco Board

Maryland property owners will see higher tax assessments in 2025 as the state continues to experience rising home prices.

Hey 👋🏾 primary residence homeowners make sure you have #Homestead Tax Credit on file with #SDAT to limit impact.

#RealEstate #Maryland

Maryland property owners will see higher tax assessments in 2025 as the state continues to experience rising home prices.

Hey 👋🏾 primary residence homeowners make sure you have #Homestead Tax Credit on file with #SDAT to limit impact.

#RealEstate #Maryland

May it bring peace and prosperity to you all.

And freedom to all oppressed peoples.

May it bring peace and prosperity to you all.

And freedom to all oppressed peoples.