📍Oslo, Norway 🇳🇴

Link to paper: doi.org/10.1093/rof/...

#EconSky #FinSky #Bitcoin #Crypto #Investing #Academic

Link to paper: doi.org/10.1093/rof/...

#EconSky #FinSky #Bitcoin #Crypto #Investing #Academic

Link to paper: dx.doi.org/10.2139/ssrn...

#EconSky #FinSky #Finance #Bitcoin #Academic

Short video clip about the content on www.laurensswinkels.com, where you can also find the data.

#EconSky #FinSky #Academic #Investing #Finance

Short video clip about the content on www.laurensswinkels.com, where you can also find the data.

#EconSky #FinSky #Academic #Investing #Finance

#sustainability #esg #finance #investing #india

#sustainability #esg #finance #investing #india

Link to paper: dx.doi.org/10.2139/ssrn...

#Gold #Bitcoin #Investing #FinSky #EconSKy #Safehaven

Link to paper: dx.doi.org/10.2139/ssrn...

#Gold #Bitcoin #Investing #FinSky #EconSKy #Safehaven

Rangvid's blogpost: blog.rangvid.com/2025/10/26/h...

#EconSky #Denmark #Debt #InterestRates #Book

Rangvid's blogpost: blog.rangvid.com/2025/10/26/h...

#EconSky #Denmark #Debt #InterestRates #Book

Link to paper: www.nber.org/papers/w34389

#EconSky #War #Economy #Academic #HistorySky

Link to paper: www.nber.org/papers/w34389

#EconSky #War #Economy #Academic #HistorySky

#Climate #Carbon #Investing #Assets #EconSky

Link to paper: www.nber.org/papers/w34342

#Climate #Carbon #Investing #Assets #EconSky

Link to paper: www.nber.org/papers/w34342

#Investing #Gold #Stocks #FinSky

Link to paper: dx.doi.org/10.2139/ssrn...

#Investing #Gold #Stocks #FinSky

Link to paper: dx.doi.org/10.2139/ssrn...

#EMD #EmergingMarkets #Investing #FinSky #EconSky #Academic

#EMD #EmergingMarkets #Investing #FinSky #EconSky #Academic

#FinSky #EconSky #Investing #Investment #Stocks #Bonds

#FinSky #EconSky #Investing #Investment #Stocks #Bonds

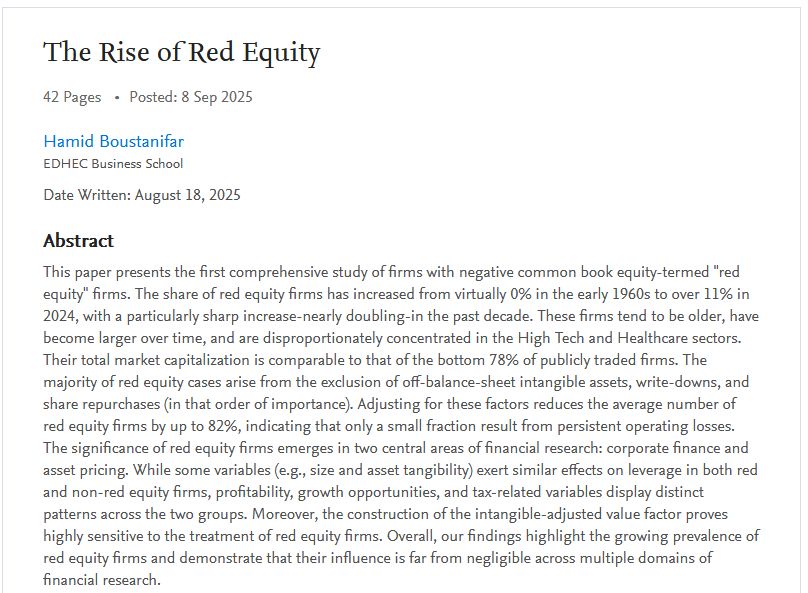

Link to paper: dx.doi.org/10.2139/ssrn...

#Investing #EconSky #FinSky #Stocks #Equities #Red

Link to paper: dx.doi.org/10.2139/ssrn...

#Investing #EconSky #FinSky #Stocks #Equities #Red

Its pretty basic maths informs massive capital allocations.

A no equation explainer: on.ft.com/4p7CwsD

Its pretty basic maths informs massive capital allocations.

A no equation explainer: on.ft.com/4p7CwsD

#Climate #Norway #Carbon #CarbonCapture #Sustainability

#Climate #Norway #Carbon #CarbonCapture #Sustainability