Tax, budget, policy, racial and economic justice | Views are my own

she/her

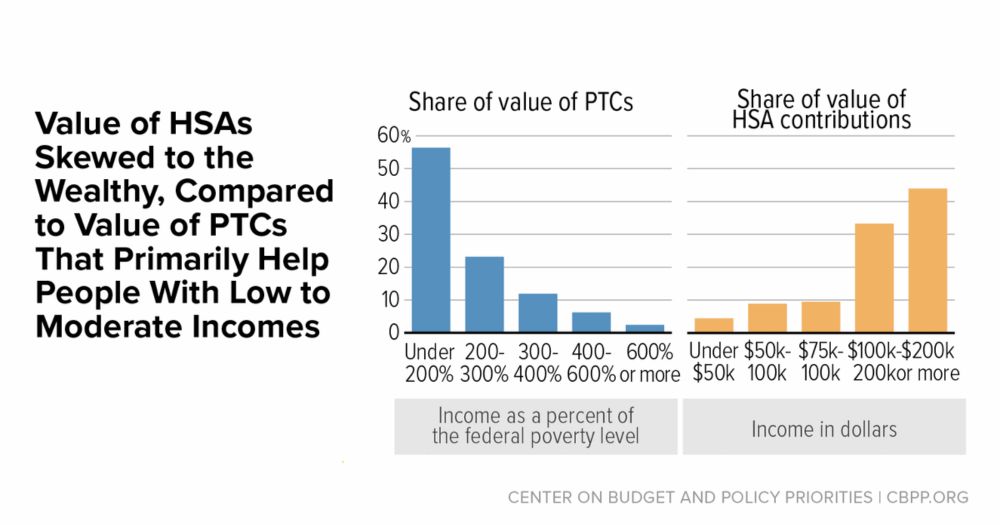

Will this increase help lower- and middle-income retirees?

Nope, and here’s why. 🧵

Will this increase help lower- and middle-income retirees?

Nope, and here’s why. 🧵

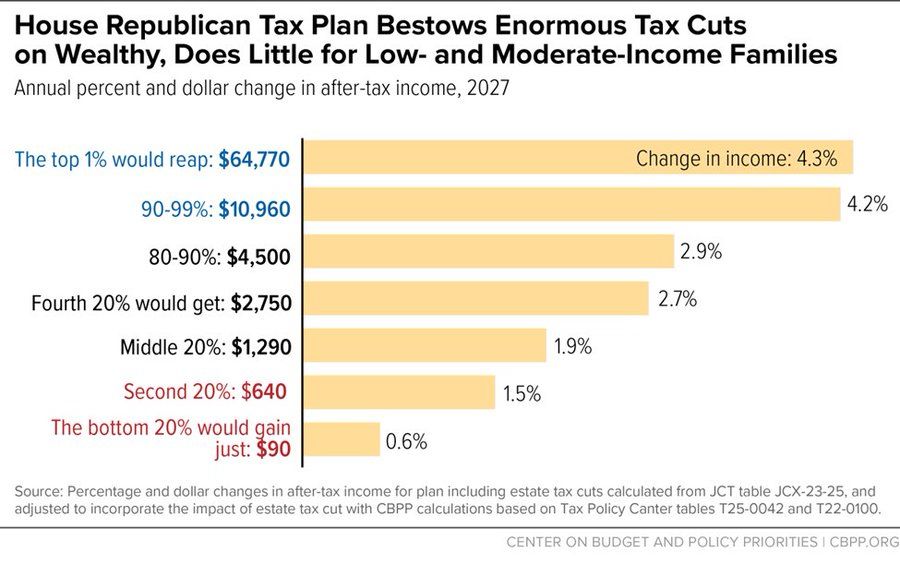

The bad news: it doesn’t have the votes because the House Freedom Caucus is trying to make the yellow bar bigger and the SALT caucus is trying to make the red bar bigger.

The bad news: it doesn’t have the votes because the House Freedom Caucus is trying to make the yellow bar bigger and the SALT caucus is trying to make the red bar bigger.

They took on RFK and the Trump admin—and won. Story soon.

They took on RFK and the Trump admin—and won. Story soon.

For some, these will be life or death situations. For many, these natural disasters will yield devastating loss.

We should have a FEMA ready, able and fully staffed to support the American public when it needs it most.

@wsj.com

www.wsj.com/politics/pol...

For some, these will be life or death situations. For many, these natural disasters will yield devastating loss.

We should have a FEMA ready, able and fully staffed to support the American public when it needs it most.

One of those miners decided to fight back—and won.

inthesetimes.com/article/west...

One of those miners decided to fight back—and won.

inthesetimes.com/article/west...

www.cbpp.org/blog/how-hou...

taxlawcenter.org/blog/ways-an...

taxlawcenter.org/blog/ways-an...

Despite extending profligate tax cuts for the wealthy, this is the 1 tax cut the W&M cmte doesn’t extend. 4M ppl will lose coverage as a result per CBO

Despite extending profligate tax cuts for the wealthy, this is the 1 tax cut the W&M cmte doesn’t extend. 4M ppl will lose coverage as a result per CBO

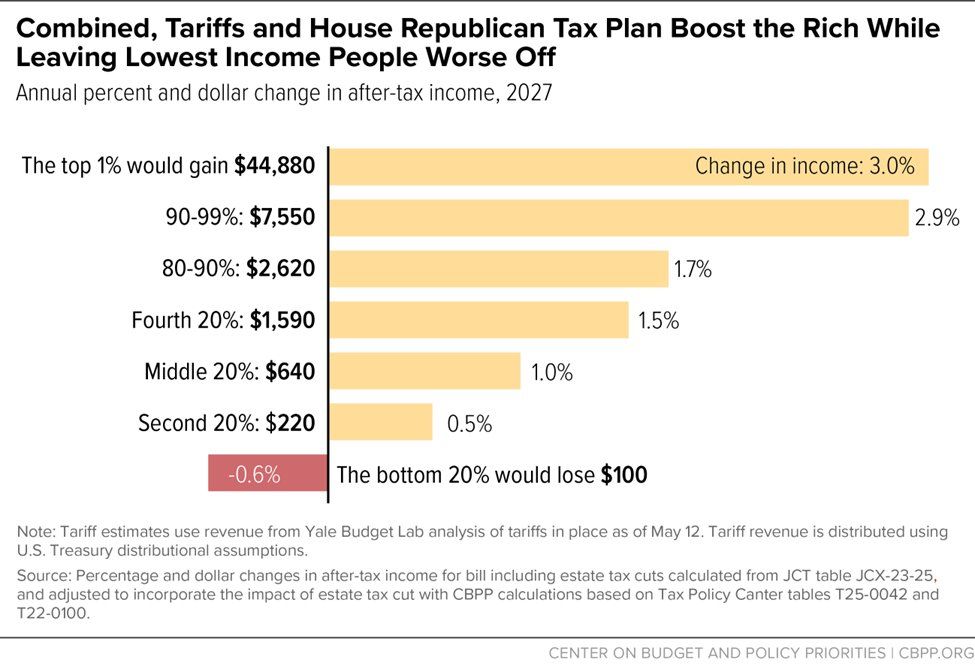

We hope to have combined impacts soon–but even if you just add in the effects of the tariffs most families barely benefit if at all.

We hope to have combined impacts soon–but even if you just add in the effects of the tariffs most families barely benefit if at all.

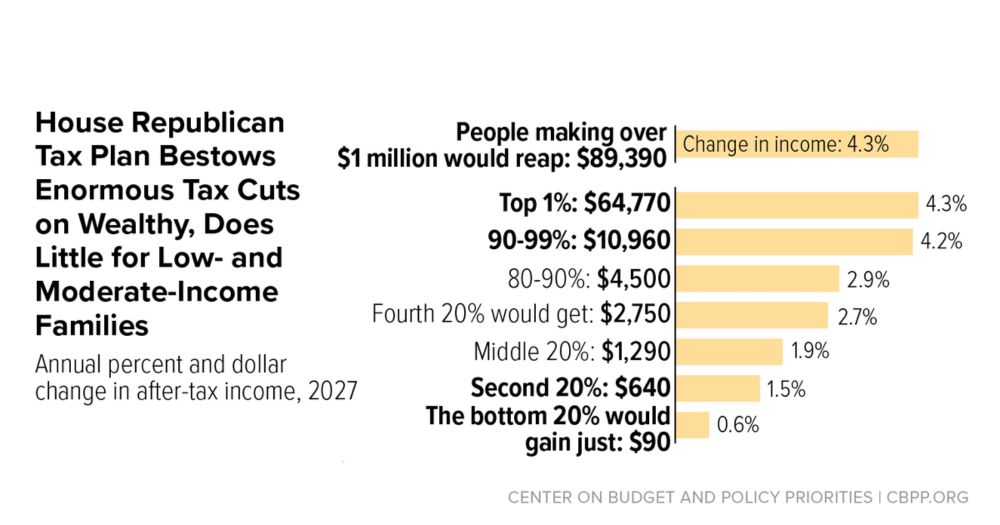

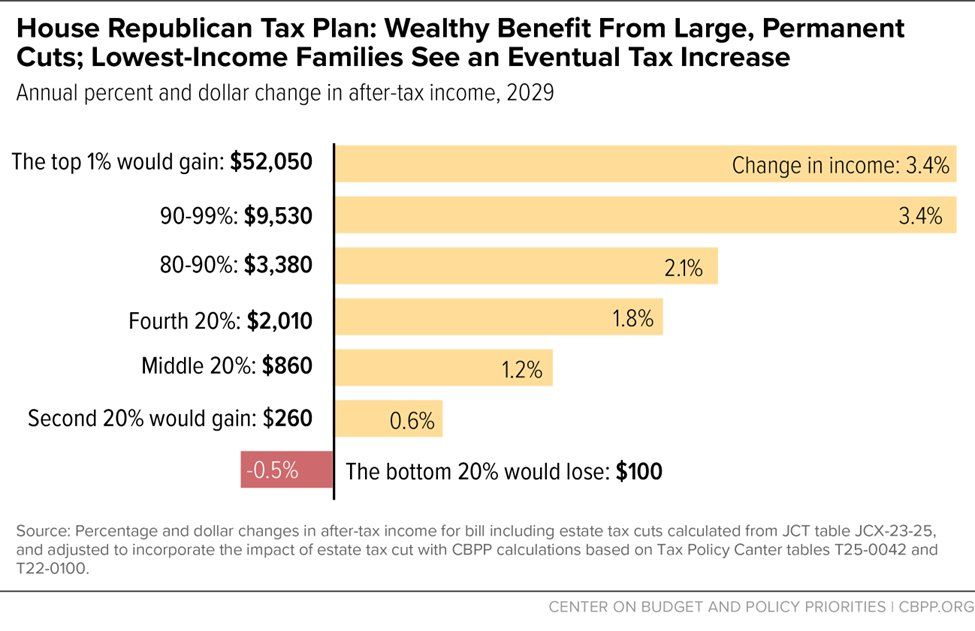

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

I'm lucky. That choice wouldn't cost my job or make me lose pay.

But if the GOP proposal passes low-income families would have to weigh all that and if staying home would jeopardize their ability to eat.

Imagine getting LESS help to feed your kids if your boss cuts your hours.

I'm lucky. That choice wouldn't cost my job or make me lose pay.

But if the GOP proposal passes low-income families would have to weigh all that and if staying home would jeopardize their ability to eat.

Imagine getting LESS help to feed your kids if your boss cuts your hours.

Imagine getting LESS help to feed your kids if your boss cuts your hours.

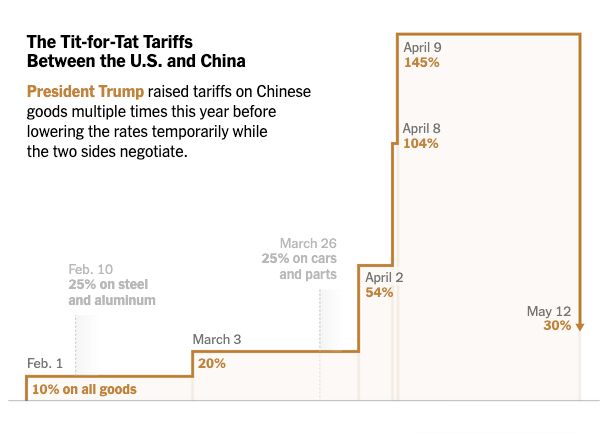

In the space of about 3 months, tariffs on China:

-- doubled;

-- went up ≈ 2.5X from there;

-- roughly doubled again;

-- went up ≈ 40% from there;

-- and now have dropped ≈ 80% from the peak -- but are still 3X what they were in February.

www.nytimes.com/article/trum...

In the space of about 3 months, tariffs on China:

-- doubled;

-- went up ≈ 2.5X from there;

-- roughly doubled again;

-- went up ≈ 40% from there;

-- and now have dropped ≈ 80% from the peak -- but are still 3X what they were in February.

www.nytimes.com/article/trum...