Tax, budget, policy, racial and economic justice | Views are my own

she/her

Despite extending profligate tax cuts for the wealthy, this is the 1 tax cut the W&M cmte doesn’t extend. 4M ppl will lose coverage as a result per CBO

Despite extending profligate tax cuts for the wealthy, this is the 1 tax cut the W&M cmte doesn’t extend. 4M ppl will lose coverage as a result per CBO

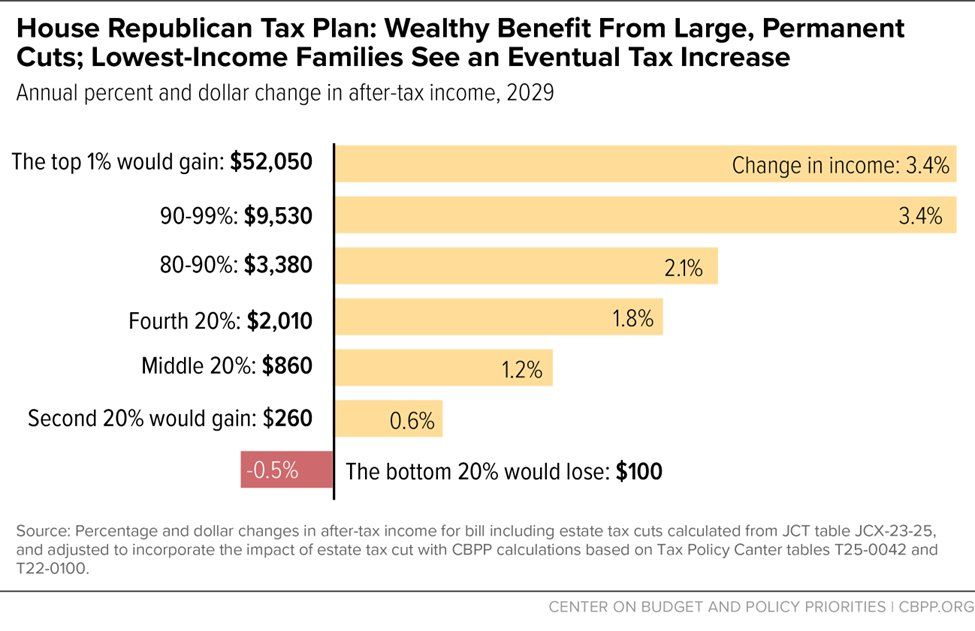

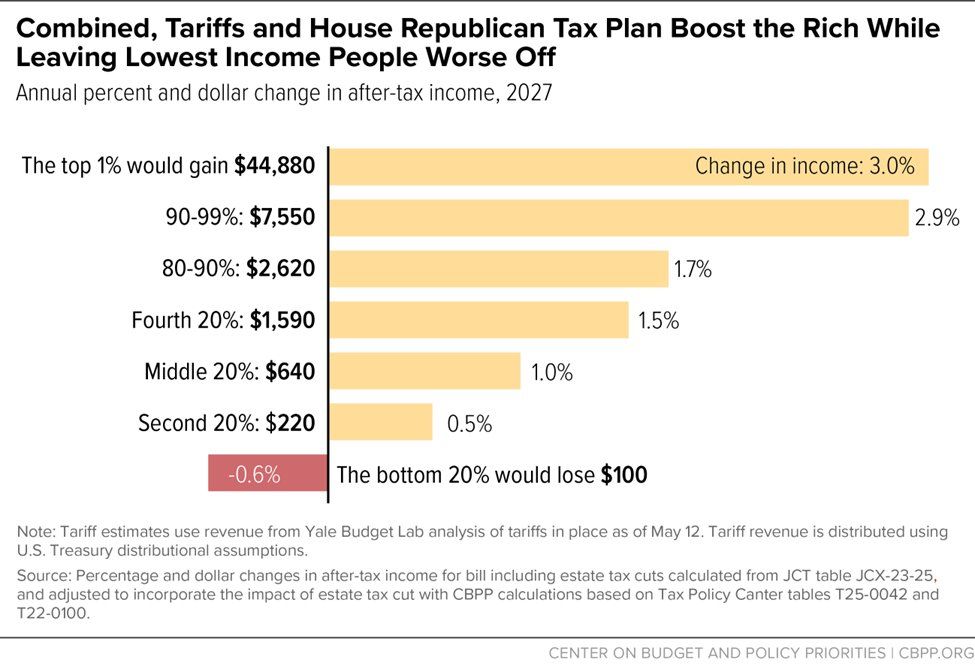

We hope to have combined impacts soon–but even if you just add in the effects of the tariffs most families barely benefit if at all.

We hope to have combined impacts soon–but even if you just add in the effects of the tariffs most families barely benefit if at all.