👉 www.tandfonline.com/doi/full/10....

👉 www.tandfonline.com/doi/full/10....

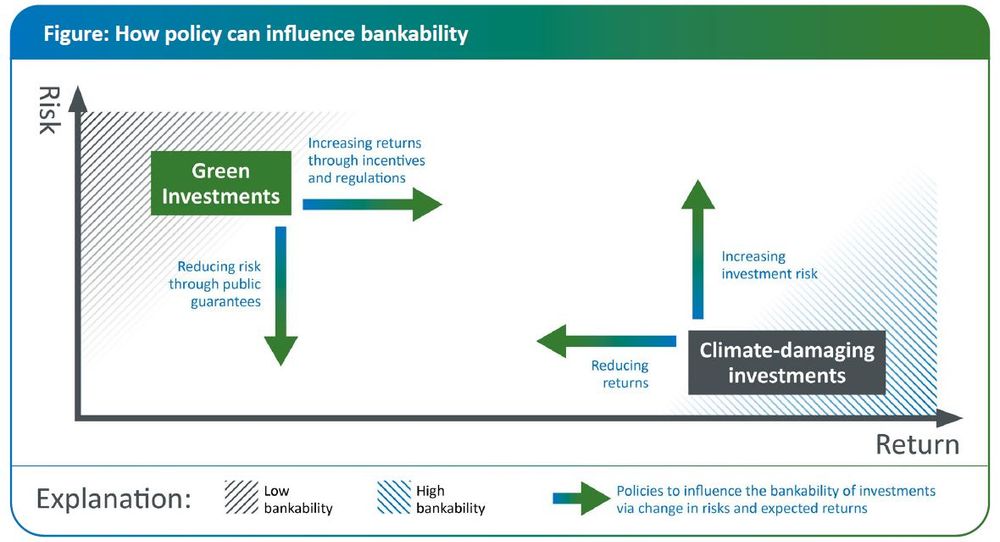

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

www.wbgu.de/ip-sicherheit

@akhornidge.bsky.social

@alettabonn.bsky.social

@traidlhoffmann.bsky.social

@jwullweber.bsky.social

www.wbgu.de/ip-sicherheit

@akhornidge.bsky.social

@alettabonn.bsky.social

@traidlhoffmann.bsky.social

@jwullweber.bsky.social

The aim of the four-pager is to stimulate debates on security and its relation to sustainability.

@akhornidge.bsky.social @alettabonn.bsky.social

@traidlhoffmann.bsky.social @jwullweber.bsky.social

The aim of the four-pager is to stimulate debates on security and its relation to sustainability.

@akhornidge.bsky.social @alettabonn.bsky.social

@traidlhoffmann.bsky.social @jwullweber.bsky.social

Find answers in our new open-access article in @ripejournal.bsky.social:

www.tandfonline.com/doi/full/10....

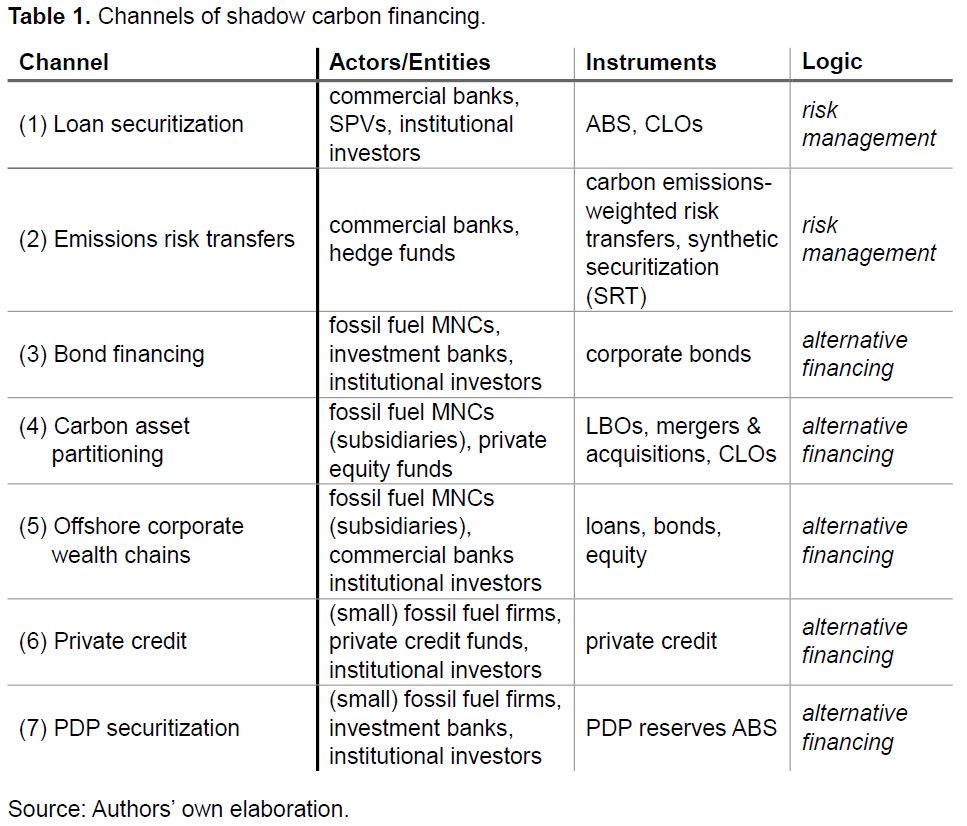

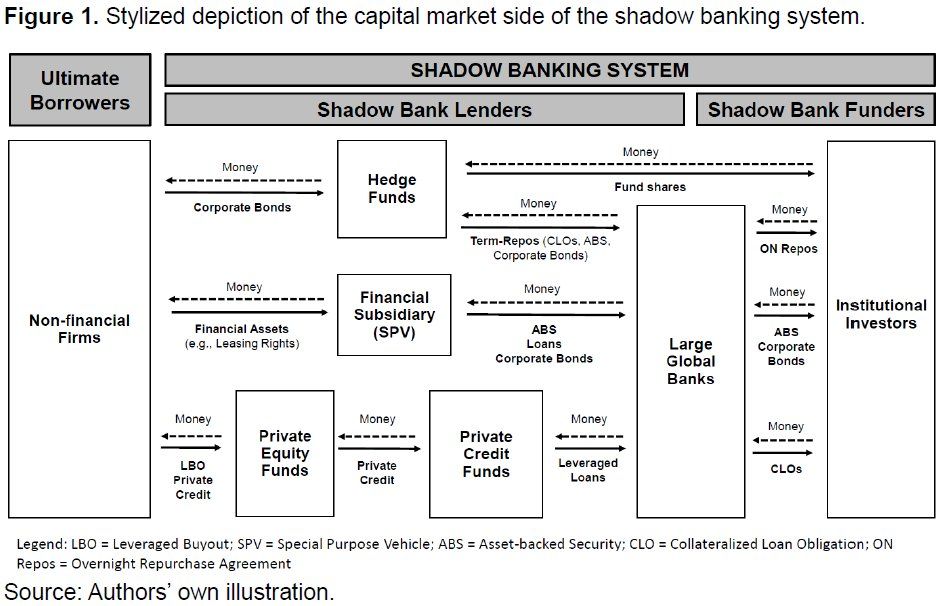

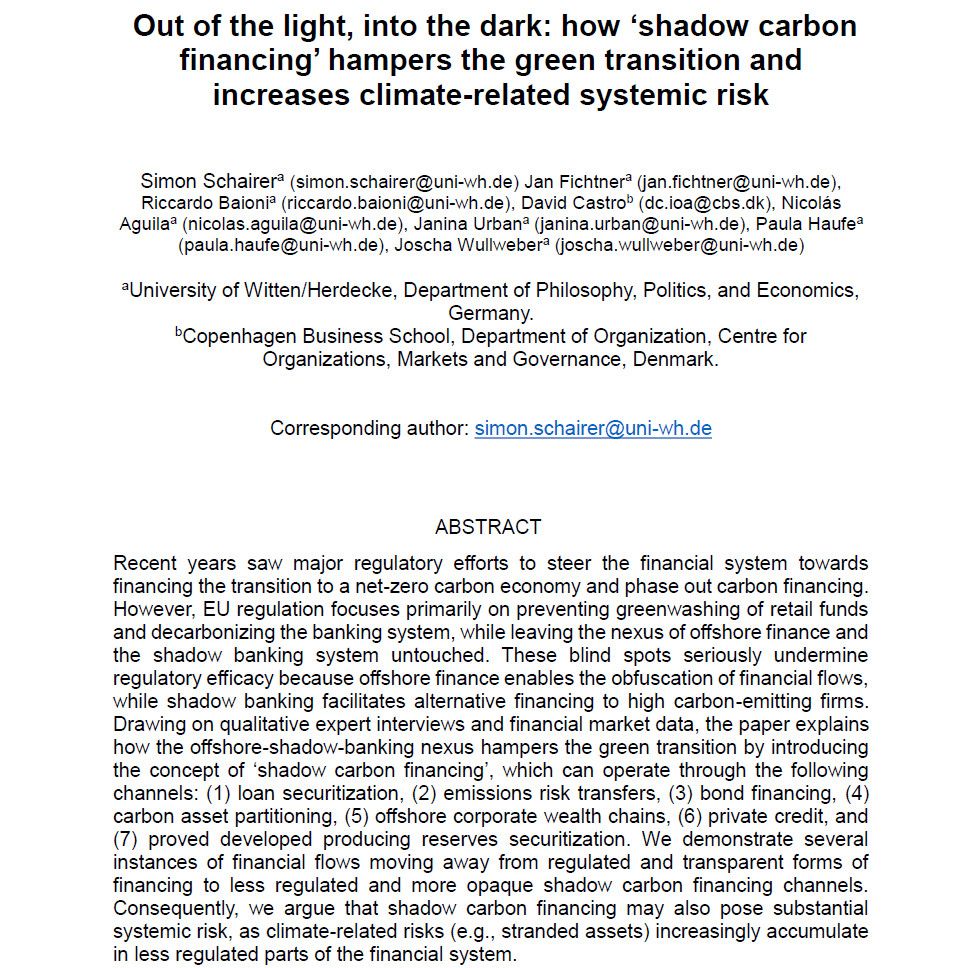

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Nicolás Águila, @paulahaufe.bsky.social & @jwullweber.bsky.social argue for the Ecor, a new monetary tool that could break the current impasse surrounding climate transition financing.

isrf.org/blog/towards...

Nicolás Águila, @paulahaufe.bsky.social & @jwullweber.bsky.social argue for the Ecor, a new monetary tool that could break the current impasse surrounding climate transition financing.

isrf.org/blog/towards...

Nicolás Águila, @paulahaufe.bsky.social and @jwullweber.bsky.social argue for the Ecor, a new international monetary tool, based on Keynes's Bancor, that could break the current impasse surrounding climate transition financing.

isrf.org/blog/towards...

Nicolás Águila, @paulahaufe.bsky.social and @jwullweber.bsky.social argue for the Ecor, a new international monetary tool, based on Keynes's Bancor, that could break the current impasse surrounding climate transition financing.

isrf.org/blog/towards...

Nicolás Águila, @paulahaufe.bsky.social and @jwullweber.bsky.social argue for the Ecor, a new international monetary tool, based on Keynes's Bancor, that could break the current impasse surrounding climate transition financing.

isrf.org/blog/towards...

Our article on what politicians think about the ECB is now out in @jcms-eu.bsky.social

We surveyed Members of the European Parliament to uncover their views on the ECB

👉 Available at onlinelibrary.wiley.com/doi/10.1111/...

And a short thread here -->

Our article on what politicians think about the ECB is now out in @jcms-eu.bsky.social

We surveyed Members of the European Parliament to uncover their views on the ECB

👉 Available at onlinelibrary.wiley.com/doi/10.1111/...

And a short thread here -->

Here's a 🧵 on the result of @danielagabor.bsky.social and I wrecking our brains for four years.

www.tandfonline.com/doi/full/10....