@danmertens.bsky.social and @nataschavanderzwan.bsky.social define EU sustainable finance & outline how best to analyse it 💡

🔗 www.tandfonline.com/doi/full/10....

It looks at why renewable energy buildout in Europe has been *so* unsteady - tracing the evolution of/conflict over the regime for RE derisking over the last two+ decades...

It's open access! 👉 doi.org/10.1080/1350...

Short 🧵 ...

It looks at why renewable energy buildout in Europe has been *so* unsteady - tracing the evolution of/conflict over the regime for RE derisking over the last two+ decades...

It's open access! 👉 doi.org/10.1080/1350...

Short 🧵 ...

👉 www.tandfonline.com/doi/full/10....

👉 www.tandfonline.com/doi/full/10....

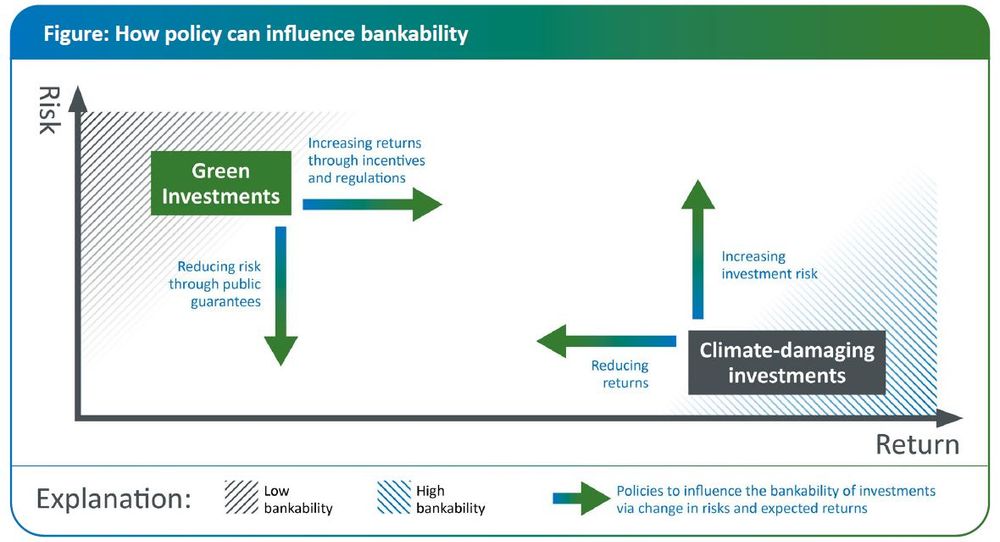

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

🛢️💸🏝️

papers.ssrn.com/sol3/papers....