www.nytco.com/press/jeanna...

www.nytco.com/press/jeanna...

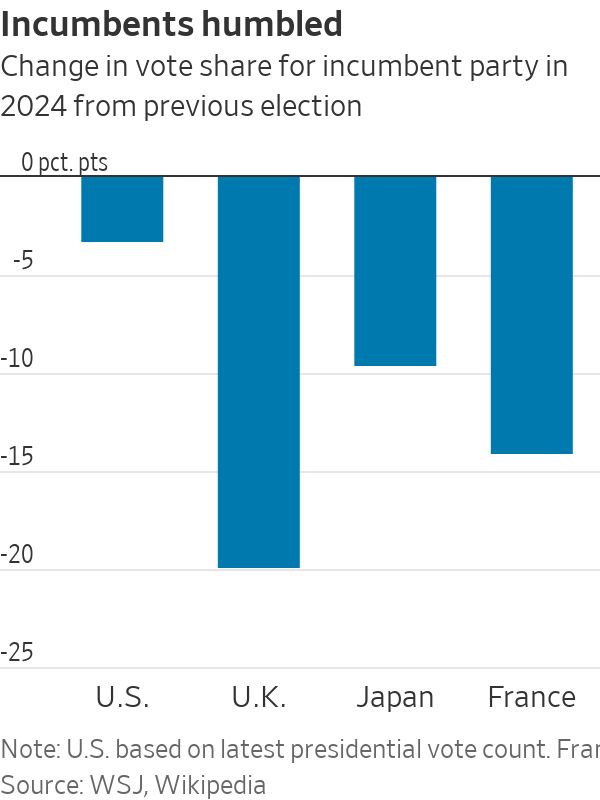

www.wsj.com/politics/ele...

www.wsj.com/politics/ele...

@michaelsantoli.bsky.social

@gregip.bsky.social

@boes.bsky.social

@maxblau.bsky.social

@michaelsantoli.bsky.social

@gregip.bsky.social

@boes.bsky.social

@maxblau.bsky.social

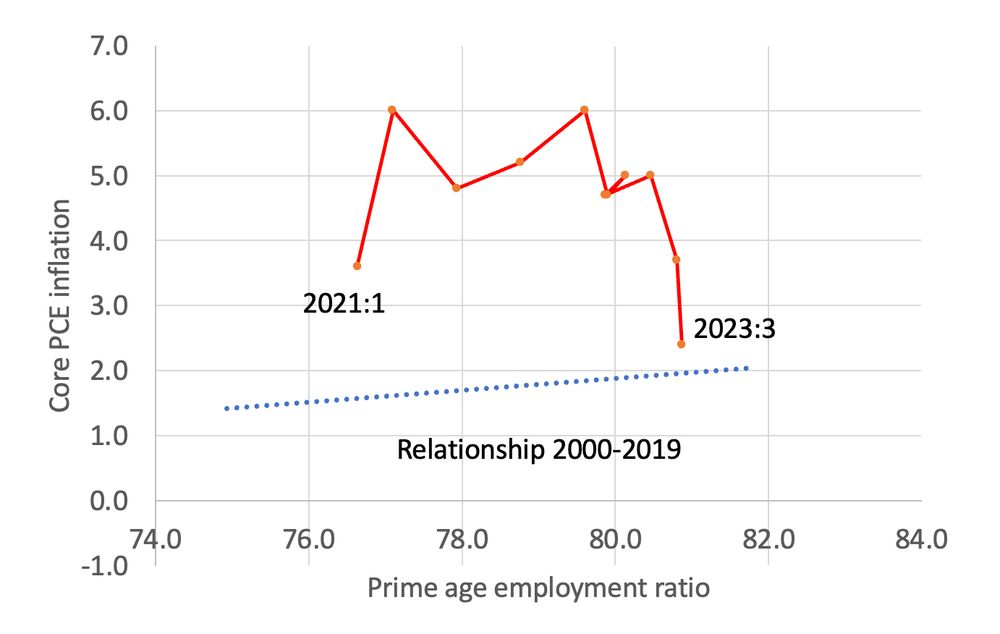

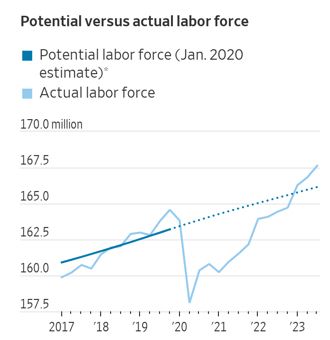

We are currently above where CBO thought we'd be before COVID was a thing - as if the pandemic never happened.