"Everything hinges on these medical reports," said DesRoches, who heads the not-for-profit FAIR Association of Victims for Accident Insurance Reform

www.cbc.ca/news/health/...

www.cbc.ca/player/play/...

Protecting consumers generally left to provinces and we know how much Ontario's government cares...

So please help out and take a minute or two to sign this!

Canadians - please help this homeowner & sign this petition. A minimum of 500 signatures needed by Jan. 1/26 for this to be considered.

ourcommons.ca/petitions/en...

It could be you/your child/your friend next.

#factorybuilthousing #modularhousing #prefabhousing

Protecting consumers generally left to provinces and we know how much Ontario's government cares...

So please help out and take a minute or two to sign this!

Could "drivers convicted of “intoxication manslaughter” who killed a child’s parent or guardian must pay child support until they turn 18 or graduate from high school" happen?

globalnews.ca/news/1153102...

Could "drivers convicted of “intoxication manslaughter” who killed a child’s parent or guardian must pay child support until they turn 18 or graduate from high school" happen?

globalnews.ca/news/1153102...

of 7,330 total contacts, 550 were Informal Conciliation, six to Mediation, and two to Senior Adjudication

4614 were about auto insurance + the majority of inquiries came from Ontario

giocanada.org/wp-content/u...

of 7,330 total contacts, 550 were Informal Conciliation, six to Mediation, and two to Senior Adjudication

4614 were about auto insurance + the majority of inquiries came from Ontario

giocanada.org/wp-content/u...

Turn down rate is very high, people end up at a tribunal where very few succeed in getting the help they need.

It's what happens when we are legislated to buy an inferior product.

She got nothing for pain, suffering & income loss. How can these psychopaths sleep at night?

Turn down rate is very high, people end up at a tribunal where very few succeed in getting the help they need.

It's what happens when we are legislated to buy an inferior product.

strigberger.com/tort/ontario...

strigberger.com/tort/ontario...

Rules vary across Canada

"companies may cut costs by putting unlicensed or unskilled workers in charge of certain maintenance and repairs — instead of licensed mechanics"

www.cbc.ca/news/gopubli...

Rules vary across Canada

"companies may cut costs by putting unlicensed or unskilled workers in charge of certain maintenance and repairs — instead of licensed mechanics"

www.cbc.ca/news/gopubli...

"The audit highlighted a 30% increase in the at-fault collision rate among drivers who passed the shortened test (2.4%) compared to those who completed the full test (1.8%)."

www.insurancebusinessmag.com/ca/news/auto...

driving.ca/auto-news/cr...

The change is "also about protecting our democracy," she said, noting that the change will help preserve the integrity and security of elections.

www.cbc.ca/news/canada/...

The change is "also about protecting our democracy," she said, noting that the change will help preserve the integrity and security of elections.

www.cbc.ca/news/canada/...

driving.ca/auto-news/cr...

driving.ca/auto-news/cr...

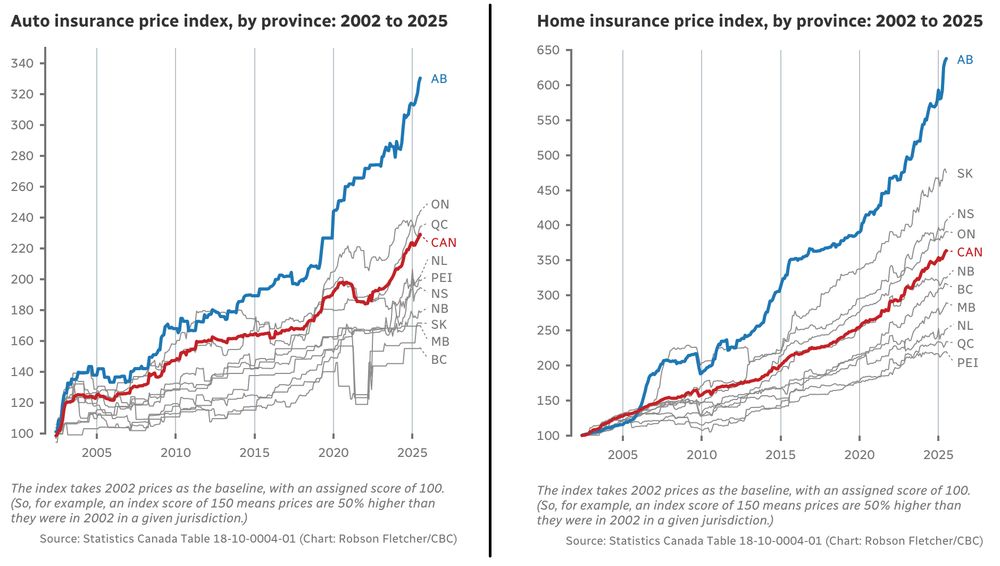

Alberta absolutely in a league of its own here.

Not increased or indexed for 2 decades = far below the poverty line. Insurance is designed around injured people being dumped on Ontario Disability (ODSP) and CPP-D, also below cost of living.

Punishing claimants is the plan

More on this: www.volts.wtf/p/climate-ch...

More on this: www.volts.wtf/p/climate-ch...

Your car will likely be fixed in weeks but you will spend years trying to get medical help - Ontario car insurance has become a scam product.

Your car will likely be fixed in weeks but you will spend years trying to get medical help - Ontario car insurance has become a scam product.

Car insurance is often an empty promise - just ask the 15,000 Ontarians who had to take their insurer to court last year!

Alberta absolutely in a league of its own here.

Car insurance is often an empty promise - just ask the 15,000 Ontarians who had to take their insurer to court last year!

ISAC’s Recommendations:

"Like physicians, we are deeply concerned about the health care crisis and the administrative burden involved in supporting patients living in poverty who are pursuing disability benefits."

policyconsult.cpso.on.ca/ISAC_Respons...

ISAC’s Recommendations:

"Like physicians, we are deeply concerned about the health care crisis and the administrative burden involved in supporting patients living in poverty who are pursuing disability benefits."

policyconsult.cpso.on.ca/ISAC_Respons...

using touch for controls in its newer cars. @fairassociation.bsky.social

Volvo V70 2005 rolled 306 meters before the tasks were completed

The car with most complex display 1,372 meters.

In Volvo the job took 10 seconds, compared to 44.6 seconds in the MG:

Volvo V70 fra 2005 rakk å trille 306 meter før oppgavene var utført

Bilen med den mest komplekse skjermen gikk 1372 meter.

I Volvoen tok jobben 10 sekunder, mot 44,6 sekunder i MG-en:

using touch for controls in its newer cars. @fairassociation.bsky.social

canadianunderwriter.ca/news/claims/...

canadianunderwriter.ca/news/claims/...

Every accident victim deserves compassion, advocacy, and justice.

oatleyvigmond.com/advocating-f...

Every accident victim deserves compassion, advocacy, and justice.

oatleyvigmond.com/advocating-f...

“Équité Association said in a report released Monday that the number of vehicles reported stolen nationally dropped 19.1 per cent in the first half of 2025 compared to the same period in 2024.”

⬇️ Ontario 25.9%

⬇️ Quebec 22.2%

#Canada

“Équité Association said in a report released Monday that the number of vehicles reported stolen nationally dropped 19.1 per cent in the first half of 2025 compared to the same period in 2024.”

⬇️ Ontario 25.9%

⬇️ Quebec 22.2%

#Canada

Bottom lines above their customer needs?

Who wants to buy from a company who will take "remedial action" when standing behind their product is more expensive than they expected?

No one we know.

Bottom lines above their customer needs?

Who wants to buy from a company who will take "remedial action" when standing behind their product is more expensive than they expected?

No one we know.

It’s not a moral failing.

It’s not something you can “try harder” your way out of.

All it takes is one illness, accident or stroke of bad luck.

We all need & deserve better social supports

It’s not a moral failing.

It’s not something you can “try harder” your way out of.

All it takes is one illness, accident or stroke of bad luck.

We all need & deserve better social supports

www.ctvnews.ca/northern-ont...

www.ctvnews.ca/northern-ont...