(I'm guessing from the fact you raised it, you're doubtful...)

(I'm guessing from the fact you raised it, you're doubtful...)

bsky.app/profile/nobl...

#ukhousing

bsky.app/profile/nobl...

1. Adult rate "not to fall below 2/3 median wages" i.e. in practice this means rise in line with forecast average earnings (will have a look at the likely rate later)

1. Adult rate "not to fall below 2/3 median wages" i.e. in practice this means rise in line with forecast average earnings (will have a look at the likely rate later)

Or, as a minority of BoE policymakers probably will, decide it's time for a pause.

Or, as a minority of BoE policymakers probably will, decide it's time for a pause.

Sometimes these surveys can be a knee-jerk reaction to a recent rise in inflation, but they might also reflect less certainty that inflation will average near the BoE's 2% target.

Sometimes these surveys can be a knee-jerk reaction to a recent rise in inflation, but they might also reflect less certainty that inflation will average near the BoE's 2% target.

Lots hangs on whether it continues to slow as the BoE expects - returning to pre-pandemic rates of around 3% - or bottoms out at a higher level.

Lots hangs on whether it continues to slow as the BoE expects - returning to pre-pandemic rates of around 3% - or bottoms out at a higher level.

Services inflation at 4.7% is 2 percentage points higher than in 2019.

And food prices, which drive shorter-term inflation moves, are rebounding after a fall in 2025.

Services inflation at 4.7% is 2 percentage points higher than in 2019.

And food prices, which drive shorter-term inflation moves, are rebounding after a fall in 2025.

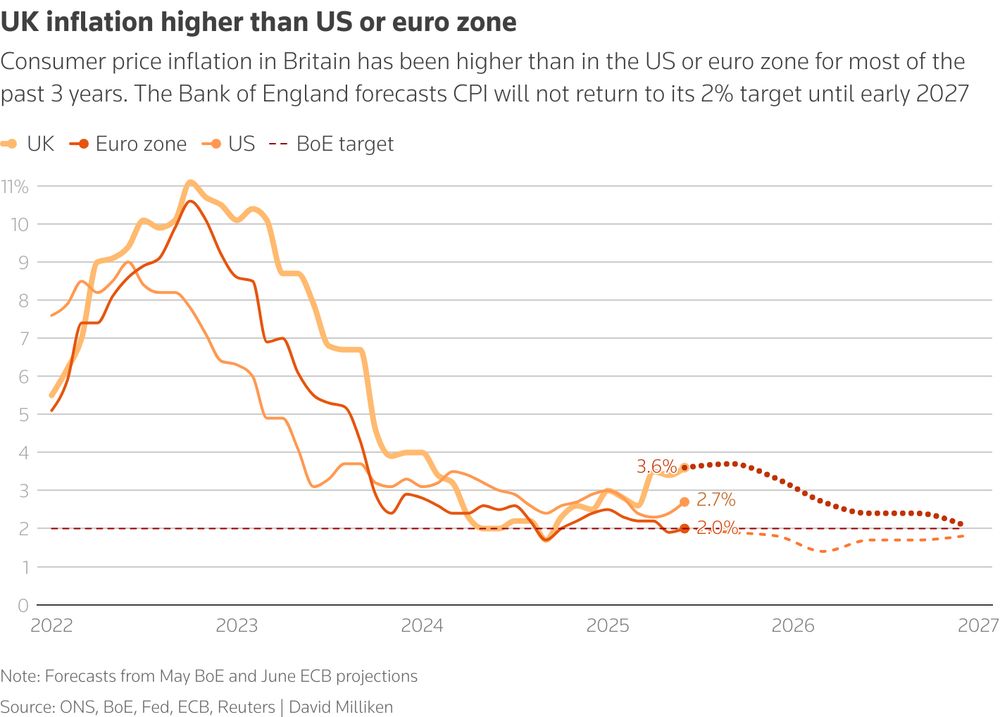

But (as of May) it didn't expect inflation to get back to its 2% target until early 2027, unlike the euro zone where it stays close to 2%

But (as of May) it didn't expect inflation to get back to its 2% target until early 2027, unlike the euro zone where it stays close to 2%

But since hitting a low of 1.7% in September 2024, it has more than doubled, reaching 3.6% in June.

But since hitting a low of 1.7% in September 2024, it has more than doubled, reaching 3.6% in June.