Sometimes these surveys can be a knee-jerk reaction to a recent rise in inflation, but they might also reflect less certainty that inflation will average near the BoE's 2% target.

Sometimes these surveys can be a knee-jerk reaction to a recent rise in inflation, but they might also reflect less certainty that inflation will average near the BoE's 2% target.

Lots hangs on whether it continues to slow as the BoE expects - returning to pre-pandemic rates of around 3% - or bottoms out at a higher level.

Lots hangs on whether it continues to slow as the BoE expects - returning to pre-pandemic rates of around 3% - or bottoms out at a higher level.

Services inflation at 4.7% is 2 percentage points higher than in 2019.

And food prices, which drive shorter-term inflation moves, are rebounding after a fall in 2025.

Services inflation at 4.7% is 2 percentage points higher than in 2019.

And food prices, which drive shorter-term inflation moves, are rebounding after a fall in 2025.

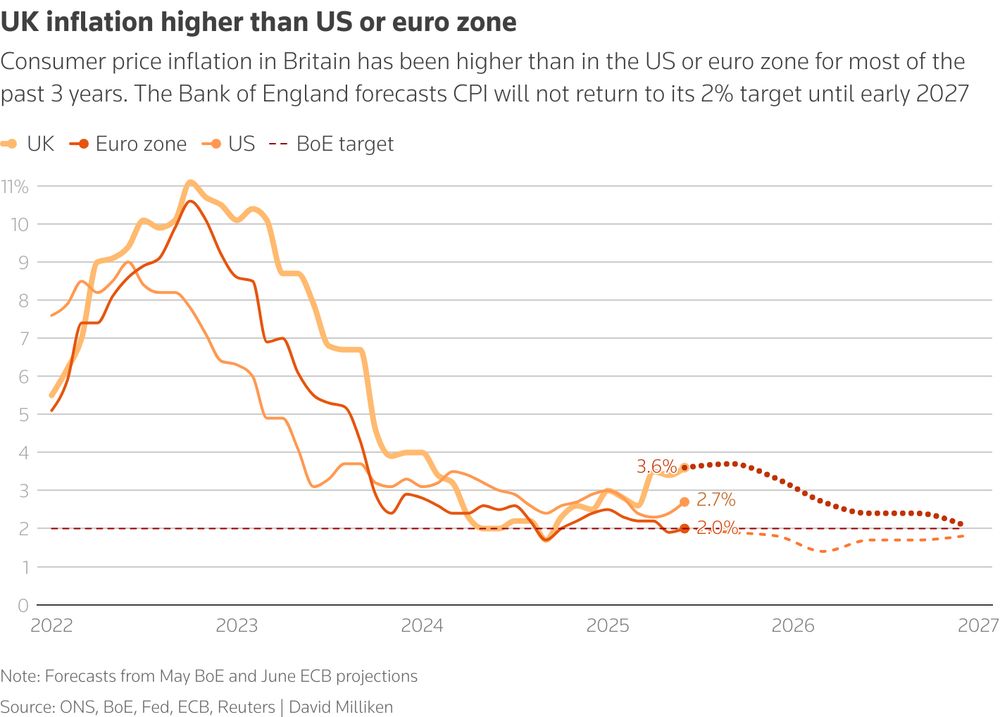

But since hitting a low of 1.7% in September 2024, it has more than doubled, reaching 3.6% in June.

But since hitting a low of 1.7% in September 2024, it has more than doubled, reaching 3.6% in June.

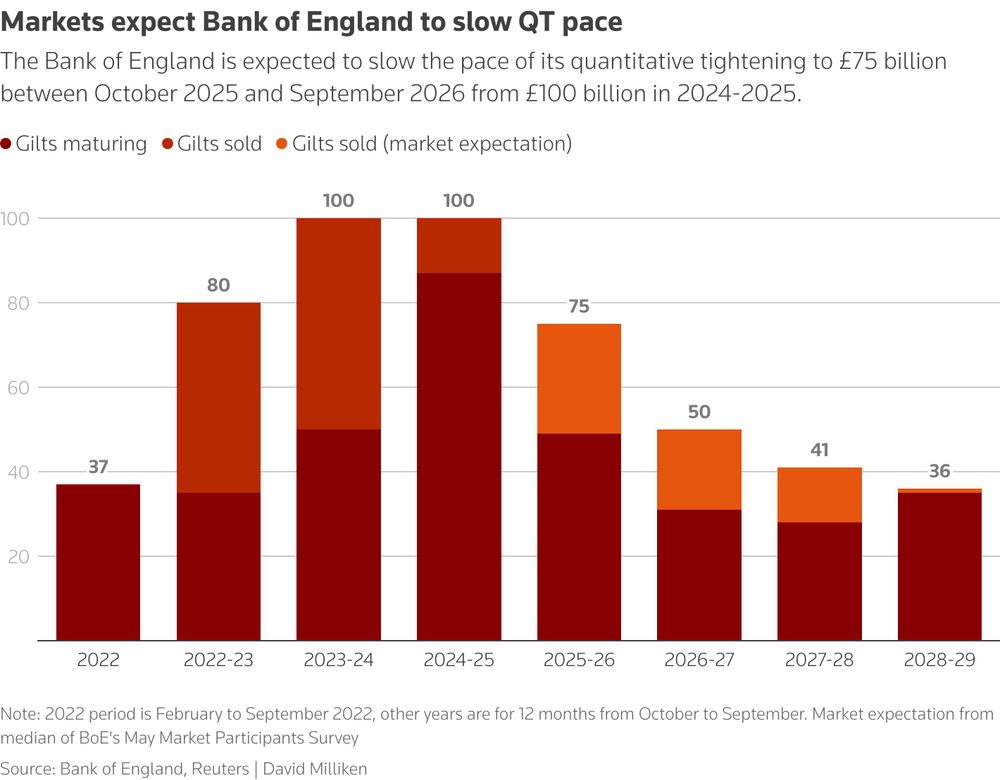

Note that actually means an *increase* in gilts sold by the BoE, as there's a sharp drop in QT gilts that are due to mature between Oct 2025 and Sept 2026.

Note that actually means an *increase* in gilts sold by the BoE, as there's a sharp drop in QT gilts that are due to mature between Oct 2025 and Sept 2026.

A BoE survey in May showed a median forecast it would fall to £357 bln by September 2029 from £558 bln. But around half thought it would stay above £400 bln or fall below £290 bln.

A BoE survey in May showed a median forecast it would fall to £357 bln by September 2029 from £558 bln. But around half thought it would stay above £400 bln or fall below £290 bln.

They're on track to rise 0.19 percentage points today - the sharpest jump since Truss's mini-budget.

It's mostly a reaction to Trump, but also investor jitters about illiquid markets and the UK's high borrowing.

They're on track to rise 0.19 percentage points today - the sharpest jump since Truss's mini-budget.

It's mostly a reaction to Trump, but also investor jitters about illiquid markets and the UK's high borrowing.

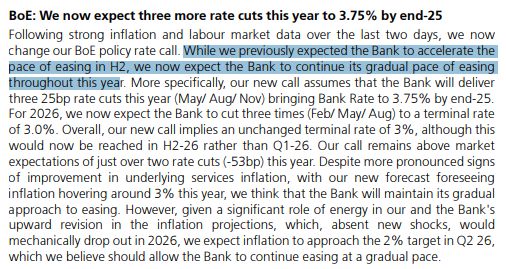

Markets still see 2 more rate cuts this year. Some banks e.g. UBS trimming their bets.

Markets still see 2 more rate cuts this year. Some banks e.g. UBS trimming their bets.

Markets still just about see 2 more quarter-point rate cuts from the Bank of England this year.

Markets still just about see 2 more quarter-point rate cuts from the Bank of England this year.

But in many ways it was a mirror image of December's weaker-than-expected 2.5% reading.

Air fares were a driving factor both times, adding 0.25pp in Dec and subtracting 0.14pp in Jan

But in many ways it was a mirror image of December's weaker-than-expected 2.5% reading.

Air fares were a driving factor both times, adding 0.25pp in Dec and subtracting 0.14pp in Jan

Top line: he's cautious about further rate cuts (which isn't a no - but means a slowish pace) due to weaknesses in the supply side of the economy and it's ability to match demand.

Other key lines here:

Top line: he's cautious about further rate cuts (which isn't a no - but means a slowish pace) due to weaknesses in the supply side of the economy and it's ability to match demand.

Other key lines here:

Productivity in the health service was up just 0.2% qq in Q3 2024 - despite the end of strikes - and is still nearly 19% below where it was in Q4 2019.

Productivity in the health service was up just 0.2% qq in Q3 2024 - despite the end of strikes - and is still nearly 19% below where it was in Q4 2019.

"Debt management is an inherently cautious business," notes Moyeen Islam at Barclays.

And the DMO has a lot of debt to manage...

8/n

"Debt management is an inherently cautious business," notes Moyeen Islam at Barclays.

And the DMO has a lot of debt to manage...

8/n

But some investors say it now needs to go faster.

5/n

But some investors say it now needs to go faster.

5/n

The starting point is that Britain is an outlier. The average maturity of a UK government bond trading today is 14 years, versus 7 years for other rich countries.

1/n

The starting point is that Britain is an outlier. The average maturity of a UK government bond trading today is 14 years, versus 7 years for other rich countries.

1/n

Instead, it was the weak ONS wage readings earlier in 2024 which were wrong!

Instead, it was the weak ONS wage readings earlier in 2024 which were wrong!

An inhouse model of theirs based on sentiment data estimates UK wage is nearer 4.5%.

An inhouse model of theirs based on sentiment data estimates UK wage is nearer 4.5%.

Cathal Kennedy at RBC says a bit more here:

Cathal Kennedy at RBC says a bit more here:

That leaves 2-year and 5-year gilts just 5 basis points above where they were at the start of the year, while 10s and 30s are about 15 bps higher

That leaves 2-year and 5-year gilts just 5 basis points above where they were at the start of the year, while 10s and 30s are about 15 bps higher