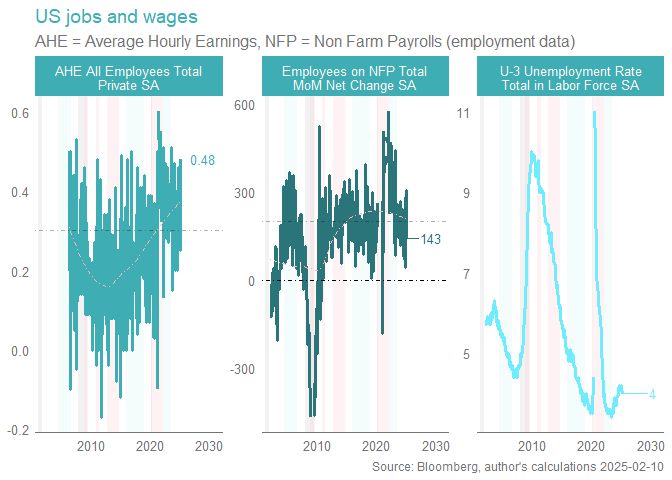

1) the average workweek is very low

2) manufacturing job growth is negative and is worsening

3) the hires rate remains early 2010’s sluggish

4) the largest publicly-traded homebuilder stock is cratering

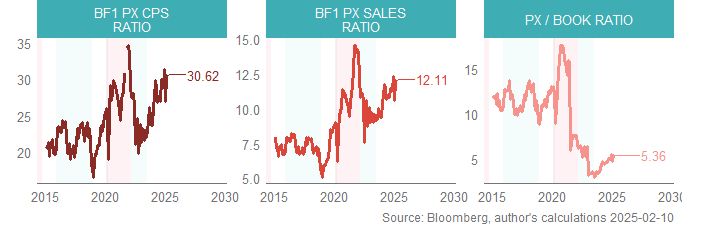

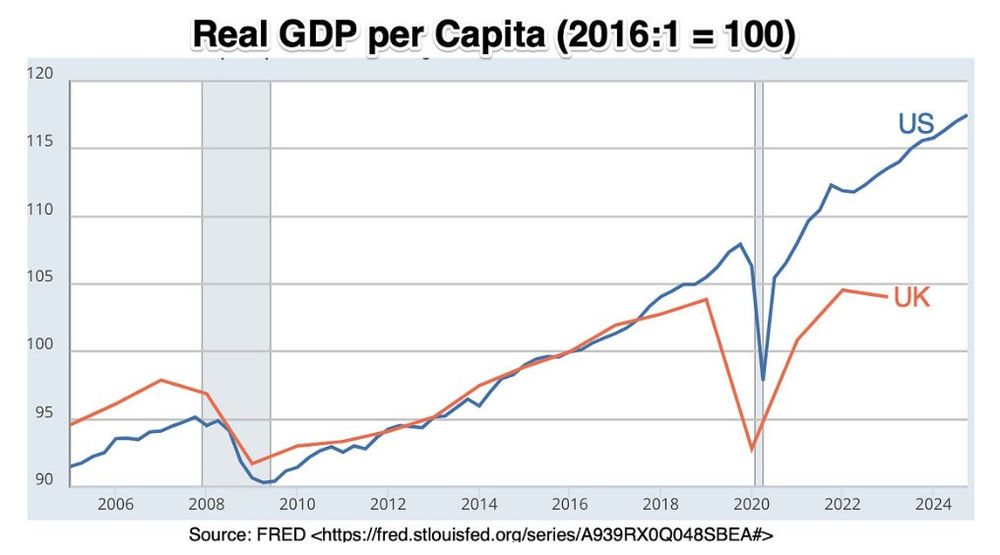

@antipodeanmacro.bsky.social) in New Zealand housing activity, I can't help but think the whole "housing bubbles + high household debt are the toxic combo to avoid at all costs" narrative can't quite be all there is.

@antipodeanmacro.bsky.social) in New Zealand housing activity, I can't help but think the whole "housing bubbles + high household debt are the toxic combo to avoid at all costs" narrative can't quite be all there is.