(more than you think)

awealthofcommonsense.com/2025/10/how-...

(more than you think)

awealthofcommonsense.com/2025/10/how-...

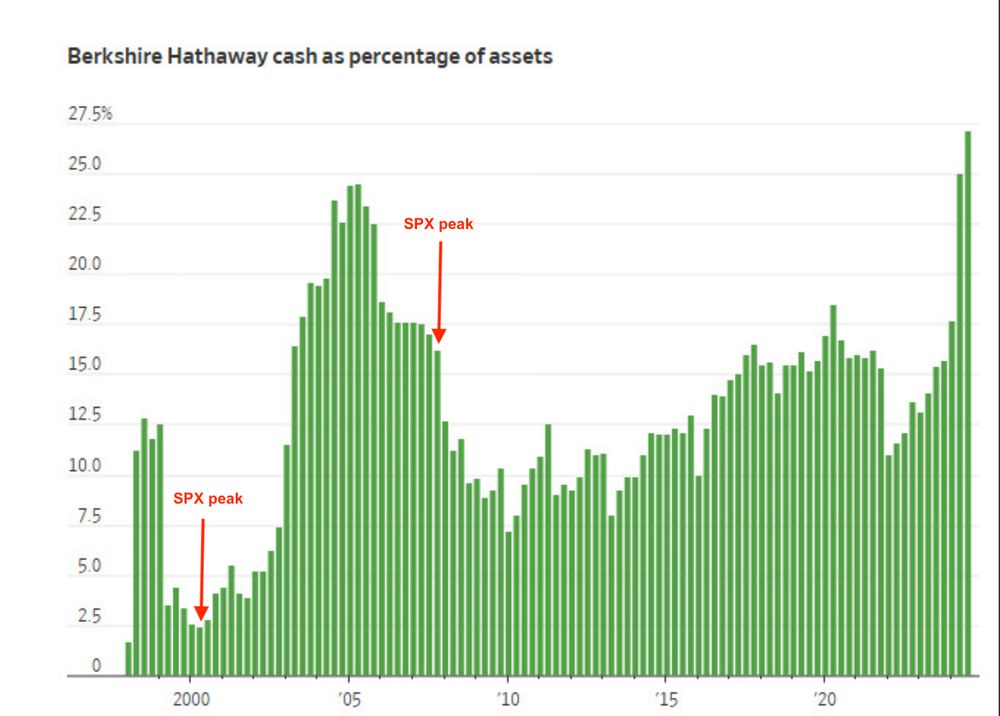

5,502,284% for Berkshire vs 39,054% in the S&P 500.

I forget who pointed this out but Berkshire could fall 99% and he'd still have outperformed over his career.

5,502,284% for Berkshire vs 39,054% in the S&P 500.

I forget who pointed this out but Berkshire could fall 99% and he'd still have outperformed over his career.

It's been 1-1/3 yrs since the last 10% drop and 2-1/3 yrs since the last 15% drop. Something to look forward to

It's been 1-1/3 yrs since the last 10% drop and 2-1/3 yrs since the last 15% drop. Something to look forward to

Great company and smart investors but BRK hasn't sustained any market outperformance in 23 yrs (RHS).

Great company and smart investors but BRK hasn't sustained any market outperformance in 23 yrs (RHS).

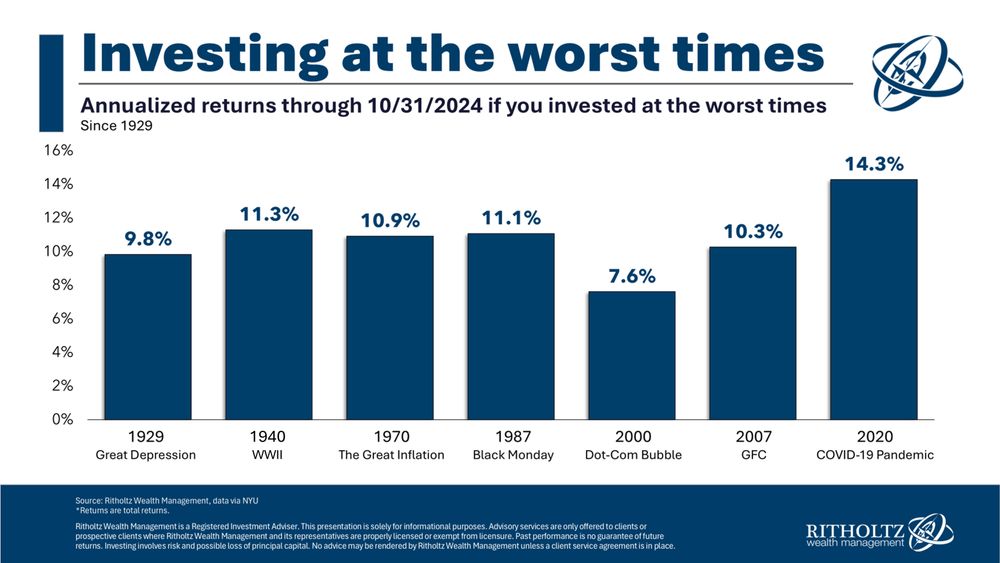

1928-2024: +9.9%

1950-2024: +11.5%

2000-2024: +7.6%

2009-2024: +14.5%

The long-term depends on your time horizon

awealthofcommonsense.com/2025/02/the-...

1928-2024: +9.9%

1950-2024: +11.5%

2000-2024: +7.6%

2009-2024: +14.5%

The long-term depends on your time horizon

awealthofcommonsense.com/2025/02/the-...

2020: Global pandemic

2021: Inflation runs toward 9%

2022: Russia Invades Ukraine

2023: Hamas surprise attack/Israeli-Gaza war

2024: DeepSeek roils markets, challenges US advantages in AI

ritholtz.com/2025/01/nobo...

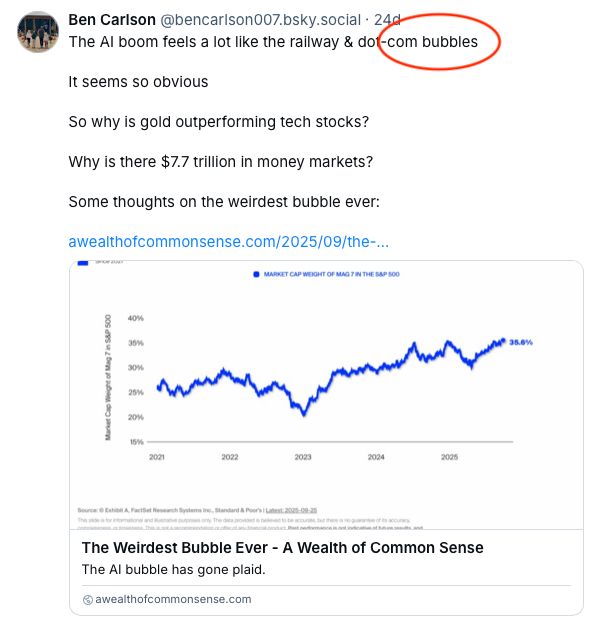

Mag 7 stocks - 35x

S&P 500 ex-Mag 7 - 15.5x

S&P Mid Cap 400 - 16.4x

S&P Small Cap 600 - 16.2x

Mag 7 stocks - 35x

S&P 500 ex-Mag 7 - 15.5x

S&P Mid Cap 400 - 16.4x

S&P Small Cap 600 - 16.2x

In the previous 17 years the S&P was up ~16%/year

It would rise another 115% before the dot-com bubble popped following Greenspan's speech

Things can always get crazier

awealthofcommonsense.com/2024/12/sign...

Turning thoughts into words sharpens reasoning. What's fuzzy in your head is clear on the page.

"I'm not a writer" shouldn't stop you from writing. Writing is a tool for thinking.

Turning thoughts into words sharpens reasoning. What's fuzzy in your head is clear on the page.

"I'm not a writer" shouldn't stop you from writing. Writing is a tool for thinking.

1️⃣ The S&P 500 has gained 20%+ for two straight years

Three 20%+ years hasn't happened outside of the 1990

But are stocks doomed? Not necessarily.

Big gains happen more often than you think.

1️⃣ The S&P 500 has gained 20%+ for two straight years

Three 20%+ years hasn't happened outside of the 1990

But are stocks doomed? Not necessarily.

Big gains happen more often than you think.

awealthofcommonsense.com/2024/11/the-...

awealthofcommonsense.com/2024/11/the-...