#econsky @aaronsojourner.org @betseystevenson.bsky.social @justinwolfers.bsky.social @jasonfurman.bsky.social @jedkolko.bsky.social

#econsky @aaronsojourner.org @betseystevenson.bsky.social @justinwolfers.bsky.social @jasonfurman.bsky.social @jedkolko.bsky.social

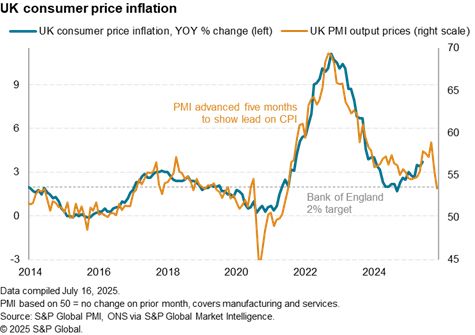

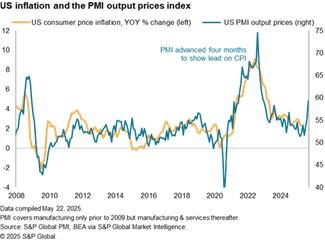

www.spglobal.com/marketintell...

www.spglobal.com/marketintell...

Read all about it in our Week Ahead preview: www.spglobal.com/marketintell...

Read all about it in our Week Ahead preview: www.spglobal.com/marketintell...

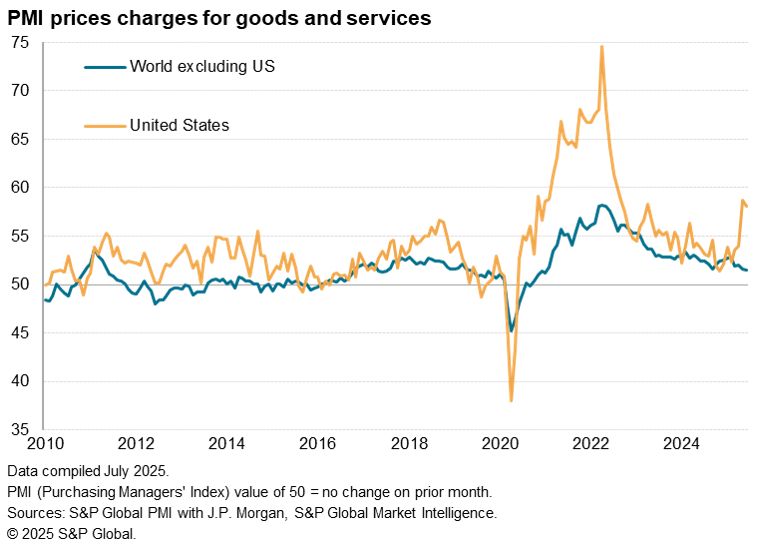

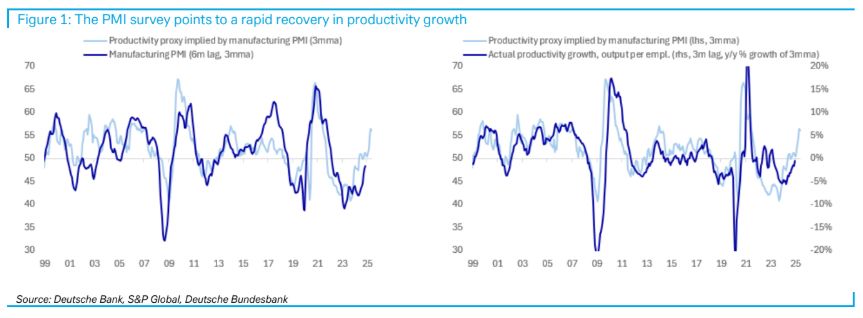

(c) Deutsche Bank

(c) Deutsche Bank

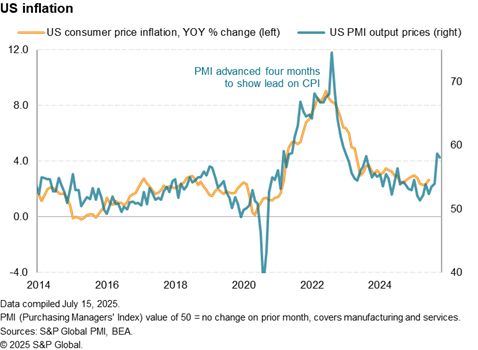

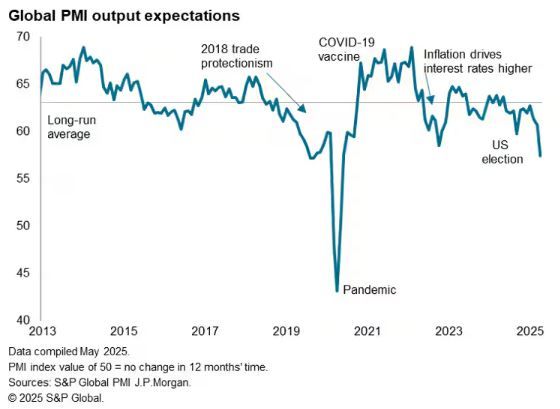

Read more in our free-to-read preview of the week ahead: www.spglobal.com/marketintell...

Read more in our free-to-read preview of the week ahead: www.spglobal.com/marketintell...

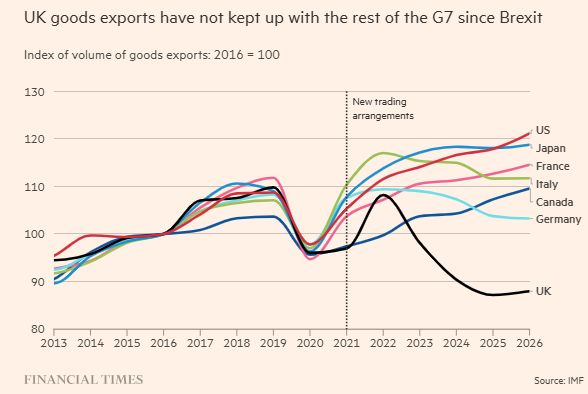

Spoiler, it does not end happily

www.ft.com/content/342d...