Working with firm-level data on corporate finance without the self-serving blinds.

=> Corporate financialization, inequality and climate, but Interested in macro in general. Blogging at https://bakoumertens.quarto.pub

doi.org/10.1093/ser/...

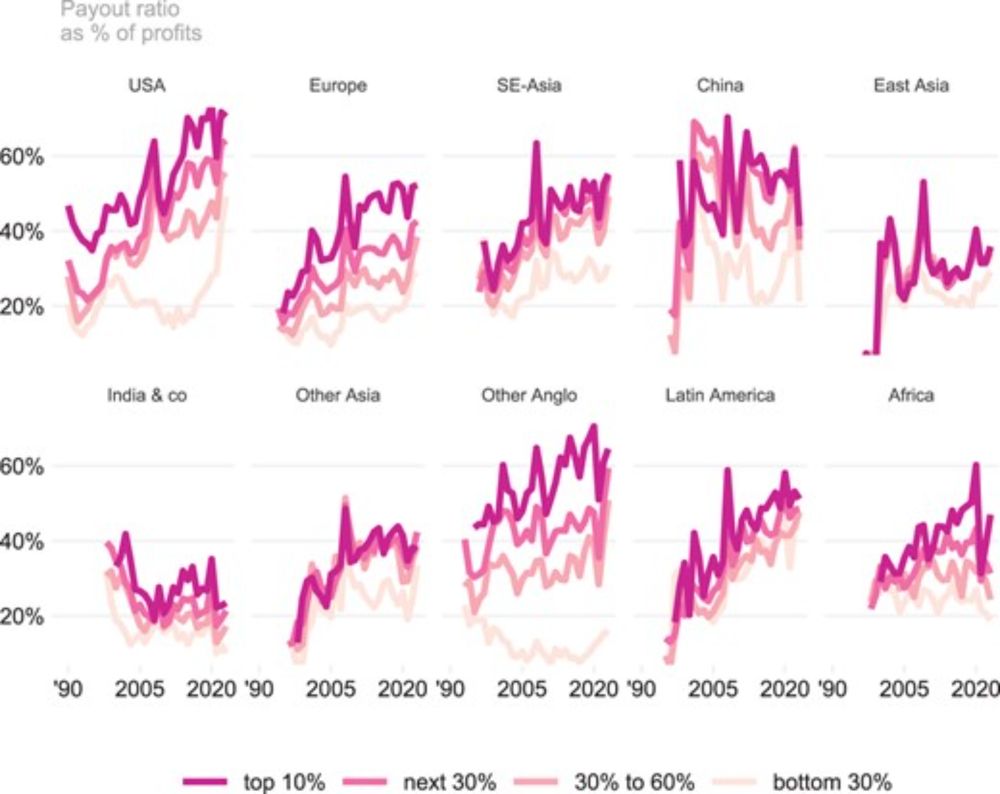

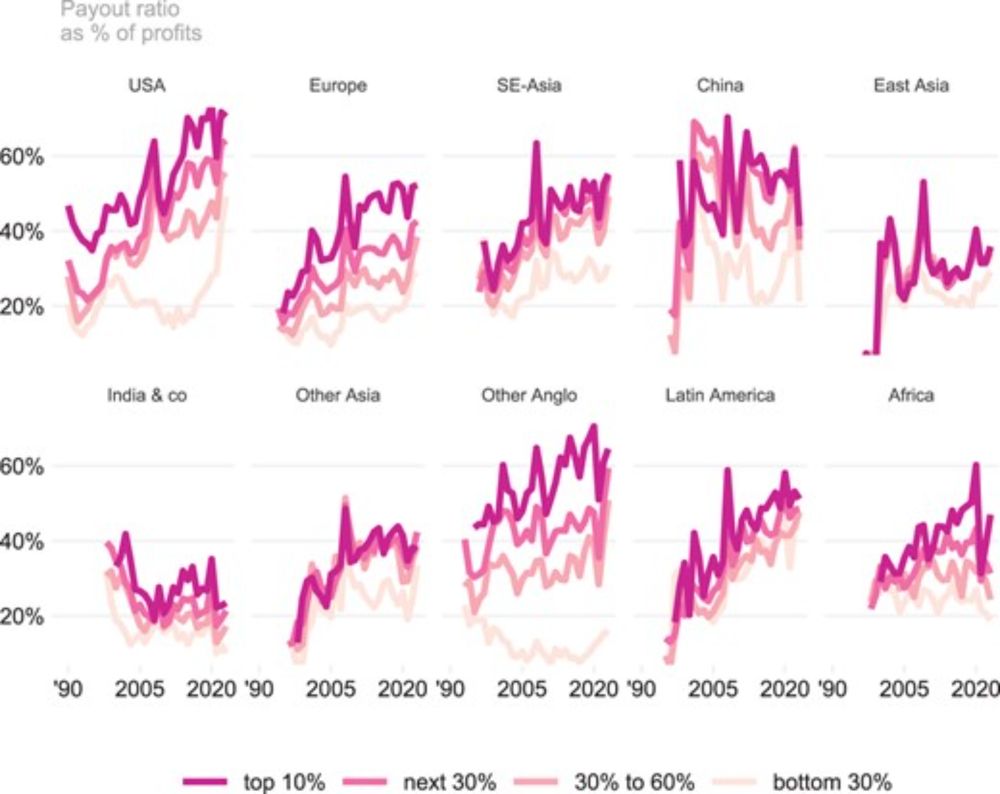

Using firm-level data on all stock listed firms in the world I show that it is not the growth of shareholder remunerations that causes rising payout ratios, but precisely their inability to fall, their downward rigidity.

crux: "heads, shareholders win, tails, society loses"

shareholders do not share in the costs of negative profit shocks. This ratchets up payout ratio persistently over the ensuing years.

1/n

crux: "heads, shareholders win, tails, society loses"

shareholders do not share in the costs of negative profit shocks. This ratchets up payout ratio persistently over the ensuing years.

1/n

1) Aren't we all shareholders?

2) Do shareholders invest in our economy?

3) Is the stock market a source or a drain of funds?

De aandeelhouder: investeerder, rentenier of parasiet?

www.sampol.be/2024/04/de-a...

1) Aren't we all shareholders?

2) Do shareholders invest in our economy?

3) Is the stock market a source or a drain of funds?

the assumption that shareholders are the key investors in business innovation is simply taken as a given

it's past time to abandon this myth: shareholders of corporations are not always, or even often, “investors.”

@lenorepalladino.bsky.social & Harrison Karlewicz argue we need to abandon the myth that shareholding and investing go hand in hand 🤝 and rethink the regulation of financial markets: rooseveltinstitute.org/publications...

the assumption that shareholders are the key investors in business innovation is simply taken as a given

it's past time to abandon this myth: shareholders of corporations are not always, or even often, “investors.”

doi.org/10.1093/ser/...

Using firm-level data on all stock listed firms in the world I show that it is not the growth of shareholder remunerations that causes rising payout ratios, but precisely their inability to fall, their downward rigidity.

doi.org/10.1093/ser/...

Using firm-level data on all stock listed firms in the world I show that it is not the growth of shareholder remunerations that causes rising payout ratios, but precisely their inability to fall, their downward rigidity.