Working with firm-level data on corporate finance without the self-serving blinds.

=> Corporate financialization, inequality and climate, but Interested in macro in general. Blogging at https://bakoumertens.quarto.pub

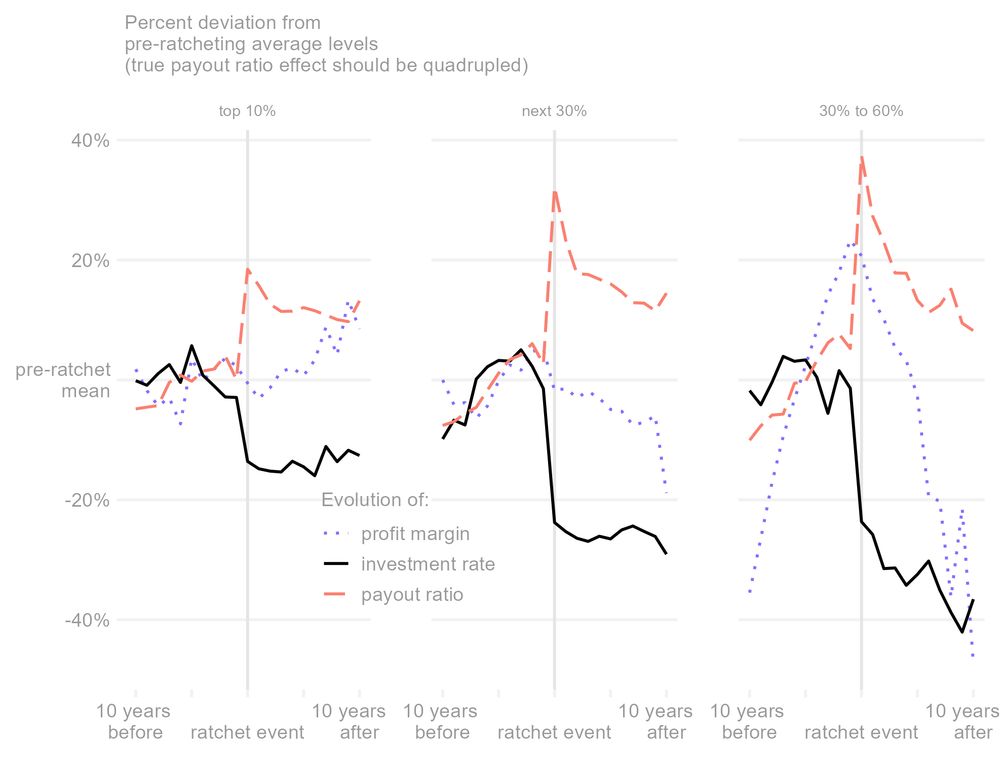

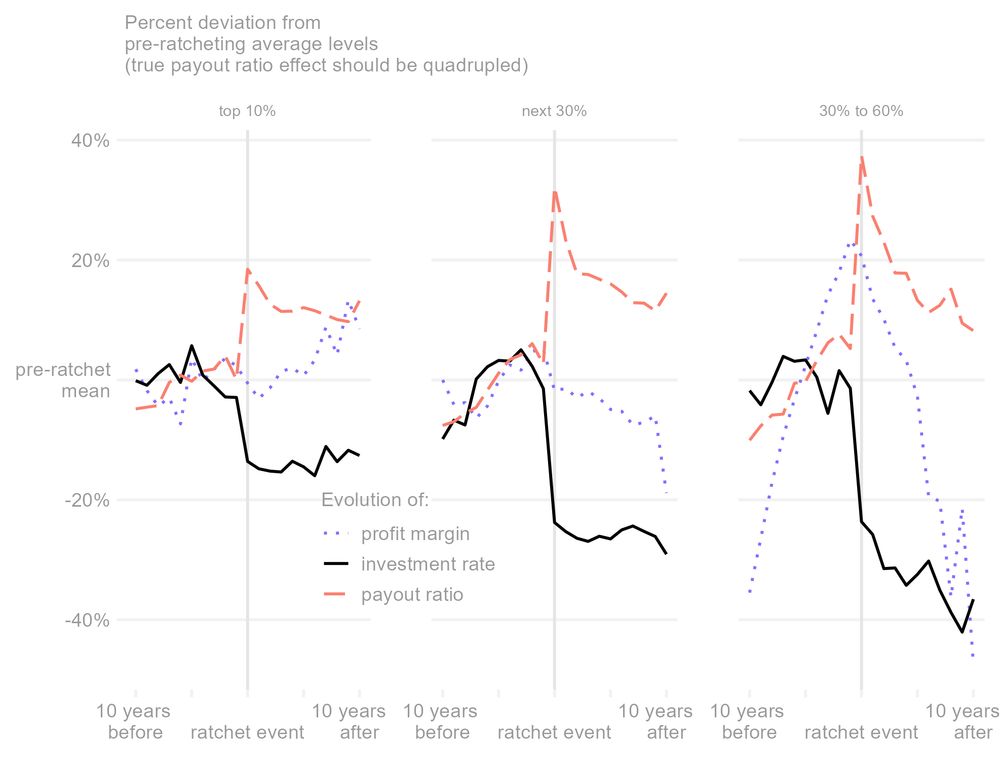

sneak peak: ratchet events cause persistently: 1) higher payout ratios, 2) higher indebtedness and 3) lower investments.

Hopefully coming soonish!

sneak peak: ratchet events cause persistently: 1) higher payout ratios, 2) higher indebtedness and 3) lower investments.

Hopefully coming soonish!

What does the data say?

1) Aggregate payout ratios are structured along the frequency of ratchet behaviour, across size, sector & region (although differences do exist)

What does the data say?

1) Aggregate payout ratios are structured along the frequency of ratchet behaviour, across size, sector & region (although differences do exist)

=> Upward trend in both payout ratios and profits can emerge despite falling payout ratios whenever profits rise!

=> Upward trend in both payout ratios and profits can emerge despite falling payout ratios whenever profits rise!

1) Aggregate payout ratios are structured along the frequency of ratchet behaviour

2) At the firm level each ratchet event persistently raises the payout ratio for a decade (staggered DiD)

1) Aggregate payout ratios are structured along the frequency of ratchet behaviour

2) At the firm level each ratchet event persistently raises the payout ratio for a decade (staggered DiD)