Mer i dagens Börsmorgon där vi också pratar räntebesked med Annika Winsth och @susannespector.bsky.social

#finanssky

Hela programmet:

PODD

podcasts.apple.com/se/podcast/e...

TV

di.se/ditv/borsmor...

Mer i dagens Börsmorgon där vi också pratar räntebesked med Annika Winsth och @susannespector.bsky.social

#finanssky

Hela programmet:

PODD

podcasts.apple.com/se/podcast/e...

TV

di.se/ditv/borsmor...

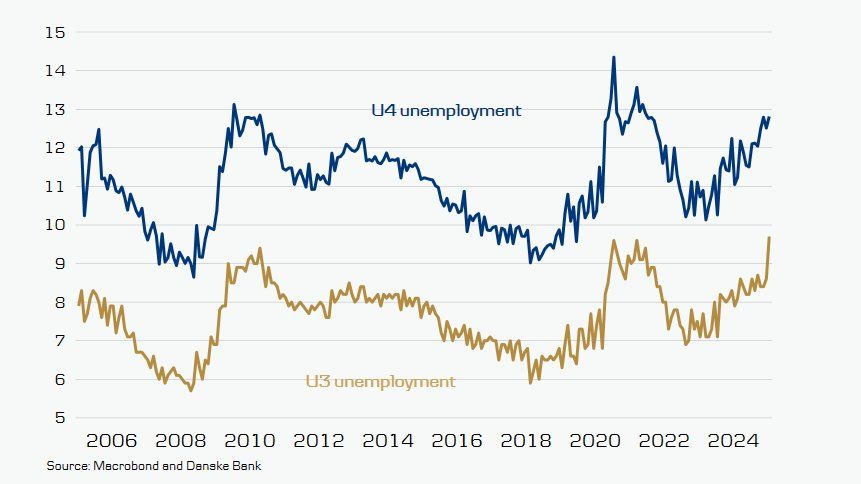

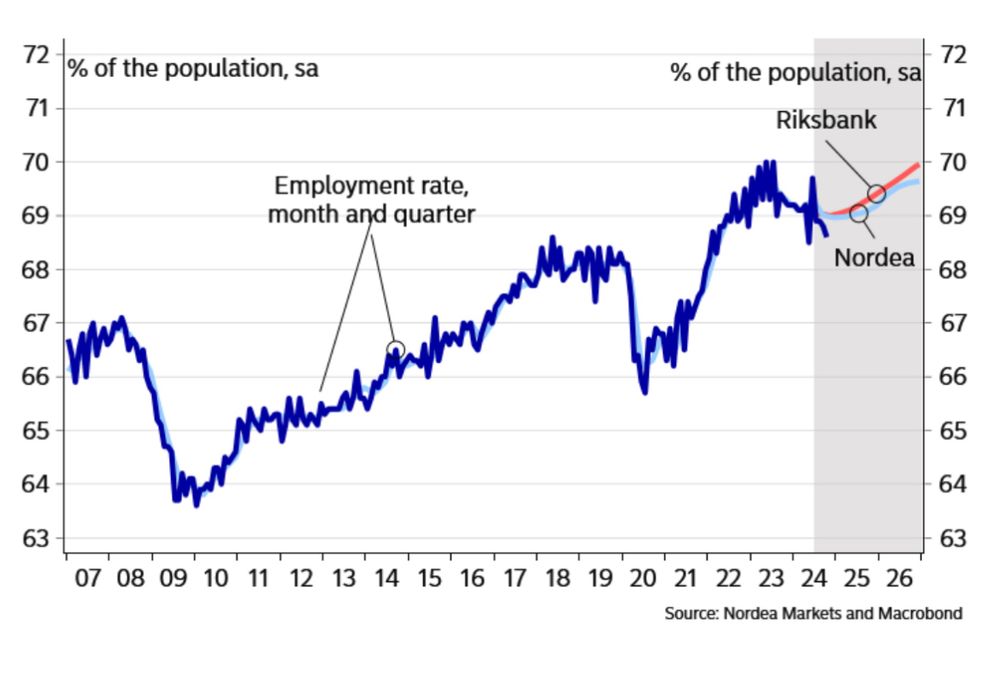

A single month should always be interpreted with caution, but the overall picture is that individuals who exited the labour market during the autumn have now returned.

A single month should always be interpreted with caution, but the overall picture is that individuals who exited the labour market during the autumn have now returned.

kevinrinz.substack.com/p/revisiting...

kevinrinz.substack.com/p/revisiting...

Full seminar (in Swedish): m.youtube.com/watch?v=5dn2...

Full seminar (in Swedish): m.youtube.com/watch?v=5dn2...

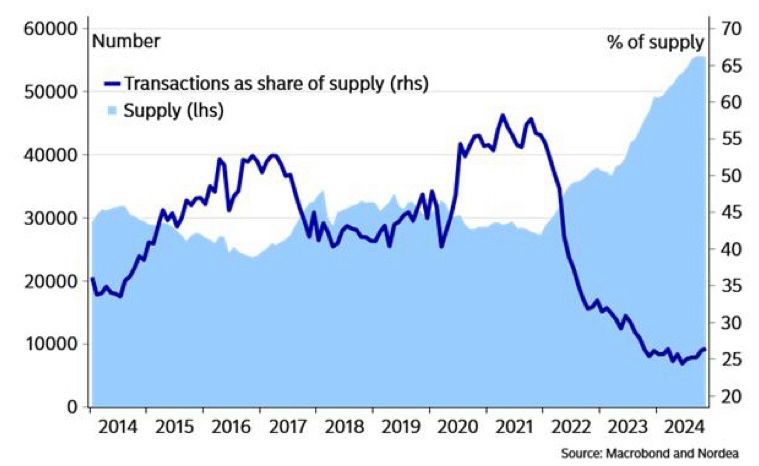

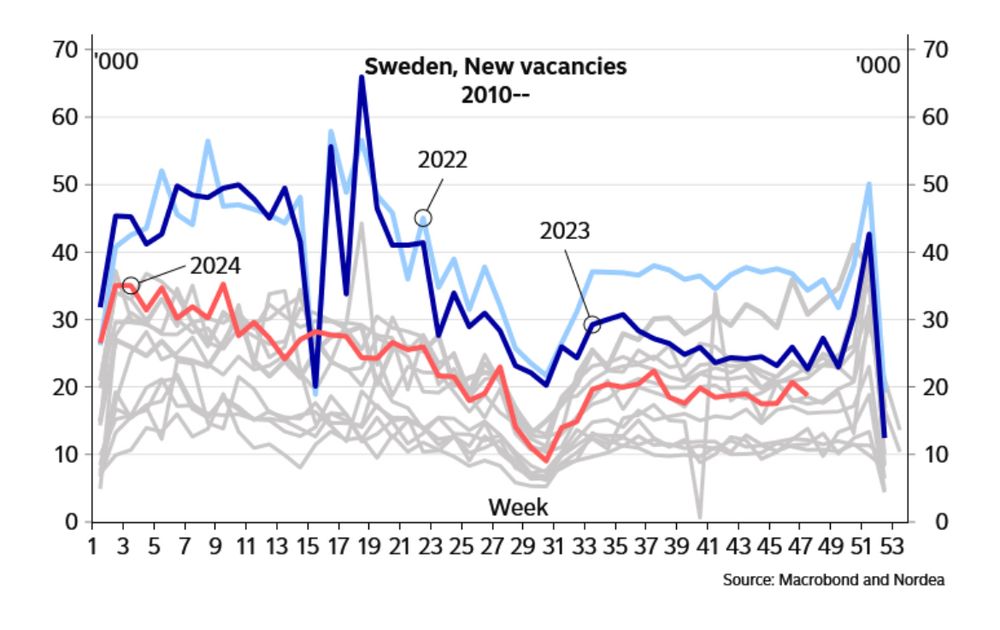

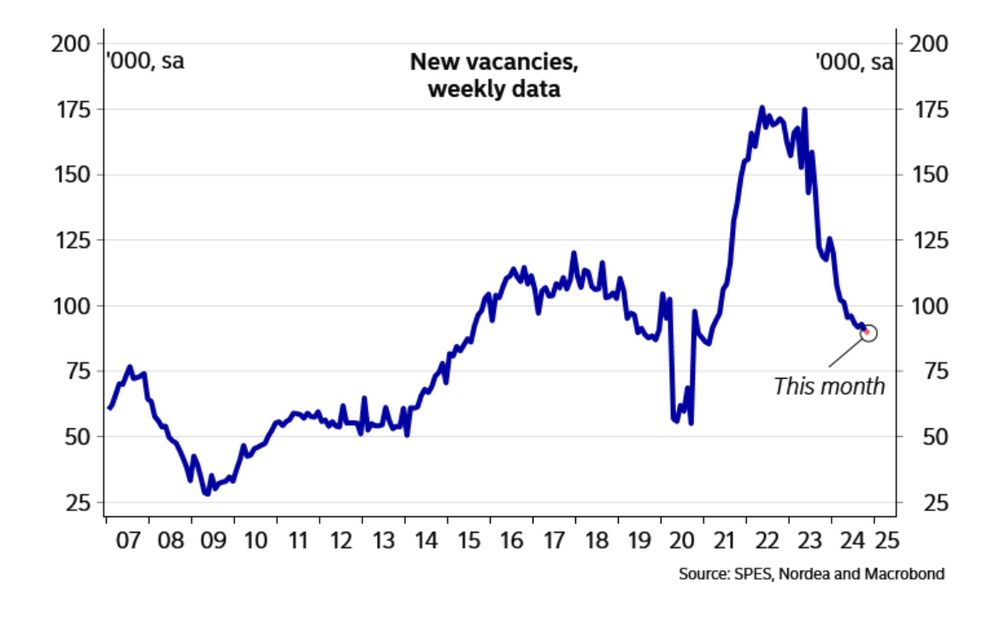

the labor market by 6 months. The fact that we do not yet see a clear turnaround in demand for labor suggests that forecasts of recovery early next year may be too optimistic.

the labor market by 6 months. The fact that we do not yet see a clear turnaround in demand for labor suggests that forecasts of recovery early next year may be too optimistic.

The weekly statistics so far in November show that new job vacancies remain subdued.

The weekly statistics so far in November show that new job vacancies remain subdued.

▫️Employment declined by 0.2% and the employment rate fell further

▫️ The unemployment rate also declined to 8.4% due to a drop in the labor force by 0.5% over the month

▫️ Weaker than forecast and underscores the risks to the expected recovery

▫️Employment declined by 0.2% and the employment rate fell further

▫️ The unemployment rate also declined to 8.4% due to a drop in the labor force by 0.5% over the month

▫️ Weaker than forecast and underscores the risks to the expected recovery