Felix Geiger

@flxgeiger.bsky.social

@bundesbank | views are my own | private | monetary policy, financial markets, finance, economics | retweets, likes and following do not imply endorsement

𝗡𝗲𝘄 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵: 𝗠𝗜𝗟𝗔 (𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆-𝗜𝗻𝘁𝗲𝗹𝗹𝗶𝗴𝗲𝗻𝘁 𝗟𝗮𝗻𝗴𝘂𝗮𝗴𝗲 𝗔𝗴𝗲𝗻𝘁)

We introduce MILA—a new AI-driven solution for analyzing central bank communication.

MILA operates on individual sentences by using the macro and in-document context. 1/n

We introduce MILA—a new AI-driven solution for analyzing central bank communication.

MILA operates on individual sentences by using the macro and in-document context. 1/n

April 9, 2025 at 9:22 PM

𝗡𝗲𝘄 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵: 𝗠𝗜𝗟𝗔 (𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆-𝗜𝗻𝘁𝗲𝗹𝗹𝗶𝗴𝗲𝗻𝘁 𝗟𝗮𝗻𝗴𝘂𝗮𝗴𝗲 𝗔𝗴𝗲𝗻𝘁)

We introduce MILA—a new AI-driven solution for analyzing central bank communication.

MILA operates on individual sentences by using the macro and in-document context. 1/n

We introduce MILA—a new AI-driven solution for analyzing central bank communication.

MILA operates on individual sentences by using the macro and in-document context. 1/n

Reposted by Felix Geiger

Guten Morgen aus #Frankfurt!

Wir begrüßen Sie auf unserem offiziellen Bluesky-Kanal!👋

Ab heute halten wir Sie hier über alles Wissenswerte rund um die #Geldpolitik, #Bankenaufsicht und #Finanzstabilität sowie über viele weitere Aufgaben der #Bundesbank auf dem Laufenden.

#HerzlichWillkommen

Wir begrüßen Sie auf unserem offiziellen Bluesky-Kanal!👋

Ab heute halten wir Sie hier über alles Wissenswerte rund um die #Geldpolitik, #Bankenaufsicht und #Finanzstabilität sowie über viele weitere Aufgaben der #Bundesbank auf dem Laufenden.

#HerzlichWillkommen

April 9, 2025 at 8:14 AM

Guten Morgen aus #Frankfurt!

Wir begrüßen Sie auf unserem offiziellen Bluesky-Kanal!👋

Ab heute halten wir Sie hier über alles Wissenswerte rund um die #Geldpolitik, #Bankenaufsicht und #Finanzstabilität sowie über viele weitere Aufgaben der #Bundesbank auf dem Laufenden.

#HerzlichWillkommen

Wir begrüßen Sie auf unserem offiziellen Bluesky-Kanal!👋

Ab heute halten wir Sie hier über alles Wissenswerte rund um die #Geldpolitik, #Bankenaufsicht und #Finanzstabilität sowie über viele weitere Aufgaben der #Bundesbank auf dem Laufenden.

#HerzlichWillkommen

How to measure the broader monetary policy stance in the euro area?

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

March 20, 2025 at 1:36 PM

How to measure the broader monetary policy stance in the euro area?

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

At @bundesbank.de, we have developed 𝗠𝗜𝗟𝗔 (𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆-𝗜𝗻𝘁𝗲𝗹𝗹𝗶𝗴𝗲𝗻𝘁 𝗟𝗮𝗻𝗴𝘂𝗮𝗴𝗲 𝗔𝗴𝗲𝗻𝘁) - an AI tool designed to evaluate ECB communication, assessing individual sentences from monetary policy statements and speeches given in-document as well as the macro context. \1 #EconSky

March 18, 2025 at 8:55 PM

At @bundesbank.de, we have developed 𝗠𝗜𝗟𝗔 (𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆-𝗜𝗻𝘁𝗲𝗹𝗹𝗶𝗴𝗲𝗻𝘁 𝗟𝗮𝗻𝗴𝘂𝗮𝗴𝗲 𝗔𝗴𝗲𝗻𝘁) - an AI tool designed to evaluate ECB communication, assessing individual sentences from monetary policy statements and speeches given in-document as well as the macro context. \1 #EconSky

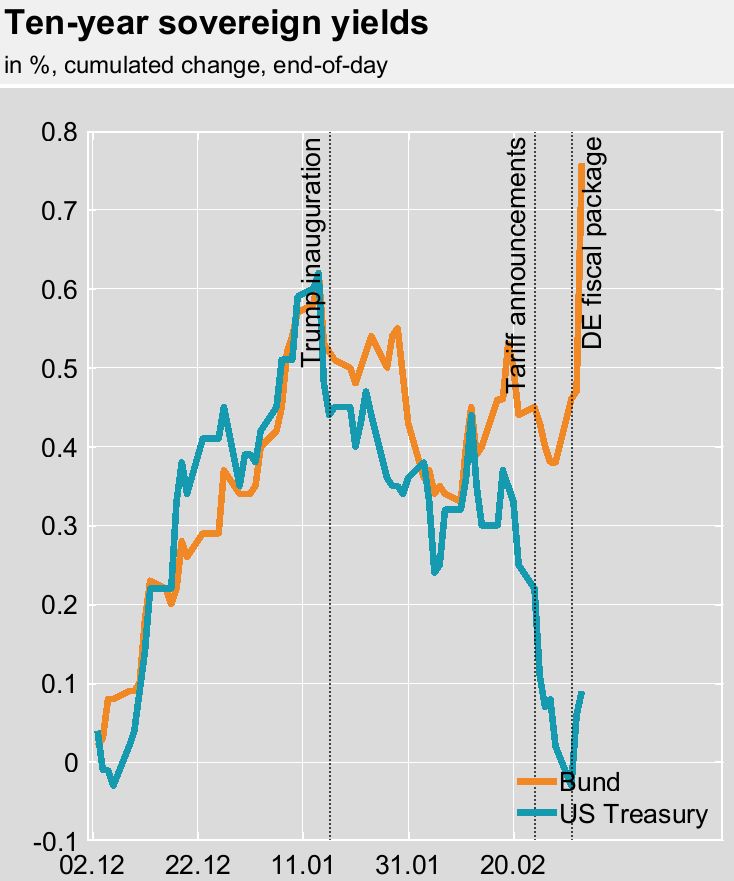

The script has flipped 🌎

- Euro area macro drives euro yields aka Bunds up

- US macro drives these yields down.

- Euro area macro drives euro yields aka Bunds up

- US macro drives these yields down.

March 6, 2025 at 5:41 PM

The script has flipped 🌎

- Euro area macro drives euro yields aka Bunds up

- US macro drives these yields down.

- Euro area macro drives euro yields aka Bunds up

- US macro drives these yields down.

US Treasuries: slide. 🛝

Bunds: hold my beer. 🍺

Bunds: hold my beer. 🍺

March 6, 2025 at 12:41 PM

US Treasuries: slide. 🛝

Bunds: hold my beer. 🍺

Bunds: hold my beer. 🍺

Reposted by Felix Geiger

Yesterday I delivered a speech with the title “No longer convenient? Safe asset abundance and r*” at the @bankofengland.bsky.social's #2025BEARconference. Let me summarise the main messages in a 🧵. 1/16

Moving from a global savings to a global bond glut is putting upward pressure on the real equilibrium rate, says Executive Board member @isabelschnabel.bsky.social. Monetary policy may be less restrictive and balance sheet policies less effective than thought.

www.ecb.europa.eu/press/key/da...

www.ecb.europa.eu/press/key/da...

February 26, 2025 at 9:38 AM

Yesterday I delivered a speech with the title “No longer convenient? Safe asset abundance and r*” at the @bankofengland.bsky.social's #2025BEARconference. Let me summarise the main messages in a 🧵. 1/16

This is an important observation by @isabelschnabel.bsky.social:

Typically, tight monetary policy transmits also by increasing risk premia on financial markets. Without it, transmission is notably weaker.

During the recent hiking cycle, we did not observe this feature.

bsky.app/profile/flxg...

Typically, tight monetary policy transmits also by increasing risk premia on financial markets. Without it, transmission is notably weaker.

During the recent hiking cycle, we did not observe this feature.

bsky.app/profile/flxg...

Transmission: Our easing has been transmitted smoothly, as seen in short-term rates and bank lending rates. Sovereign bond yields have been broadly stable after a strong repricing in 2022, representing the new normal. Strong risk appetite has boosted equity prices and compressed credit spreads. 9/16

February 19, 2025 at 6:29 PM

This is an important observation by @isabelschnabel.bsky.social:

Typically, tight monetary policy transmits also by increasing risk premia on financial markets. Without it, transmission is notably weaker.

During the recent hiking cycle, we did not observe this feature.

bsky.app/profile/flxg...

Typically, tight monetary policy transmits also by increasing risk premia on financial markets. Without it, transmission is notably weaker.

During the recent hiking cycle, we did not observe this feature.

bsky.app/profile/flxg...

Reposted by Felix Geiger

In my interview with @financialtimes.com published today I explained my current thinking about the @ecb.europa.eu ’s monetary policy and gave some personal reflections on the upcoming update of our monetary policy strategy. Let me briefly summarise the main points in a 🧵. 1/16

As we can no longer be confident that our monetary policy is restrictive, the direction of travel is less clear, Executive Board member @isabelschnabel.bsky.social tells @financialtimes.com. We are nearing the point where we may need to pause or halt our rate cuts.

www.ecb.europa.eu/press/inter/...

www.ecb.europa.eu/press/inter/...

February 19, 2025 at 4:14 PM

In my interview with @financialtimes.com published today I explained my current thinking about the @ecb.europa.eu ’s monetary policy and gave some personal reflections on the upcoming update of our monetary policy strategy. Let me briefly summarise the main points in a 🧵. 1/16

Reposted by Felix Geiger

As we can no longer be confident that our monetary policy is restrictive, the direction of travel is less clear, Executive Board member @isabelschnabel.bsky.social tells @financialtimes.com. We are nearing the point where we may need to pause or halt our rate cuts.

www.ecb.europa.eu/press/inter/...

www.ecb.europa.eu/press/inter/...

February 19, 2025 at 11:02 AM

As we can no longer be confident that our monetary policy is restrictive, the direction of travel is less clear, Executive Board member @isabelschnabel.bsky.social tells @financialtimes.com. We are nearing the point where we may need to pause or halt our rate cuts.

www.ecb.europa.eu/press/inter/...

www.ecb.europa.eu/press/inter/...

Reposted by Felix Geiger

Many #ECB watchers have waited for this article. Chart A shows the huge model uncertainty surrounding the estimates. Adding parameter and filter uncertainty, data revisions and considering all models (not just those available for Q4 2024), you can see what we know about r* ... very little.

Updated estimates of the euro area natural interest rate remain broadly unchanged since the end of 2023 following a modest post-pandemic increase, our latest #EconomicBulletin finds.

Read more here www.ecb.europa.eu/press/econom...

Read more here www.ecb.europa.eu/press/econom...

February 7, 2025 at 6:05 PM

Many #ECB watchers have waited for this article. Chart A shows the huge model uncertainty surrounding the estimates. Adding parameter and filter uncertainty, data revisions and considering all models (not just those available for Q4 2024), you can see what we know about r* ... very little.

Reposted by Felix Geiger

To all econ students on the market and advisors: I am thinking about filling an additional postdoc position at the University of Mannheim working on portfolio choice, wealth inequality, and labor markets. Interested? If yes, please let me know!

sites.google.com/site/kuhneco...

sites.google.com/site/kuhneco...

Moritz Kuhn

Moritz Kuhn

Professor

Department of Economics

University of Mannheim

L 7, 3-5, 68161 Mannheim, Germany

mokuhn@uni-mannheim.de

+49 621 181 1929

Office hours: please send an email (judith.price@uni-ma...

sites.google.com

February 6, 2025 at 5:34 PM

To all econ students on the market and advisors: I am thinking about filling an additional postdoc position at the University of Mannheim working on portfolio choice, wealth inequality, and labor markets. Interested? If yes, please let me know!

sites.google.com/site/kuhneco...

sites.google.com/site/kuhneco...

Reposted by Felix Geiger

It's high time to have another look at interesting papers like this one!

"Anticipation effects of protectionist U.S. trade policies" by Norbert Metiu.

Article in the Journal of International Economics:

www.sciencedirect.com/science/arti...

Working paper:

papers.ssrn.com/sol3/papers....

"Anticipation effects of protectionist U.S. trade policies" by Norbert Metiu.

Article in the Journal of International Economics:

www.sciencedirect.com/science/arti...

Working paper:

papers.ssrn.com/sol3/papers....

February 3, 2025 at 2:21 PM

It's high time to have another look at interesting papers like this one!

"Anticipation effects of protectionist U.S. trade policies" by Norbert Metiu.

Article in the Journal of International Economics:

www.sciencedirect.com/science/arti...

Working paper:

papers.ssrn.com/sol3/papers....

"Anticipation effects of protectionist U.S. trade policies" by Norbert Metiu.

Article in the Journal of International Economics:

www.sciencedirect.com/science/arti...

Working paper:

papers.ssrn.com/sol3/papers....

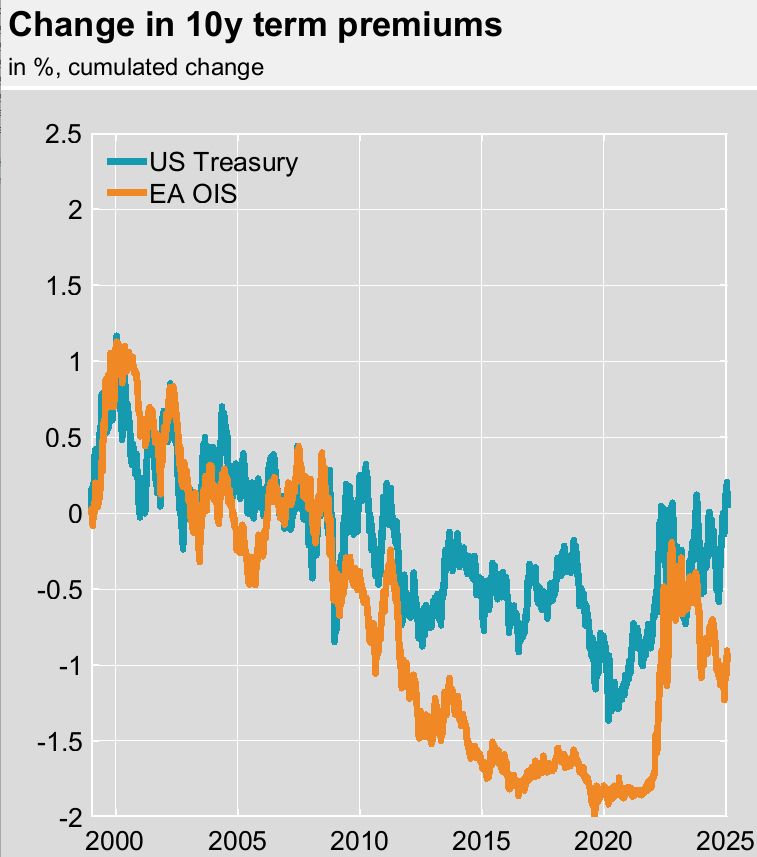

🧵As 𝘁𝗲𝗿𝗺 𝗽𝗿𝗲𝗺𝗶𝘂𝗺𝘀 took center stage these days - Chart depicts dynamics for US and EA 1/n

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

January 31, 2025 at 1:20 PM

🧵As 𝘁𝗲𝗿𝗺 𝗽𝗿𝗲𝗺𝗶𝘂𝗺𝘀 took center stage these days - Chart depicts dynamics for US and EA 1/n

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

Reposted by Felix Geiger

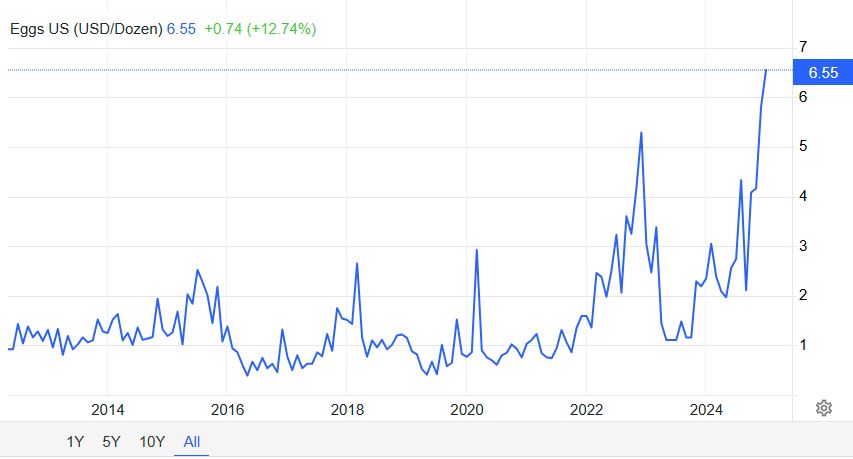

An executive order to defeat inflation:

"I hereby order the heads of all executive departments and agencies to deliver emergency price relief, consistent with applicable law, to the American people and increase the prosperity of the American worker."

www.whitehouse.gov/presidential...

"I hereby order the heads of all executive departments and agencies to deliver emergency price relief, consistent with applicable law, to the American people and increase the prosperity of the American worker."

www.whitehouse.gov/presidential...

January 24, 2025 at 6:12 PM

An executive order to defeat inflation:

"I hereby order the heads of all executive departments and agencies to deliver emergency price relief, consistent with applicable law, to the American people and increase the prosperity of the American worker."

www.whitehouse.gov/presidential...

"I hereby order the heads of all executive departments and agencies to deliver emergency price relief, consistent with applicable law, to the American people and increase the prosperity of the American worker."

www.whitehouse.gov/presidential...

Reposted by Felix Geiger

The folks obsessively posting about egg prices for the past few years have gone strangely quiet just as egg prices hit an all-time high.

January 23, 2025 at 8:08 PM

The folks obsessively posting about egg prices for the past few years have gone strangely quiet just as egg prices hit an all-time high.

🧵In our latest report of @bundesbank.de, we examine how 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀' 𝗿𝗶𝘀𝗸 𝗮𝗽𝗽𝗲𝘁𝗶𝘁𝗲 in the euro area interacts with 𝗺𝗼𝗻𝗲𝘁𝗮𝗿𝘆 𝗽𝗼𝗹𝗶𝗰𝘆 𝘁𝗼 𝘀𝗵𝗮𝗽𝗲 𝗺𝗮𝗰𝗿𝗼𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗼𝘂𝘁𝗰𝗼𝗺𝗲𝘀. Key takeaways ⬇️1/n #EconSky

January 21, 2025 at 1:42 PM

🧵In our latest report of @bundesbank.de, we examine how 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀' 𝗿𝗶𝘀𝗸 𝗮𝗽𝗽𝗲𝘁𝗶𝘁𝗲 in the euro area interacts with 𝗺𝗼𝗻𝗲𝘁𝗮𝗿𝘆 𝗽𝗼𝗹𝗶𝗰𝘆 𝘁𝗼 𝘀𝗵𝗮𝗽𝗲 𝗺𝗮𝗰𝗿𝗼𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗼𝘂𝘁𝗰𝗼𝗺𝗲𝘀. Key takeaways ⬇️1/n #EconSky

Reposted by Felix Geiger

January 17, 2025 at 11:26 PM

Reposted by Felix Geiger

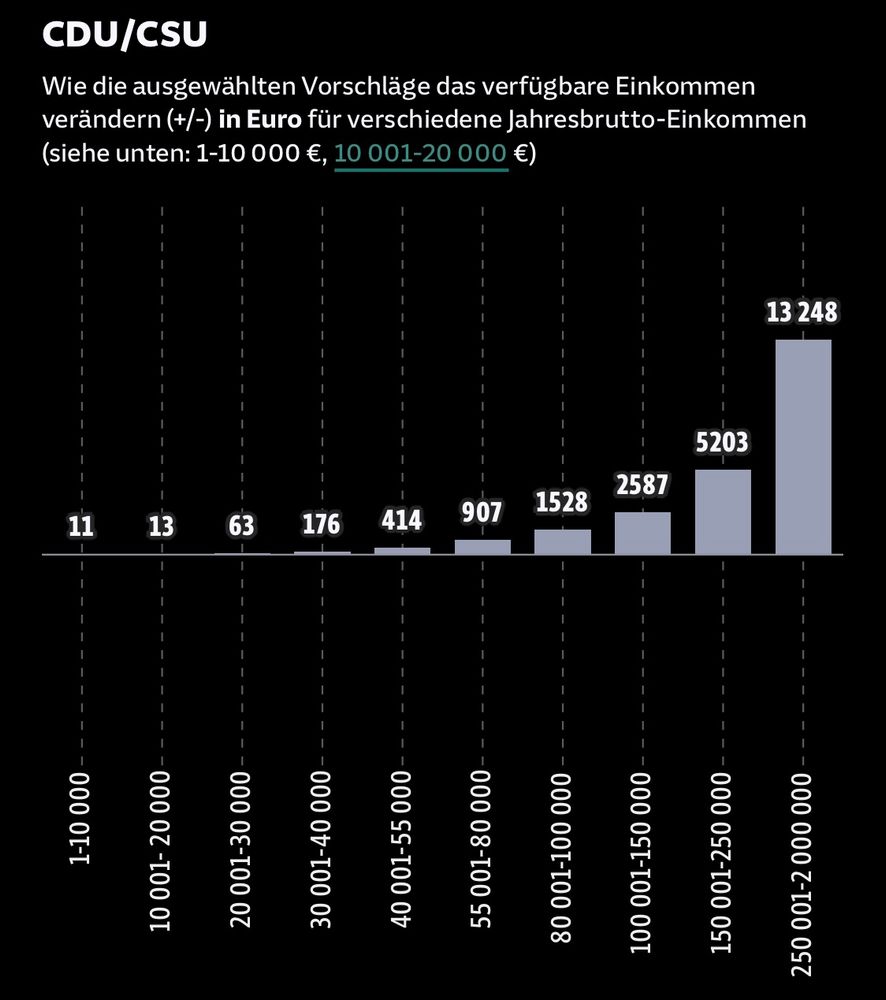

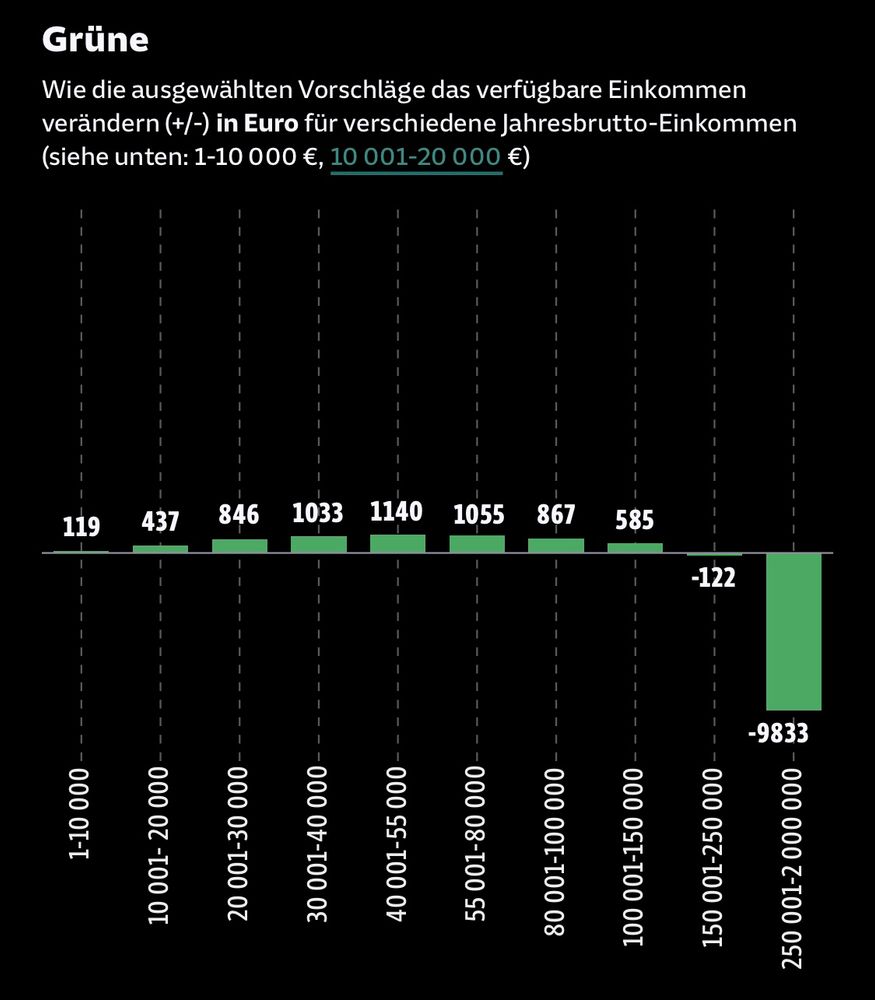

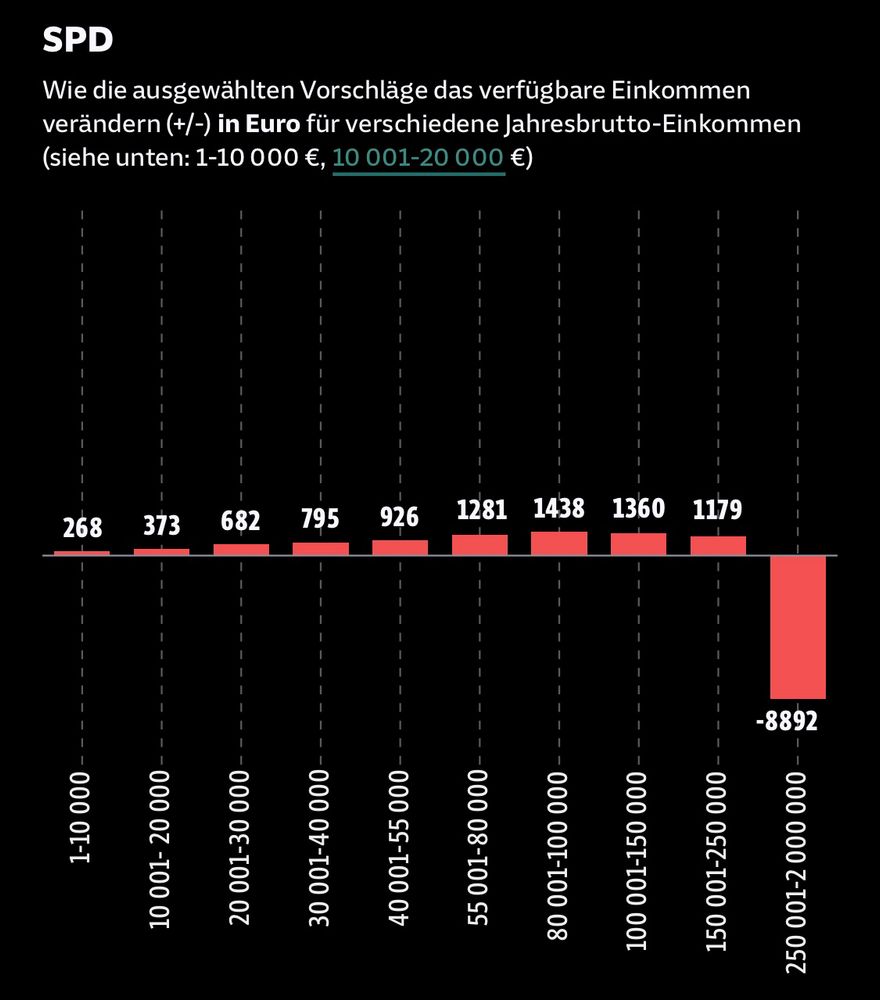

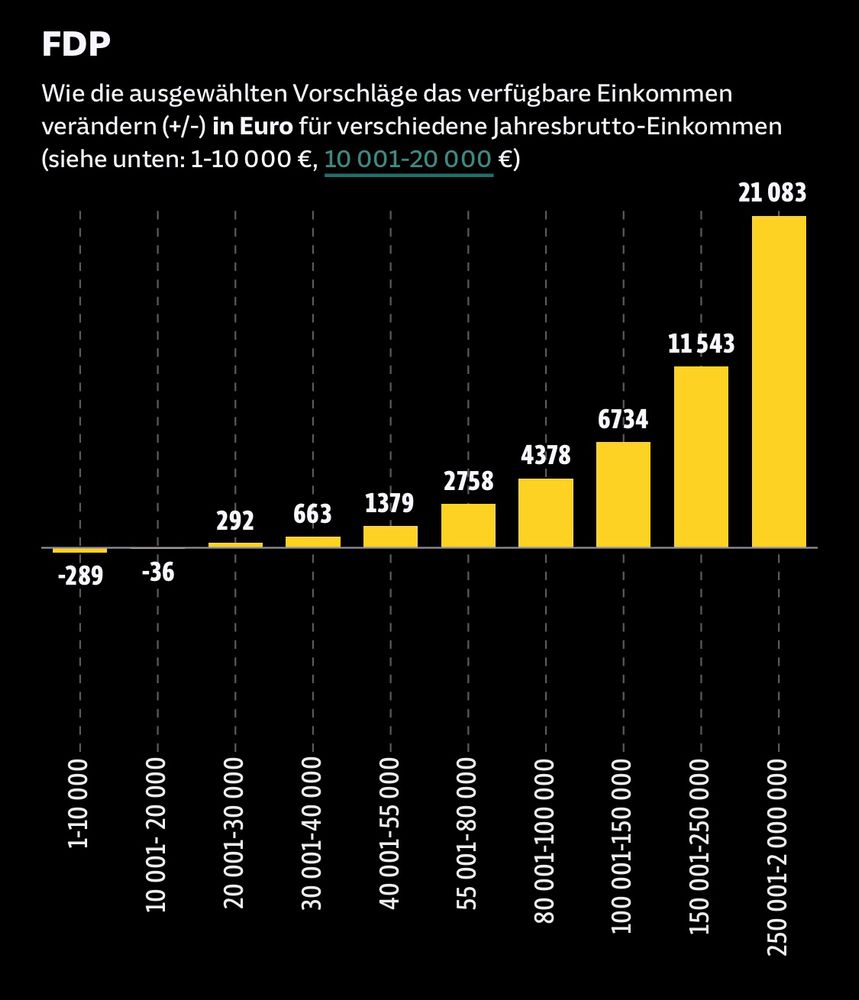

Das ZEW hat ausgerechnet, welche Einkommensgruppen von den Wahlprogrammen der Parteien jeweils am stärksten profitieren: www.sueddeutsche.de/projekte/art...

January 17, 2025 at 4:46 PM

Das ZEW hat ausgerechnet, welche Einkommensgruppen von den Wahlprogrammen der Parteien jeweils am stärksten profitieren: www.sueddeutsche.de/projekte/art...

Reposted by Felix Geiger

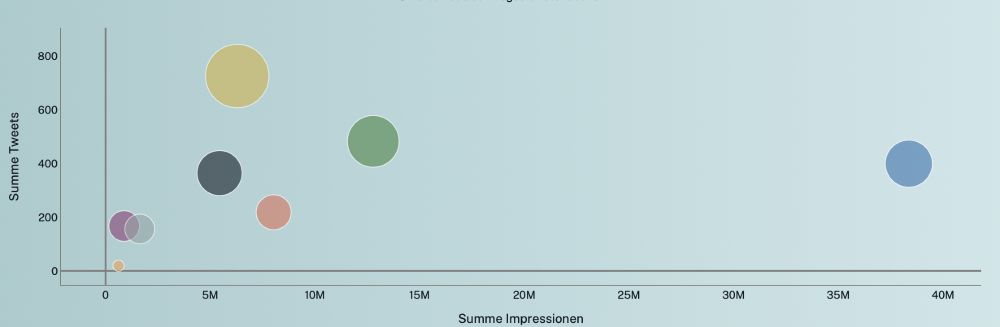

In case you were wondering how things are going in Germany & on X, after Elon Musk announced his support for the far-right "Alternative für Deutschland" (AfD) in the upcoming Federal election:

The chart below shows sums of tweets x impressions by members of parliament over the past 7 days...🧵⤵️

The chart below shows sums of tweets x impressions by members of parliament over the past 7 days...🧵⤵️

January 9, 2025 at 12:38 PM

In case you were wondering how things are going in Germany & on X, after Elon Musk announced his support for the far-right "Alternative für Deutschland" (AfD) in the upcoming Federal election:

The chart below shows sums of tweets x impressions by members of parliament over the past 7 days...🧵⤵️

The chart below shows sums of tweets x impressions by members of parliament over the past 7 days...🧵⤵️

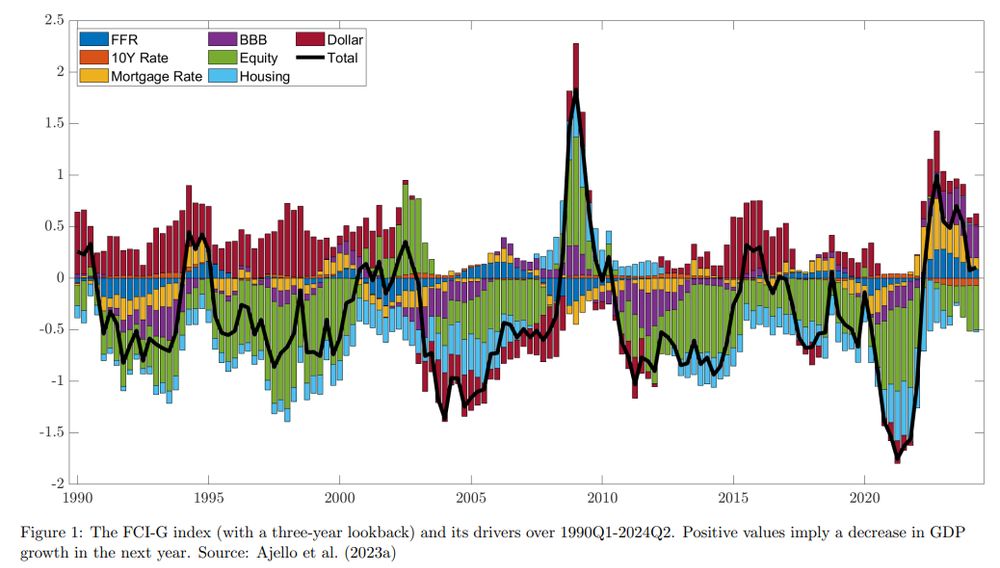

Great paper showing why the US economy keeps surprising to the upside despite high policy rates.

➡️Financial conditions may be loose with high stock valuations and compressed risk spreads

➡️For the economy these conditions matter

➡️By targeting financial conditions, Fed may reduce output volatility

➡️Financial conditions may be loose with high stock valuations and compressed risk spreads

➡️For the economy these conditions matter

➡️By targeting financial conditions, Fed may reduce output volatility

January 16, 2025 at 3:05 PM

Great paper showing why the US economy keeps surprising to the upside despite high policy rates.

➡️Financial conditions may be loose with high stock valuations and compressed risk spreads

➡️For the economy these conditions matter

➡️By targeting financial conditions, Fed may reduce output volatility

➡️Financial conditions may be loose with high stock valuations and compressed risk spreads

➡️For the economy these conditions matter

➡️By targeting financial conditions, Fed may reduce output volatility

Reposted by Felix Geiger

Financial noise disrupts markets and the real economy. Monetary policy that targets financial conditions can stabilize the economy by recruiting arbitrageurs to trade against noise, from Ricardo J. Caballero, Tomás E. Caravello and Alp Simsek https://www.nber.org/papers/w33206

December 4, 2024 at 2:00 PM

Financial noise disrupts markets and the real economy. Monetary policy that targets financial conditions can stabilize the economy by recruiting arbitrageurs to trade against noise, from Ricardo J. Caballero, Tomás E. Caravello and Alp Simsek https://www.nber.org/papers/w33206

Reposted by Felix Geiger

Account of the monetary policy meeting of the Governing Council of the ECB on 11-12 December 2024 www.ecb.europa.eu/press/accoun...

January 16, 2025 at 12:35 PM

Account of the monetary policy meeting of the Governing Council of the ECB on 11-12 December 2024 www.ecb.europa.eu/press/accoun...

Reposted by Felix Geiger

New paper: "𝗧𝗵𝗲 𝗘𝗺𝗼𝘁𝗶𝗼𝗻𝘀 𝗼𝗳 𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆 𝗣𝗼𝗹𝗶𝗰𝘆". We measure the facial and vocal expressions of the ECB presidents at a high frequency.

With @jens-klose.bsky.social, @sinemkandemir.bsky.social, Mamadou-Lamine Barry, Brenton J. Bruns and Victor Smirnov.

The paper: lnkd.in/eR4AXeiz

With @jens-klose.bsky.social, @sinemkandemir.bsky.social, Mamadou-Lamine Barry, Brenton J. Bruns and Victor Smirnov.

The paper: lnkd.in/eR4AXeiz

January 14, 2025 at 9:37 AM

New paper: "𝗧𝗵𝗲 𝗘𝗺𝗼𝘁𝗶𝗼𝗻𝘀 𝗼𝗳 𝗠𝗼𝗻𝗲𝘁𝗮𝗿𝘆 𝗣𝗼𝗹𝗶𝗰𝘆". We measure the facial and vocal expressions of the ECB presidents at a high frequency.

With @jens-klose.bsky.social, @sinemkandemir.bsky.social, Mamadou-Lamine Barry, Brenton J. Bruns and Victor Smirnov.

The paper: lnkd.in/eR4AXeiz

With @jens-klose.bsky.social, @sinemkandemir.bsky.social, Mamadou-Lamine Barry, Brenton J. Bruns and Victor Smirnov.

The paper: lnkd.in/eR4AXeiz