Felix Geiger

@flxgeiger.bsky.social

@bundesbank | views are my own | private | monetary policy, financial markets, finance, economics | retweets, likes and following do not imply endorsement

A recent report featuring key results of MILA: publikationen.bundesbank.de/publikatione...

Monetary policy communication according to artificial intelligence

publikationen.bundesbank.de

April 9, 2025 at 9:22 PM

A recent report featuring key results of MILA: publikationen.bundesbank.de/publikatione...

Our @bundesbank.de research paper dives into the methodology. www.bundesbank.de/resource/blo...

April 9, 2025 at 9:22 PM

Our @bundesbank.de research paper dives into the methodology. www.bundesbank.de/resource/blo...

MILA’s granular approach outperforms typical full-document analyses in replicability and consistency. Despite the stochastic nature of language models, it delivers consistent results - so no need to lower the temperature to ensure replicability 3/

April 9, 2025 at 9:22 PM

MILA’s granular approach outperforms typical full-document analyses in replicability and consistency. Despite the stochastic nature of language models, it delivers consistent results - so no need to lower the temperature to ensure replicability 3/

MILA combines text mining, a large language model (LLama 3.1 70B), mathematical formulas and topic modeling 2/

April 9, 2025 at 9:22 PM

MILA combines text mining, a large language model (LLama 3.1 70B), mathematical formulas and topic modeling 2/

WebappsPublicationsPublications

publikationen.bundesbank.de

March 20, 2025 at 1:36 PM

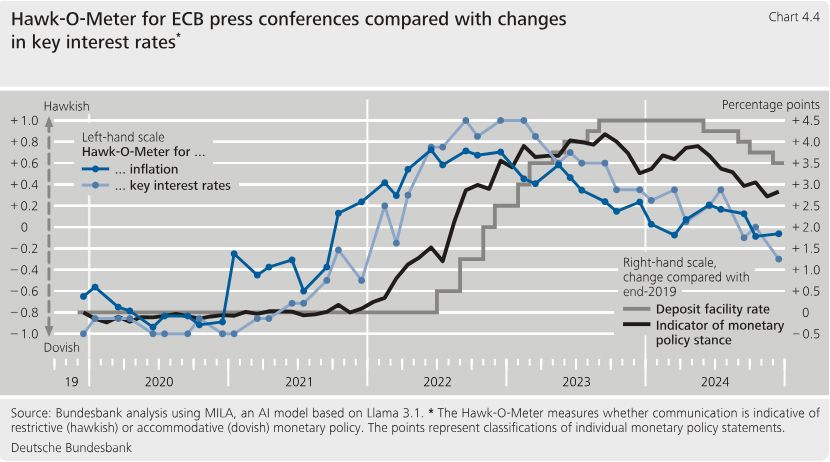

➡️ Recently, the stance has been more accommodative than policy rates suggest. This reflects lower longer-term rates and narrower spreads on sovereign and corporate bonds by historical standards, i.e. given the policy rate level, long-term rates and risk spreads historically tended to be higher. \5

March 20, 2025 at 1:36 PM

➡️ Recently, the stance has been more accommodative than policy rates suggest. This reflects lower longer-term rates and narrower spreads on sovereign and corporate bonds by historical standards, i.e. given the policy rate level, long-term rates and risk spreads historically tended to be higher. \5

➡️ Between 2022 and 2023, the extent of monetary policy tightening was comparable to the actual rise in key interest rates, but tightening began six months earlier given anticipation effects already reflected in financial market prices. \4

March 20, 2025 at 1:36 PM

➡️ Between 2022 and 2023, the extent of monetary policy tightening was comparable to the actual rise in key interest rates, but tightening began six months earlier given anticipation effects already reflected in financial market prices. \4

➡️ The rate suggests that the monetary policy stance between 2012 and 2021 was considerably more accommodative than signalled by policy rates. This comes not as a surprise, given that the proxy rate picks up impact of asset purchases and forward guidance during the effective lower bound regime. \3

March 20, 2025 at 1:36 PM

➡️ The rate suggests that the monetary policy stance between 2012 and 2021 was considerably more accommodative than signalled by policy rates. This comes not as a surprise, given that the proxy rate picks up impact of asset purchases and forward guidance during the effective lower bound regime. \3

➡️ The proxy rate maps common movements of a set of financial market variables to the actual DFR policy rate level following Doh and Choi (2016). 2\

March 20, 2025 at 1:36 PM

➡️ The proxy rate maps common movements of a set of financial market variables to the actual DFR policy rate level following Doh and Choi (2016). 2\

Since 2011, the tone of the ECB Executive Board’s monetary policy speeches has evolved in line with the ECB press conferences and the macroeconomic environment in the euro area. Some dispersion of speeches visible during the recent tightening and easing phase. \4

March 18, 2025 at 8:55 PM

Since 2011, the tone of the ECB Executive Board’s monetary policy speeches has evolved in line with the ECB press conferences and the macroeconomic environment in the euro area. Some dispersion of speeches visible during the recent tightening and easing phase. \4

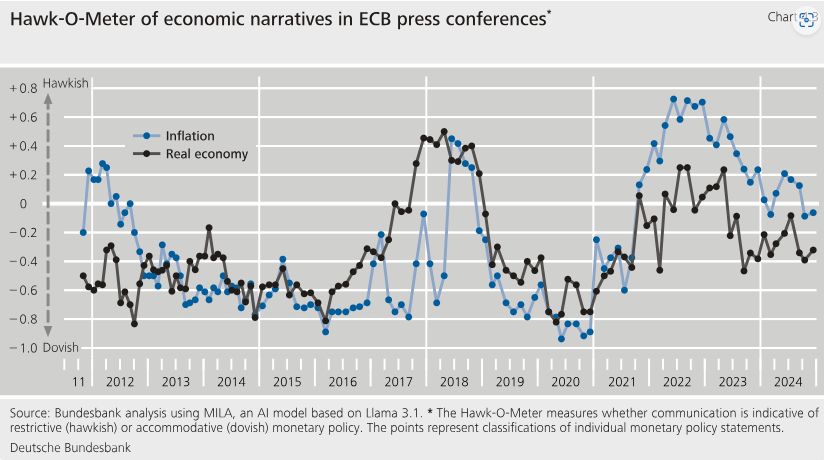

𝗦𝗵𝗶𝗳𝘁𝗶𝗻𝗴 𝗽𝗼𝗹𝗶𝗰𝘆 𝘀𝗶𝗴𝗻𝗮𝗹𝘀: MILA detects a dovish stance in 2020; a balanced inflation narrative in 2021, but still a dovish rate outlook; then a hawkish shift in 2022-23. By 2024, communication became more balanced. \3

March 18, 2025 at 8:55 PM

𝗦𝗵𝗶𝗳𝘁𝗶𝗻𝗴 𝗽𝗼𝗹𝗶𝗰𝘆 𝘀𝗶𝗴𝗻𝗮𝗹𝘀: MILA detects a dovish stance in 2020; a balanced inflation narrative in 2021, but still a dovish rate outlook; then a hawkish shift in 2022-23. By 2024, communication became more balanced. \3

𝗔𝗜-𝗽𝗼𝘄𝗲𝗿𝗲𝗱 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀: MILA provides structured assessments of ECB communication from 2011 to 2024, analyzing around 50,000 sentences on an individual basis. \2

March 18, 2025 at 8:55 PM

𝗔𝗜-𝗽𝗼𝘄𝗲𝗿𝗲𝗱 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀: MILA provides structured assessments of ECB communication from 2011 to 2024, analyzing around 50,000 sentences on an individual basis. \2