If you're interested in why land is so vital in finance everywhere, the rise and fall of Georgism, and how land shaped Japan, China and Singapore, this is the book for you

If you're interested in why land is so vital in finance everywhere, the rise and fall of Georgism, and how land shaped Japan, China and Singapore, this is the book for you

If you're interested, the best thing you can possibly do now is pre-order! Available all over the place - Amazon, Barnes & Noble, Guardian Bookshop and many other bookshops.

If you're interested, the best thing you can possibly do now is pre-order! Available all over the place - Amazon, Barnes & Noble, Guardian Bookshop and many other bookshops.

You can preorder here, or get yourself a print copy! Or ideally, both! Available at a bunch of other places too.

www.amazon.com/Land-Trap-Hi...

You can preorder here, or get yourself a print copy! Or ideally, both! Available at a bunch of other places too.

www.amazon.com/Land-Trap-Hi...

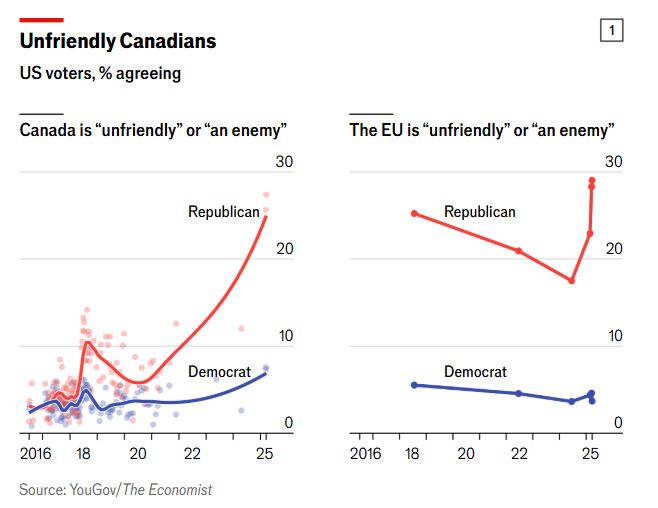

www.economist.com/finance-and-...

www.economist.com/finance-and-...

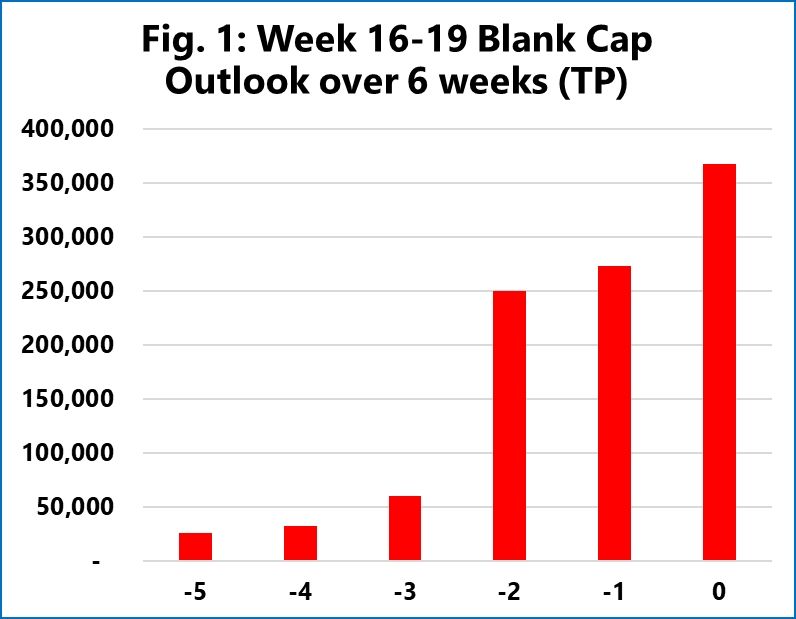

Three weeks ago, about 60,000 TEU (a measure of container volume) were scheduled to be "blanked" from April 16-May 10 (cancelled voyages/stops at a port). Now the figure is *367,800*

www.sea-intelligence.com/press-room/3...

Three weeks ago, about 60,000 TEU (a measure of container volume) were scheduled to be "blanked" from April 16-May 10 (cancelled voyages/stops at a port). Now the figure is *367,800*

www.sea-intelligence.com/press-room/3...

It's not just the mindless economic hit. Amateurish execution undermines the widespread belief in pro-market US governance

www.economist.com/finance-and-...

It's not just the mindless economic hit. Amateurish execution undermines the widespread belief in pro-market US governance

www.economist.com/finance-and-...

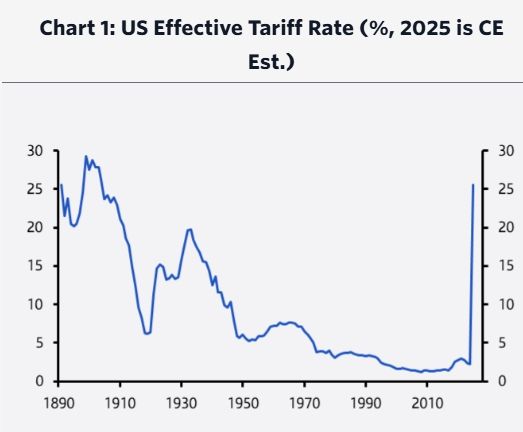

"The effective tariff rate on all imports will rise from 2.3% last year to around 26%, leaving it at a 131-year high"

"The effective tariff rate on all imports will rise from 2.3% last year to around 26%, leaving it at a 131-year high"

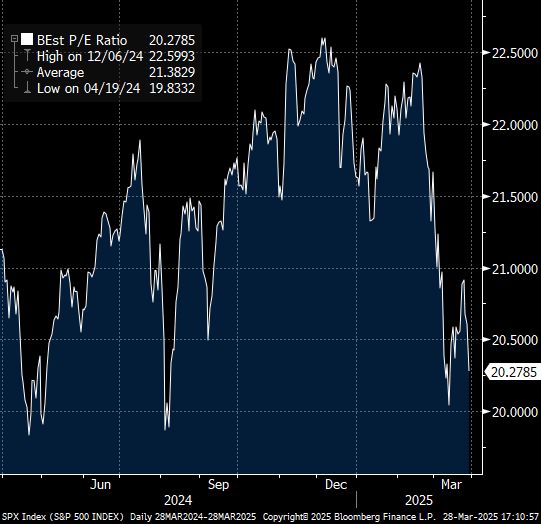

Investors in Dubai, Singapore and Zurich will not feel the same compunctions. My column this week.

www.economist.com/finance-and-...

Investors in Dubai, Singapore and Zurich will not feel the same compunctions. My column this week.

www.economist.com/finance-and-...