If you're interested in why land is so vital in finance everywhere, the rise and fall of Georgism, and how land shaped Japan, China and Singapore, this is the book for you

If you're interested in why land is so vital in finance everywhere, the rise and fall of Georgism, and how land shaped Japan, China and Singapore, this is the book for you

You can preorder here, or get yourself a print copy! Or ideally, both! Available at a bunch of other places too.

www.amazon.com/Land-Trap-Hi...

You can preorder here, or get yourself a print copy! Or ideally, both! Available at a bunch of other places too.

www.amazon.com/Land-Trap-Hi...

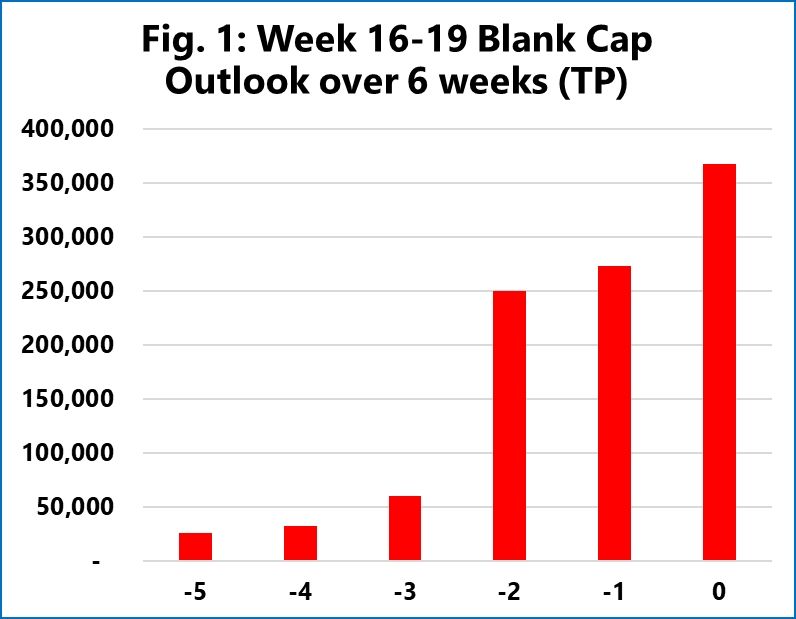

Three weeks ago, about 60,000 TEU (a measure of container volume) were scheduled to be "blanked" from April 16-May 10 (cancelled voyages/stops at a port). Now the figure is *367,800*

www.sea-intelligence.com/press-room/3...

Three weeks ago, about 60,000 TEU (a measure of container volume) were scheduled to be "blanked" from April 16-May 10 (cancelled voyages/stops at a port). Now the figure is *367,800*

www.sea-intelligence.com/press-room/3...

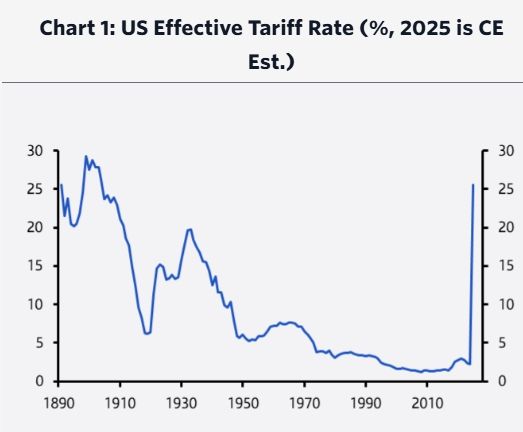

"The effective tariff rate on all imports will rise from 2.3% last year to around 26%, leaving it at a 131-year high"

"The effective tariff rate on all imports will rise from 2.3% last year to around 26%, leaving it at a 131-year high"

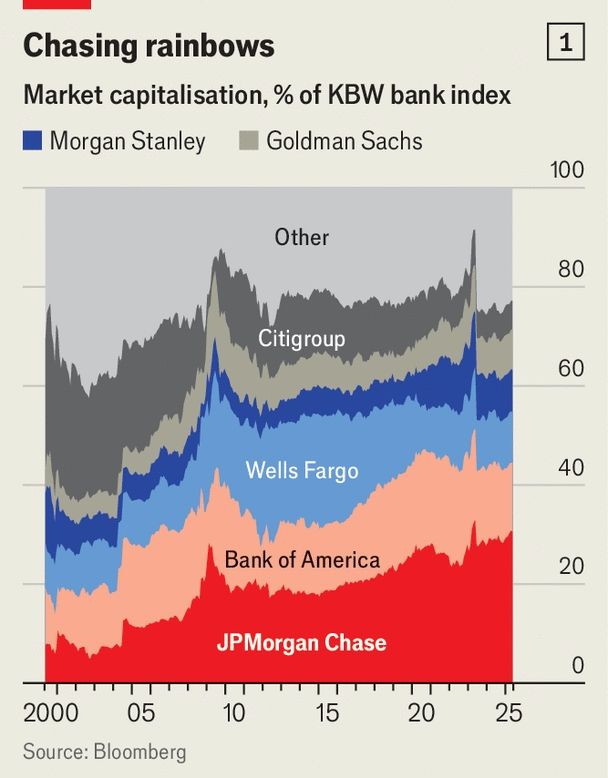

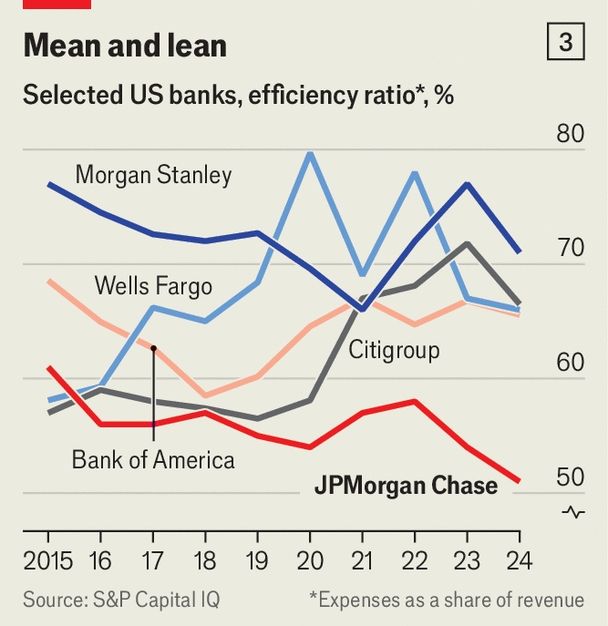

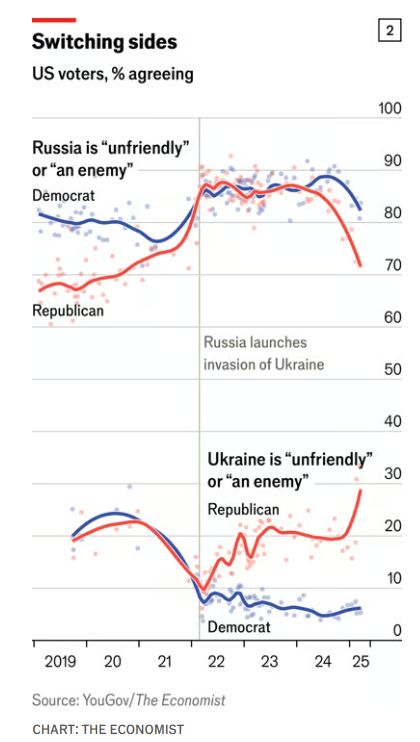

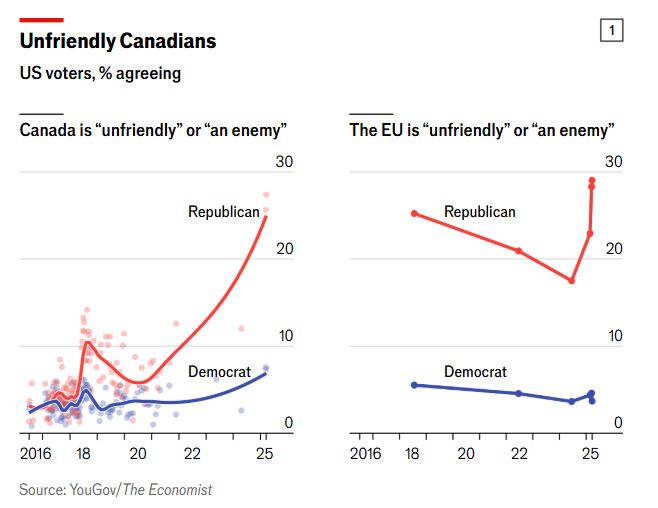

But the way they interpret a selloff is now being warped by the country's divisive politics www.economist.com/finance-and-...

But the way they interpret a selloff is now being warped by the country's divisive politics www.economist.com/finance-and-...