Professor of Economics and Finance at Johns Hopkins Carey Business School. International finance and macroeconomics. Former IMF and IDB.

https://carey.jhu.edu/faculty/faculty-directory/alessandro-rebucci-phd

anderseninstitute.org/regulation-b...

Answer: "Sorry, that's beyond my current scope. Let’s talk about something else."

Reposted by Alessandro Rebucci

International Economics and Geopolitics meeting at NBER Summer Institute

See call for submission below

submit at:

www.nber.org/confsubmit/b... by 11:59 pm (EST) on March 20, 2025.

Reposted by Alessandro Rebucci

@bmarzi.bsky.social

cepr.org/voxeu/column...

#EconSky

Reposted by Alessandro Rebucci

Reposted by Alessandro Rebucci, Matteo Maggiori

🗓️ Friday, May 2 | 2:00–7:00 PM

📍 Hopkins Bloomberg Center, Washington, DC

🔗 Register here: lnkd.in/eEzhX_PQ.

The conference Website is here: lnkd.in/eGbz-s_j

#Geoeconomics #JohnsHopkins

Reposted by Alessandro Rebucci

I am grateful to Fabio Natalucci for the opportunity to collaborate with his outstanding team, and I am excited to contribute to this critical dialogue.#Technologyg#AIAI#Fragmentationo#Deglobalizationon

Miran had suggested foreign official holders should be forced to demand more USTs ... Bessent is settling for forcing US banks and stablecoin holders to help lower borrowing costs.

Reposted by Alessandro Rebucci

open.spotify.com/episode/6dUH...

mediahost.sais-jhu.edu/saismedia/me...

mediahost.sais-jhu.edu/saismedia/me...

Reposted by Alessandro Rebucci

Reposted by Alessandro Rebucci

https://www.ft.com/content/478c1c64-8923-4ec2-858d-670b30ae44f9

If a tariff is imposed across the board without distinguishing between final and intermediate products, tariffs can become a cost push or supply chain shock, and stock prices react to supply chain risks: academic.oup.com/qje/article-...

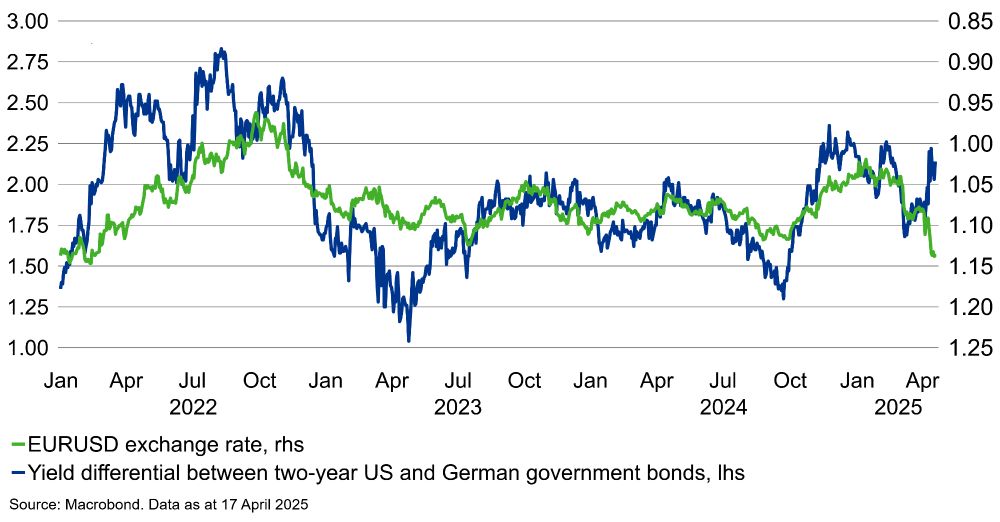

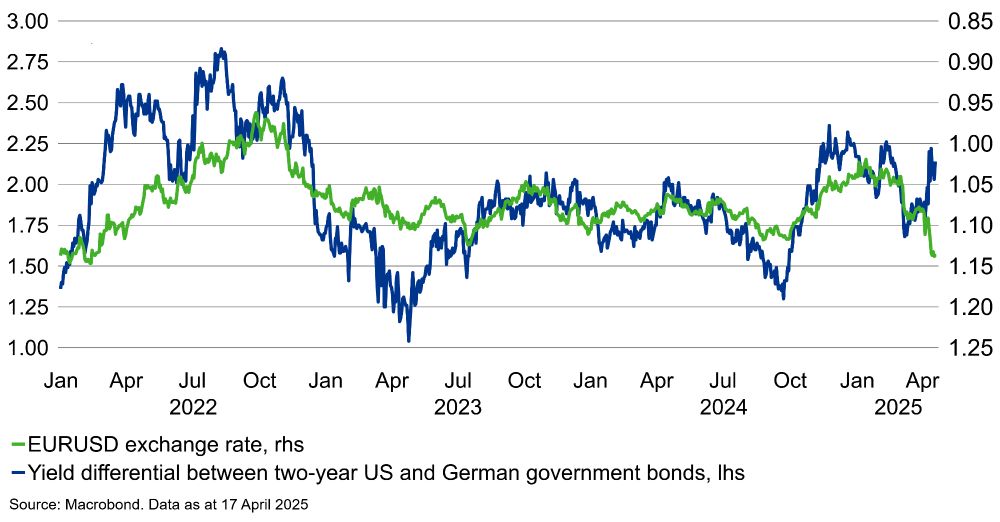

This is unusual: theory and prior evidence suggest that tariffs weaken the currency of the countries being targeted. Indeed, floating EM currencies depreciated.

1/7 🧵

cepr.org/voxeu/column...

#EconSky #News

🗓️ Friday, May 2 | 2:00–7:00 PM

📍 Hopkins Bloomberg Center, Washington, DC

🔗 Register here: lnkd.in/eEzhX_PQ.

The conference Website is here: lnkd.in/eGbz-s_j

#Geoeconomics #JohnsHopkins

Reposted by Matteo Maggiori

💬 From 4–6 PM, Gillian Tett (FT) will moderate a high-level panel discussion.

🥂 A reception will follow from 6–7 PM.

This promises to be a timely and thought-provoking event—don’t miss it.

www.imf.org/en/Blogs/Art...

Albeit a bit too late.

Will Trade War II be seen as the birth of the next dominant currency once the Yuan becomes convertible?